How we Use a Short Strangle to Reduce Cost Basis

Today we’re going to talk about how to use a short strangle to reduce our cost basis. A strangle is when we have a put and a call on the same underlying company at the same time, but with different strike prices. In this case we’re going to sell a cash secured put and a covered call option contract on OXY. Here’s the pose that walks through our most recent trade. The point of this type of trade is to use the options premium to reduce our cost basis. We own some shares, we’re ok with buying more shares in this price range, and we’re ok with selling some shares above our cost basis.

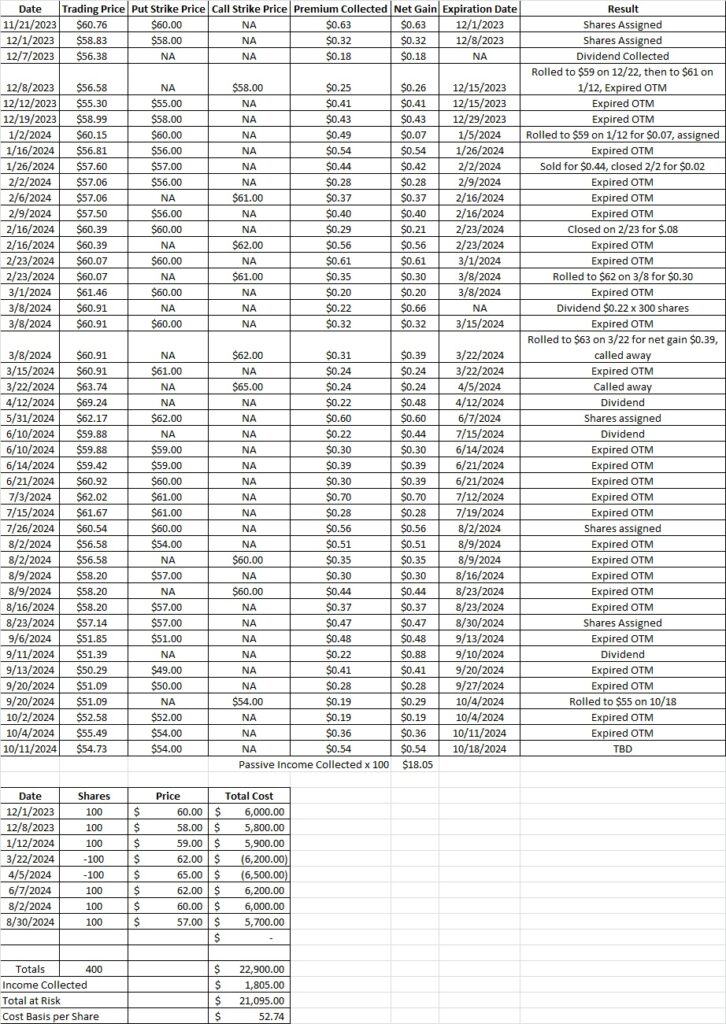

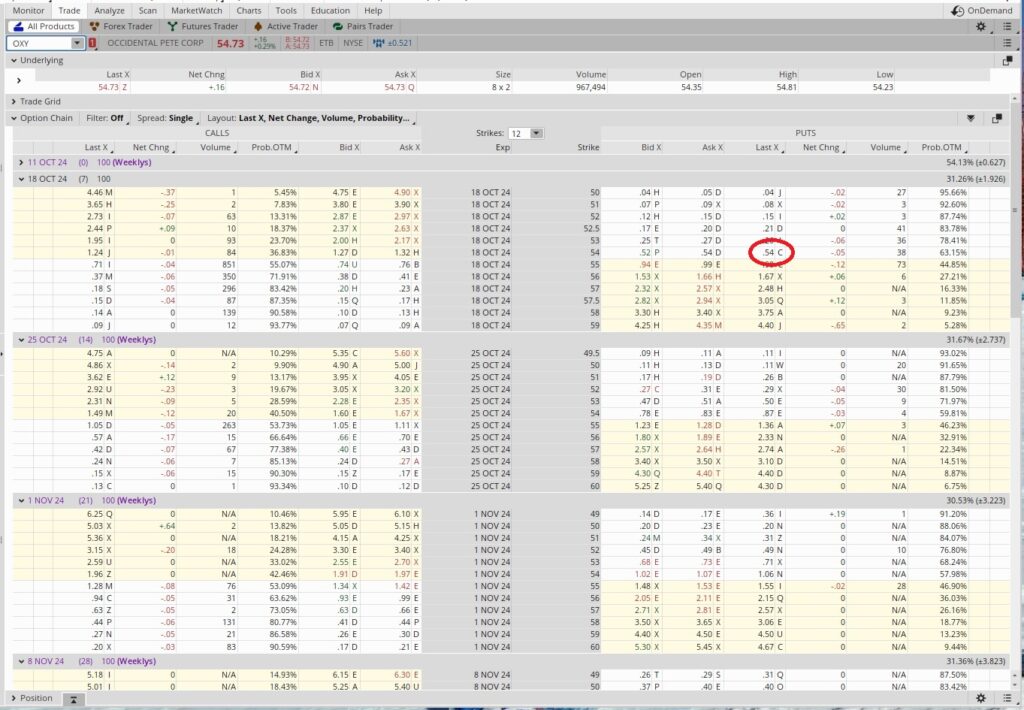

We’ve been trading OXY for several months and we currently own 400 shares in this portfolio. We’ve been able to work our cost basis down to $52.87 per share by selling options to generate passive income. We have a put at the $54 strike that will expire out of the money today, 10/11. That expiration will give us access to that capital again. With OXY currently trading at $54.73 let’s take a look at some other options to generate passive income.

We can sell the same $54 put again this week for the $54 strike for $0.54. So we’re getting 1% return on that investment ($0.54 premium divided into the $54 strike price). This is a one week long trade that will expire next Friday, 10/18. Since there are 52 weeks in a year we could theoretically do this trade (or a similar trade on a different company) 52 times over the course of a year. So we multiply that 1% by 52 and we get a 52% annualized return on our capital. That’s solid. Here’s the tool we use to help us with that math.

The other side of using a short strangle to reduce cost basis is selling a covered call. We currently have a covered call that we rolled at the $55 strike for the 10/18 expiration date. This post shows how we did that trade.

Weekly Trade Recap

We sold to open the $54 put for the 10/18 expiration date for $0.54. We also have the $55 call for the 10/18 expiration date. These trades show how we were able to use a short strangle to reduce our cost basis by $0.54 with the put and another $0.29 with the call at the same time. That’s a gain of $0.83. If either of these trade go in the money we could either get assigned more shares with the put, let shares go with the call, or roll the contract to a different expiration date that is further out in time. We used this short strangle to reduce our cost basis down to $52.74 per share.