Generate passive income selling stock options on companies you own or want to own. This passive investment strategy for accredited investors can give you an extra ‘dividend’ each week or month on company shares already in your portfolio, or by making a promise to buy shares of a company you want to own at the price you want to own it. For a primer on stock option contracts, read Introduction to Stock Options below.

Introduction to Stock Options

Using Stock Option Contracts as a Passive Income Sidehustle

How to Sell a Put Option Contract for Passive Income

Weekly Options Trade to Generate Passive Income – 11-02-23

Sell Put Options to Collect a Dividend for Passive Income 11-08-23

Work from Anywhere Passive Income Trade – 11-21-23

What to do When a Put Option Gets Assigned – 12-01-23

What to do when a put option gets assigned. I can sell a call at the strike the shares were assigned, sell another put at a lower strike, or both.

What’s a Good Return on a Passive Income Investment – 12-11-23

How to Roll a Call Option Contract- 12-15-23

Roll an In The Money Call Option – 12-21-23

Roll an In The Money call option contract as a weekly options trade for passive income.

Roll a Put Option to Avoid Assignment – 01-05-24

Roll a put option contract to avoid assignment when the option contract goes In The Money.

Selling Puts on a Market Down Day – 01-16-24

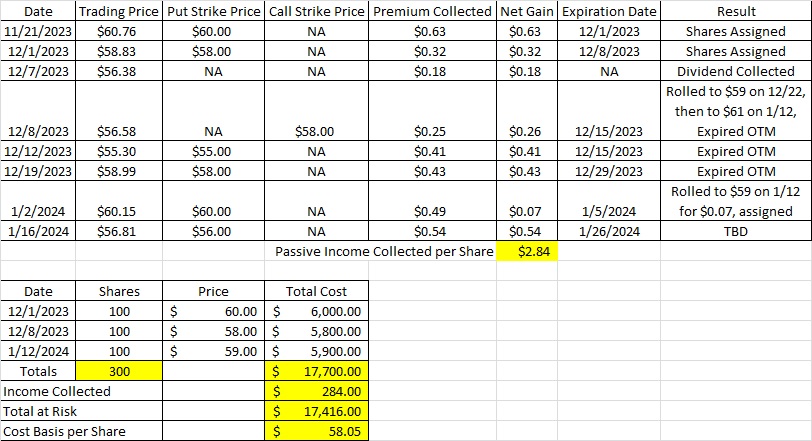

Reduced Cost Basis per Share Calculator

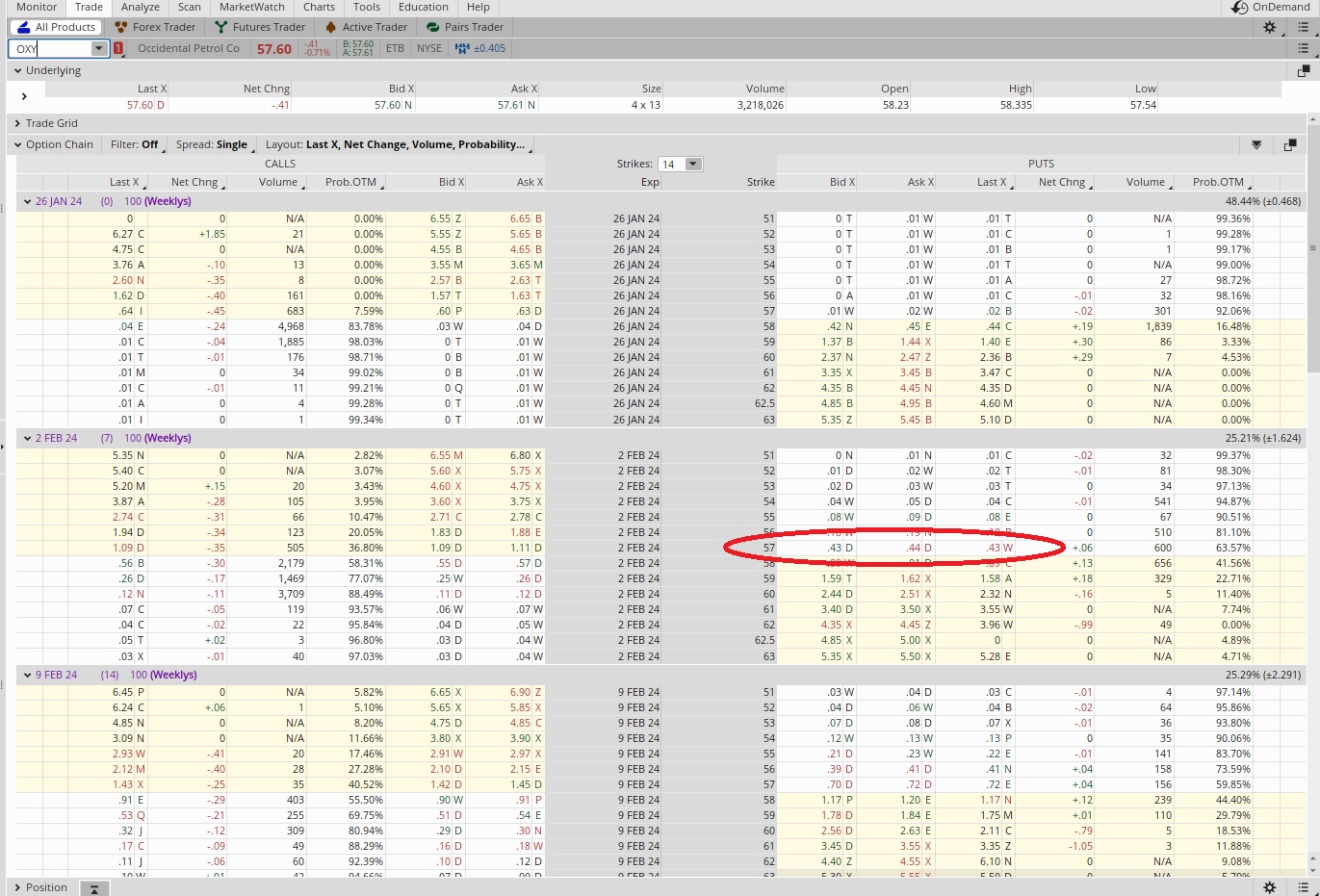

Selling Options for Weekly Income 2-2-24

Selling options for weekly income is a passive income strategy for accredited investors.

