Learn Options Trading

When we began to learn options trading, we started with simple options trades. The first trade is a cash secured put option. That’s when we promise to buy a company at a specific price on or before a certain date. To be successful with this approach our valuation needs to be accurate. We also need to be strict in only selling put options on companies we want to own at the strike price we sell. The risk is that we buy a company we want to buy at the price we want to buy it. We’re ok with that, but we need to be diligent with our valuation to be successful.

Our second step when we started to learn options trading was to sell a covered call on shares we own. We typically sell puts a few times before a contract goes in the money. That means the options premium has helped us build equity in the company before we own shares.

Once we own shares we can sell the covered call option at the assignment strike price of the put. We’ll collect more premium on the covered call and we’ll make money on the sale of the shares if they are called away. If the contract expires out of the money we’ll sell another call when the trade expires. We’ll continue to sell puts and calls this way to reduce our basis. We’ll build our position in the company as the trading price falls. Then we’ll reduce our position as the share price rises and we sell some of our shares with covered calls.

We only sell calls on a portion of our position. That way when the share price rises and some of our shares are called away, we’ll still own some shares for the long term. After we’ve done a number of these trades and some of our shares will be called away. We’ll still own shares of the company but our basis will be much lower than the trading price. Ideally our basis will be near zero or even negative. We’ll have recouped all of the capital that we’ve risked entering the company and still own some shares. When we learn options trading we want to keep it simple with trades like this. We’re starting this sequence right now with UPS.

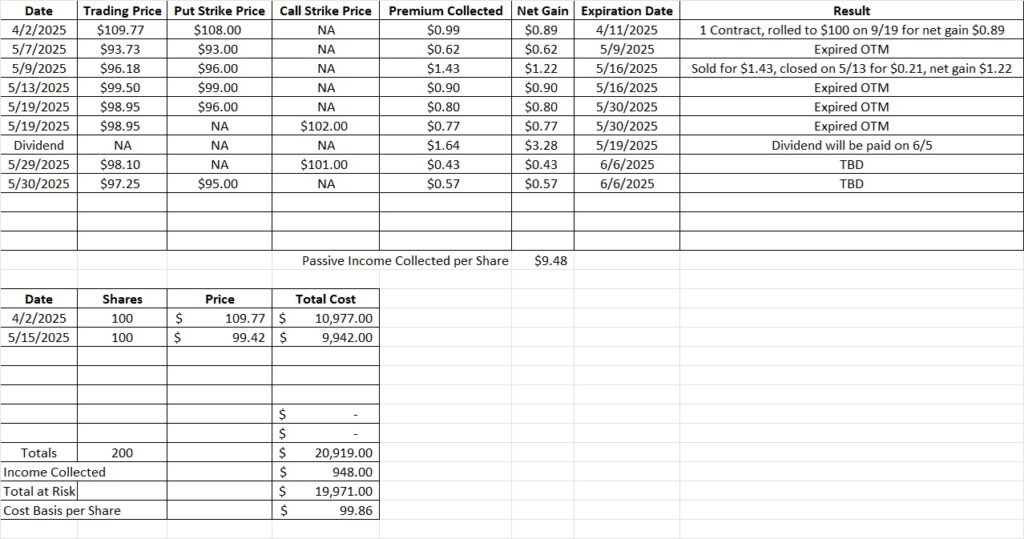

We currently own 200 shares of UPS in this portfolio with a basis of $100.36 per share. We’d like more shares and we’re comfortable with a total allocation of $60,000 to UPS. We broke that up into tranches of about $10,000 each. So with UPS trading around $100 right now we have six possible tranches. We have a put option at the $96 strike that expires today, 5/30.

We also have a covered call at the $102 strike that also expires today. Both option contracts will expire out of the money worthless today. So we’ll keep the option premium we collected in passive income when we sold to open the trades. That options premium will reduce our basis on the shares we own. And since our put will expire worthless we’re going to sell to open another one.

