Rolling Versus Letting Shares Go

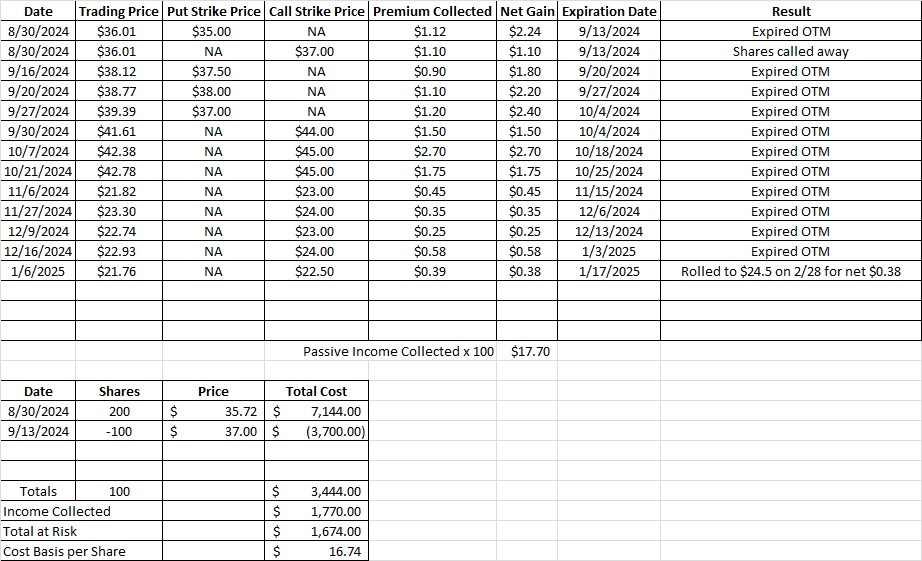

Our covered call on CPRI is in the money so we’re going to discuss rolling versus letting the shares go. Here’s our most recent trade on CPRI.

Back on 1/6 we sold to open the $22.50 covered call on CPRI. We still have 100 shares of CPRI in this portfolio and our cost basis on those shares is $16.73. CPRI is currently trading at $24.12, which means our covered call option contract is in the money. We’ll sell our shares at market close today if we do not roll the contract. Rolling means we can buy to close the contract that we sold to open. When we do that we’ll incur a temporary loss on the trade, because it will cost more to buy the contract back than we received in premium when we sold to open the contract. Then we’ll look for another strike on a date that is further out in time that will give us enough premium to cover what it cost to close the original trade.

When we roll, a lot of times we’ll end up in a position that is not as favorable as the original trade, so we need to pay close attention to the return and the potential of keeping or selling the shares. If we let our shares go today, 1/17, at $22.50 we’ll have a gain of $5.77 per share. That’s a profitable series of trades and we’ll have made money on our capital.

Another option is to buy to close this contract and sell to open another one to make up the difference. We can continue making trades on CPRI to get our cost basis down lower than the current $16.73 per share or have a strike price that is higher than our current $22.50 per share. Another factor in our decision of rolling versus letting shares go is if we have another way we’d like to deploy this capital right now.

