How We Enter A Position

Today we’re going to walk through how we enter a position in a company we want to buy. We’ve been researching UPS and it’s now dropped down far enough that it’s near our buy level. Before we start buying shares of a company we want to be sure we understand why their share price dropped. We call that an event. If we understand why the trading price dropped and we feel the company will overcome the challenge that caused the share price to drop, we can more comfortably allocate our capital to shares of the company.

In this case we see the event as having a few components. First is that profit margins for UPS have decreased. This is due to an increase in shipping volume for smaller packages. It’s also due to their agreement with shipping Amazon packages for Prime delivery. Their Amazon business is a lot of volume but with a much lower margin profile, as CEO Carol Tome stated on their recent earnings call. There are also concerns about the health of the overall economy, as revenue for UPS is a reflection of consumer strength. Then we also have the Trump Tariff uncertainty and how that will impact business decisions including spending and staffing levels. People who are concerned about keeping their job are less likely to spend on discretionary items. So there are lots of factors that could have an impact on UPS. Here we can see the recent share price.

On the chart below we can see UPS is trading at a multi-year low.

Given the uncertainty surrounding not only UPS but the American economy as a whole, we want to give ourselves a sizeable margin of safety when we discuss how we enter a position in UPS. With the drop in trading price from a high of $233 per share in February of ’22 to today’s trading price of $109.77, we feel that we’re in a good position by starting a position today. We have a total of $60,000 we’re comfortable allocating to UPS in this portfolio. We aren’t going to throw all of that at UPS today. Instead we’re going to break it up into five tranches. Each tranche will be about $12,000, which in this case is about 100 shares. Since one put option contract is for 100 shares, we’ll just go with that.