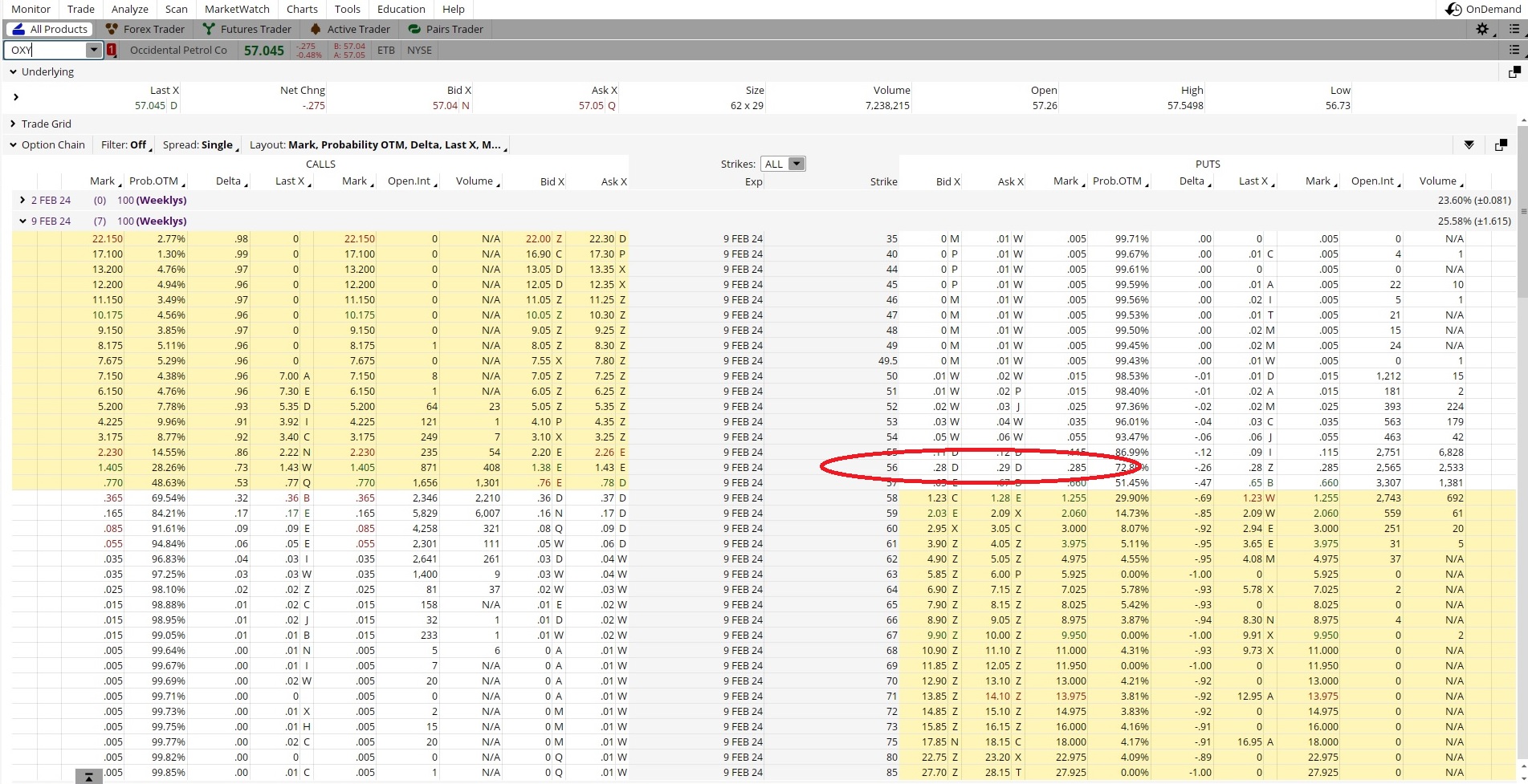

Sell Put Options Through Earnings 2-9-24

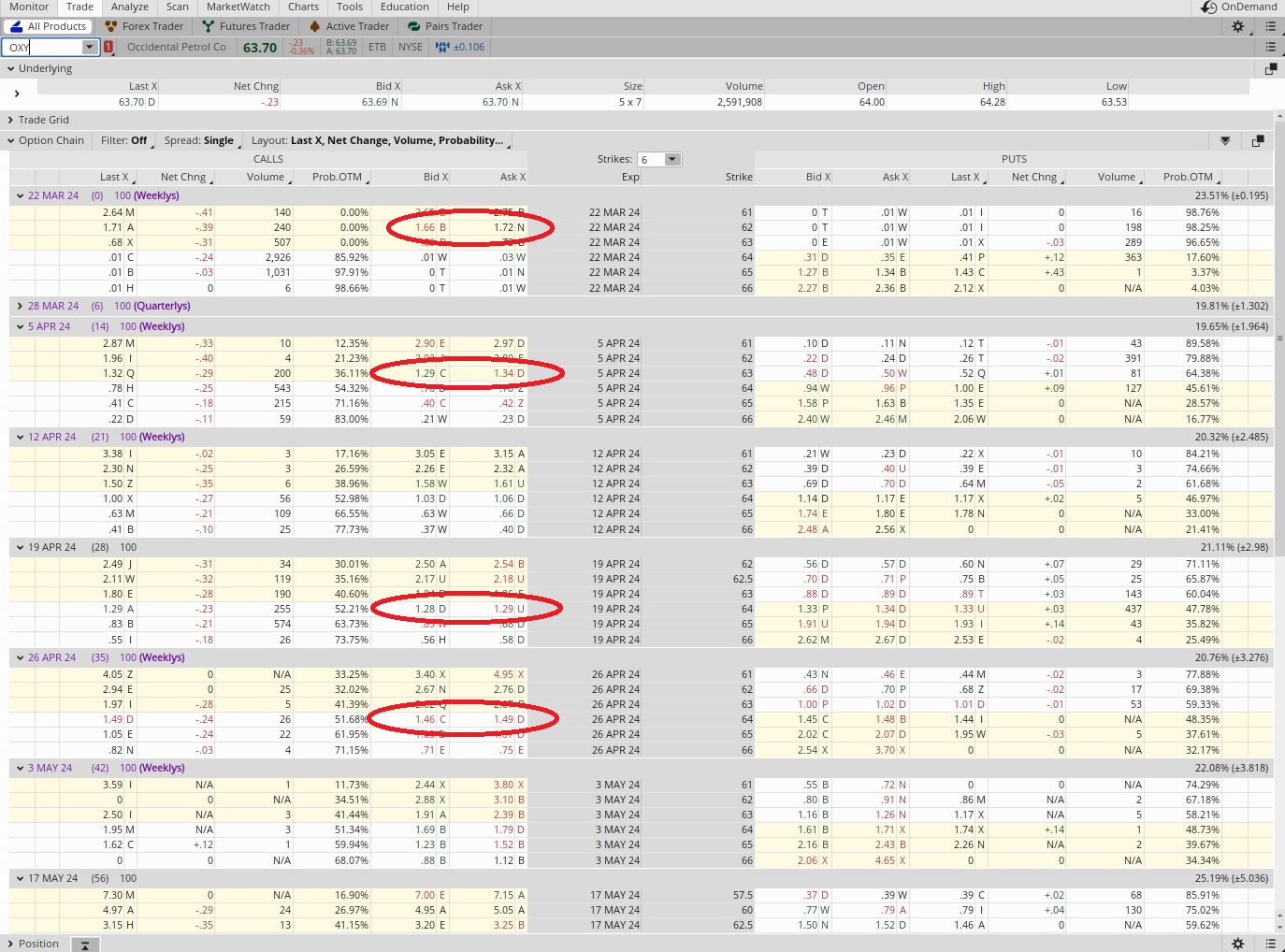

Scalable Sidehustle for Accredited Investors 2-23-24

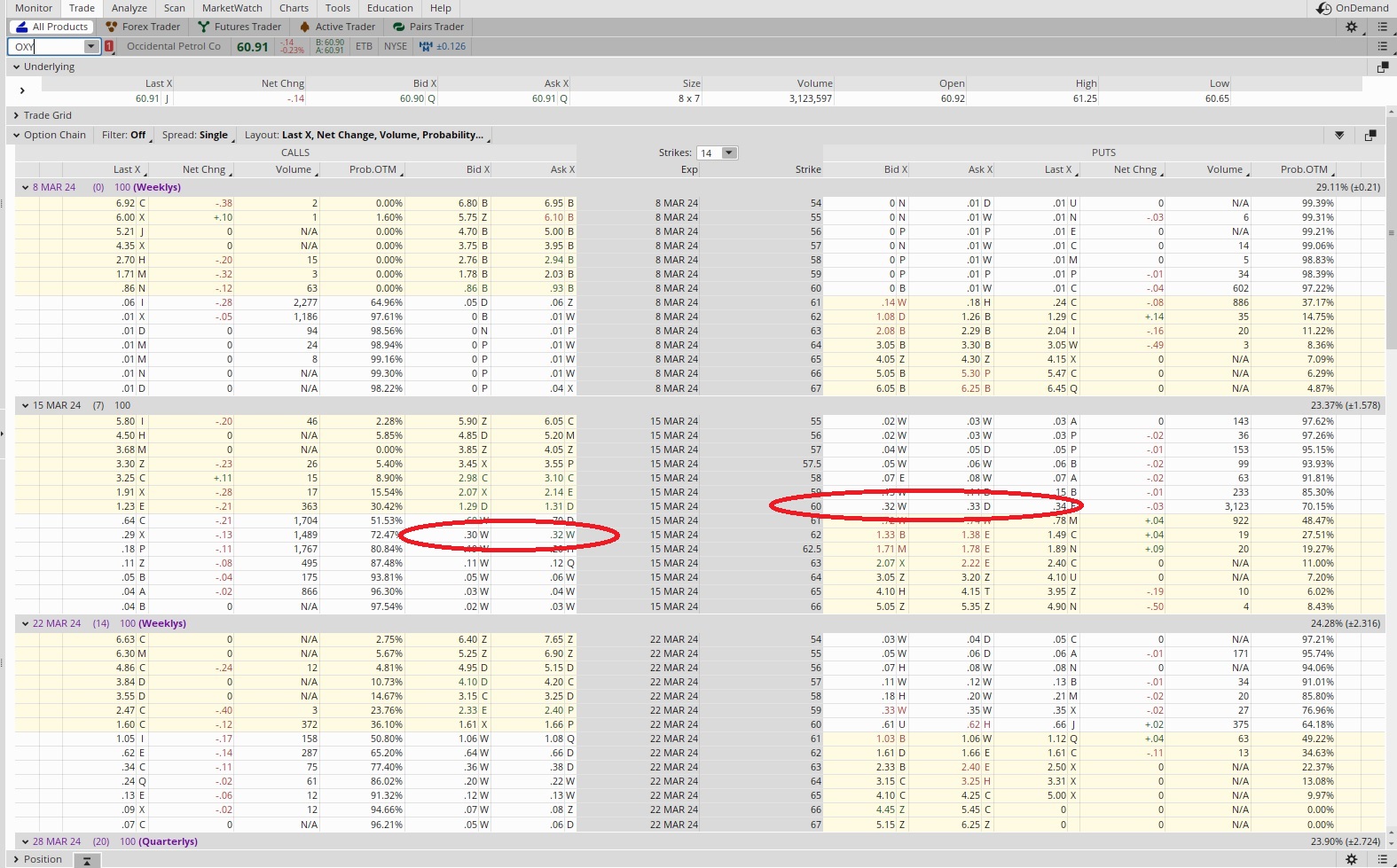

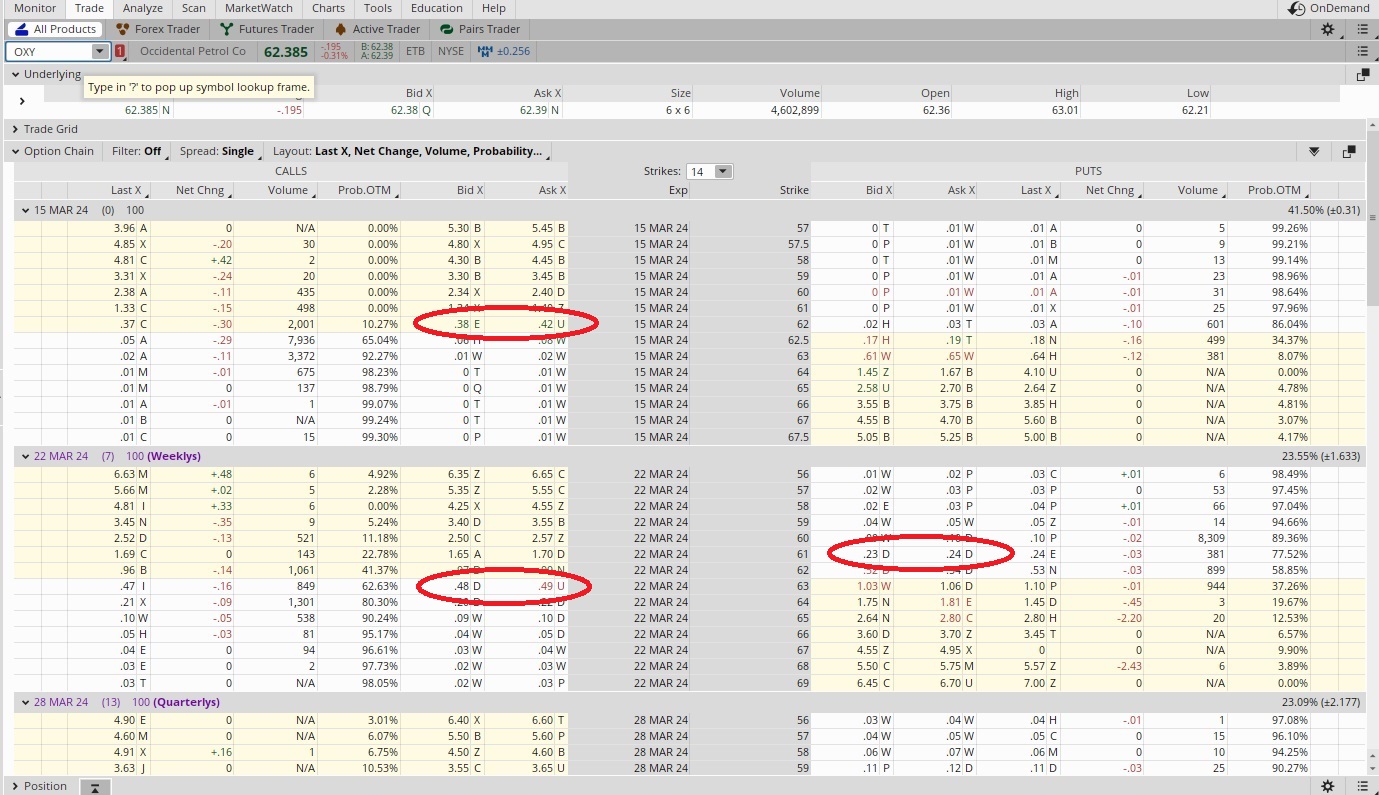

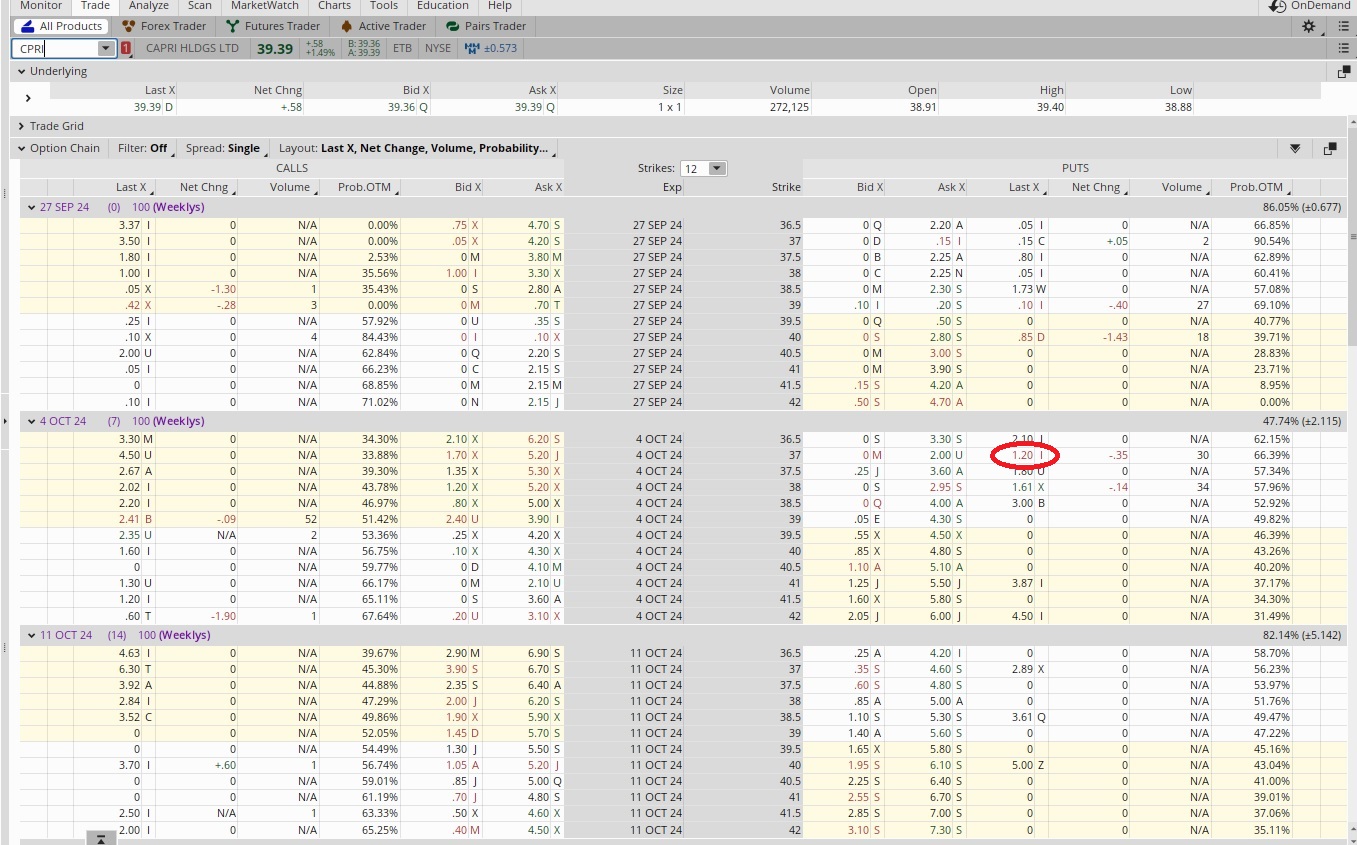

Earn Passive Income with a Strangle Option 3-08-24

This strategy for setting up weekly strangle options can earn passive income on a weekly basis.