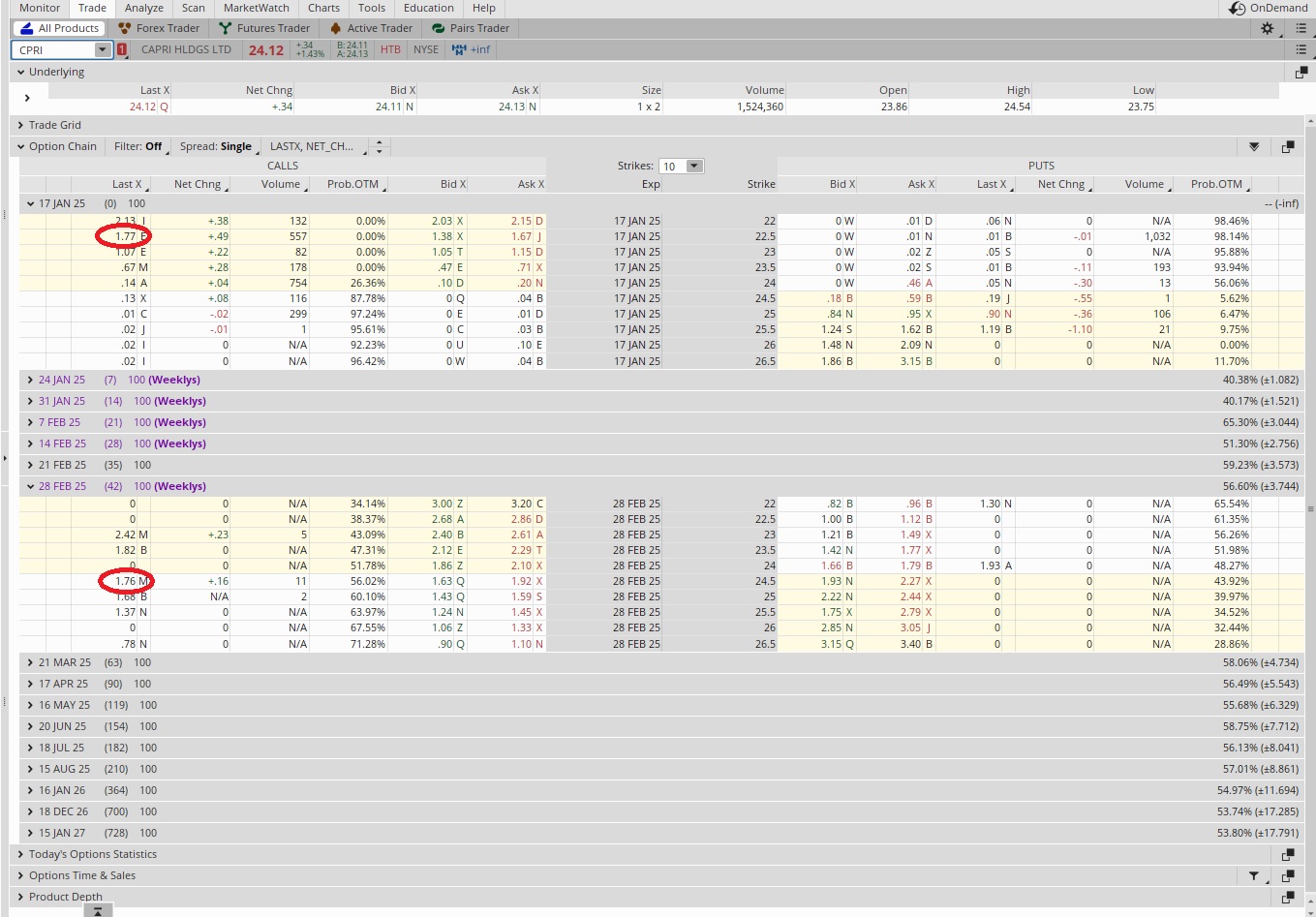

With CPRI trading at $24.12 and our cost basis at $16.73 we’re comfortable that we won’t be losing money if we choose to roll the contract and keep our shares awhile longer. We can buy to close our covered call at the $22.50 strike that expires today, 1/17, for $1.77. We brought in $0.39 in passive income when we sold to open that contract. So we start with that $0.39, then we subtract the $1.77 that we pay to close that contract. That gives us a temporary loss of $1.38. Now we need to find a call strike that will give us at least $1.38 in options premium. Ideally we’ll find a call strike that will give us what we paid to exit the contract. In this case that’s $1.77.

We can see the $24.50 call strike on the 2/28 expiration date with a mark of $1.76. That’s nearly the $1.77 we paid to close our contract. It’s also more than the $1.38 that we need to make up for this to be a profitable trade. Our temporary loss of $1.38 plus the $0.76 for selling to open this covered call nets us a positive $0.38 on the trade. It also moves our call strike up from $22.50 to $24.50. So while we’re making $0.38 on the trades, if CPRI runs up above our strike we’ll be called away at $24.50, not $22.50.

That extra $2 per share is impactful. It means a gain of $7.76 per share vs the $5.77 we would make letting with the $22.50 strike today. If we aren’t called away, we’ll still own shares but with a basis that is significantly below the trading price. Either way we’re happy with our position. When we review rolling versus letting shares go we want to be sure that the risk of hanging on to the shares a little longer is worth it for the potential gain. In this case we feel that it is, so we rolled this trade.