Using Covered Calls to Sell Shares

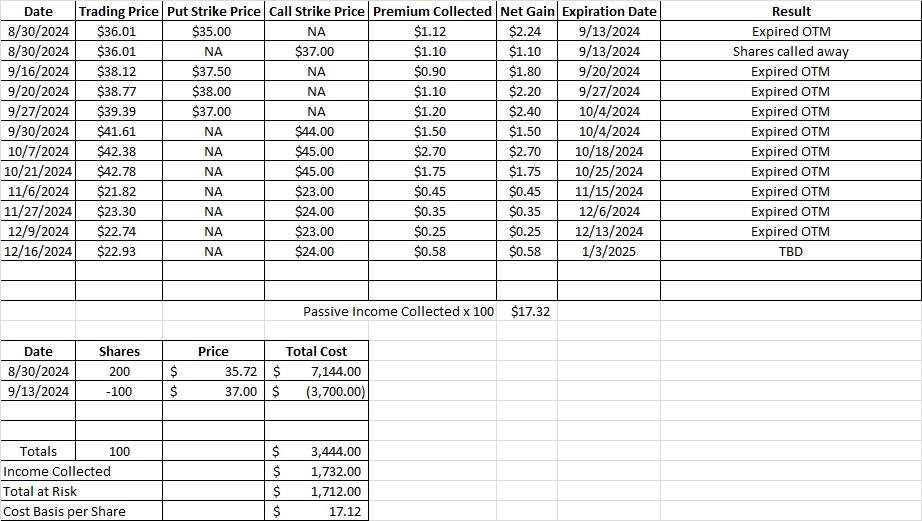

Today we’re using covered calls to sell shares of CPRI. We had started trading CPRI during the acquisition talks with Tapestry. We’ve done several weekly options trades on CPRI and have worked our basis down to $17.70 per share. With CPRI trading at $22.93 today we’re in a profitable position on this company. We’ve been selling our covered calls very close to the money because we’re happy to let these shares go and use the capital for a different trade. Here’s a link to one of our recent posts on these weekly options trades.

We only have 100 shares of CPRI left in this portfolio. Now we’re going to sell a covered call very close to the money. Entering into this contract will put us in a position to sell our shares of CPRI if the trading price goes above the strike price. We’re using covered calls to sell shares of CPRI at the price we want to sell them, and to collect additional passive income for doing it. If CPRI drops in price we’ll keep the premium and sell another covered call next week. If CPRI rises and our covered call option is in the money at expiration we’ll let the shares go.

Weekly Options Trade

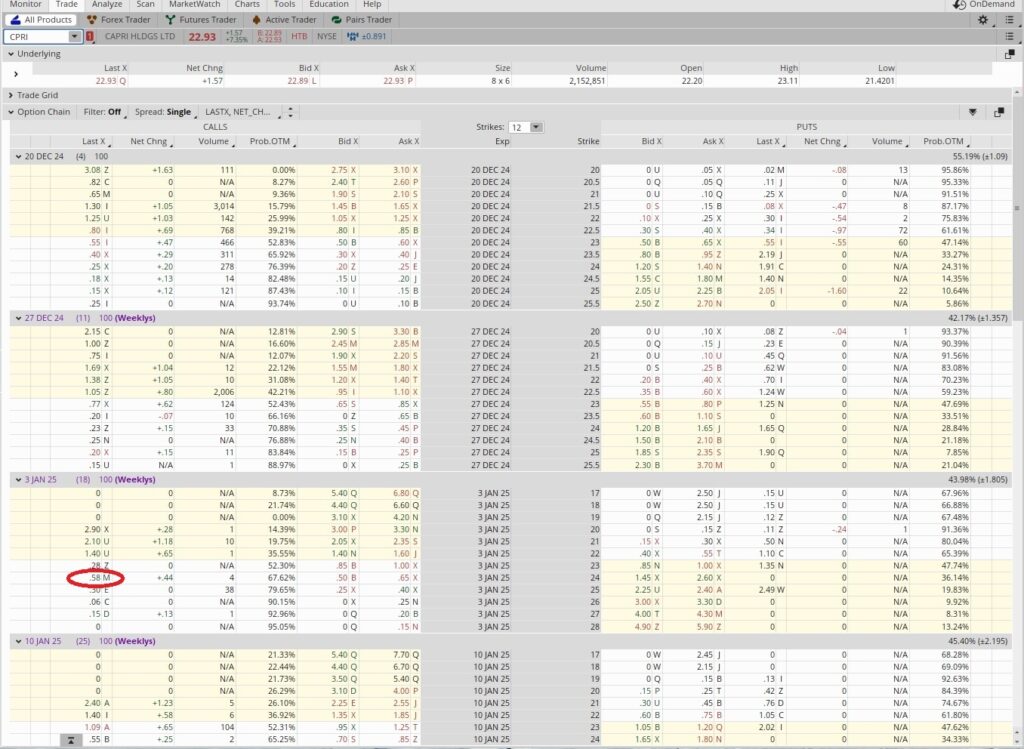

With CPRI trading at $22.93 right now we sold the $24 call with the January 3 expiration date for $0.58. We’ll keep that premium regardless of the price action with CPRI. If CPRI drops and our covered call option contract expires out of the money we’ll keep that premium. If CPRI runs up through our $24 strike our shares will be called away we’ll still keep that premium. In the event that happens, we’ll effectively be selling our shares for $24.58 (the $24 strike price plus the $0.58 in options premium for selling the covered call). The table below shows how we’ve reduced our cost basis is down to $17.12 using covered calls to sell shares.