Weekly Options Trade

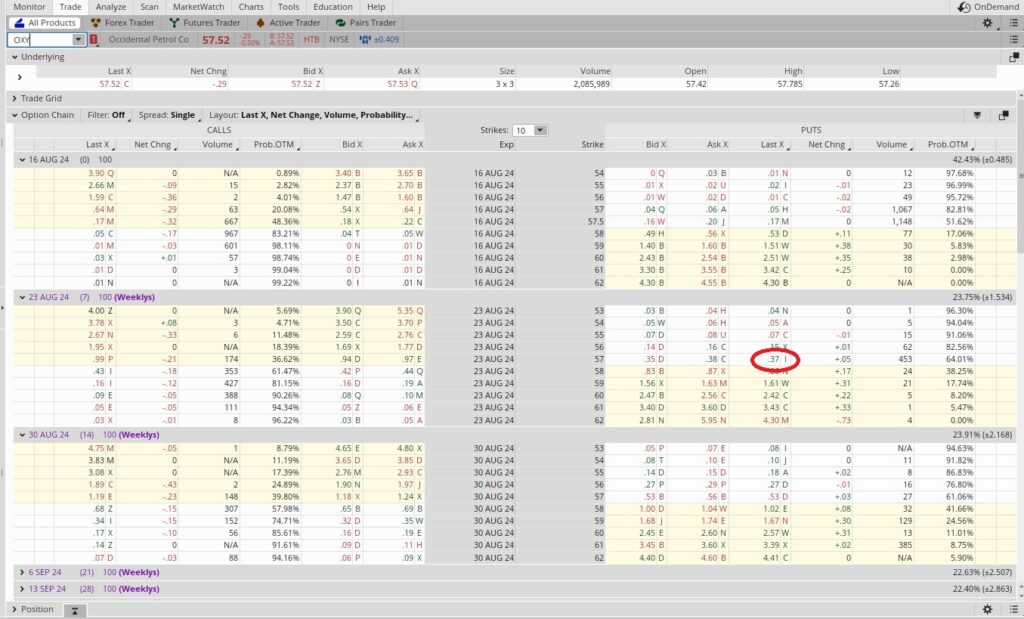

Our weekly options trade last week was a strangle option strategy on OXY. We sold the $60 call with the 8/23 expiration date and the $57 put for today’s expiration. Right now OXY is trading at $57.52 so the put leg this options trade will expire worthless. Here’s a link to the details on that trade.

Since our put at the $57 strike will expire out of the money we’ll have access to that capital again. So we’re going to sell to open another put option contract.

OXY has a dividend of $0.22 coming up. Anyone who is an owner of record as of 9/10 will get the dividend. So we’re going to be a little more aggressive selling our put this week than we typically would. If we get assigned shares on this put we can keep the shares until the ex-dividend date. Then we’ll collect the dividend and sell a covered call. If we don’t get assigned more shares we’ll still be happy collecting the additional premium we’ll receive by selling the put option contract closer to the money. We’ll also collect the dividend on the 300 shares of OXY currently in our portfolio.

We’re looking at the $57 put strike with the 8/23 expiration date for our weekly options trade. One options contract is for 100 shares of the underlying stock. The $57 put obligates us to buy 100 shares of OXY at the $57 strike price. So to do this simple options trade we’ll need to have $5,700 available in our brokerage account.

We can see how each time OXY has gotten down to $55 over the last year it’s bounced back up off of that floor. We think it’s likely for that to happen again if OXY gets down that far. Warren Buffett has recently been buying shares in from the mid $50’s to the low $60’s. Since Berkshire has a large cash position we feel it’s likely Berkshire will step in and buy shares if OXY drops much. To us, that means there likely a floor for OXY in the mid $50’s. That reduces the risk for this easy options trade. Here’s where we do that research.

