Why We Watch Bill Ackman

We’re watching Bill Ackman. He runs Pershing Square Capital, a hedge fund with assets north of $10 billion. Bill’s fund consistently owns just a handful of companies. And that makes it reasonable for an individual investor (like you!) to have capacity to follow the companies in his portfolio. Some other big fund investors have 50, 100, or even several hundred companies in the fund they manage. Owning that many companies takes a small army of analysts to keep up on all of the companies and understand what is happening at each of the holdings. Then compiling all of that into something that makes sense is not only challenging but very time consuming. That’s why we gravitate toward investors who own just a few companies.

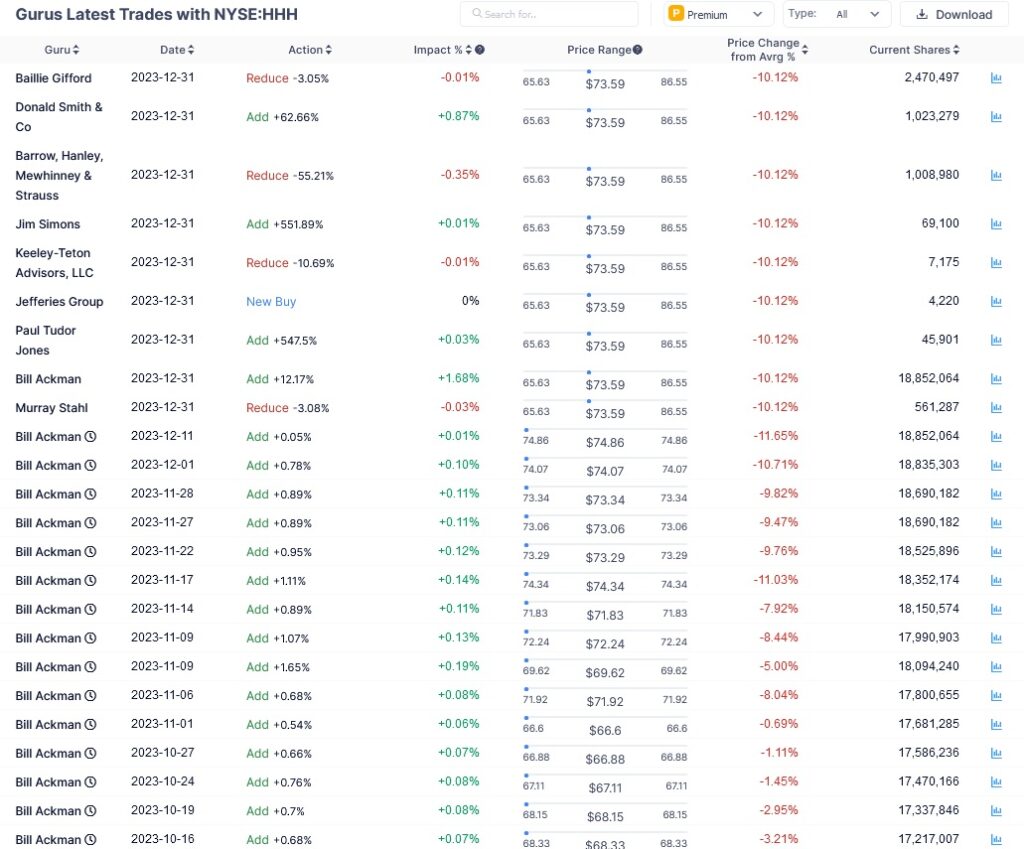

Bill is a long time shareholder of Howard Hughes Corporation. The company changed structure last August, and now those assets trade under the ticker HHH. Bill has owned over one million shares of Howard Hughes since 2018 and in December 2019 he nearly doubled his stake to over 2.1 million shares. During the Covid Crash in March of 2020 Bill added over 450% to his stake, giving him over 12 million shares. He reduced his stake by 10% in June of 2020 down to 10.9 million shares, then added another 23% in January of 2021, giving him over 13.4 million shares. We watched Bill Ackman buy shares in smaller chunks in 2023, and he now owns over 18.8 million shares of HHH. HHH currently has 50.26 million shares outstanding, and Bill owns over 37% of those.

That means each time buys or sells shares, we find out right away. We don’t need to wait until the 13Fs come out 45 days after the end of the quarter. That helps us keep on top of what Bill Ackman is doing with his shares.

We can see how Bill was buying shares of HHH in the high $60’s to low seventies on an almost weekly basis throughout the second half of last year. The highest price per share he paid was $73.59. Here is the tool we use to complete this type of research.

Here is a chart that shows the number of buy and sell transactions of HHH completed by large hedge funds. The chart on the right shows the actual number of shares traded. The overall quantity of shares bought and sold are on the right. We watched Bill Ackman make most of these buys, and most of the remainder was by Donald Smith.

The list below shows the detail for the most recent of these transactions.

Here is the price chart for HHH. We can see it hitting a floor around $65 last October. Since then it has run up over $86, and now has pulled back down to about $66.50. We feel the recent pull back from the low $80’s down to the mid $60’s is due in large part to the FOMC holding off on interest rate cuts. We’re opening a position in HHH two different ways. We bought 100 shares at $66.57. That gives us some shares in case HHH runs back up. We’re comfortable buying shares outright here because we feel that we’re near a price floor with Bill Ackman providing the support. He’s recently purchased shares from the high $60’s up through $73.59. So we’re buying into a company that Bill Ackman owns a large part of, and doing it at a per share price that’s lower than what Bill paid.

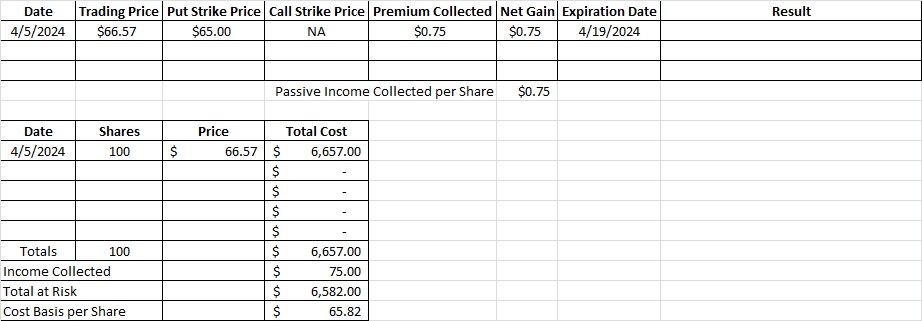

The Weekly Trade

We’re also going to sell a put at the $65 strike. The premium for the put will lower our basis, and if we get the shares at $65 we’ll dollar-cost average down a bit. The $65 put expiring April 19 is trading at $0.75. This is a two week trade, and there are 26 two week periods in a year. So our time multiplier is 26. We divide the $0.75 premium into the $65 strike and we get 0.0115. That, times 26, is 0.2999, or an annualized return of 30%. If the trading price for HHH stays above $65 from now through 4/19 we’ll just keep the premium. That will reduce our cost basis per share from the $66.57 we paid this afternoon down to $65.82. If the trading price drops below $65 we’ll keep the premium and get the shares at $65.

Cost Basis per Share