Generate Income Using Options

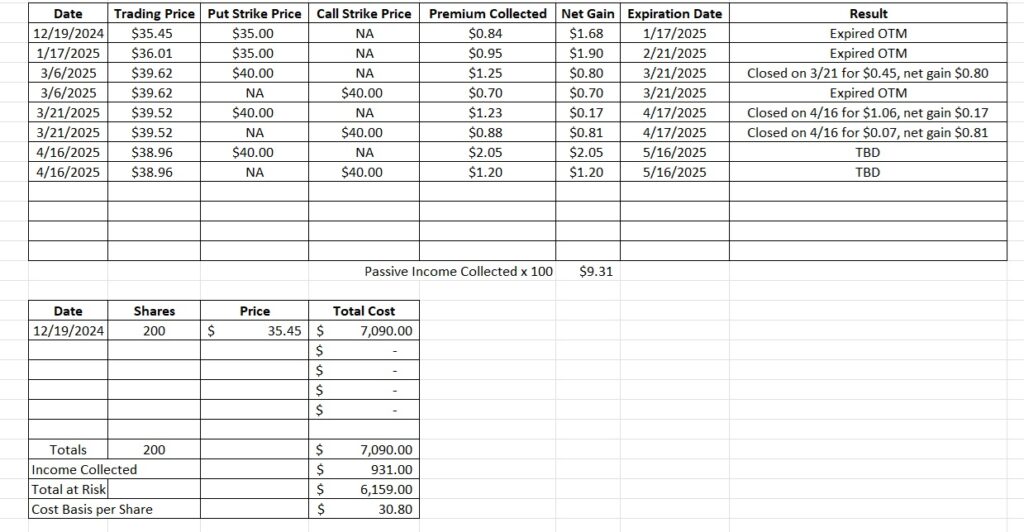

Today we’re going to walk through how we generate income using options. We currently own 200 shares of RGR in this portfolio with a basis of $31.86 per share. We have a straddle option strategy trade active right on RGR now and the trade expires tomorrow, 4/17. Here is the post that shows how we executed that profitable options trade.

With RGR trading at $38.96 right now our put option contract at the $40 strike is in the money. That means we need to either adjust the position or take the shares at market close tomorrow. Our call option at the $40 strike is out of the money. We’ll walk through how we’re handling each side of the straddle.

On the call side our covered call option strike price is above the current trading price of RGR. As long as RGR stays below $40 from now through market close tomorrow that option contract will expire out of the money. We’ll keep the premium we collected when we sold to open the contract. Since we have lots of positions that are in the money for tomorrow’s expiration date, we’re going to close this contract early and then sell it again for the May expiration. We sold to open the covered call for $0.88 back on 3/21. Today we bought back that same contract for $0.07, or a gain of $0.81 per share on that contract.

