Options Trading Tutorial

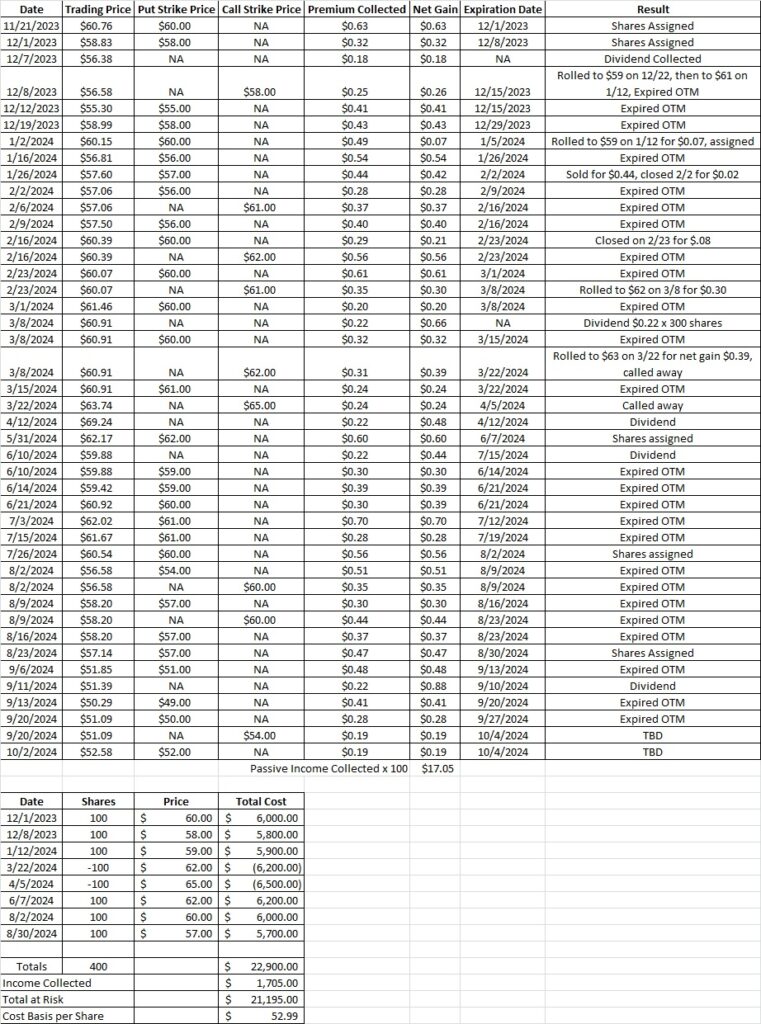

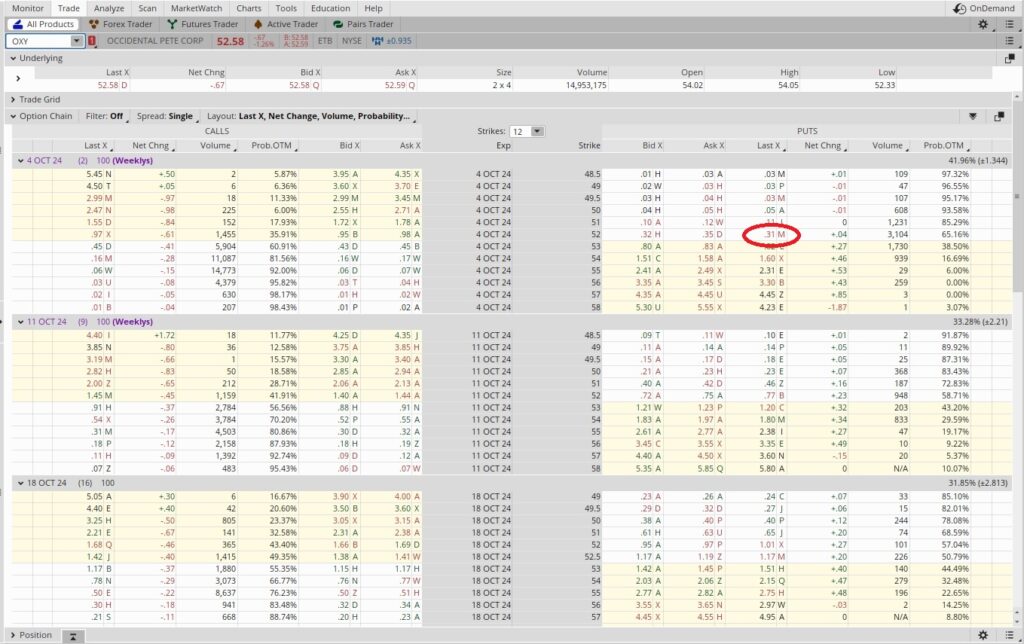

Today we’ll reduce our cost basis for shares we own in this options trading tutorial. We currently own 400 shares of OXY in this portfolio. We have a covered call option contract at the $54 strike that expires this Friday, 10/4. Our put at the $50 strike that expired out of the money worthless last Friday, 9/27. Now we have access to that capital again we can sell another cash secured put to generate some passive income. Since OXY is trading down today there’s more fear around the trading price. That means we’ll get more premium for the put than we would if we sell a put on an up day.

Our cost basis per share is $53.04, so we’re going to a sell a put with a strike price under that. We picked the $52 strike expiring 10/4 because it’s a very short term trade, it generates some solid premium, and if we get assigned shares it will reduce our cost basis. We sold the $52 put for $0.31. When we sell to open a put option contract we are making a promise to buy 100 shares of the company at the strike price. So we need to have 100 x $52 = $5,200 available in our brokerage account to make this trade. We brought in $0.31 per share in passive income when we sold the put option contract.

We calculate the return on this by dividing the premium we earn by the capital we’re risking. So we take $0.31 and divide that into $52, and that gives us 0.0059. Then we multiply that by the number of times we could do this trade in a year. Even though this trade is only two days, we could say that this is a one week long trade, because that’s the shortest time period for options on OXY. We know there are 52 weeks in a year, so we could theoretically do this trade 52 times over the course of a year. So we multiply our 0.0059 by 52 and we get 0.309, or an annualized return of 30.9% on our capital. In our options trading tutorial the annualized return is a key factor when deciding which strike we use. Here’s the tool we use to do that math.

Weekly Trade Recap

We sold the $52 put that expires this Friday, 10/4 for $0.31 in premium. We also have the $54 call active for this Friday. This options trading tutorial resulted in us collecting the additional $0.31 in premium. That premium reduces our cost basis on OXY down to $52.99 per share.