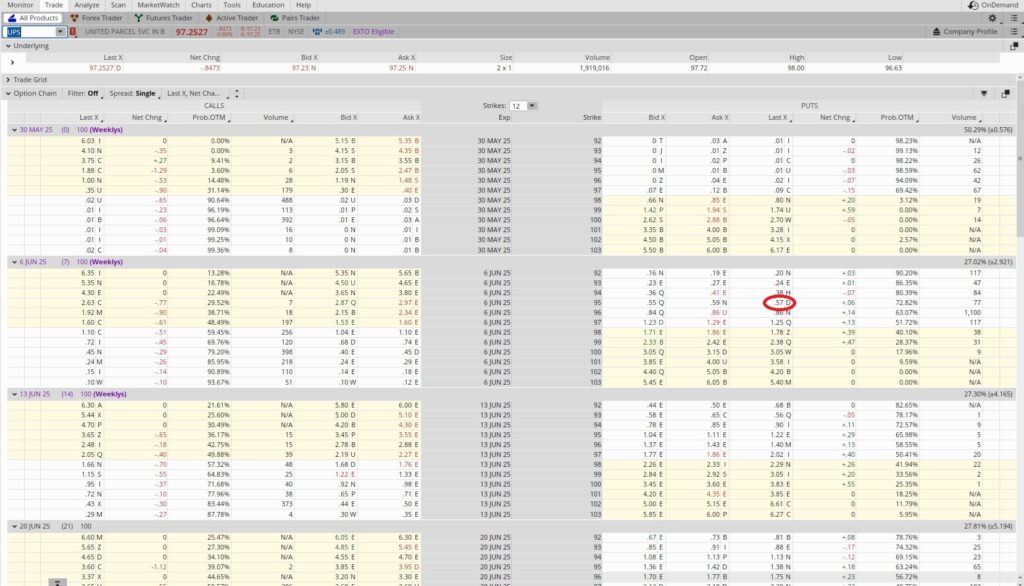

When we sell to open a cash secured put option contract we need to have enough money in our brokerage account to cover the cost of the shares in case we are assigned. Since each contract is for 100 shares, we need to have 100 times the strike price available. In this case we’re selling to open the $95 put option. So we need 100 x $95, or $9,500 available in our account to cover the trade. We want to be sure we generate an acceptable return on our capital when we enter a trade like this. So when we learn options trading we review several aspects of each trade. We look at how long the trade lasts, the capital we’re risking, and also the premium we’ll bring in. And we only trade a company we’re comfortable owning at our put option strike price.

Today is 5/30 and we’re selling to open the 6/6 put, so this trade is active for one week. There are 52 weeks in a year, so our time multiplier is 52. We’re selling the $95 put option. That means we’re promising to buy 100 shares of UPS for $95 a share at any time from now through expiration next Friday. We’re comfortable owning UPS in this price range, and if we weren’t we wouldn’t be doing this trade. We brought in $0.57 in option premium to enter this trade. So we divide the $0.57 premium into the $95 strike price and we get 0.006. Then we multiply that by the 52 times periods in a year we could do this trade. That gives us 0.312. That’s an annualized return of 31.2%. Here’s the option return calculator we use to help do that math.

We also still have our $100 put option on UPS for the 9/19 expiration date. If both this put and the $100 put are assigned, we’ll have four of our six tranches of UPS. We’ll still have room further down in case UPS drops below the floor in the mid $90’s, so we’re only selling one put option contract here.

Weekly Option Trade Recap

We sold to open the $95 put option on UPS for the 6/6 expiration date. We brought in $0.57 in passive income from the option premium. This trade gives us an annualized return of a little over 31%. We also have the covered call for the $101 strike that expires next Friday. These trades coupled with the dividend bring our basis on UPS down to $99.86 per share. We’re using the option premium to reduce our basis. We also want to give ourselves room to continue to trade UPS if it drops below the current floor. So while we have space in our portfolio to buy shares outright here, we’re going to continue being conservative. When we learn options trading we use option contracts to generate passive income and reduce our basis.