Options Called Away – 03-22-24

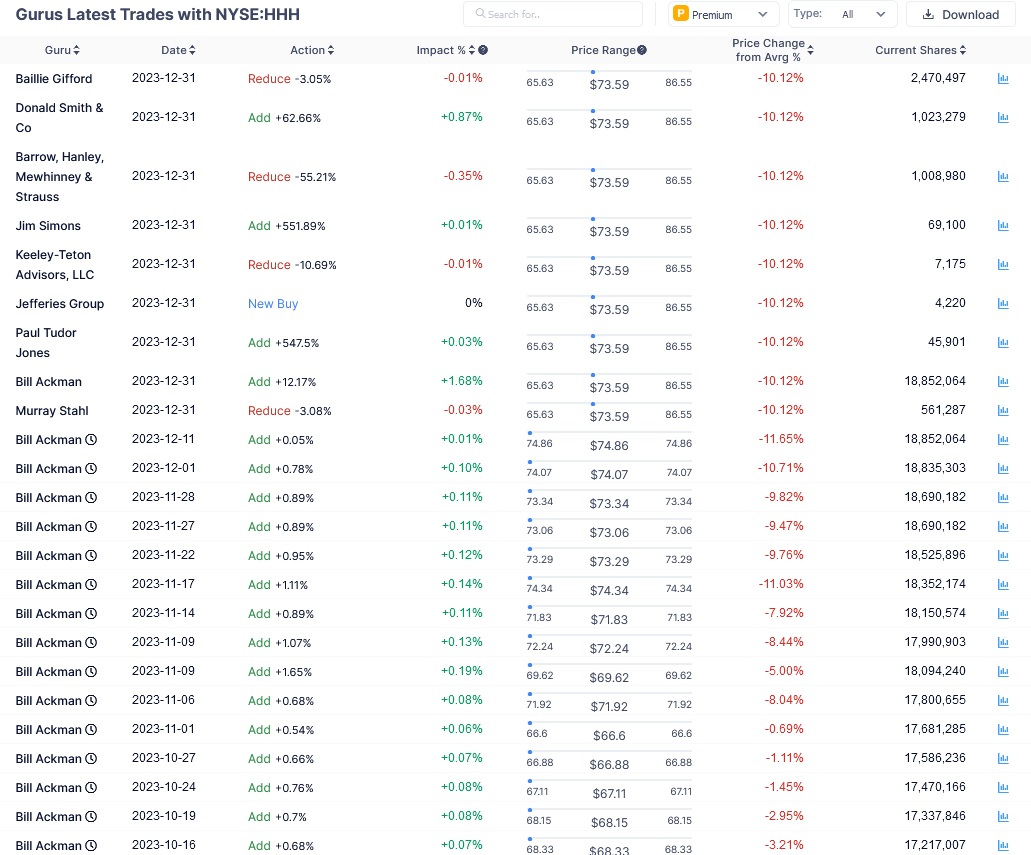

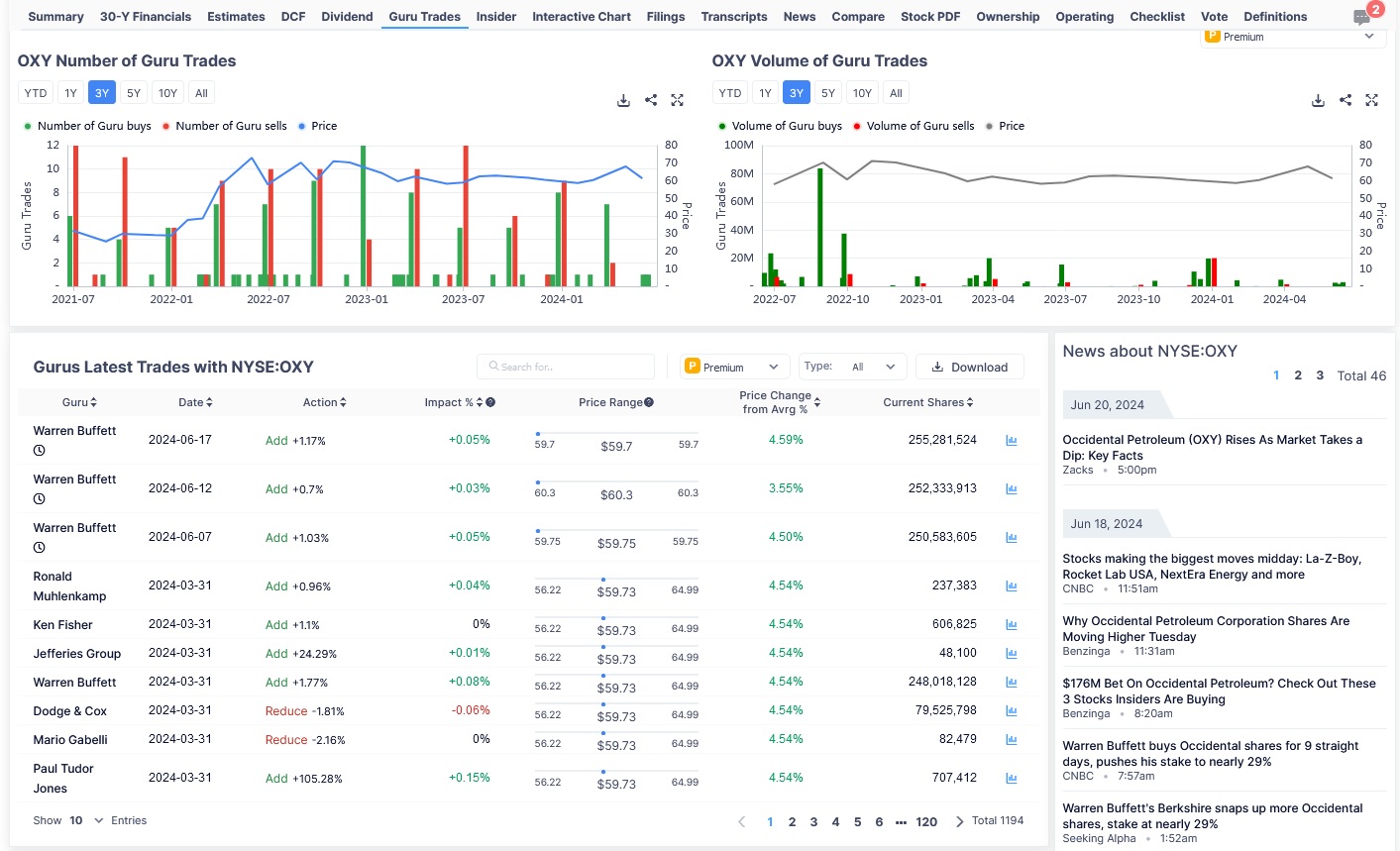

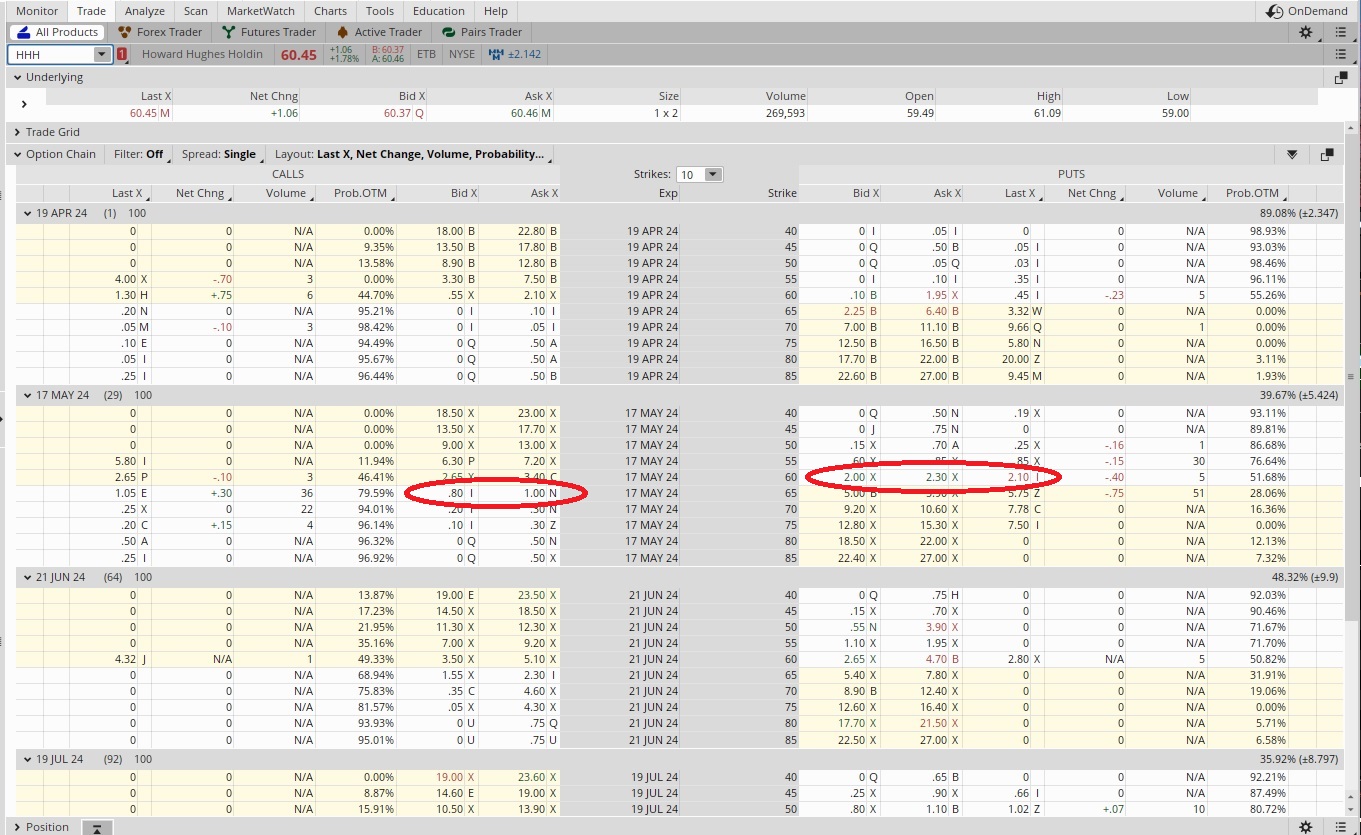

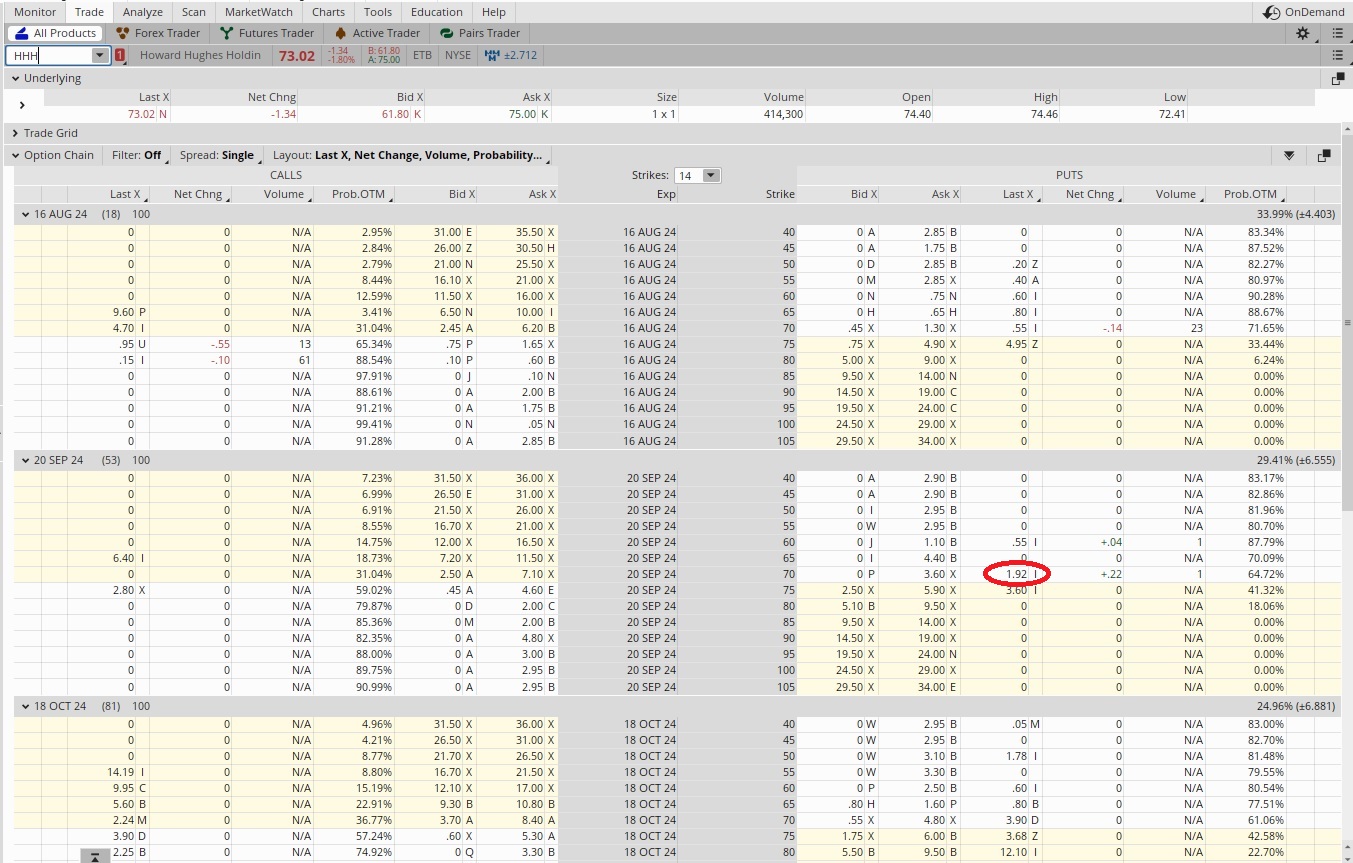

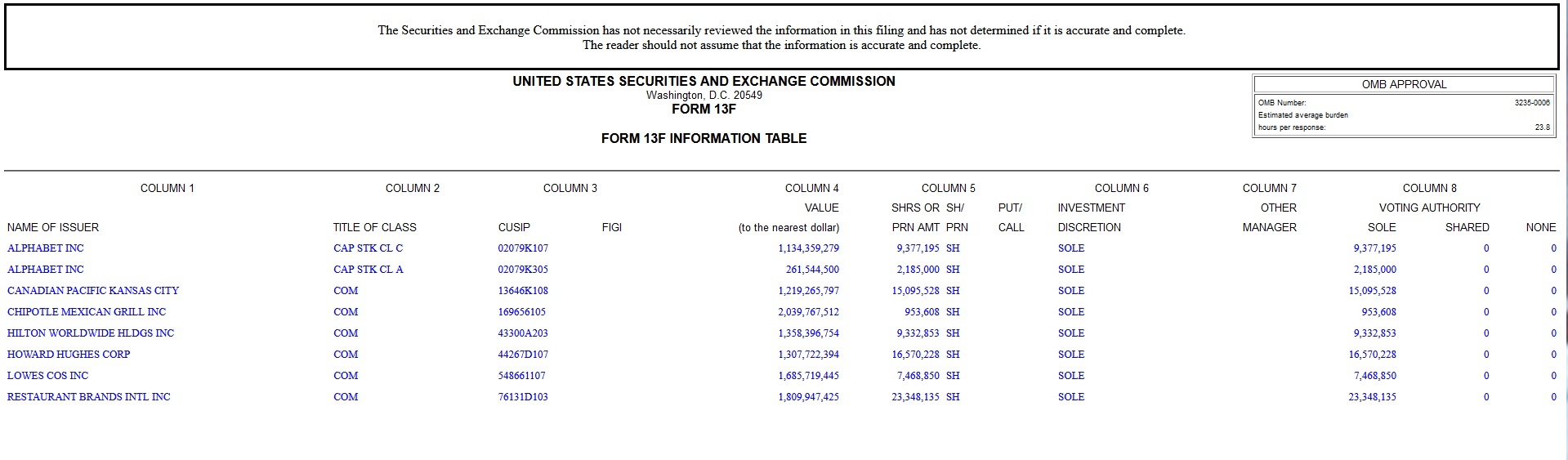

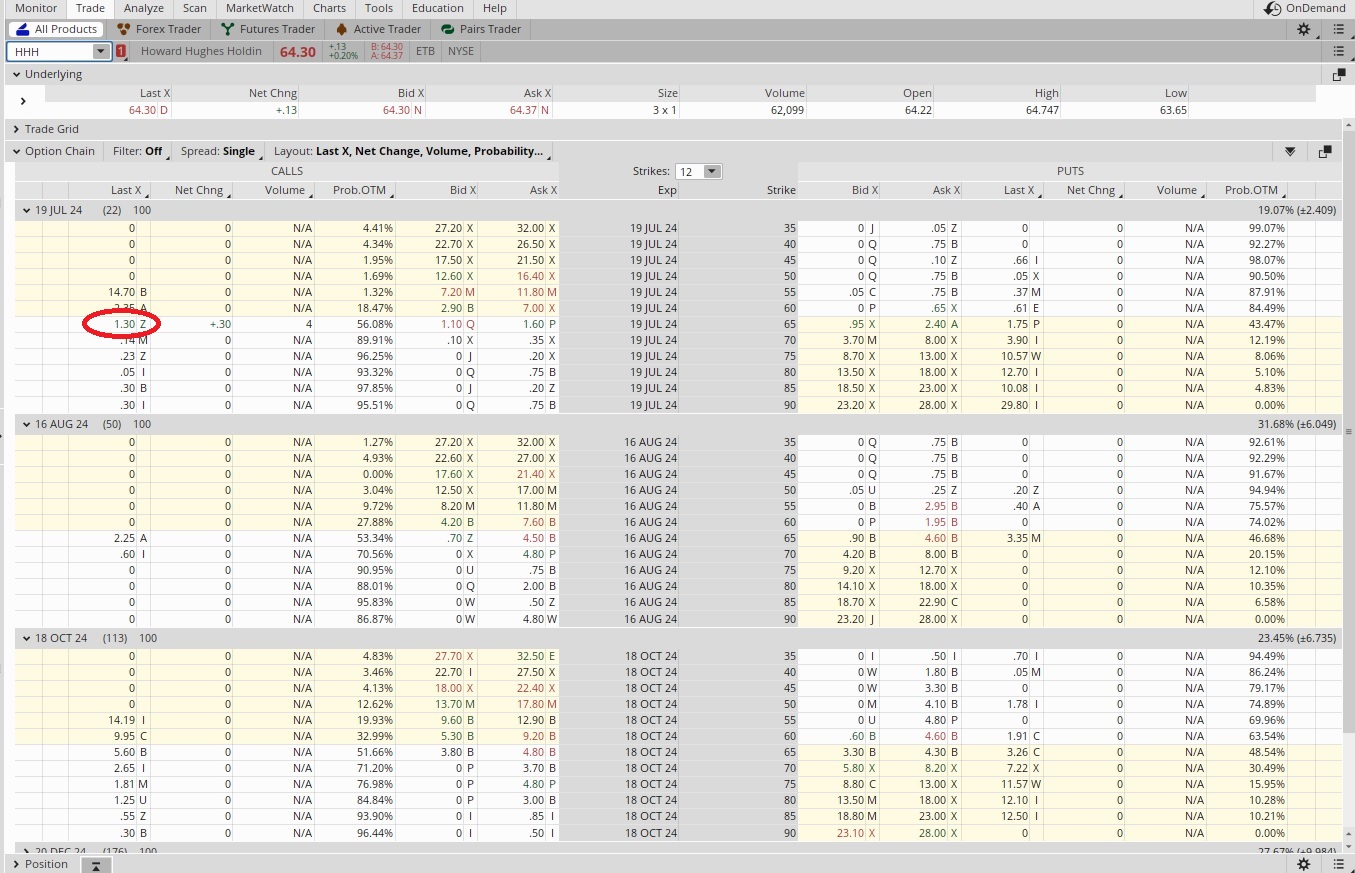

Why We Watch Bill Ackman – 04-05-24

When to Enter a Position in a Company-04-29-24

Sell a Cash Secured Put for Passive Income – 05-21-24

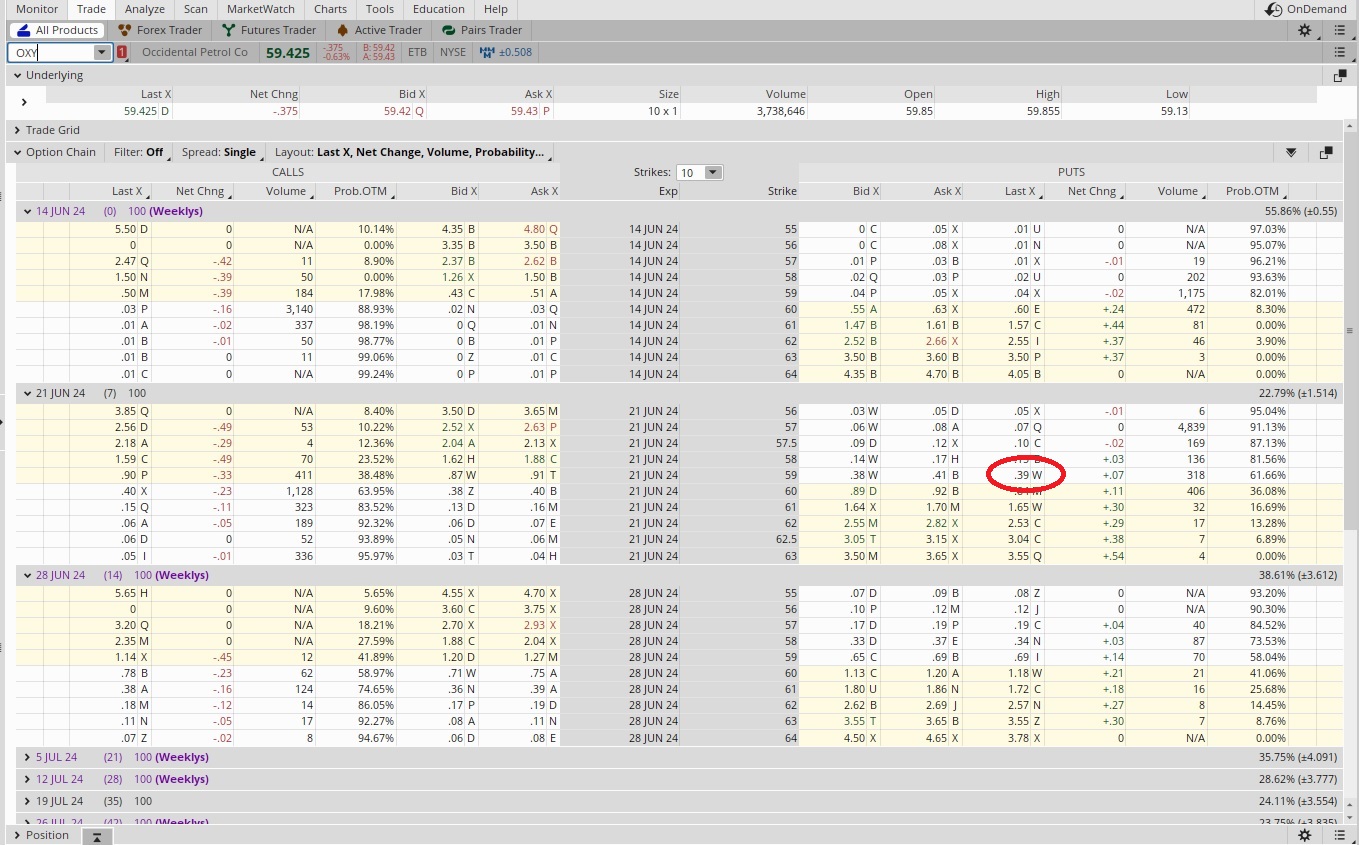

Put Option Expires Worthless – 06-10-24

Routine Options Trade – 06-21-24

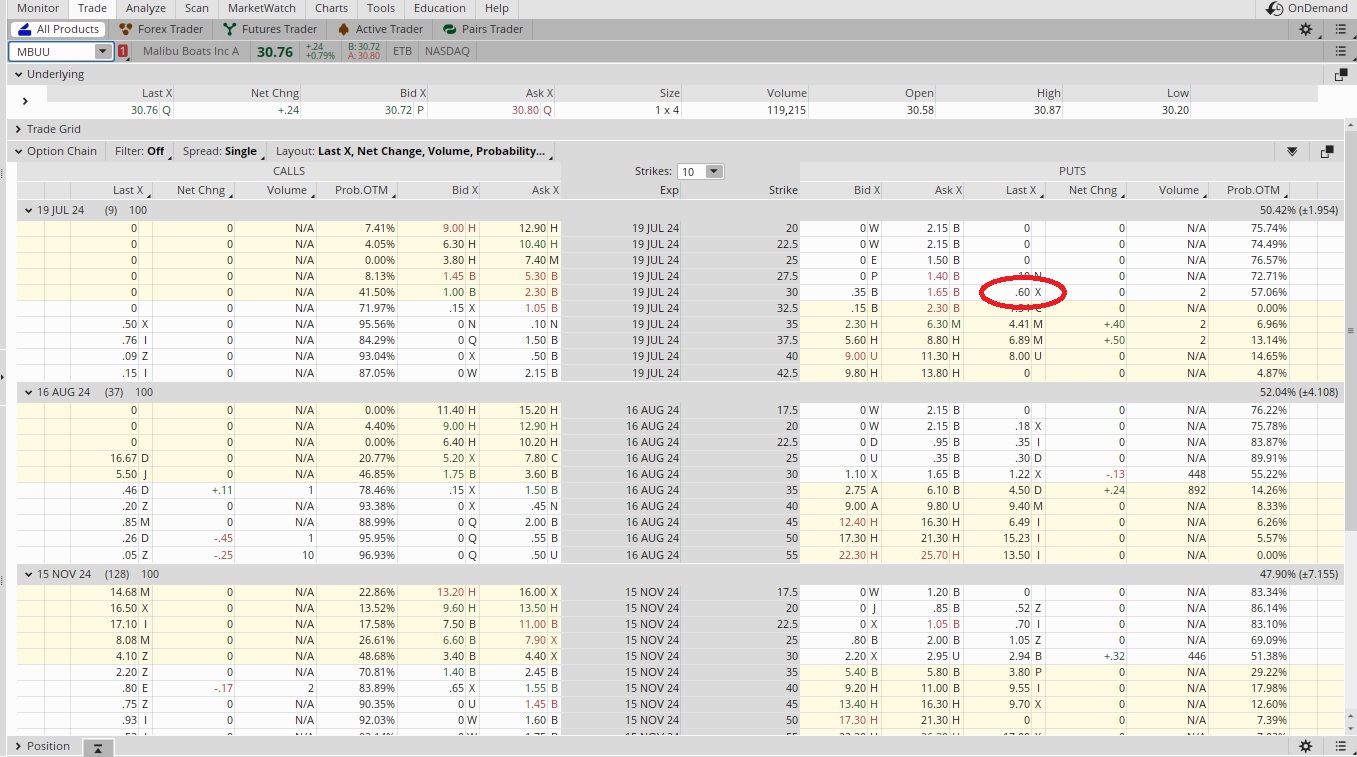

Put Expired Worthless – 07-03-24

Income Generation Options Trade – 07-15-24

Earn Passive Income in a Small Town Selling Stock Options – 07-26-24

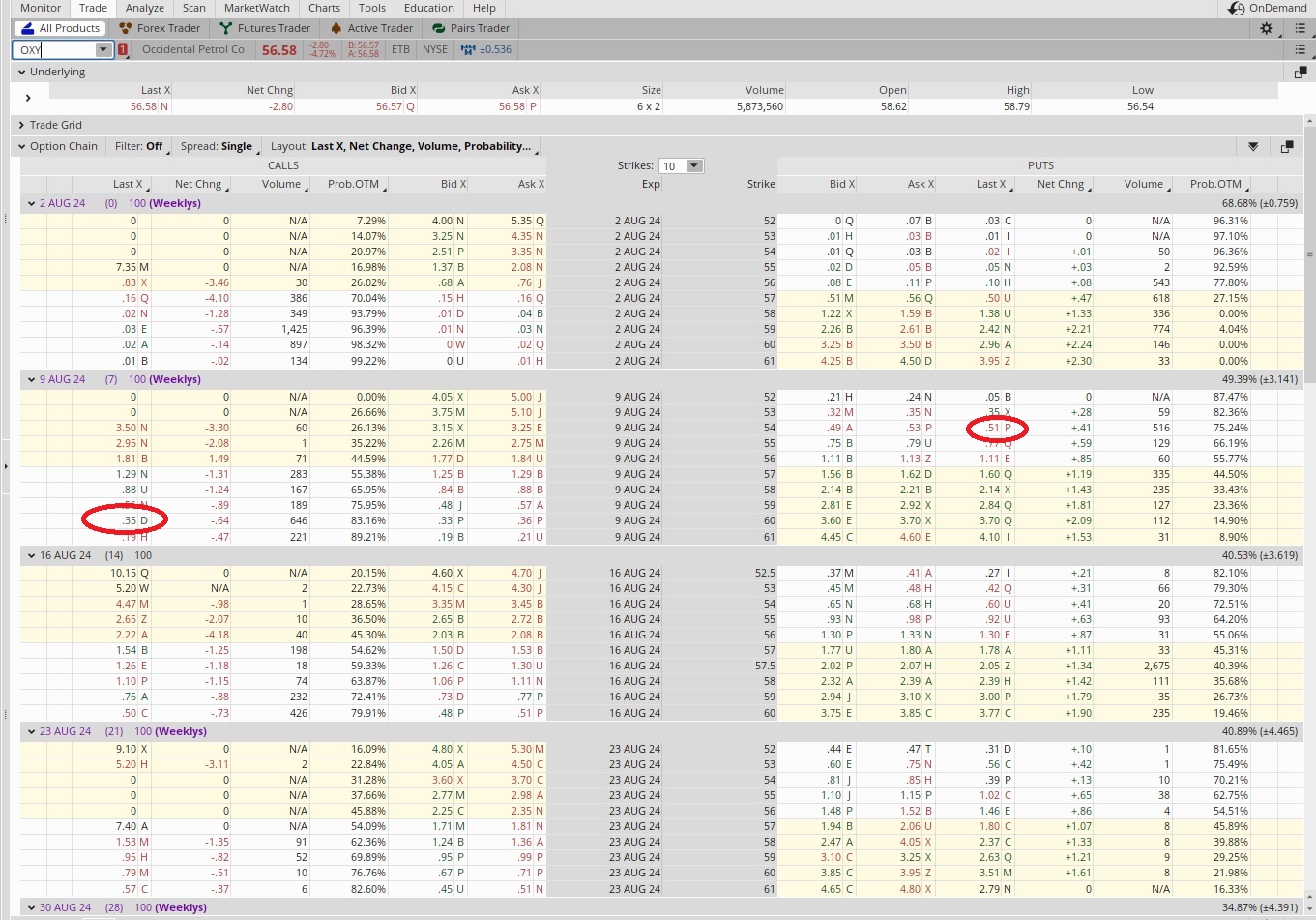

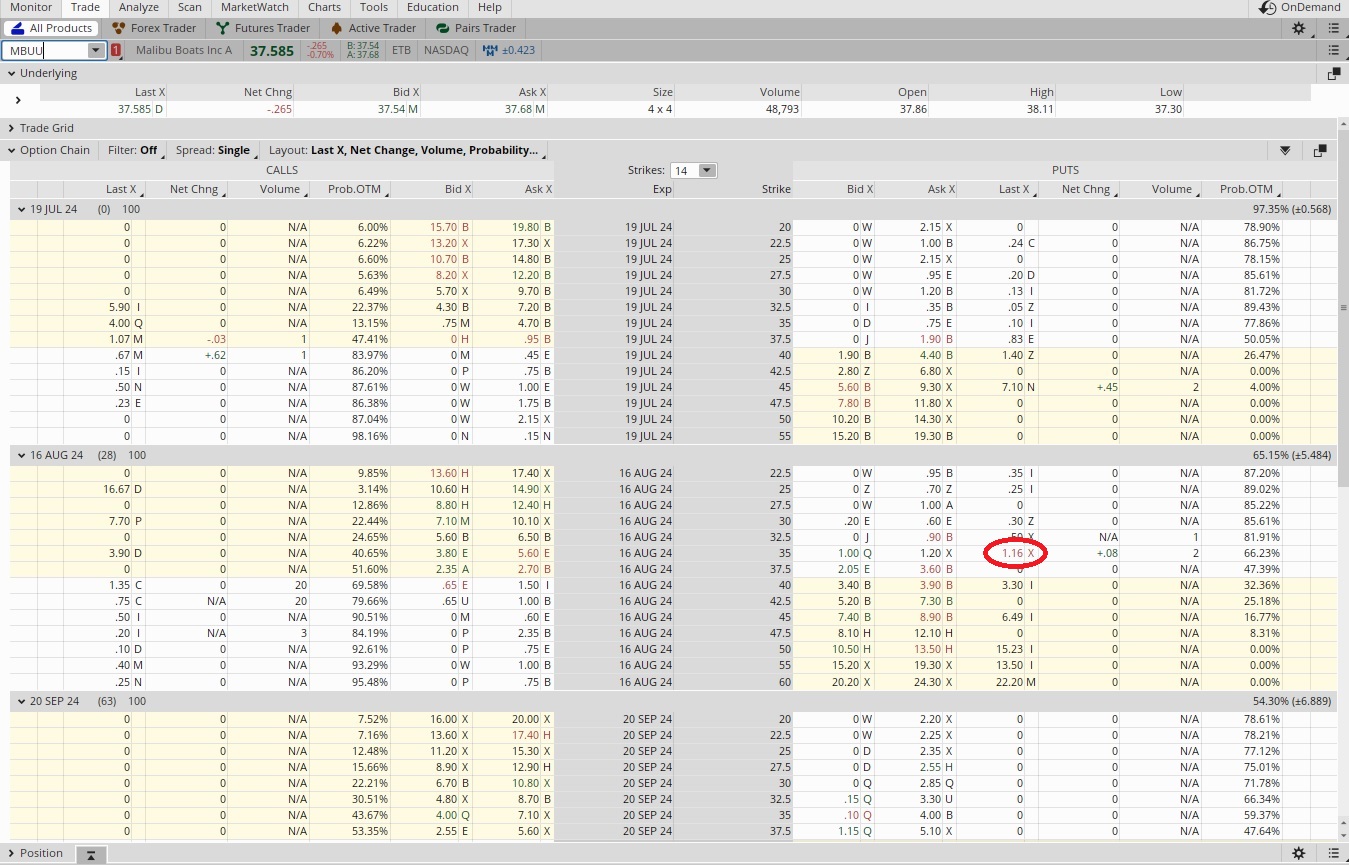

