Ratio Put to Reduce Cost Basis

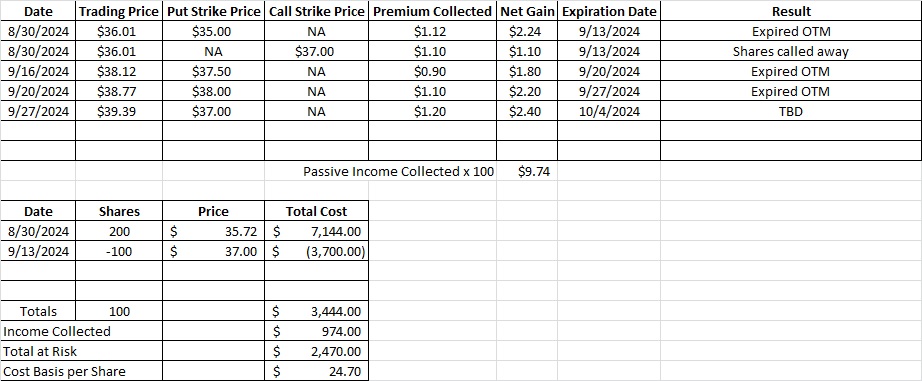

Today we’re using a ratio put to reduce our cost basis in CPRI. A few weeks ago we opened a position in CPRI using an option strangle strategy. Then we sold two cash secured put option contracts to reduce our cost basis per share further.

The puts we sold on CPRI last week at the $38 strike will expire out of the money today, 9/27. We’ll keep the $1.10 in premium from each contract and use that to reduce our cost basis per share. That’s brought our cost basis down to $27.10 per share. Since we only have 100 shares of CPRI in this portfolio we’re not going to sell a call. When we sell a covered call there is a chance the trading price for the underlying company will rise up through our strike price and our shares will get called away. We don’t want to lose these shares, so we’re not going to sell a covered call on CPRI right now.

That leaves us with option selling a put at a strike that is below the current trading price for CPRI. We only have 100 shares in this portfolio because we had 100 shares called away back on 9/13. In this portfolio one tranche is about $7,000, so we’re going to sell one tranche-worth of puts. Since our strike price will be in the mid to upper $30’s we can sell two cash secured put option contracts.

If the trading price drops below our strike price we will be obligated to buy those shares (or roll the contracts to a different strike price with an expiration date further out in time. Since we own 100 shares and we are selling two put options that will obligate us to buy 200 more share, the ratio of puts options to shares to 2 to 1. We are selling a ratio put to reduce our cost basis more quickly than just selling one put option contract.

Keep in mind the options premium for CPRI is unusually high right now because of the pending court case regarding the Tapestry acquisition of CPRI. If the FTC is successful they will block the acquisition. If CPRI and Tapestry are successful then Tapestry will buy CPRI for $53 a share. We’re happy to own CPRI for the long term at a purchase price in the low $30’s, so if the deal does not go through we’re ok with that. We’re also happy to have some shares to sell at $53 should the acquisition go through.

Weekly Options Trade

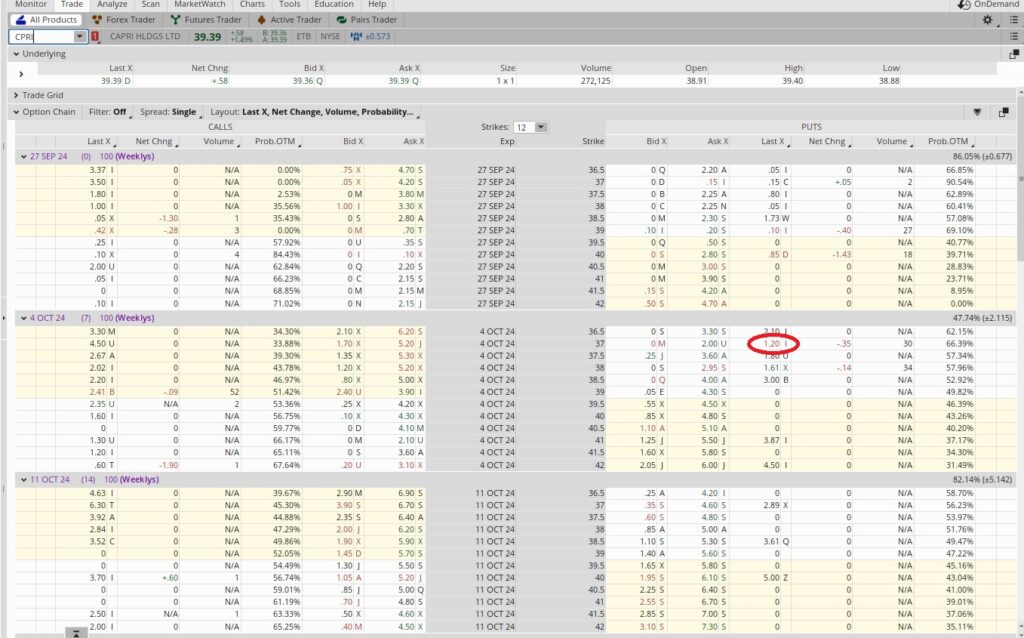

Today we used a ratio put to reduce our cost basis. We sold to open two put option contracts at the $37 strike price for the 10/4 expiration date. We took in $1.20 in option premium when we sold to open each contract. This trade is one week long, and there are fifty-two weeks in a year. So that makes our time multiplier 52. Then we divide the $1.20 in premium by the $37 strike price, and we get 0.0324. Then we multiply that by our time multiplier, so 52 x 0.0324 is 1.686. That’s an annualized return of 168% on the $3,700 we’re risking on each put option contract. By using a ratio put to reduce our cost basis per share we’re also generating a healthy annualized return.

Trade Recap

We used a ratio put to reduce our cost basis per share on CPRI. We sold to open two $37 puts expiring 10/4, and we received $1.20 in premium for each contract. That brings our cost basis down to $24.70 per share. If the trading price for CPRI stays above $37, these put options will expire out of the money. If the trading price for CPRI drops below $37 per share at expiration we will buy the shares at $37 each. Buying the shares at $37 would make our cost basis per share $32.90.