Easy Options Strategy

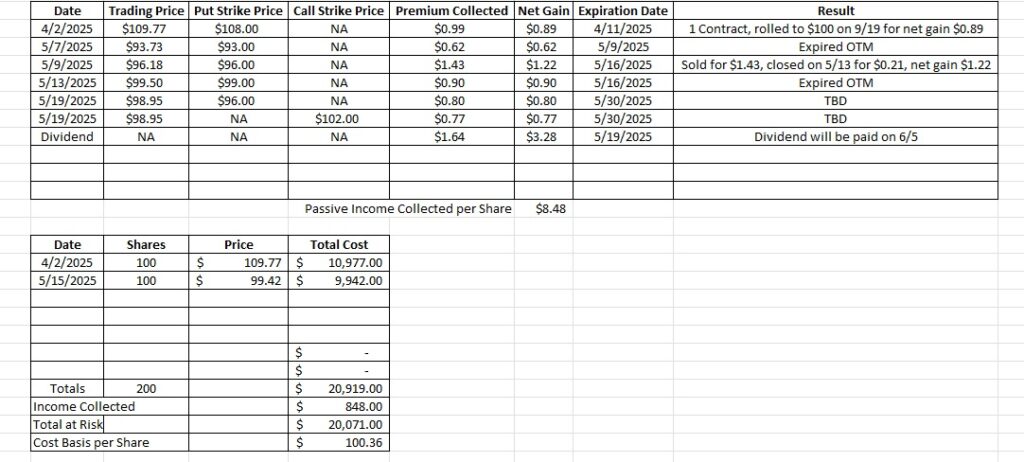

Today we’ll talk through an easy options strategy we use to create passive income. We only use this strategy to trade options on a company we want to own. And only when it is trading near the price we want to own it. We currently own 200 shares of UPS in this portfolio with a basis of $102.78 per share. For us that’s two tranches, and we have room for four more tranches of UPS. UPS went ex-dividend today, 5/19. We’ll collect that dividend of $1.64 per share on 6/5. Here is the post for the options trade we did last week on UPS. That cash secured put option expired out of the money on Friday, so now we have access to that capital again.

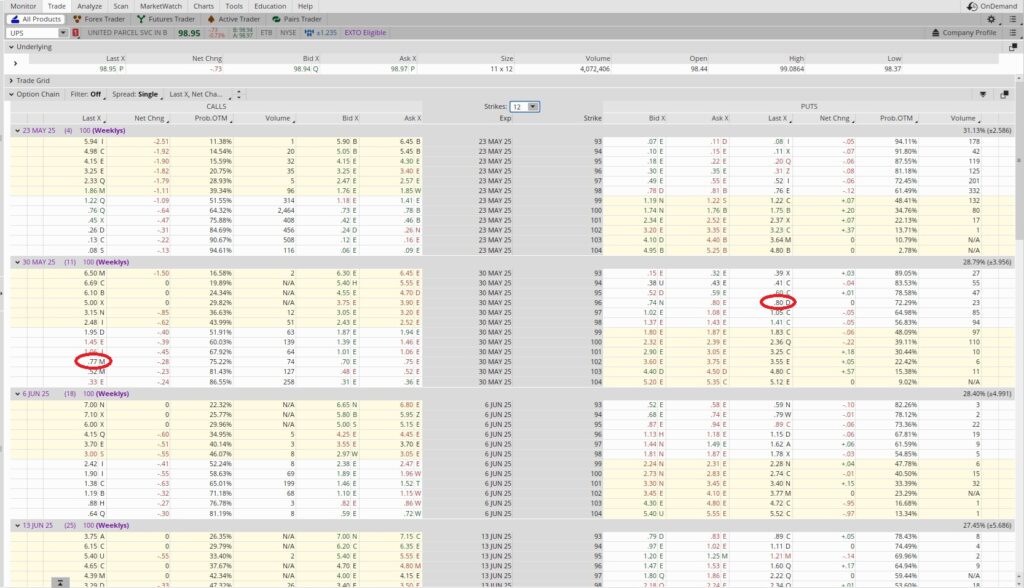

We own 200 shares and we’re happy to buy more shares in this price range. Since UPS is pulling back today it’s a good time to sell a put option. With our current basis at $102.78 per share we want our strike price to be below both that and the current trading price. UPS is trading at $98.95 right now, so we’re going to sell a put that is below that. When we sell to open a cash secured put option we’re making a promise to buy 100 shares of the company. We’ll promise to buy it at the strike price we select, on or before the expiration date we choose. We need to have enough money in our trading account to cover the cost of the shares.

Since we’re tying up our money for the duration of the put option contract, we want to be sure we’ll generate an acceptable return on that capital. Here’s the options return calculator tool we use to help us choose the best option.

We sold to open the $96 put option for the 5/30 expiration date. This easy options strategy brought in $0.80 per share for the contract, or $80. We need to have 100 times the strike price to sell this put option contract, or $9,600. This trade will expire in 11 days. To determine our annualized return on this option contract we divide the number of days in a year (365) by the number of days the contract is active (11). That gives us 33. So 33 is our time multiplier. Then we divide the options premium ($0.80) by the strike price ($96), and we get 0.0083. Then we multiply that by our time multiplier and we get 0.275. That’s an annualized return of 27.5% on the capital we’re risking to promise to buy shares of UPS at $96 on or before next Friday, 5/30.

The put option takes care of the lower side of the trade, and now we’ll also make a trade on the upper side. With UPS trading at $98.95 we’re going to sell a covered call option contract. We want to sell our covered call above our cost basis, and right now that number is $102.78 per share. We’ll be getting the dividend of $1.64 per share on the 200 shares we own. The dividend will bring our basis down to $101.14 per share. The $0.80 in premium from our put will bring our basis down another $0.40 per share (because we have 200 shares right now). So that brings our basis to $100.74. That means we can sell our covered call at any strike from $101 or higher, and not lose money if we get called away. So now let’s choose the call strike.

When we sell a covered call option we’re making a promise to sell our shares of a company at a strike price we choose on or before a date that we choose. And we also choose the premium we’ll accept to enter into the contract. In this case we’re going to go with the $102 strike for the 5/30 expiration date. We chose the $102 strike because there is a slight resistance line around $101.60, and the $102 will still yield a decent annualized return. We’re selling this call option now because UPS went ex-dividend today. That means we’re guaranteed to collect the dividend on the shares we own. We’re only selling one covered call option contract because we want to own some shares of UPS for the long term. Our objective with this trade is to create cash flow for passive income by trading options.

We sold to open the $102 covered call options for the 5/30 expiration date for $0.77 in option premium. Using our basis of $100.74, that gives us a 25% annualized return on our capital for the direction of this trade. If UPS runs up through our $102 covered call strike we can let the shares go. We could also buy to close the contract and roll it to another strike for a different expiration date.

So now we have a covered call options and a cash secured put option contract active. Both of these options contracts have the 5/30 expiration date. This easy options strategy is called a ‘strangle’. We only sell puts on a company we want to own at the strike we sell the put. And when we sell a covered call we usually only sell the call on a portion of our position so we can use the options premium for cash flow. That way we’ll still own shares of the company when the stock price rises back up to where it was trading earlier.

Weekly Options Trade

Today we sold to open the $96 put option on UPS for $0.80 in premium. We also sold to open the $102 covered call for $0.77 in premium. Both options contracts share the 5/30 expiration date. This easy options strategy, along with the dividend, bring our basis on UPS down to $100.36 per share.