Why Tranches are Important – 08-02-24

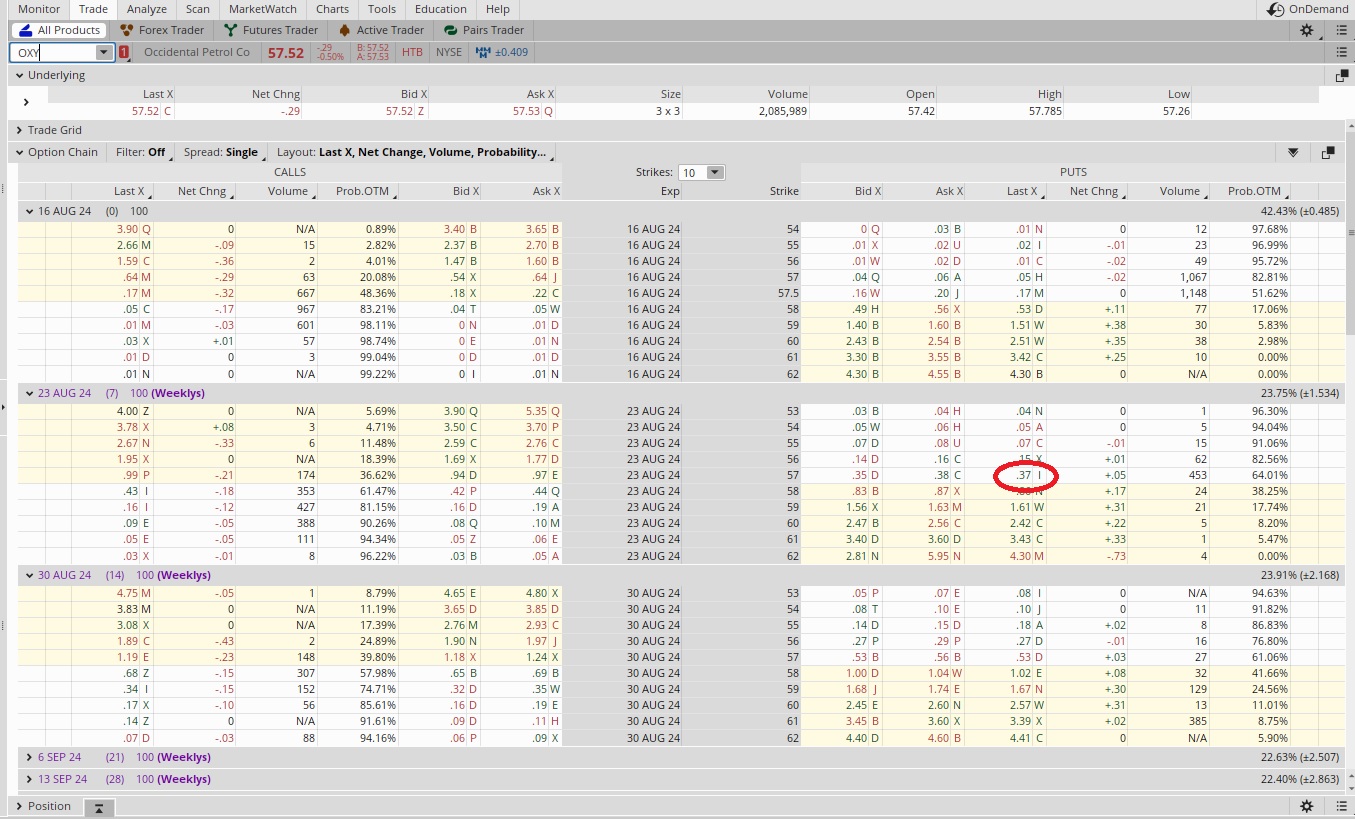

Weekly Options Trade – 08-16-24

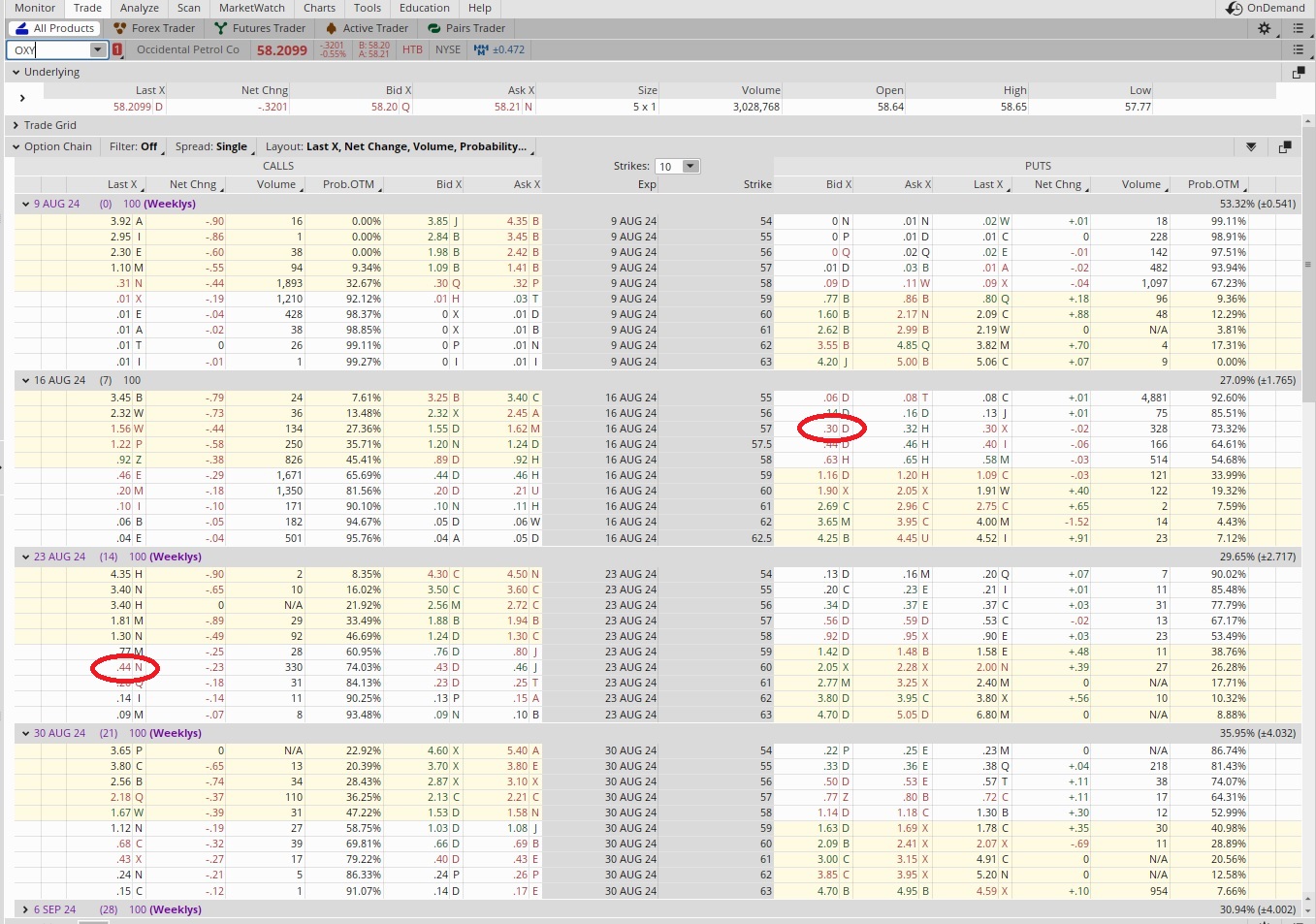

Options Trade for Cash Flow- 08-23-24

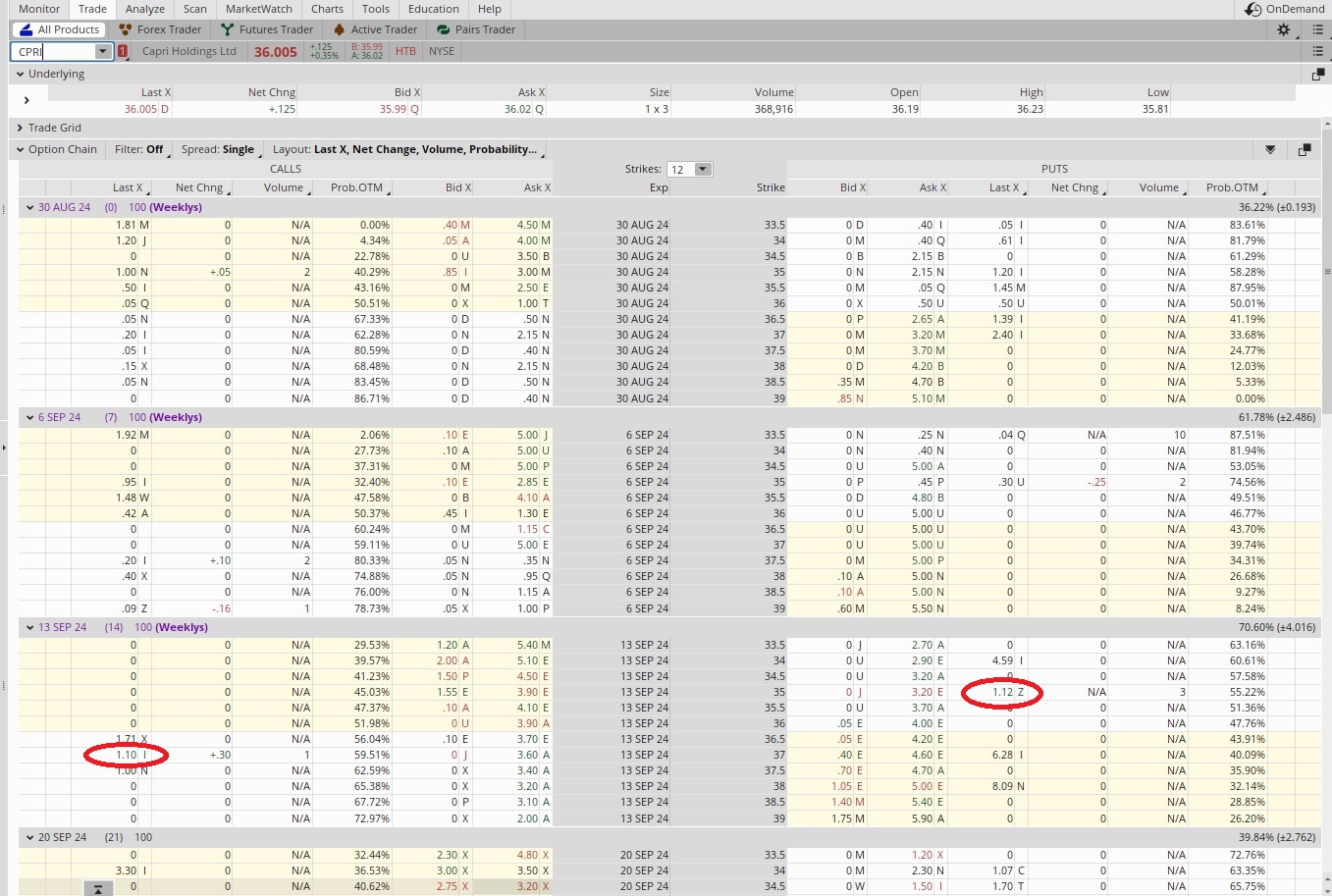

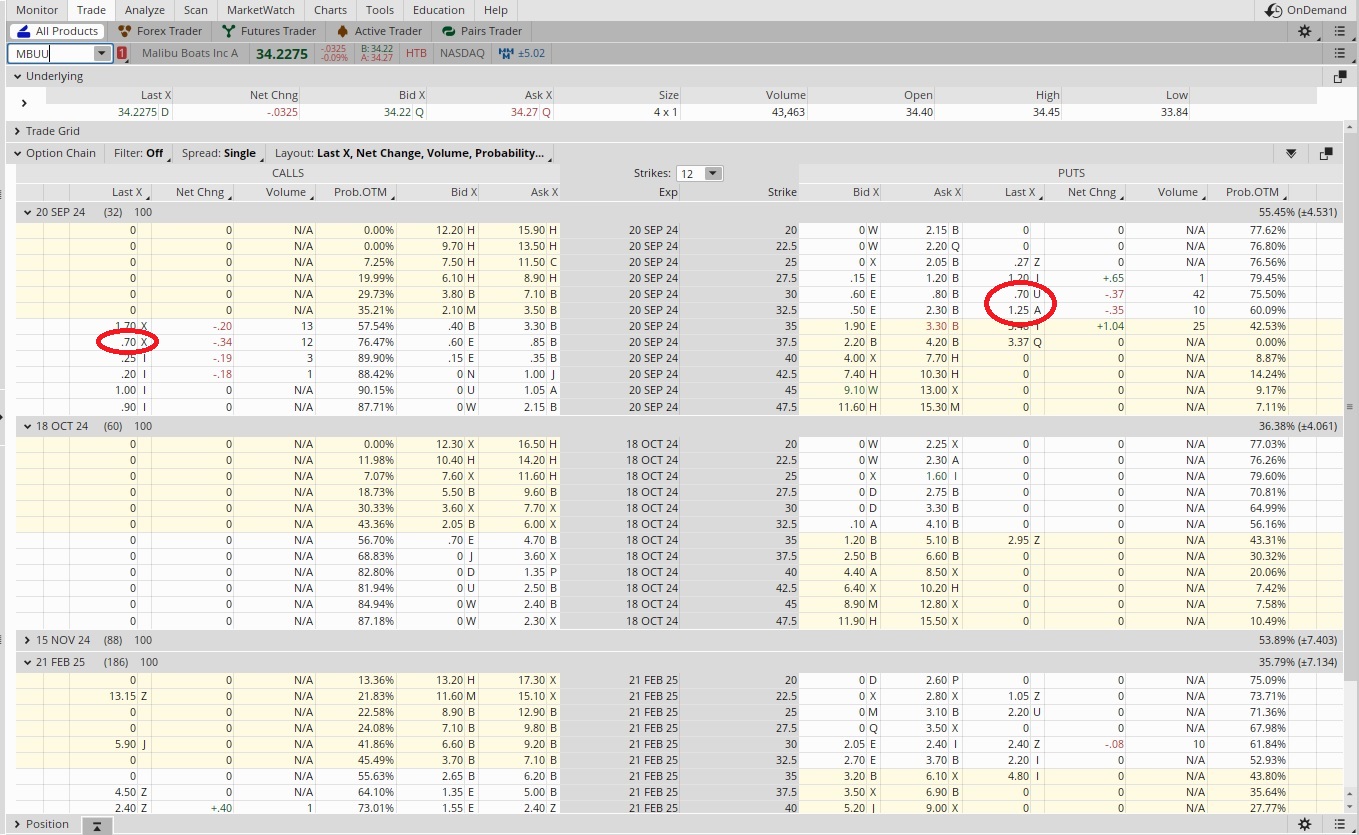

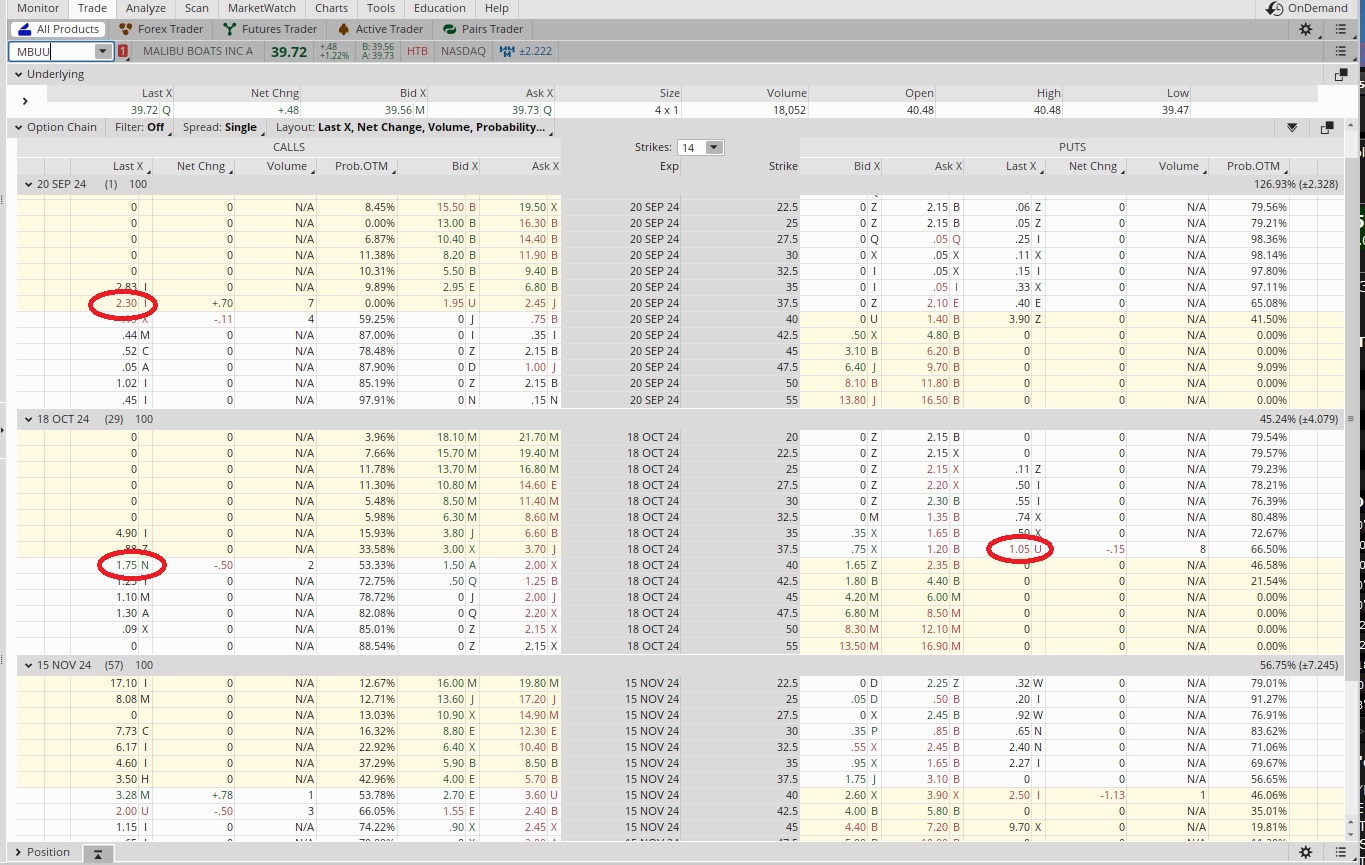

How We Used an Option Strangle to Open a Position- 08-30-24

Options Trading Basics – 09-16-24

Wheel Option Trade – 09-20-24

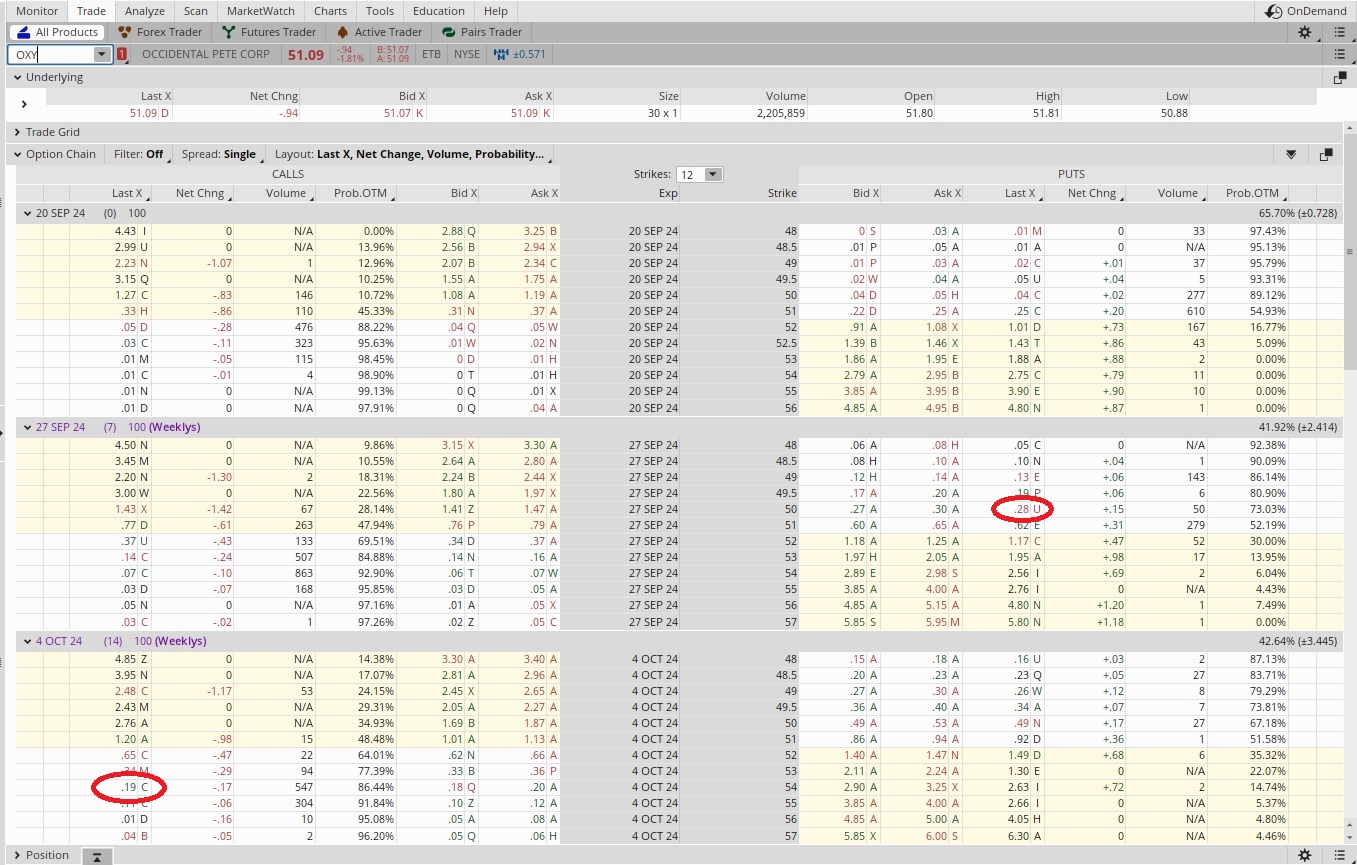

Options Trading Tutorial – 10-02-24

This options trading tutorial shows how we used a put option to reduce the cost basis of shares we already own.

Put Option Contracts for Passive Income

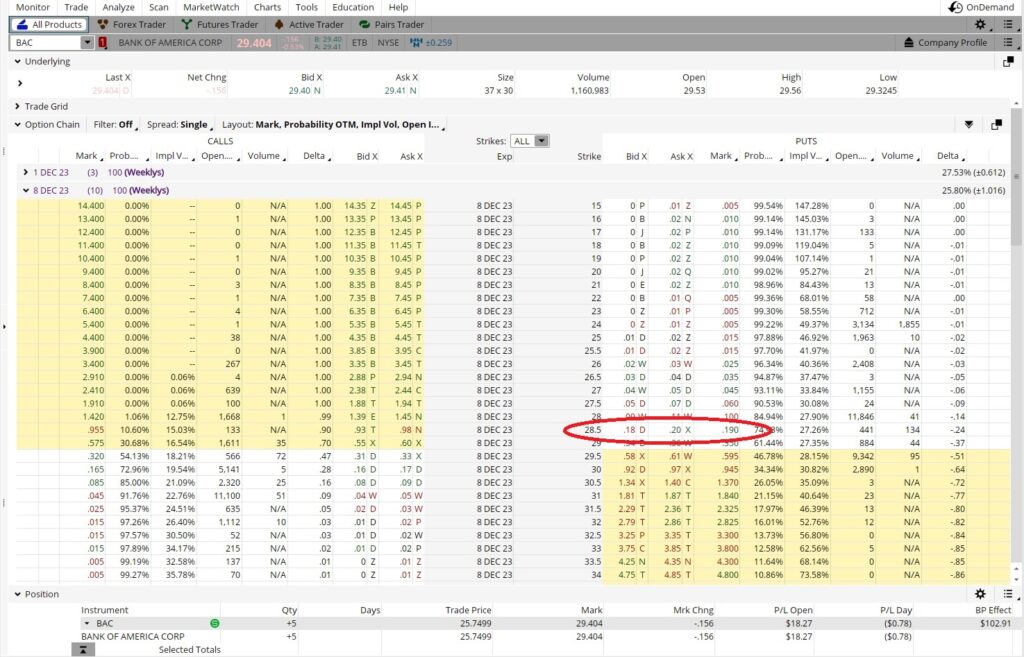

Why I sold put option contracts on BAC for a passive income strategy as an accredited investor.