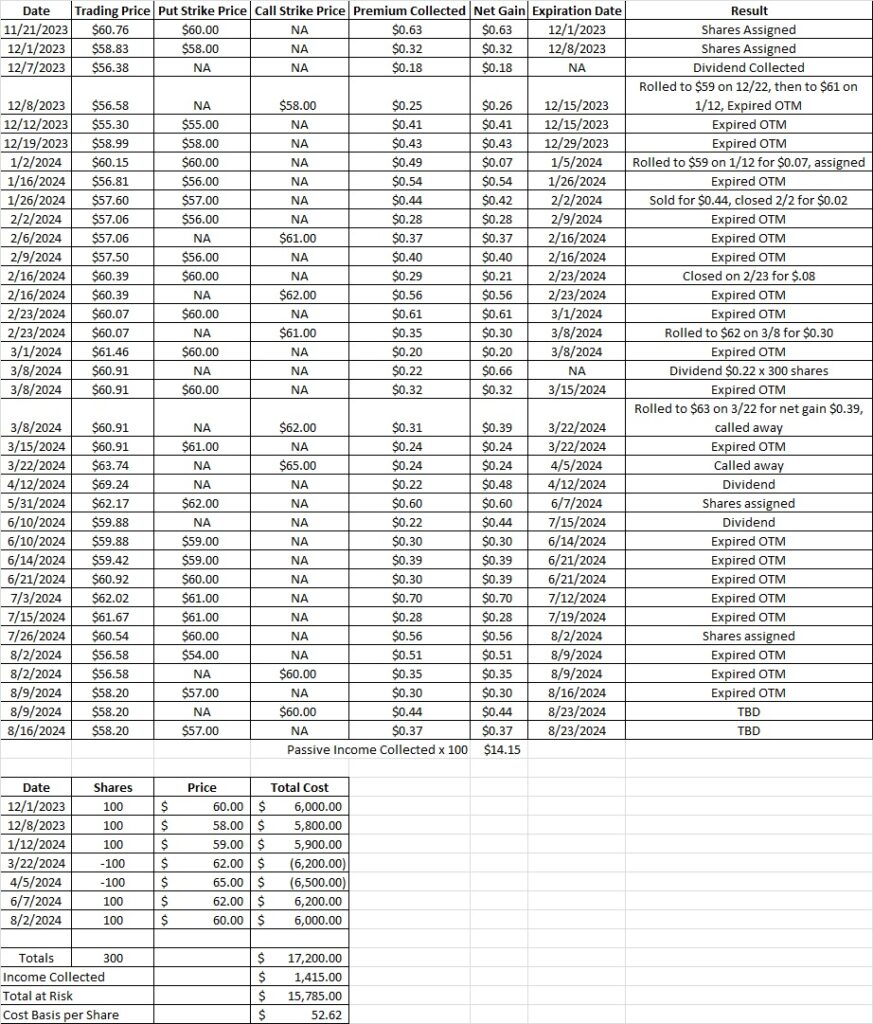

While we’re happy to own OXY at the $57 strike, also keep in mind we’re selling this put with only a fraction of what we’re willing to allocate to OXY. We currently have 300 shares and each 100 shares represents one tranche for us in this portfolio. Prior to making this trade our cost basis per share was $52.74. If we get assigned shares at $57 our total cost basis will be $53.80 per share. We’ll also still have room for another tranche in case OXY drops further. If that happens we’ll plan to sell a covered call on them after we collect the dividend.

Back to the weekly options trade. We like the $57 put strike. We can see the $0.37 in premium for the 8/23 expiration date. This is a one week trade, so we’re putting up $5,700 for one week. In theory we could do this trade (or a similar one) 52 times over the course of a year. The risk is that we get assigned shares of OXY unless we roll out of the position. But since we’re happy to own shares of OXY at the $57 strike price, we’re going to make this trade.

We’ll receive $37 in premium (100 x the $0.37 per share). So we’re making $37 over the course of one week, and using $5,700 to make that $37. So we take $37 and divide that into the $5,700 we’re risking, and that gives us 0.0065. Then we multiply that by 52 for the time period, and we get 0.338. That’s an annualized return of 33.8%. We’re happy with that rate of return. Here’s a calculator that helps with that math.

Weekly Options Trade Recap

We currently own 300 shares of OXY in this portfolio with a cost basis of $52.74 per share. We have a call at the $60 strike that expires next Friday, 8/23. Today we sold to open a put at the $57 strike that also expires on 8/23. We earned $0.37 per share in passive income for that weekly options trade. Our cost basis is now $52.62 on the 300 shares in our portfolio.