Options Income and a Dividend

Today we’re talking about collecting both options income and a dividend. Lately we’ve been trading UPS and we’re building a position. We currently own 100 shares of UPS in this portfolio with a basis of $106.83 per share. That represents one tranche for us. We have room for six tranches of UPS in this portfolio, so we’re going to sell another cash secured put option. UPS goes ex-dividend next Monday, 5/19, and the dividend is $1.64 per share. We’re going to be aggressive with our put and take the shares if it goes in the money. Then we’ll buy the shares and collect both the options income and a dividend. Here is our most recent post on UPS.

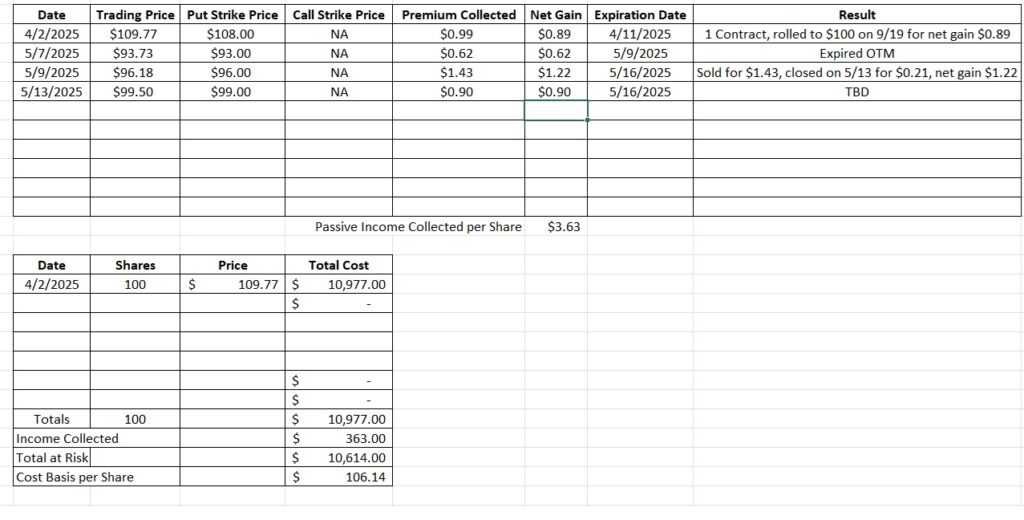

We currently have two active put option contracts on UPS. One is at the $100 strike and expires 9/19 and another is at the $96 strike and that expires this Friday, 5/16. With UPS trading at $99.50 right now, it looks like our $96 put will expire out of the money. If that happens we’ll keep the options premium but we will not get more shares. With the dividend coming up on Monday we want to have more shares of UPS.

So now we have a few choices. We can wait until Friday to see if the $96 put option contract will go in the money and give us shares. Or we can close the contract and sell another put option closer to the money. If we do that we’ll be more likely to get more shares. We could also keep the $96 put option active and sell another one that is closer to the money. But if we do that we could end up with three tranches with a basis that is very close to each other.

So we’re going to close the $96 put option early and then sell to open another put. We sold to open the $96 put for $1.43 last Friday. Now we can buy to close that same contract for $0.21, which nets us a gain of $1.22. So we closed the $96 put, locked in the gain, and now have access to that capital again.

We like UPS in this price range and we’d be happy to have more shares here, so we’re going to be aggressive with our next put option. With UPS trading at $99.50 right now we’re going to sell to open the $99 put for this Friday’s expiration. We’ll collect options income and a dividend if we get assigned shares. If it looks like we won’t be assigned we can buy to close this contract and sell another one, or just buy shares outright on Friday.

We sold to open the $99 cash secured put option for the 5/16 expiration date for $0.90. Since today is Tuesday, this trade will be active for three days. That brings us to our time multiplier. We normally divide the number of days in a year by the number of days a contract is active to give us our annualized return. But since this contract is only active for three days that would make our time multiplier 121. That’s a bit high, and we can’t actually do a trade like this 121 times in a year because we’re limited by the number of Fridays in a year for a company with weekly option contracts. So we’re going to use the weekly number instead, which is 52.

Then we divide the options premium by the strike price, or $0.90 divided by $90, and that gives us 0.0091. Then we multiply that by the 52 weeks in a year and we get 0.47. That’s an annualized return of 47% on the capital we’re risking but selling the put option. Since we’re happy to buy shares of UPS at $99, collect options income and a dividend of $1.64, we’re going to sell to open this option contract. Here’s our options return calculator that helps with that math.

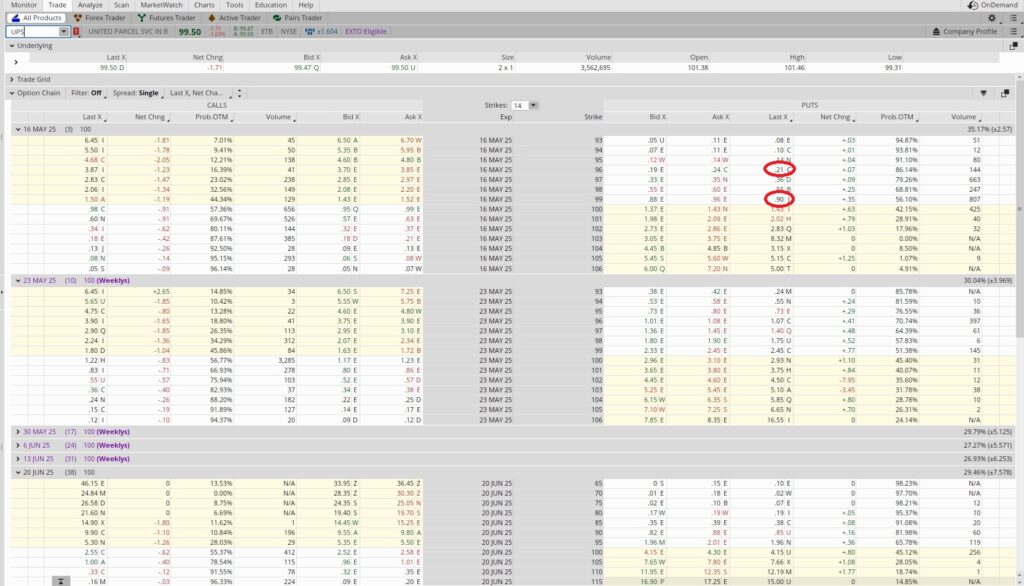

The options chain below shows the bid, ask, and last trade price for the put option contracts that expire this Friday, 5/16.

Weekly Trade Recap

We bought to close our $96 put option contract for $0.21, netting us a gain of $1.22 on that contract. Then we sold to open the $99 cash secured put option contract for $0.90 in option premium. If the trading price of UPS drops below our $99 strike price we’re happy to buy the shares with the ex-dividend date coming up. We’re able to collect option income and a dividend if the trading price of UPS drops. If the trading price stays above our strike, we can also buy shares outright to still give us the dividend. So we’ll pay close attention to the price action on UPS for the rest of this week and adjust our position if needed. Our current trades bring our basis on UPS down to $106.14 per share.