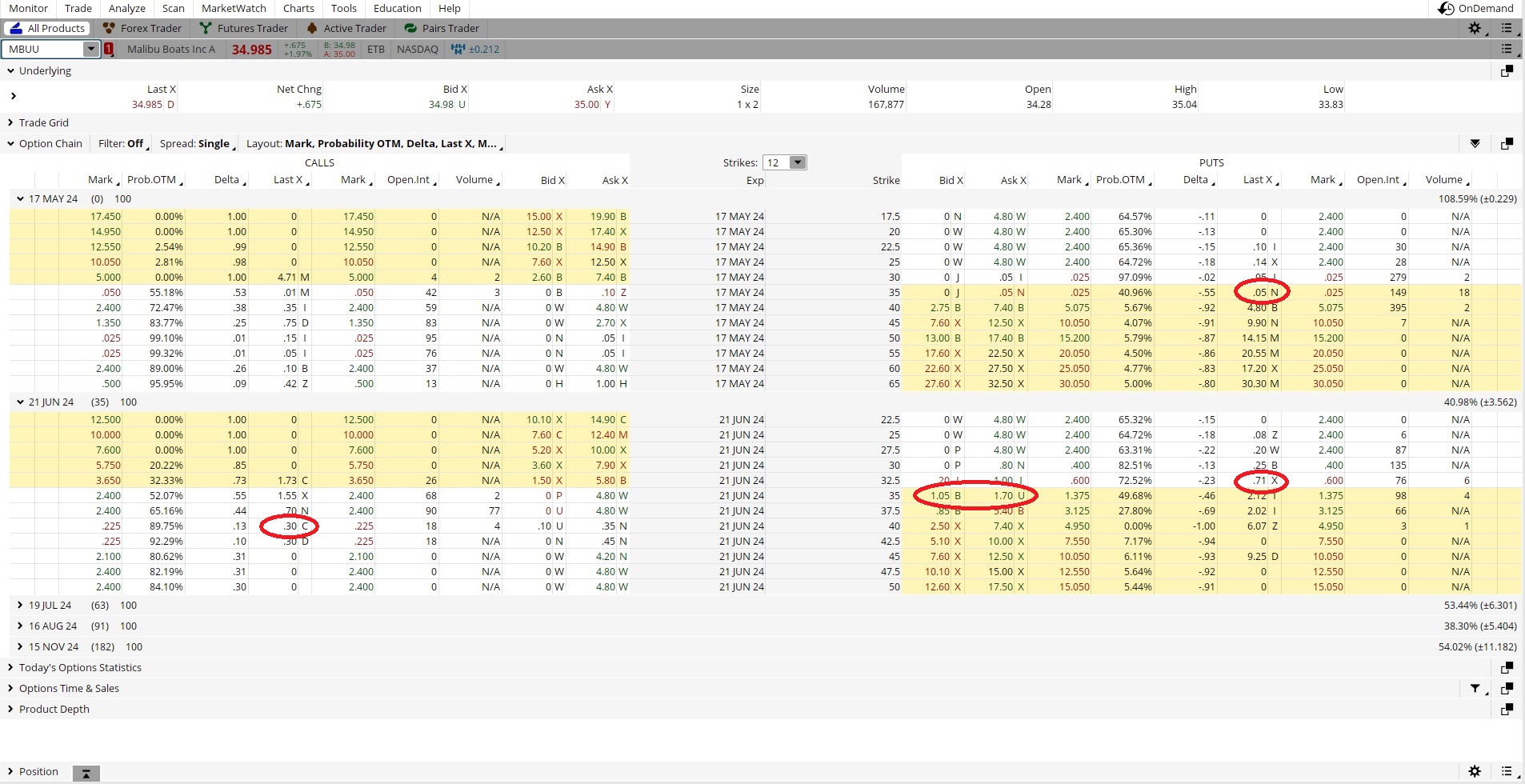

Pick a Put for Passive Profit

Here are steps to pick a put that is likely to be profitable when I sell puts for passive income.

