Options Trading Article

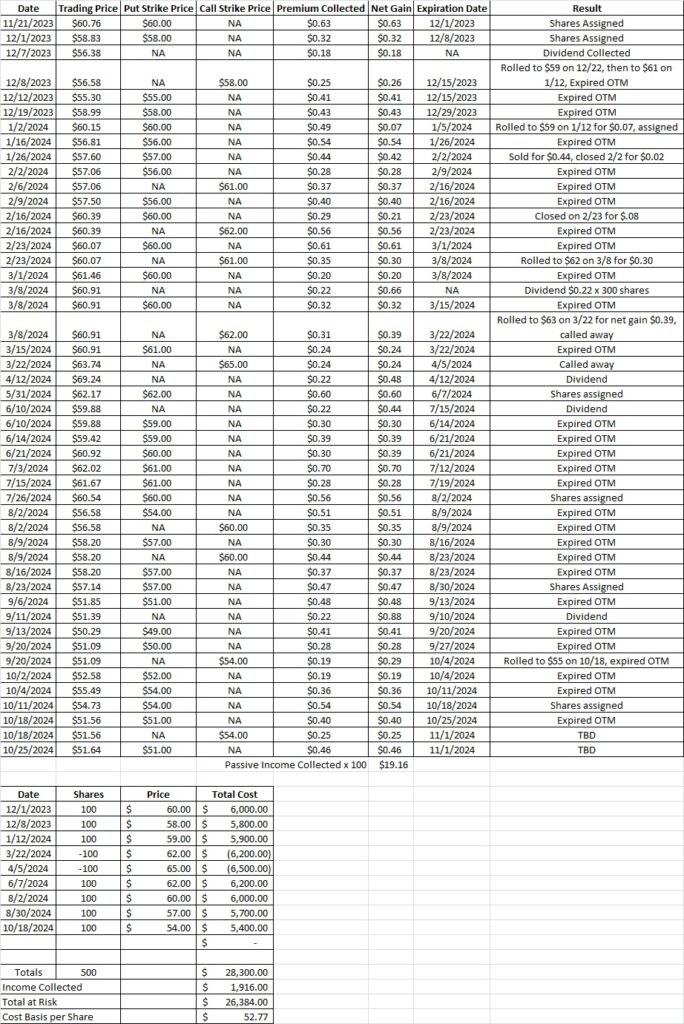

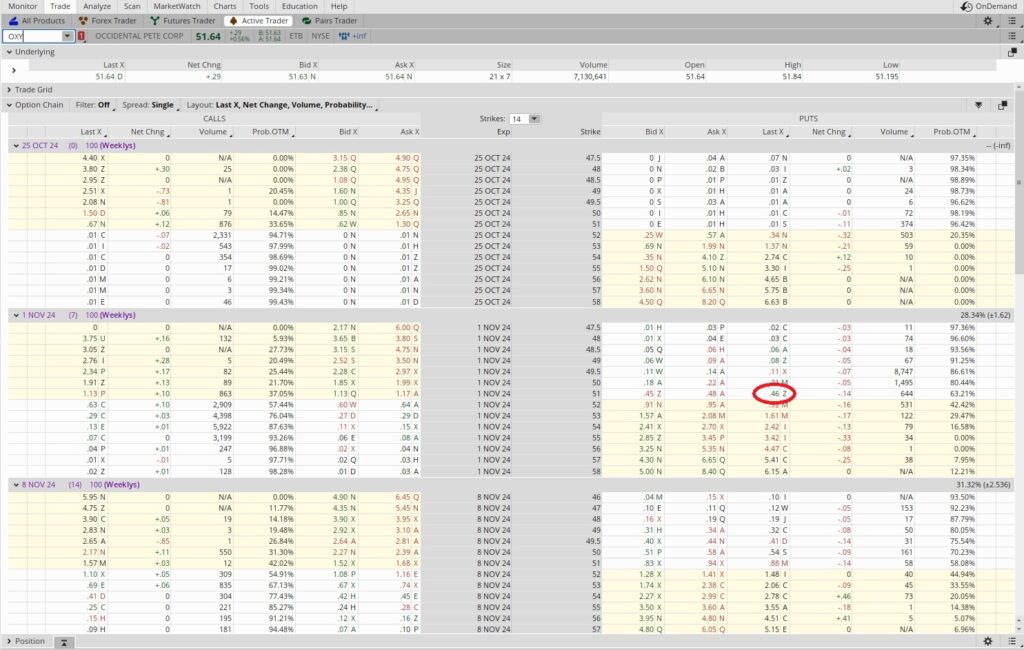

Our options trading article this week focuses on our option cash flow trades on OXY. We currently have the $51 put option contract that will expire out of the money today, 10/25. We also have a covered call option at the $54 strike that will expire next Friday, 11/1. Right now OXY is trading a $51.64. Since our put at $51 is expiring today we’re going to sell to open another put at the $51 strike.

When we sell a cash secured put option we’re making a promise to buy 100 shares of the underlying company at the strike price. The buyer of the contract could choose to exercise the contract at any time from now through the expiration date. So to sell the $51 put we need to have at least $5,100 available in our brokerage account to cover us if we need to buy the shares. We’re risking $5,100 for the duration of the trade, and we want to be sure we’re generating an acceptable return on that capital. We sold the $51 put for $0.46, so we received $46 when we made this trade. We picked the $51 strike because it’s close enough to the current trading price that we’re generating an acceptable premium.

In this options trading article we want to include the rationale for picking both the strike price and the expiration date. We could get more premium if we chose the 11/8 expiration date, but that would have the contract active through the presidential election. We anticipate the election could create some additional volatility in the markets, especially for a commodity like oil. So we’re going with an expiration date prior to the election.

To see our annualized rate of return on this trade we take the $0.46 in premium and divide it into the $51 strike. That gives us 0.009. This is a one week trade, and there are 52 weeks in a year. So if we wanted to we could do this trade, or a similar trade on a different company, 52 times over the course of a year. So we multiply that 0.009 by 52 and we get 0.469. That’s an annualized rate of return of 46.9%. We’re happy with that. Here’s a tool that helps with that math.

Weekly Options Trade

In our options trading article we outlined our weekly trade. This week that’s a put at the $51 strike on OXY that expires next Friday, 11/1. We also have the $54 call open for next Friday’s expiration date. Using these weekly options for cash flow we’ve been able to reduce our cost basis per share down to $52.77.