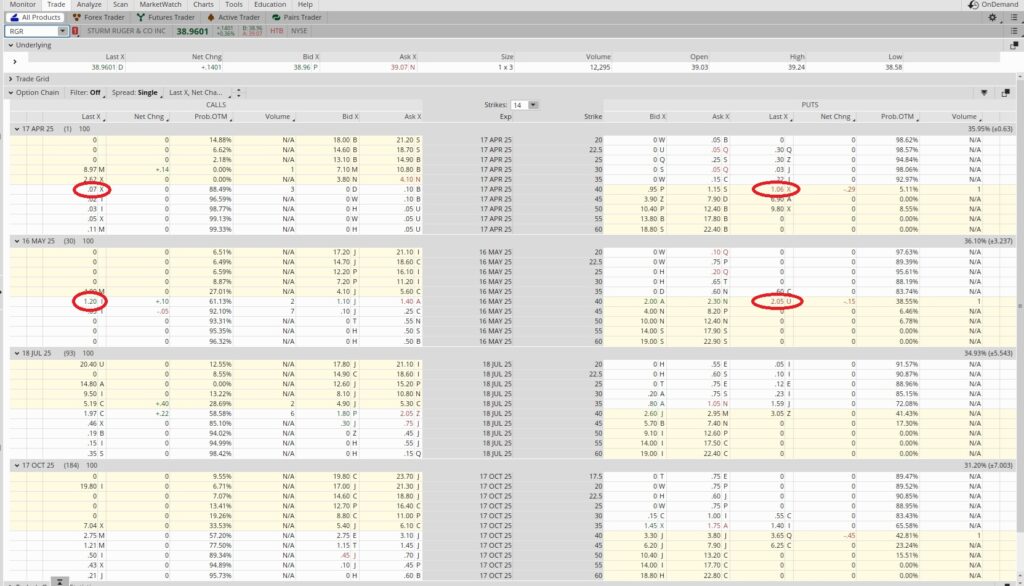

Then we looked at the $40 call option for both the May and July expiration dates. We can sell the May $40 call option for $1.20 or the July for $1.97. Let’s compare the two choices to see which one we like better to generate income using options.

Today is 4/16, and the May contract expires on 5/16. That’s 30 days from now. It’s a one month long trade, so we could theoretically do this trade twelve times over a one year period. Our basis is $31.86 per share, so we divide the premium of $1.20 into the capital we’re risking by holding these shares of $31.86. Even though RGR is trading at $38.96 right now we actually only have $31.86 at risk because of the equity we have in the shares. So the $1.20 in premium divided by $31.86 is 0.38. Then we multiply that by the 12 times in a year we could do this trade and we get 0.45. That’s an annualized return of 45% on the capital we’re risking. We use this option return calculator to do that math. Now let’s compare that to the next expiration date.

The next available expiration for RGR as of right now is July 18. That’s a three month long trade, so if we don’t get at least three times what the one month trade is giving, we’ll probably go with the one month trade. The earnings date for RGR is 5/6, so both of these expiration dates will include the next earnings announcement. We can see on the option chain that the July $40 call on RGR is $1.97. We can generate income using options of $1.20 for the one month contract. So we don’t feel it’s worth it to go three times as long for only another $0.77.

Now we have the cash secured put option side of the straddle option strategy. Our put option at the $40 strike is in the money. If RGR stays below $40 through tomorrow at expiration our put option contract obligates us to buy shares at $40 each. We could take the shares at $40 or we could roll the position to a different expiration date. When we sold to open the put option we brought in $1.23 per share in passive income. Now we can buy to close that option contract for $1.06. That’s a gain of $0.17 per share, and then we can sell the put again for the next expiration date. We’ll usually get more premium for selling a put option than for a call option, so we’re going to close this contract early to avoid assignment. That nets us a gain of $0.17 per share on that contract.

By closing that put option we now have access to that capital again. We’re happy to take shares of RGR under $40, so we’re going to look for another $40 put option. We can see the $40 put on the 5/16 expiration offers a premium of $2.05. Let’s do the math on that to make sure we’ll generate an acceptable level of return on our capital. This is a one month trade so our time multiplier is 12. We’re putting up $40 to generate $2.05 in premium. So we divide the $2.05 into the $40 strike price and we get 0.051. Then we multiply that by the twelve times a year we could do a trade like this and we get 0.615. That’s an annualized return of 61.5%. Keep in mind the contract is trading in the money right now.

An option contract consists of two types of value, intrinsic value and time value. Time value is price assigned to the time as it slowly counts down as we near expiration. Intrinsic value is the value of the actual dollars if the contract is trading in the money. So while this contract generates a higher annualized return, about half of that is intrinsic value because RGR is trading below the $40 strike.

Weekly Option Trade Recap

We closed our options straddle at the $40 strike that expires 4/17. On the put side we net $0.17 profit and on the call side we net $0.81 profit. Then we sold to open another option straddle at the $40 strike for the 5/16 expiration date. We brought in $2.05 in premium on the put side and $1.20 in premium on the call side. That premium is how we can generate income using options. These trades bring our basis on RGR down to $30.80 per share.