How to Roll a Put Option for Passive Income – 10-27-23

How to Close a Weekly Options Trade Early at a Profit – 11-06-23

Sell Put Option Contracts for Double the Premium – 11-16-23

Weekly Passive Income Trade – 11-30-23

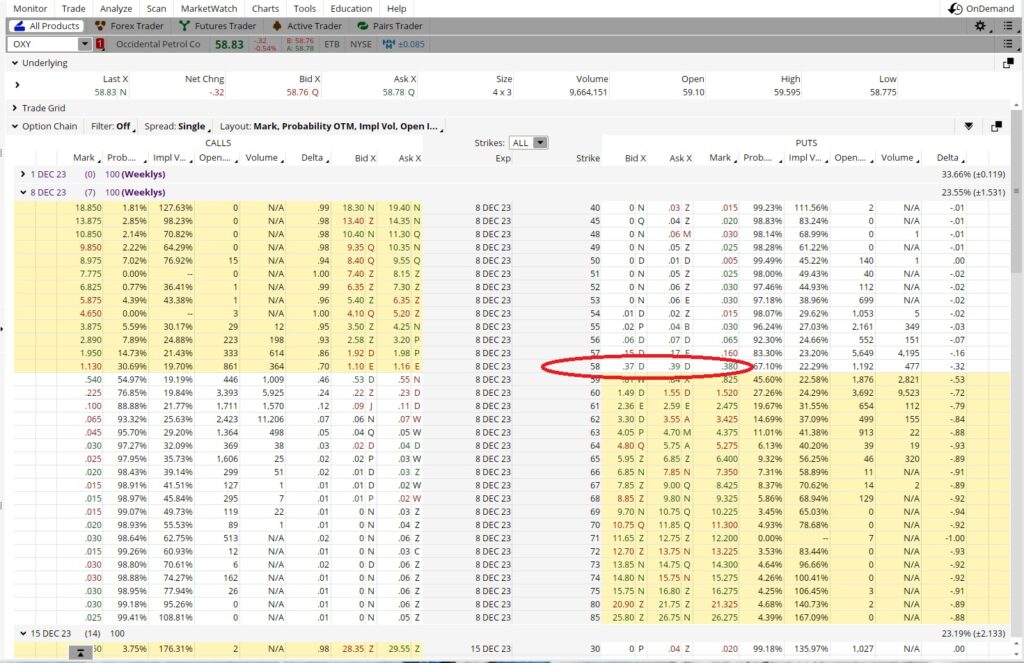

Weekly Options Trade for Passive Income – 12-08-23

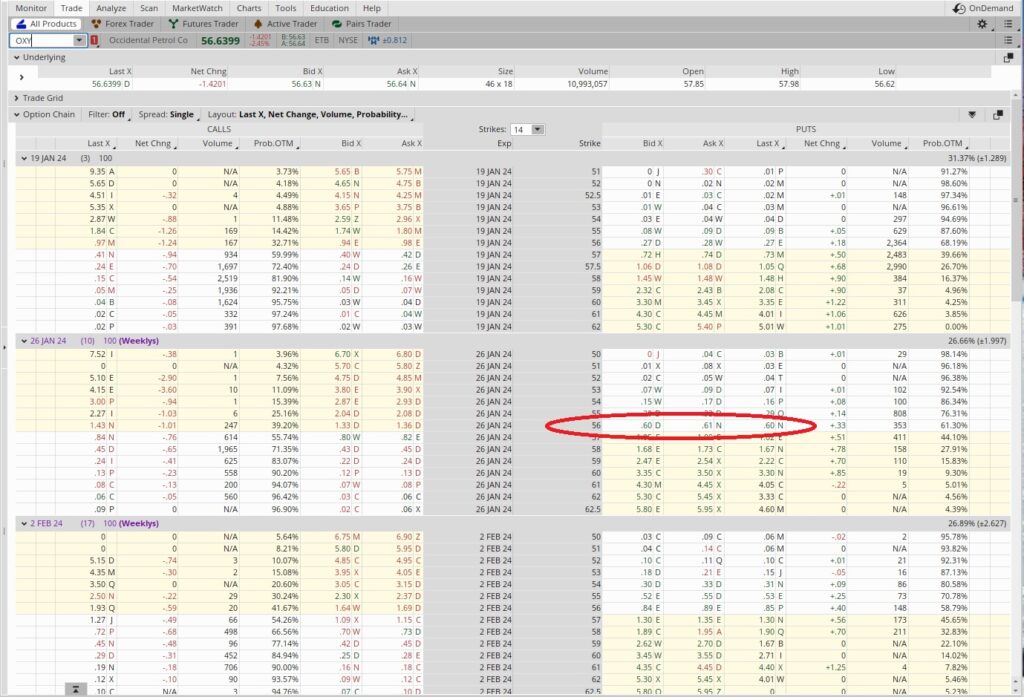

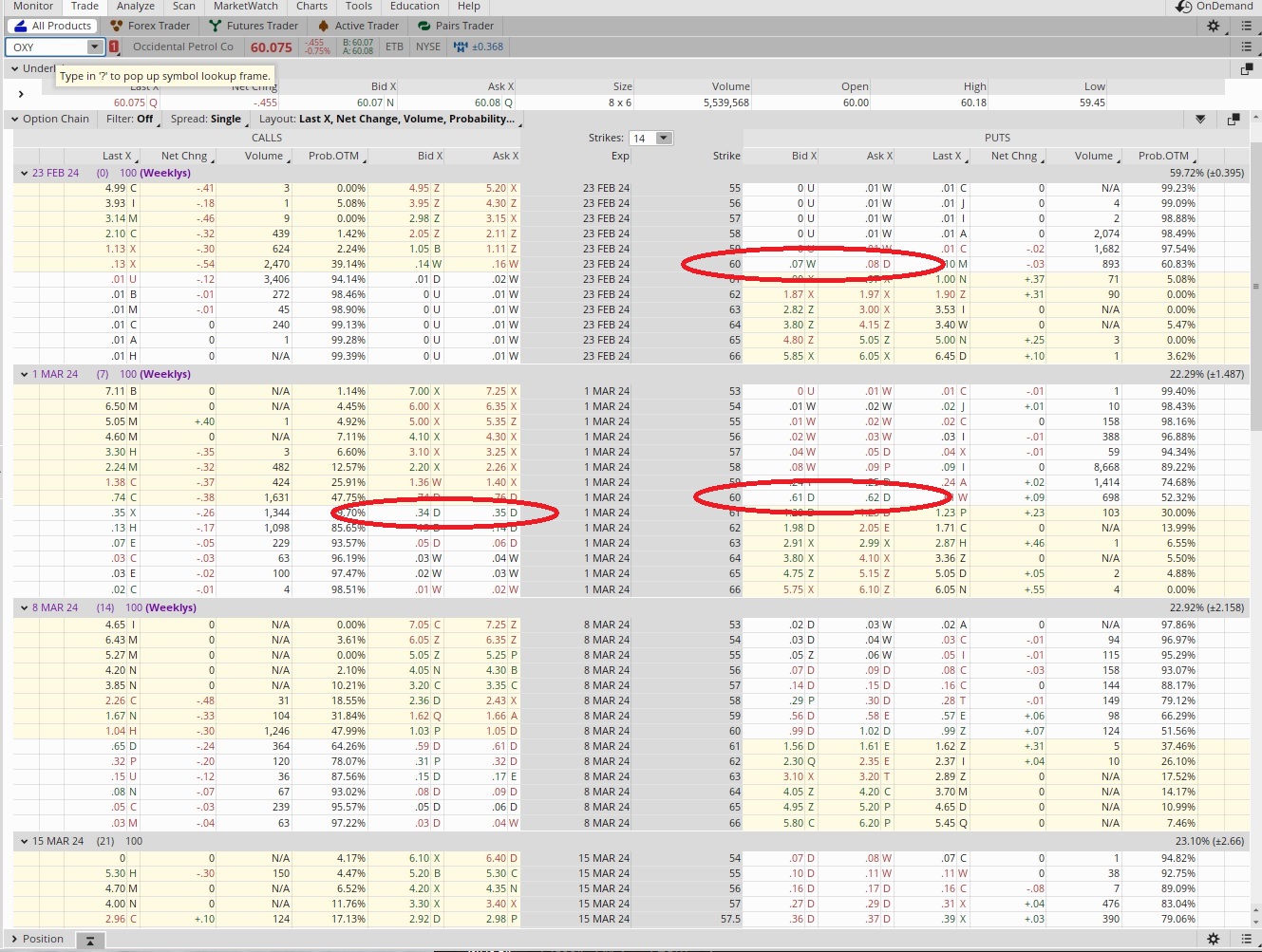

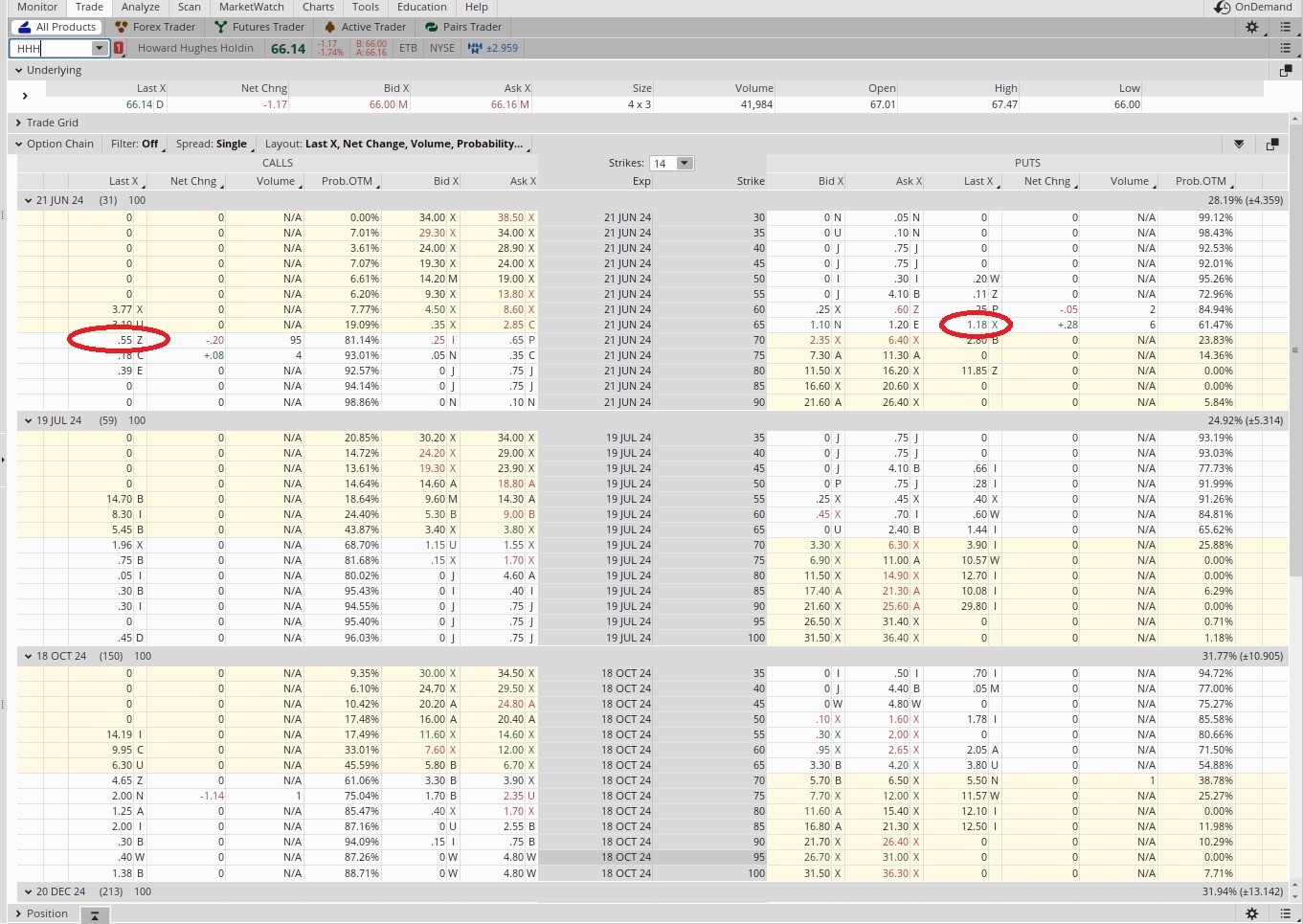

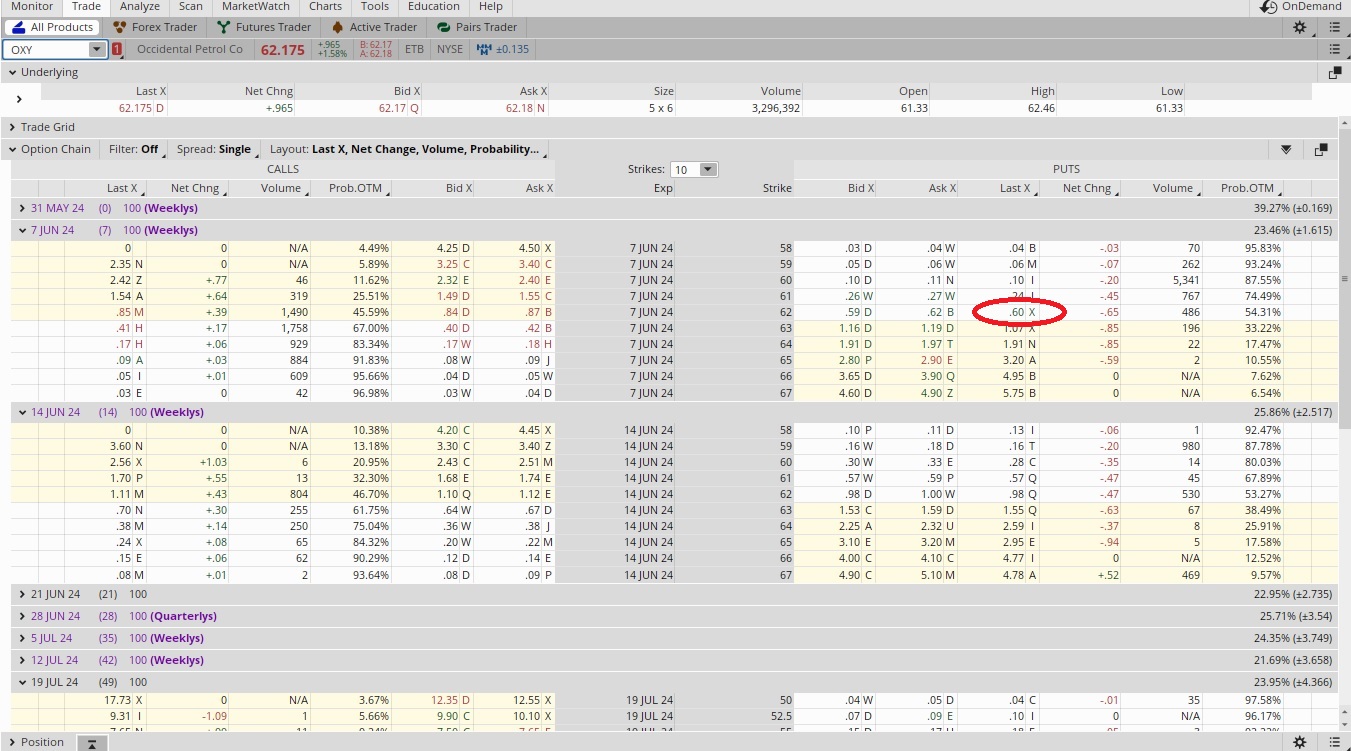

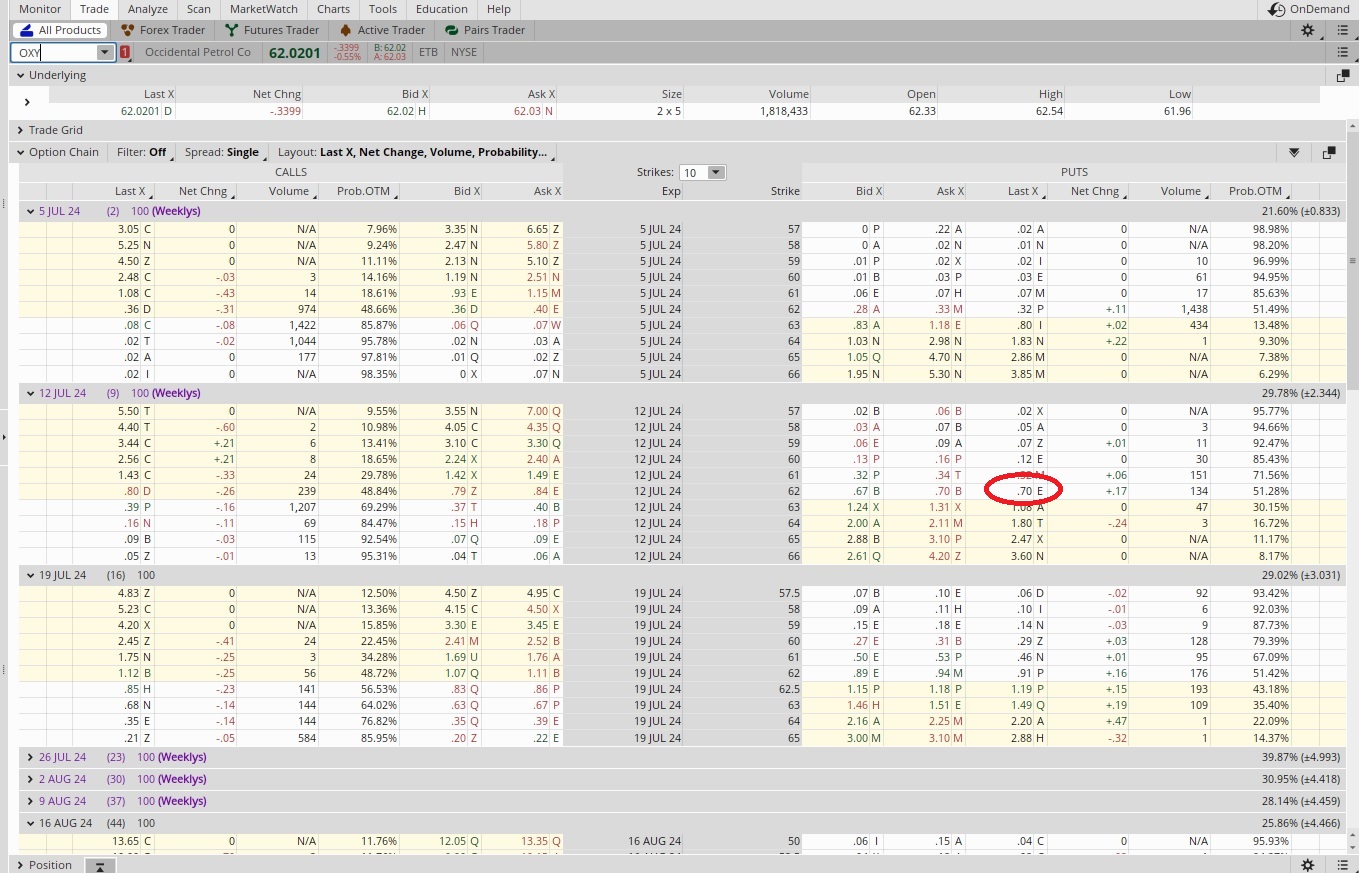

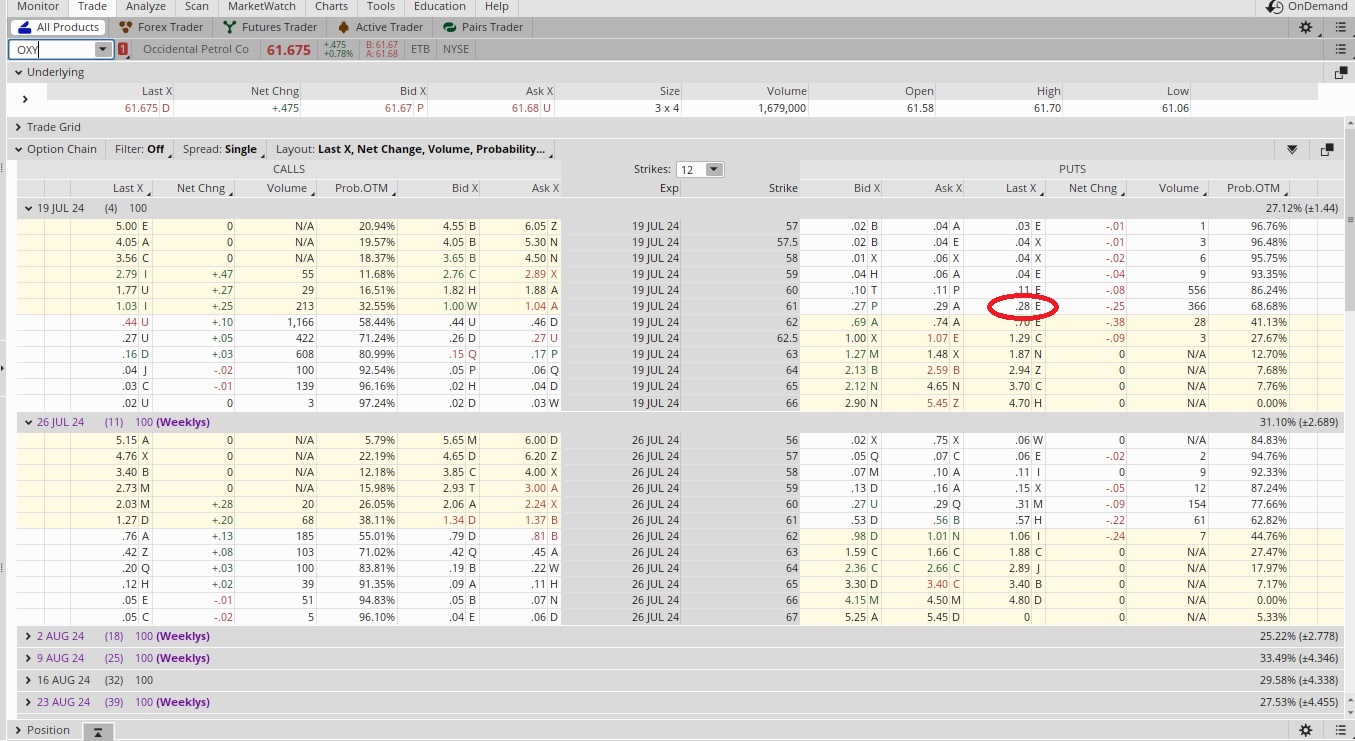

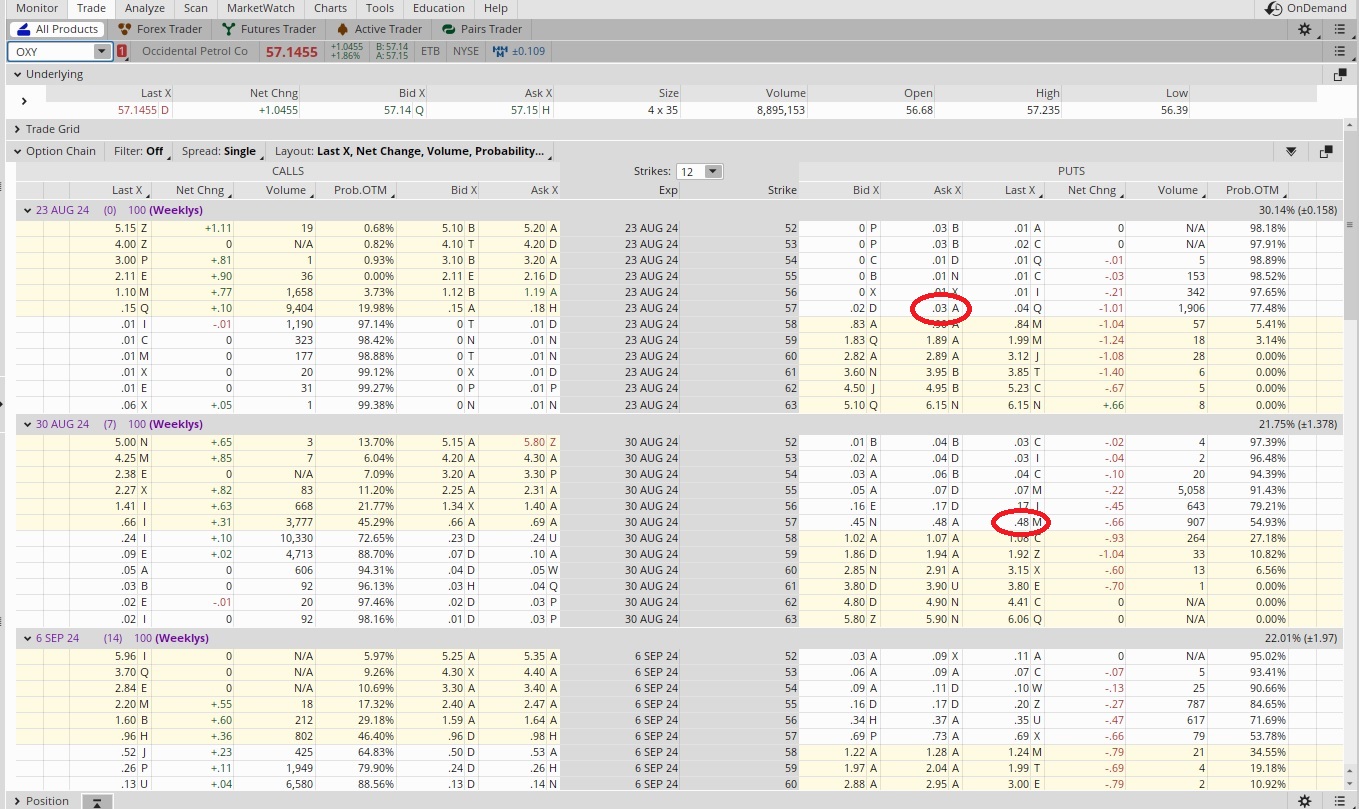

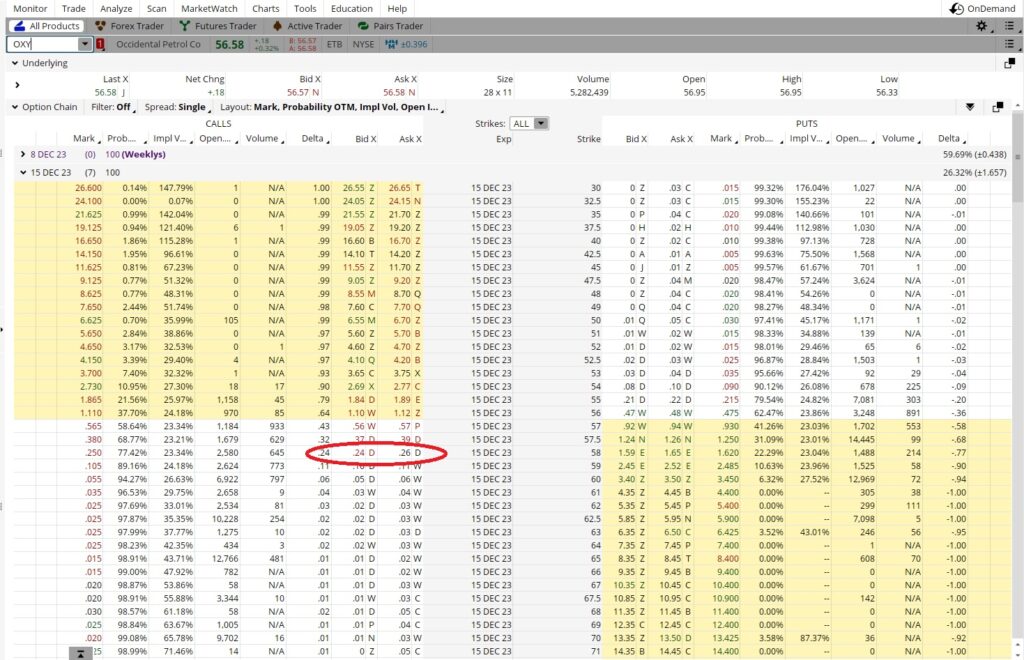