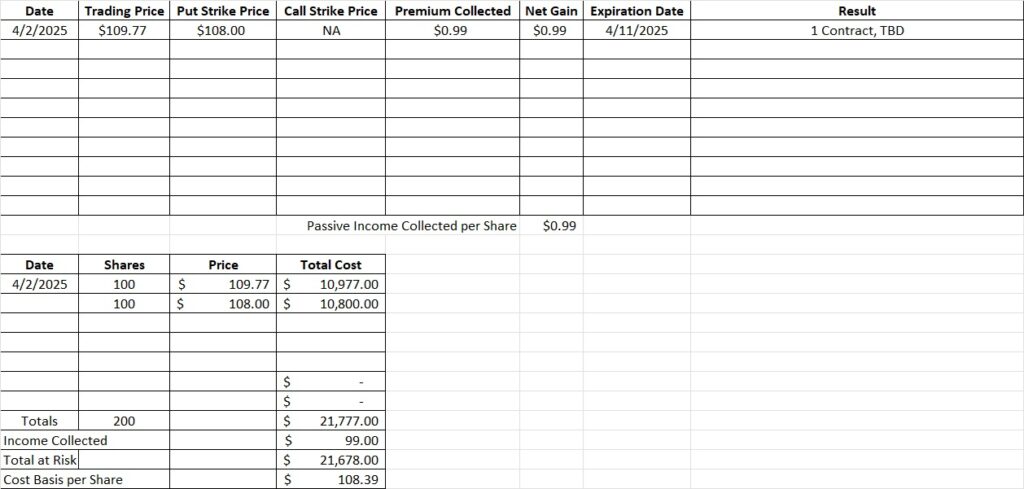

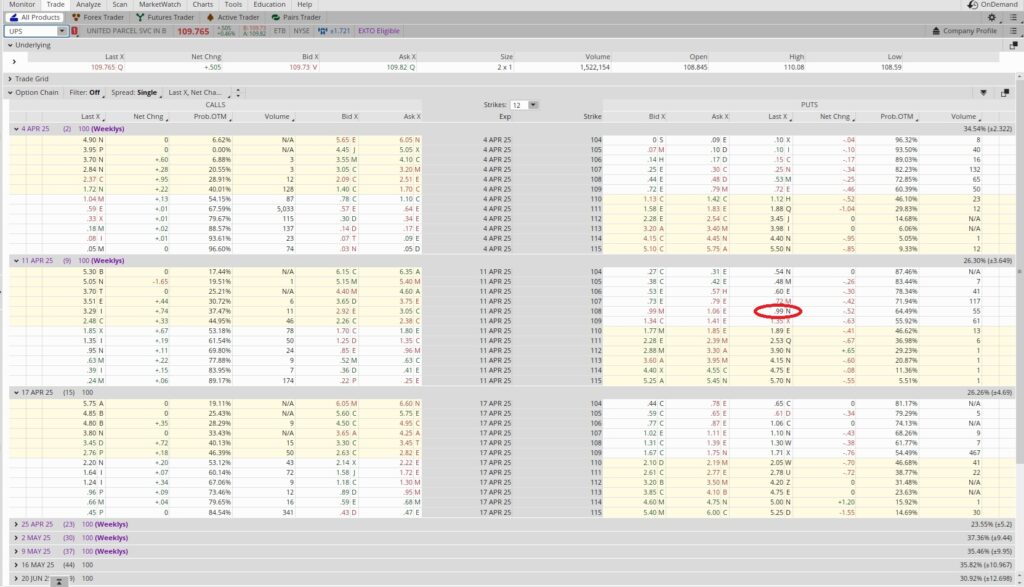

We bought 100 shares of UPS today for $109.77 per share. Then we sold to open a cash secured put option at the $108 strike price for the 4/11 expiration date. When we sell to open a put option we’re committing to buy shares of the company at the strike price on or before the expiration date. Each contract is for 100 shares, so the $108 put means we need to have $10,800 available in our brokerage account in case we need to buy the shares. If UPS continues to trade above $108 from now through the expiration date we’ll keep the option premium as passive income and the put option will expire out of the money. If that happens then we can sell to open another put option. In the event the trading price of UPS drops below $108 we will be assigned shares at $108 at expiration.

Regardless of whether or not we are assigned shares, we keep the option premium. That’s one reason trading options is a popular way to generate passive income from home. We can get paid to do what we want to do (buy a company) at the price we want to do it. We pick the strike price and we pick the expiration date. If we don’t like the company, we don’t sell a put on it. If we don’t like the strike price we can pick a different one, or wait for the trading price to fall so we can get shares at a price that is more inline with our valuation.

When we sell a cash secured put option we’re making a promise to buy that company at the strike price. We’re tying up our capital for the duration of the contract. We want to be sure we’re generating an acceptable return over that time period. So each time we sell a put option we run the same calculation to see what our annualized return is on that trade.

Here’s how we enter a position and calculate the value of the option contract. We take the number days the contract is active and we divide that into the number of days in a year. If it’s a one month contract we would use 12, because there are twelve months in a year. If it’s a one week contract it would be 52, because there are 52 weeks in a year. A contract that is 10 days would be 36, because 365 divided by 10 is 36.5. That becomes our time multiplier. In this case we’re selling to open the put option for the 4/11 expiration date. That’s nine days from today. We divide 365 days in a year by nine and we get 40. So 40 is our time multiplier.

Then we look at the capital side of the option trade. Our put strike is $108. The premium for entering into the contract is $0.99. Since we’re selling to open the put option, we’ll bring in that $0.99 per share as passive income. To bring in that $0.99 we need to have $108 in our account, so we divide $0.99 by $108. That gives us 0.0092. Then we multiply that by our time multiplier, which in this case is 40. So we take 40 x 0.0092 and we get 0.367. That’s an annualized return of 36.7%. So in this case we risk $10,800 to make $99, and if the trade goes against us we’re obligated to buy 1009 shares of UPS at $108 per share. Since we’ve done our valuation and we’re happy to buy shares of UPS at $108, we’re comfortable making this trade. This option calculator helps.

The downside here is that UPS could drop down to $100, or even lower, and we’ll need to either buy the shares at $108 or adjust the position to a different strike price on another expiration date. To minimize that risk we’re breaking our capital allocation into five tranches, and we’ll keep some space between each one. That way we can dollar cost average into the position if UPS continues to fall. This is a good example of how using tranches is a crucial part of how we enter a position.

Now let’s say UPS drops below our strike and we get assigned shares at $108. Since we sold to open the put option for $0.99, we add that $0.99 back into the share price. So we really aren’t paying $108 per share. We’d be paying $108 – $0.99, or $107.01 per share. And if that happens we can turn around and sell the covered call on those shares for additional passive income. When we sell the covered call we’ll only sell it on a portion of our shares. That way we’ll hold at least some shares when UPS starts to climb back up.

Weekly Trade Recap

We bought 100 shares of UPS at $109.77 per share. Then we sold to open a cash secured put option contract at the $108 strike for $0.99. That brings our basis on UPS down to $108.78 per share if we are not assigned. If the trading price for UPS drops below $108 and we are assigned another 100 shares our basis will be $108.39. Remember, we’re only doing this trade because we’re happy to buy shares of UPS in this price range. These option trades are a key component in how we enter a position in a company we want to own.