Generate Passive Income Over the Holidays

We’d like to generate passive income over the holidays this season so we’re going to sell some covered calls. We’re going to go further in time than we typically do so we can step away over the holidays. By selling longer dated call options we’re able to pick a strike price that is further away from the money and still generate a decent return.

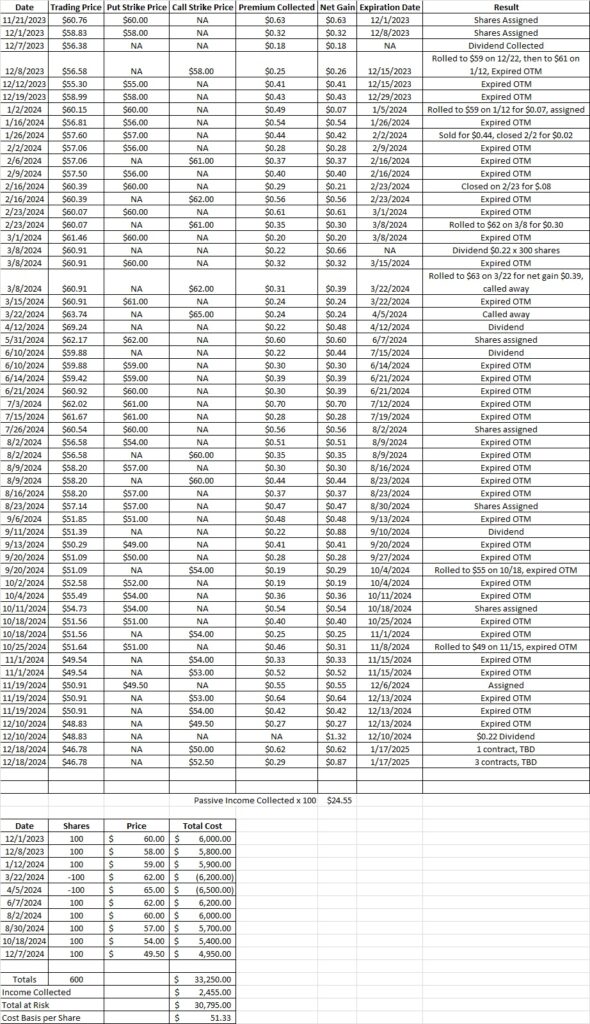

We currently have 600 shares of OXY in this portfolio. So far we’ve worked our cost basis down to $51.57 per share. Now we can sell a covered call at the $52 strike and, if we get called away, we’ll still make money on the trade when we factor in both the premium and the strike price. Here’s a link to our most recent post on our weekly options trades for passive income. You may recall that we wanted to collect the dividend on OXY and sold covered calls after the ex-dividend date. Those call options expired worthless out of the money, so we still have all of our shares. Now we’re going to sell more covered calls on part of our position to generate passive income over the holidays.

Our bottom tranche of OXY gave us shares at $49.50, so we want to be sure our lowest strike price is at $49.50 or higher. Our average cost basis for all of our shares on OXY is currently $51.57, so any other covered call option contracts we sell we’ll want to have a strike price of $52 or higher. We’re going to go with two different strike prices this time because OXY has dropped a bit and is now trading below our cost basis. We’d like to generate as much premium as we can. We also want to be careful that we don’t lose money if OXY runs up through our call strike and our shares get called away.

Weekly Options Trade

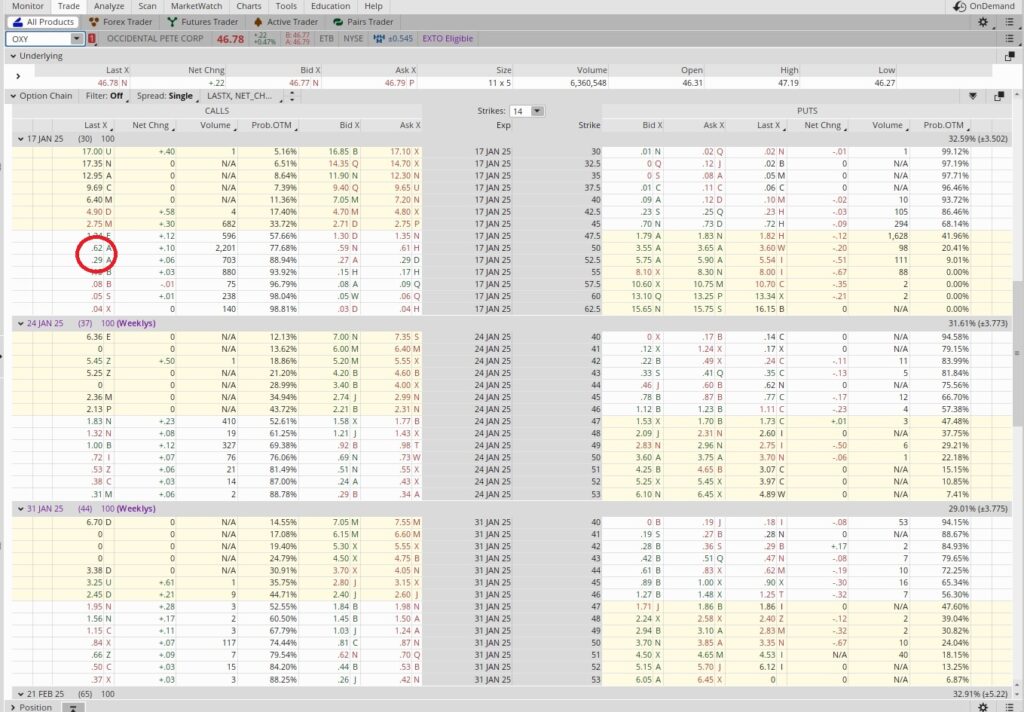

We sold to open one contract of the $50 strike call option contract for the 1/17 expiration date. Entering into that contract brought in $0.62 in passive income. We only sold one contract because we only have one contract of shares at the $49.50 strike. By going out to the 1/17 expiration date we’re able to generate passive income over the holidays but not have to worry about an expiration date while we’re away.

We also sold to open three contracts of the $52.50 strike call option contract, also with the 1/17 expiration date. These contracts gave us $0.29 in premium per share. If OXY runs up and is trading above $52.50 at expiration we’ll have 400 shares called away. That’s fine because if we sell shares at that strike we’ll be selling those shares above our current cost basis. We also could sell 100 shares at the $50 strike but keep the 300 shares with the $52.50 strike. If we do sell, we’ll make money from both the options premium and also the sale of the shares. These trades not only generate passive income over the holidays, they also reduce our basis down to $51.33 per share.