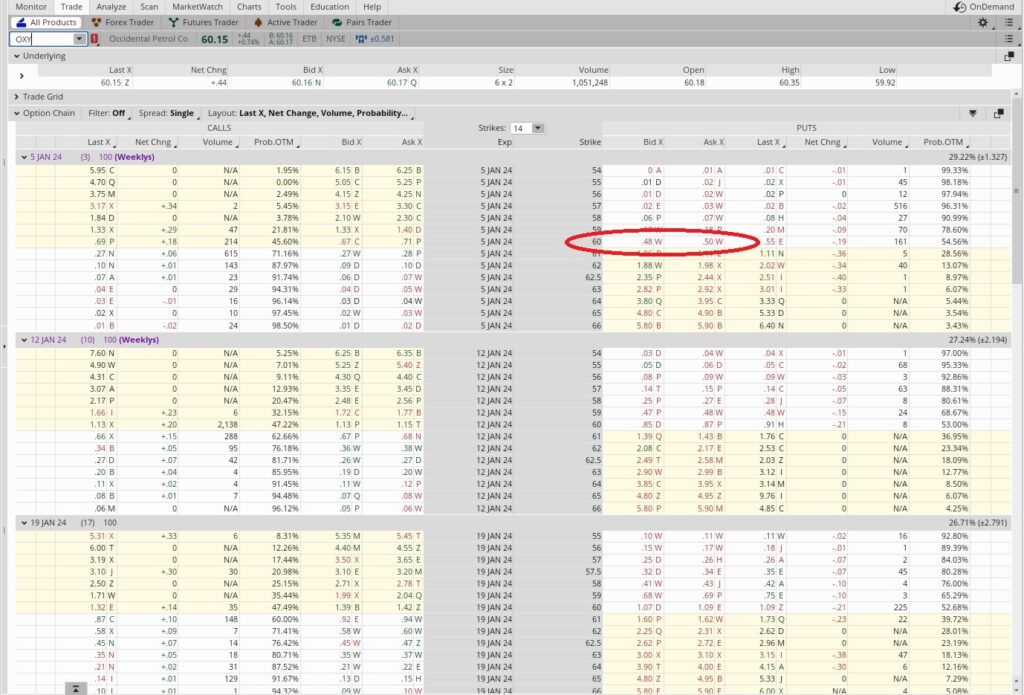

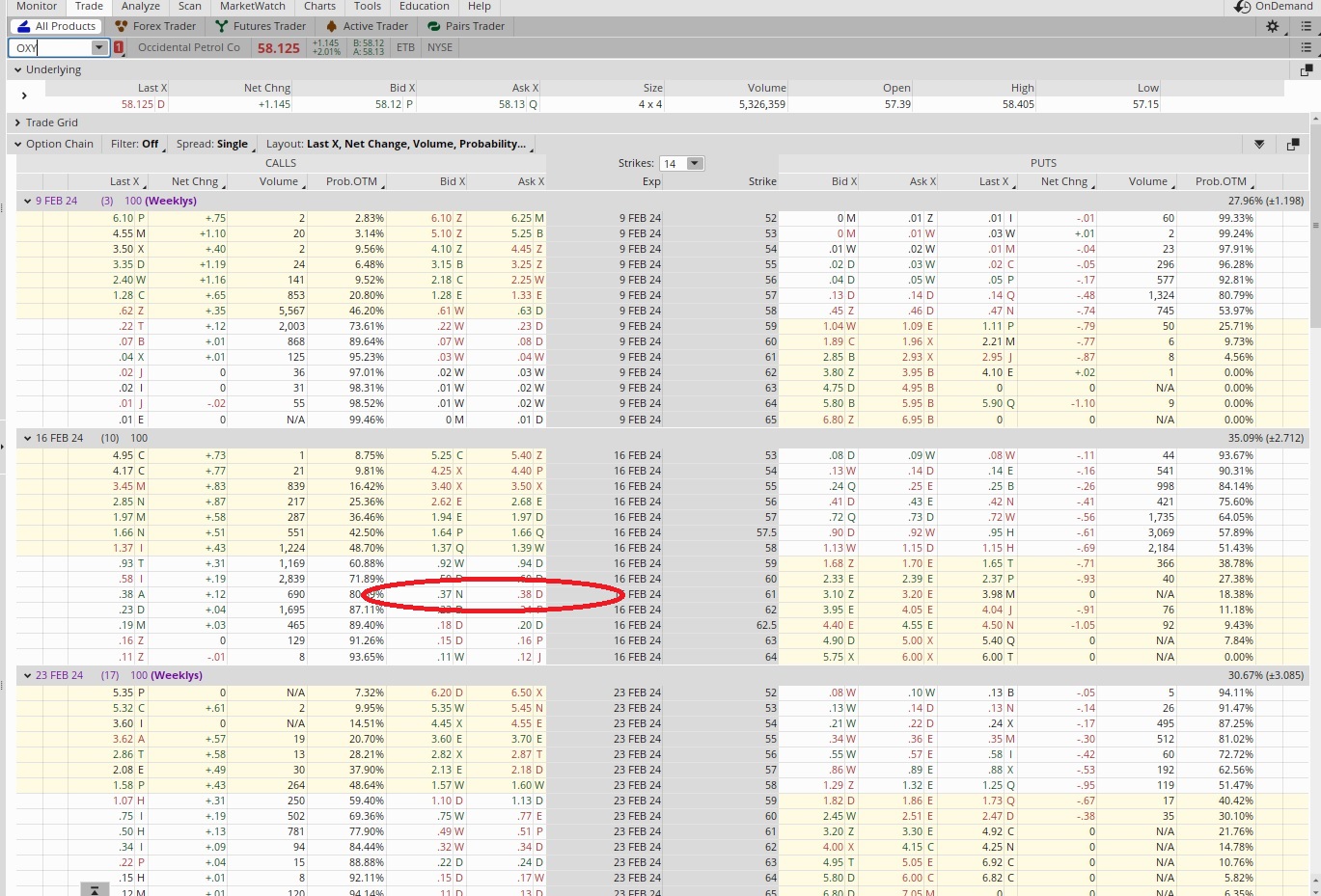

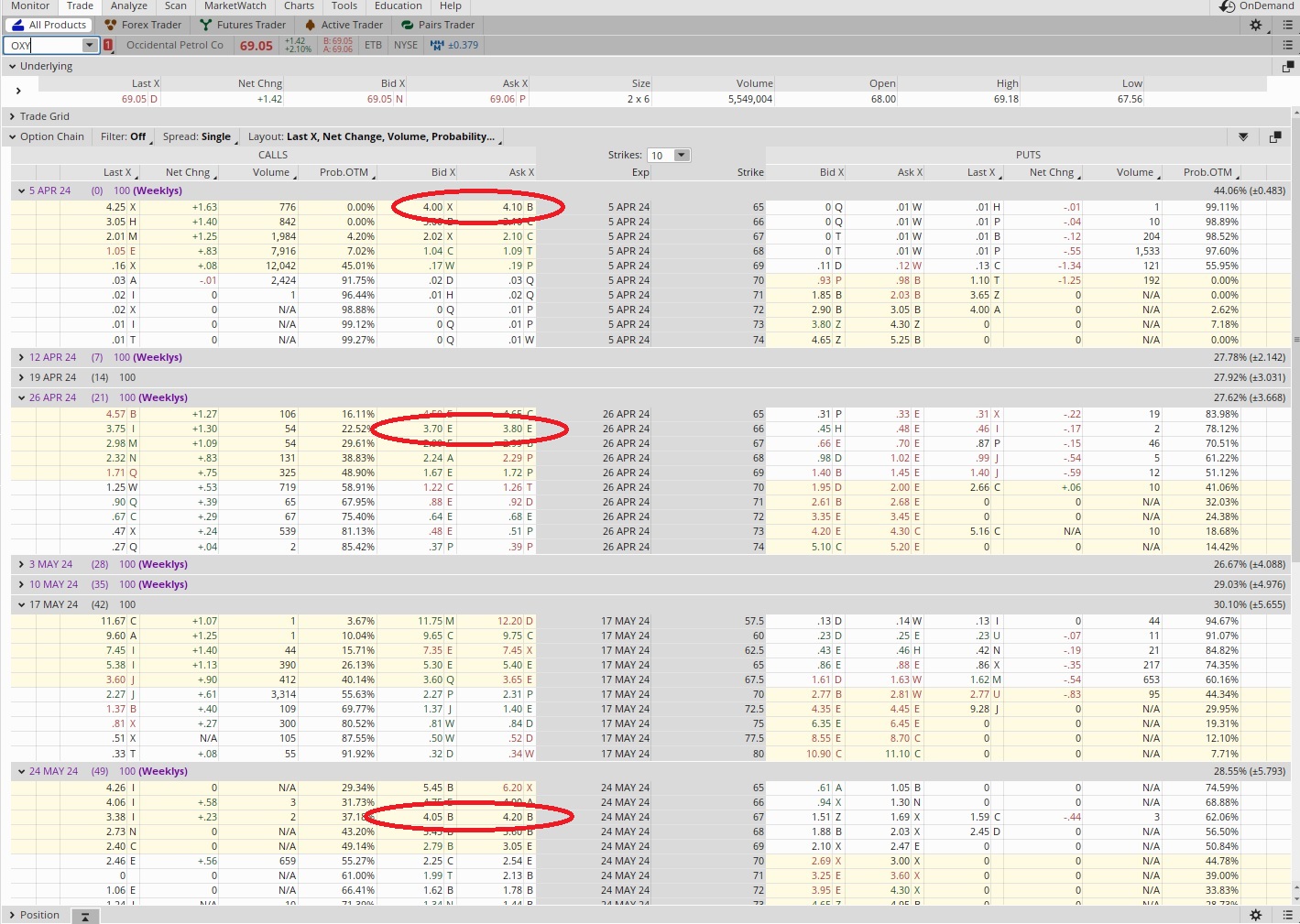

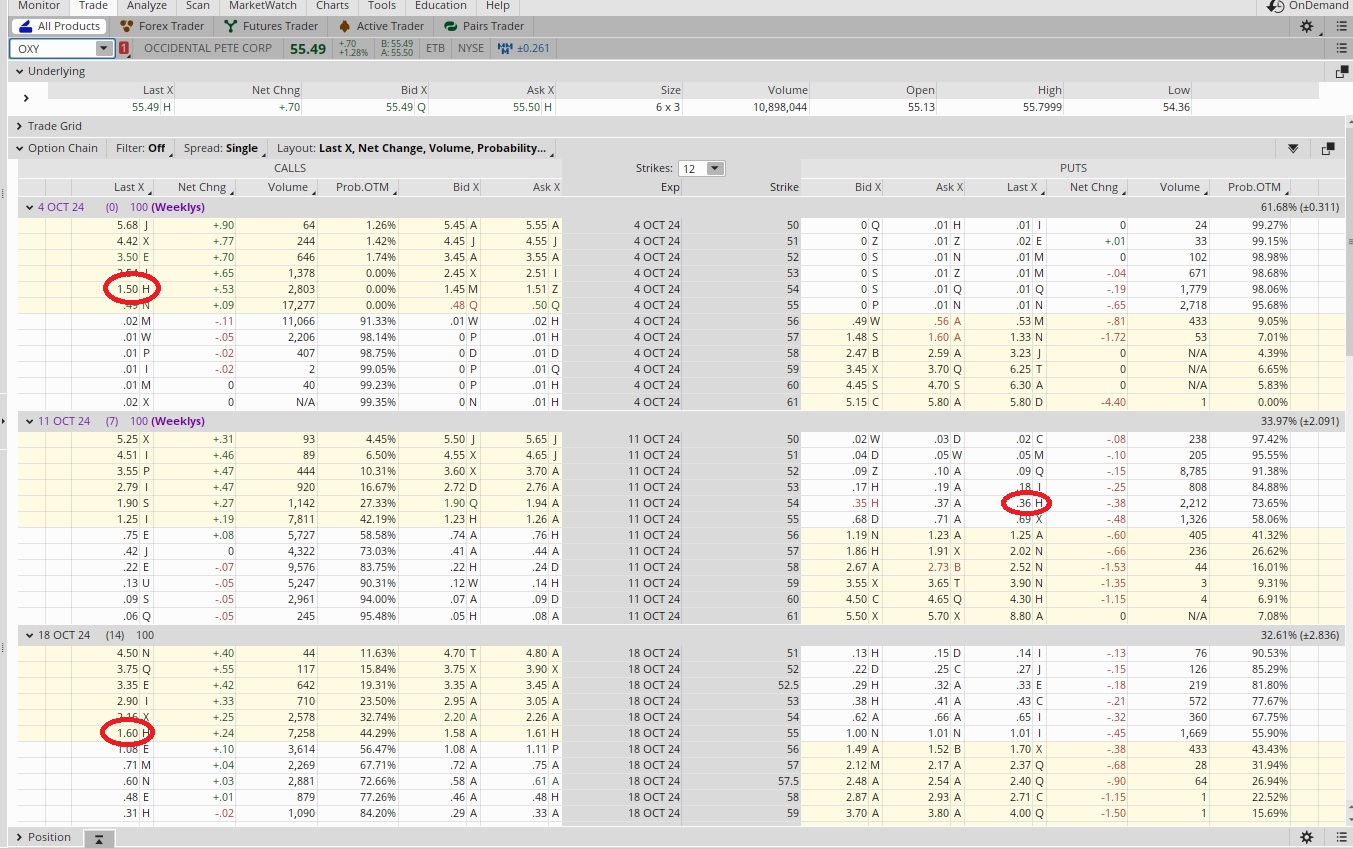

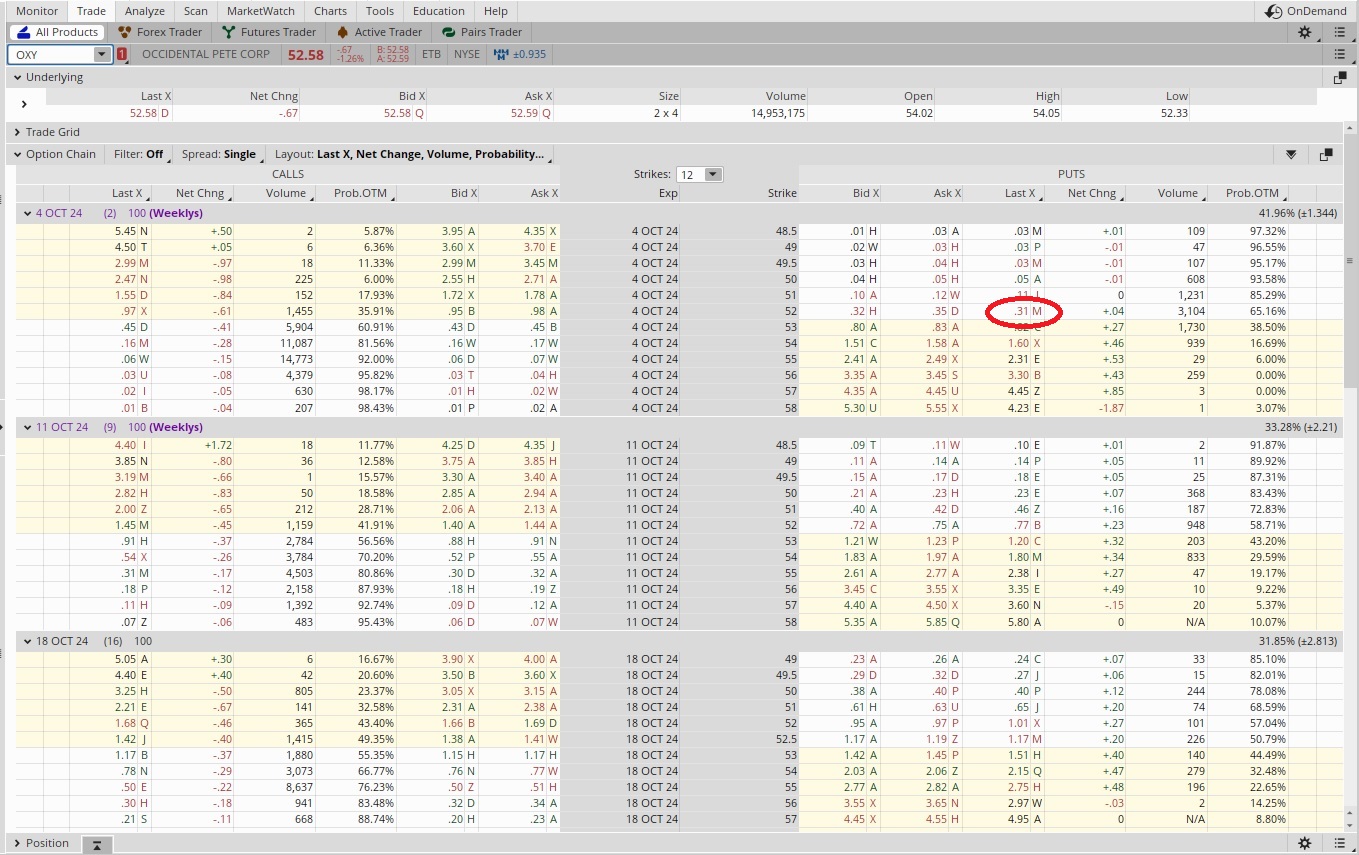

Weekly Options Trade for Passive Income on OXY – 12-12-23

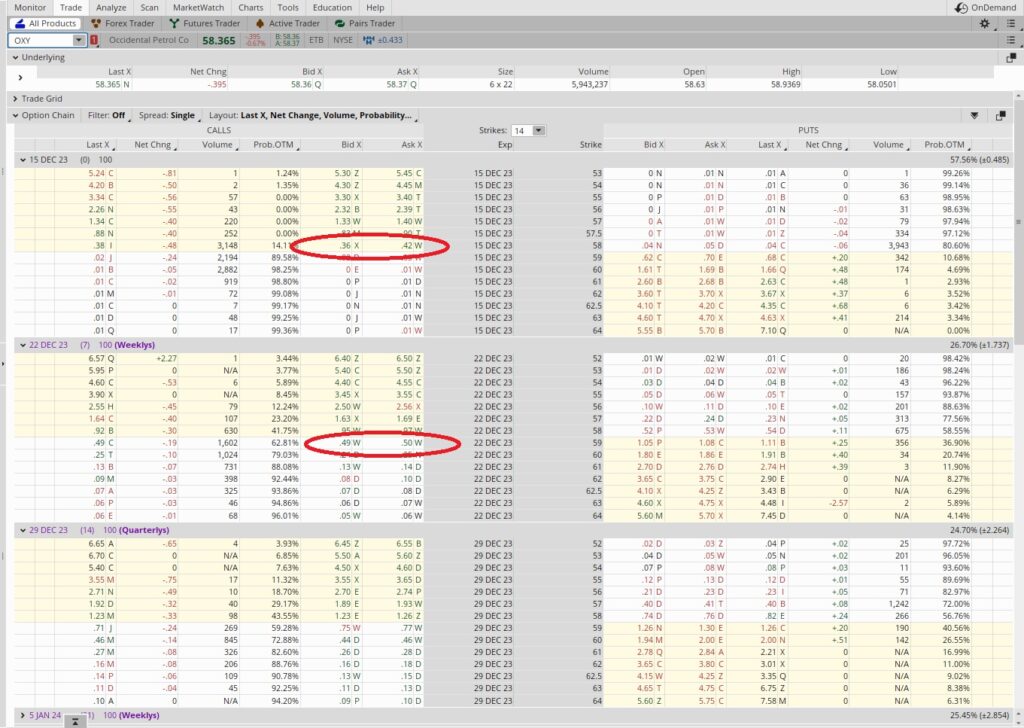

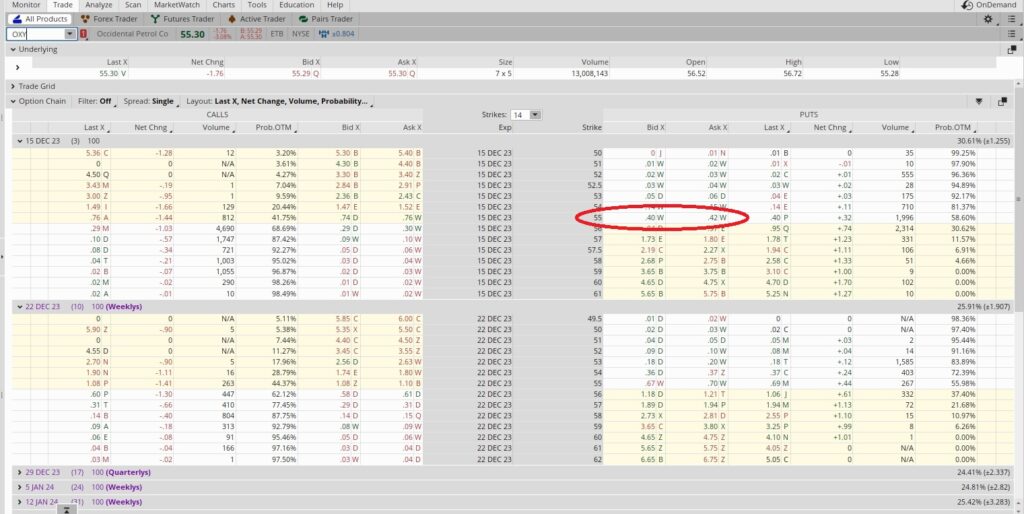

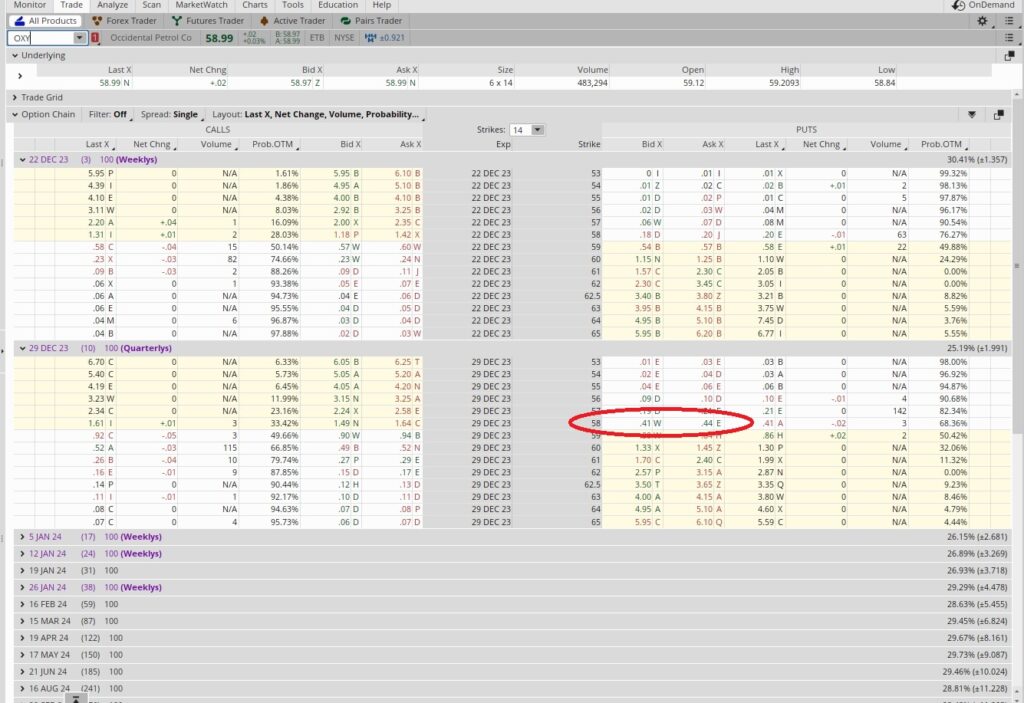

Another Weekly Options Trade for Passive Income on OXY – 12-19-23

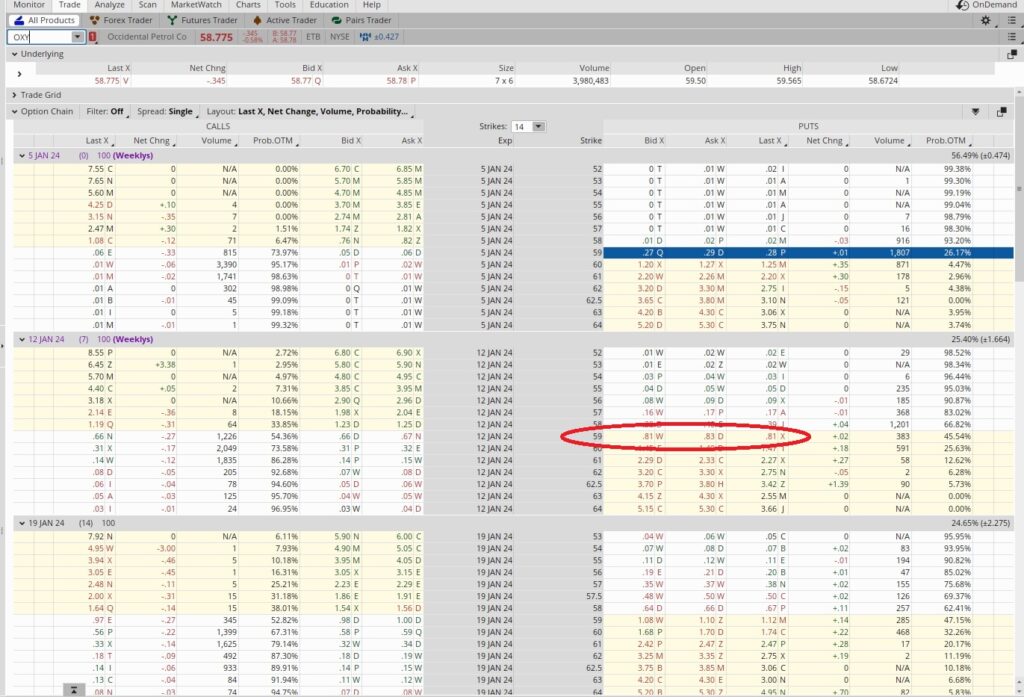

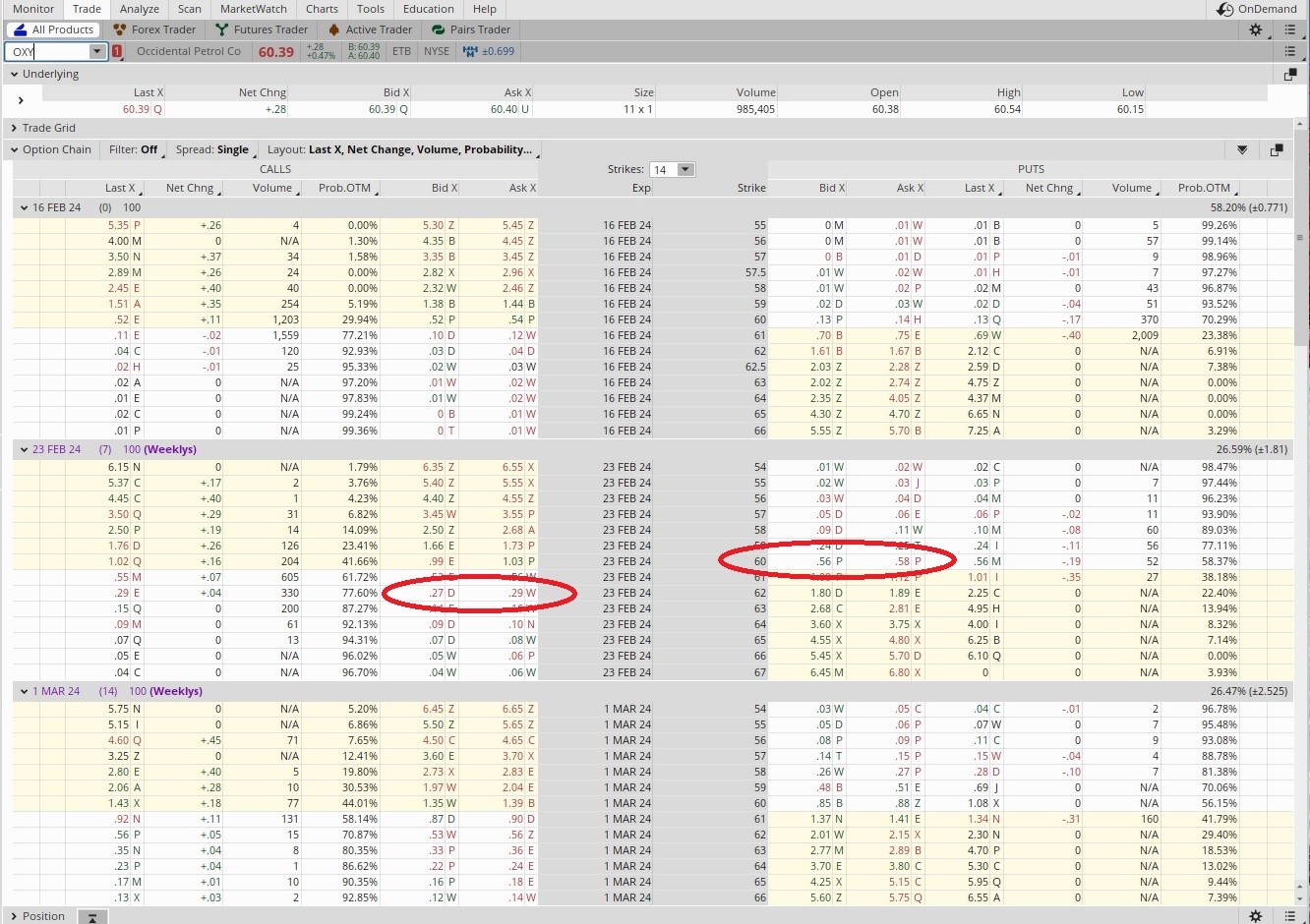

Sell a Put as a Weekly Options Trade – 01-02-24

Sell a put option contract as a weekly options trade for passive income.

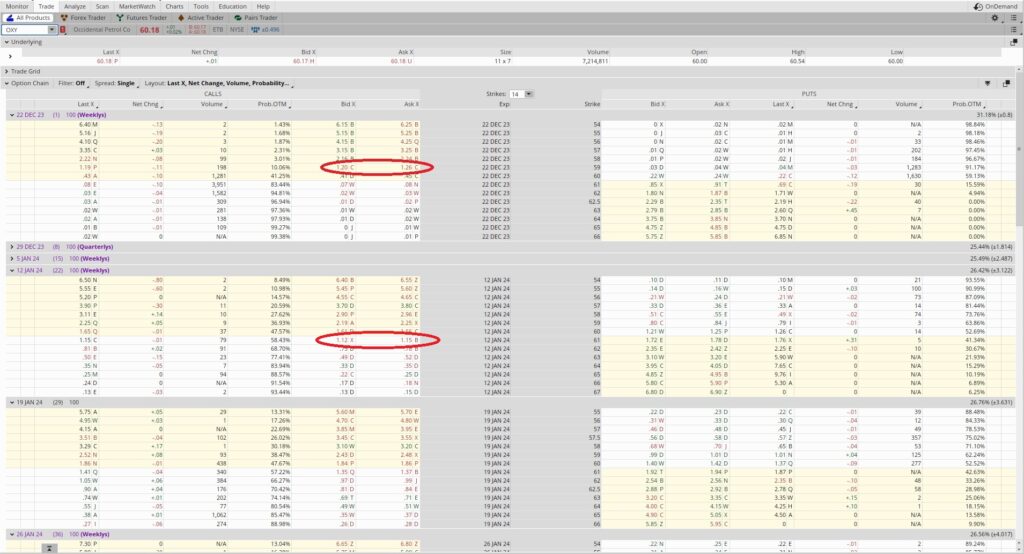

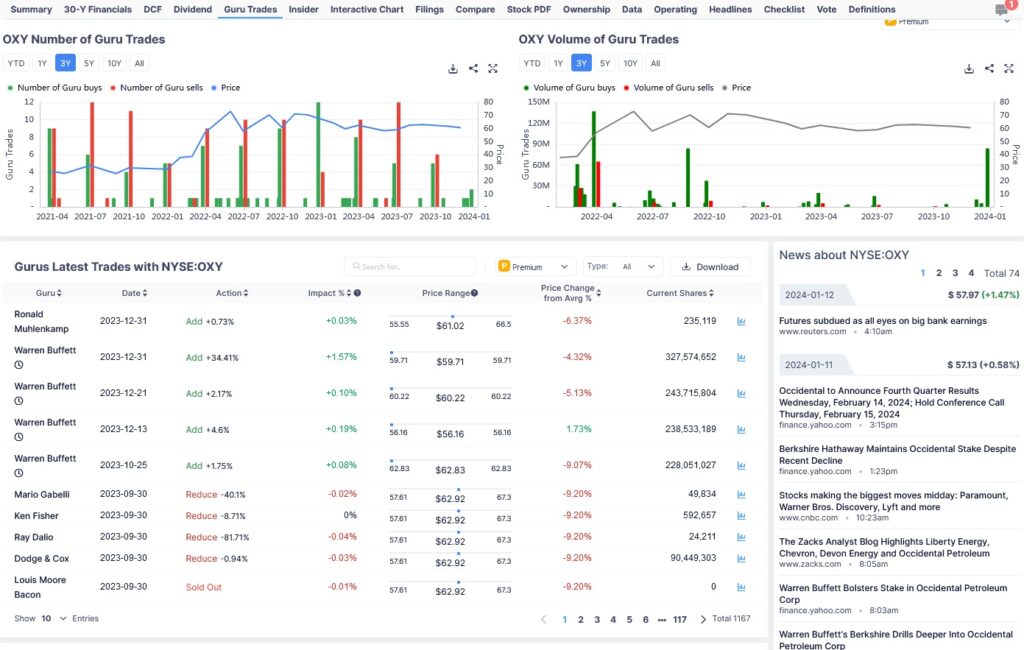

Why We’re Taking the Shares – 01-12-24

Why we’re taking the shares when our put option contract went In The Money.

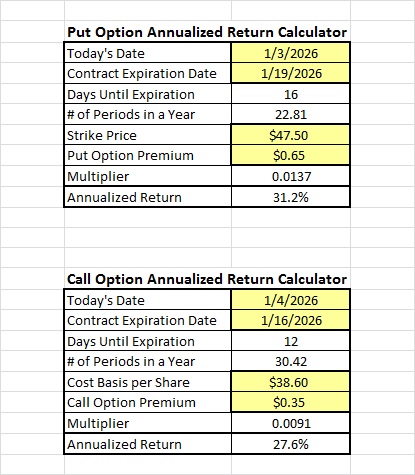

Option Contract Annualized Return Calculator

This tool calculates the annual return of a short-term option contract.

Put Option Contract Expired Out of the Money – 1-26-24

Sell Calls on a Market Up Day – 2-6-24

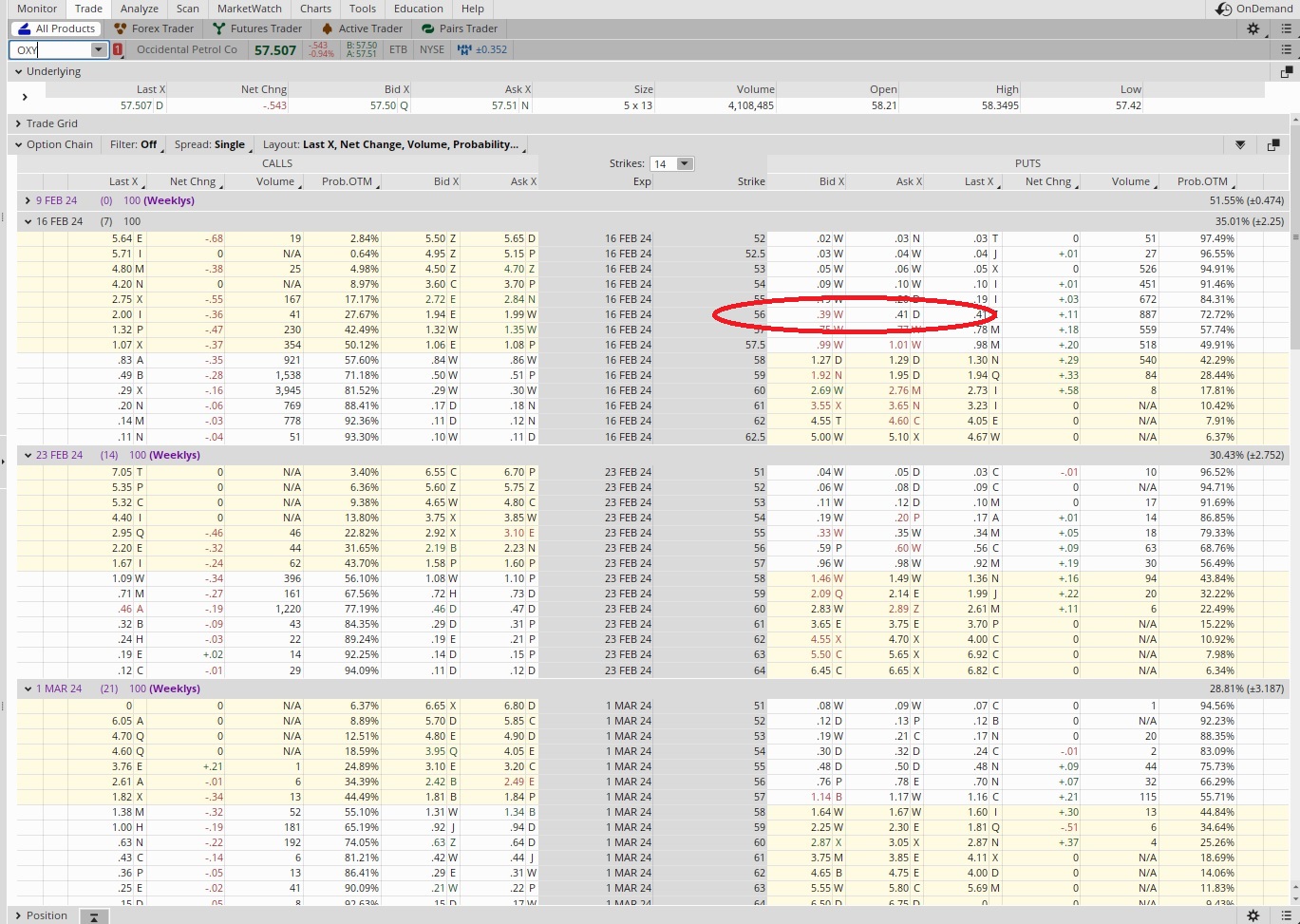

Sell a Strangle to Reduce Cost Basis – 2-16-24

We can sell a strangle to reduce our cost basis per share, which means we sell a put and call on the same company at different strikes.

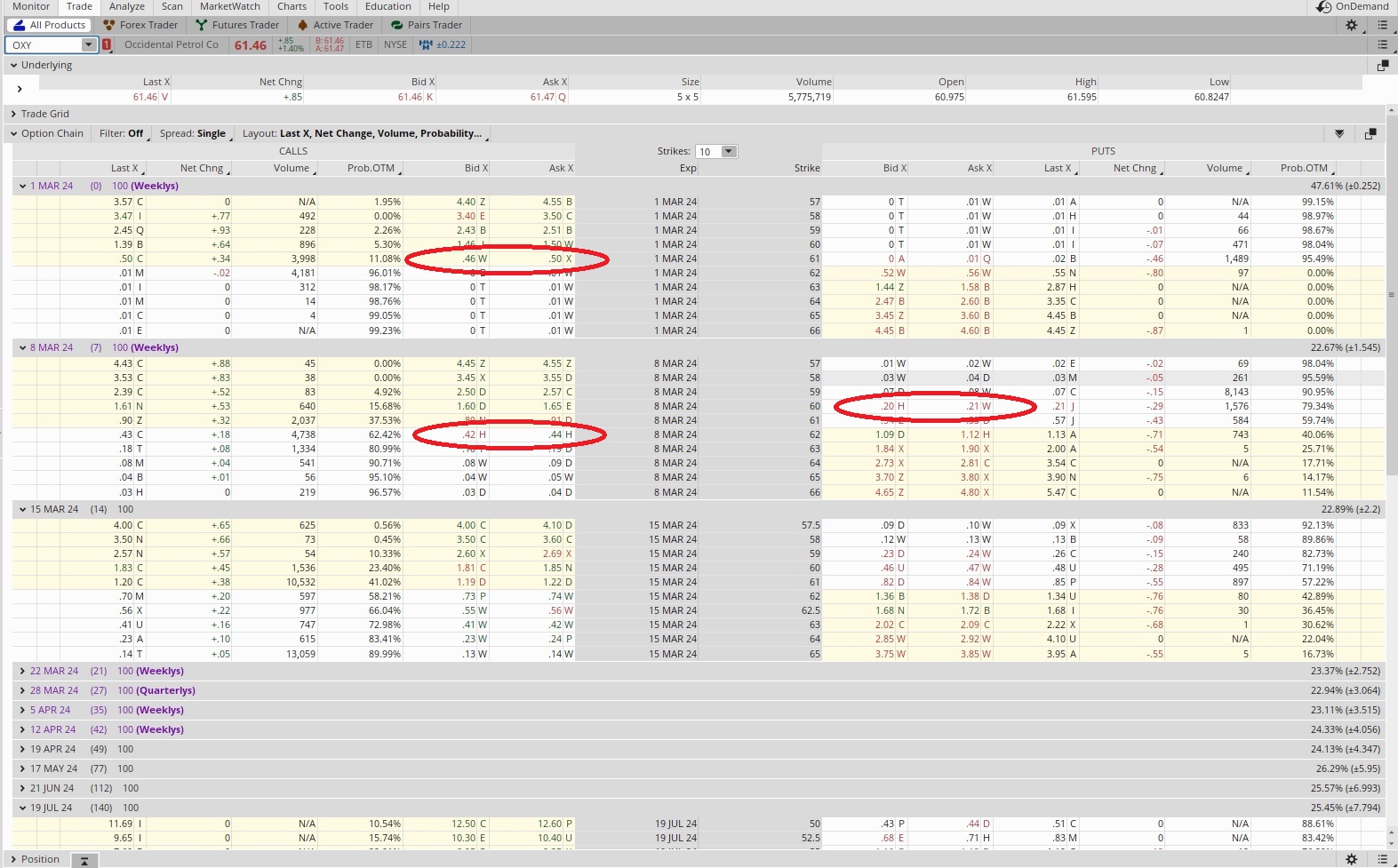

Roll One Leg of the Option Trade – 3-01-24

Produce Passive Income Selling Options – 3-15-24

Buy to Close an Option Contract – 04-05-24

Sell a Strangle Option for Passive Income – 04-18-24

Sell to Open a Put Option Contract – 05-17-24

Sell to Open a Put Option for Cash Flow – 05-31-24

Simple Options Trade – 06-14-24

Option Wheel Trade – 06-27-24

How We Opened a Position – 07-10-24

Put Option Contract for Passive Income – 07-19-24

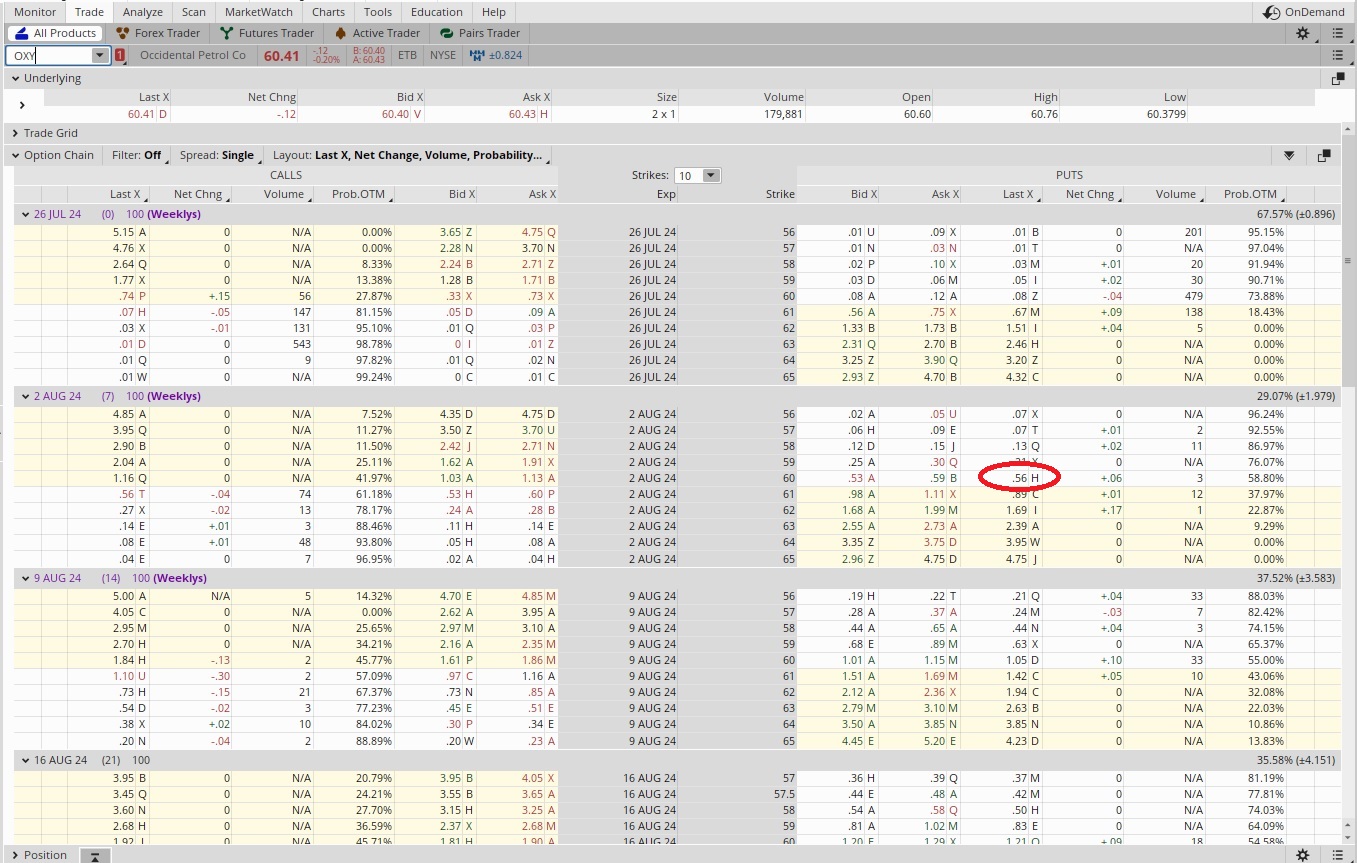

Easy Trade for Options Traders – 07-29-24

Easy Trade for Today – 08-09-24

Wheel Trade – 08-19-24

How We Find Good Companies to Trade – 08-27-24

How We Get Shares to Collect the Dividend – 09-06-24

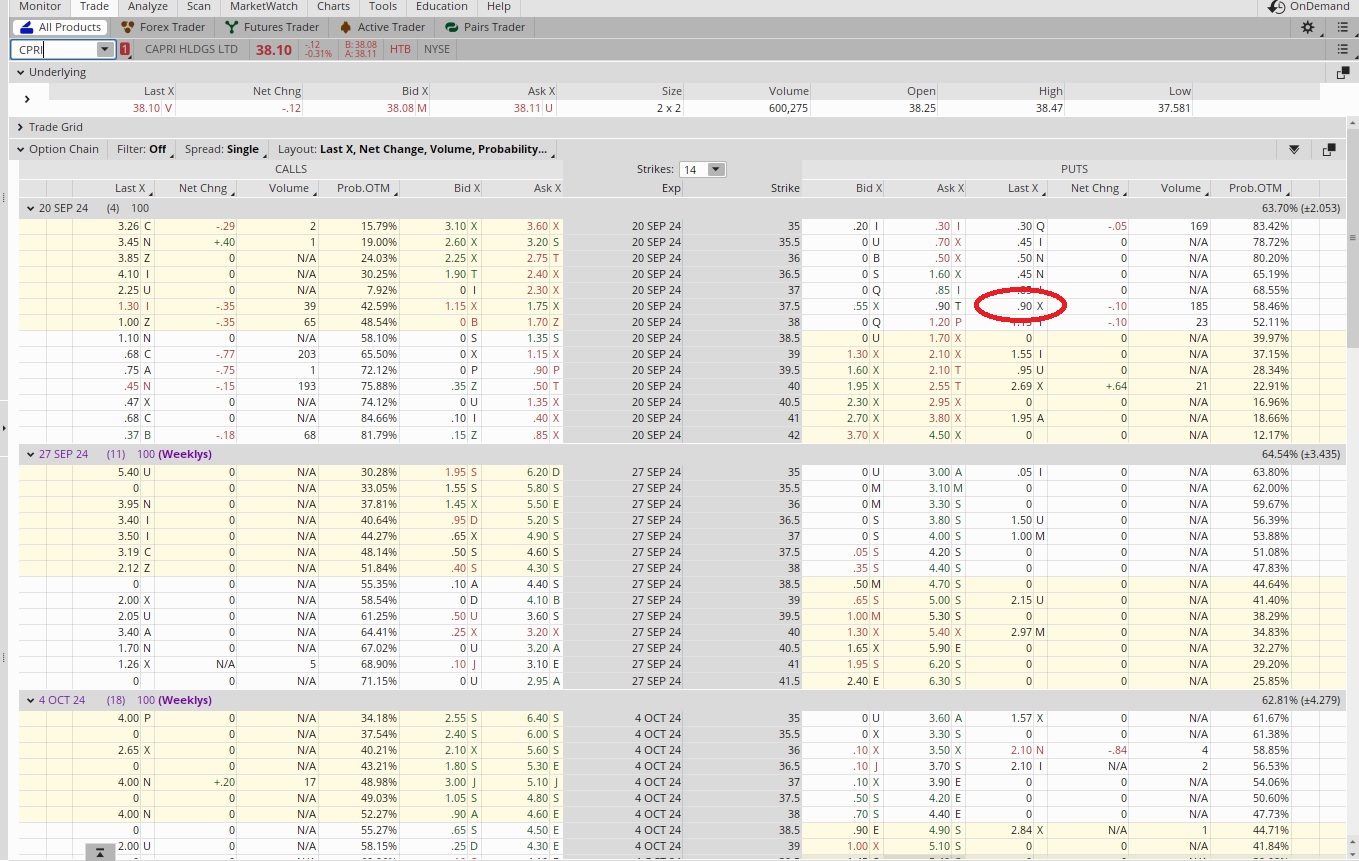

Example of a Profitable Wheel Option Trade – 09-19-24

Ratio Put to Reduce Cost Basis – 09-27-24

This example walks through how we used a ratio put to reduce our cost basis per share.