Trade Options for Weekly Income

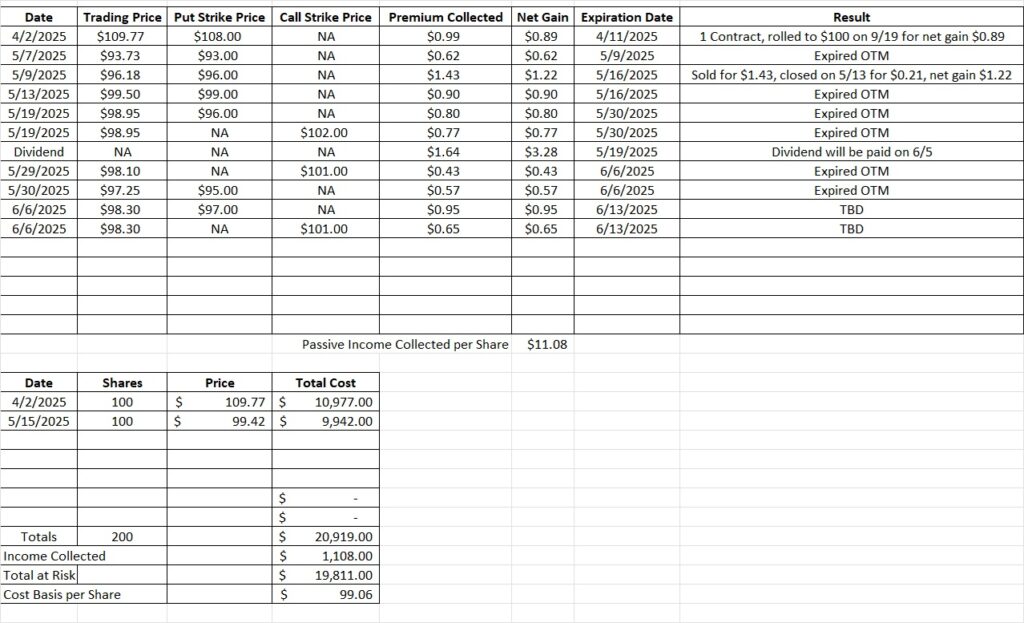

Lately we’ve been using UPS as our underlying company to trade options for weekly income. We like UPS for a few reasons, including their recent strategy changes and their dividend. Last week sold to open the cash secured put option at the $95 strike for $0.57 per share. We also sold to open the covered call at the $101 strike for $0.43. Both of those trades will expire out of the money today, 6/6. We’ll keep the premium we brought in when we sold to open each contract. Here is the post that walks through those trades.

Today we’re going to use UPS again to trade options for weekly income. This week we’re also going to use the strangle option strategy. We’ll sell a cash secured put option with a strike price that is just below the current trading price. We’re only entering into that contract because we’re happy to buy more shares of UPS at that price. We’ll also sell a covered call option, but with a strike price that is just above the current trading price. So as long as UPS continues to trade in the range between our two strikes we’ll keep both the option premium and our shares. If UPS drops below the put strike, we’ll be obligated to buy 100 shares of UPS at the strike price. If we’d prefer to not buy more shares at that price we can also adjust the position.

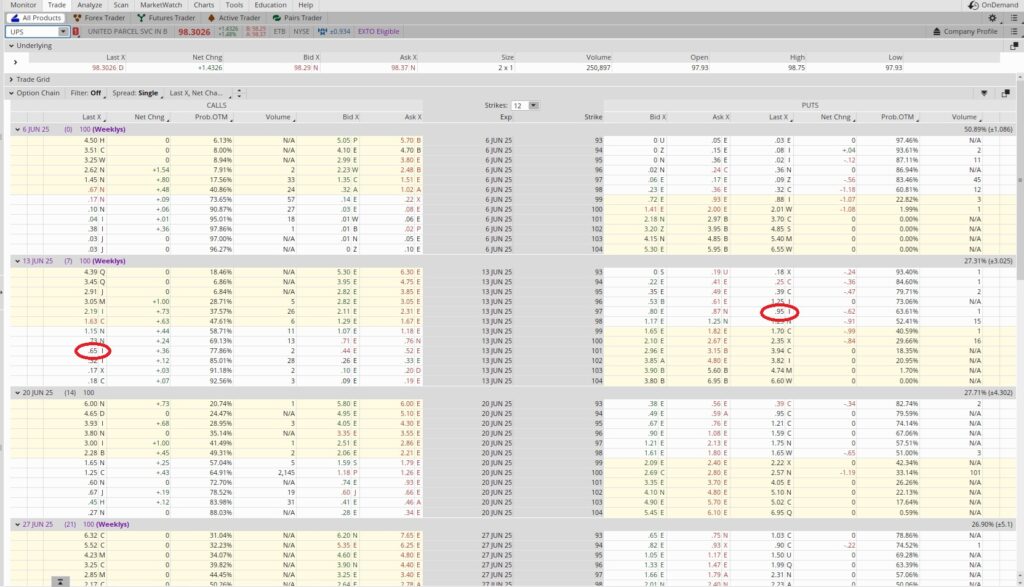

We currently own 200 shares of UPS in this portfolio with a basis of $99.86 per share. For this portfolio that’s two tranches, and we have room for a total of six tranches of UPS. So we’re going to be pretty aggressive with our put strike. When we trade options for weekly income we generally prefer the weekly option contracts vs the monthly. In most cases we can generate more option premium from trading a weekly contract four times over the course of a month than we can from trading a monthly contract one time. This week we’re going to look at the 6/13 expiration date.

With UPS trading at $98.30 right now we sold to open the $97 put option contract for the 6/13 expiration date. Selling to open this contract obligates us to buy 100 shares of UPS for each contract we opened. We only sold to open this contract because we’re happy to buy shares of UPS at this price. We received $0.95 per share to open this contract, or $95 in total. If the trading price of UPS drops below our $97 strike price and we are assigned shares our effective purchase price on this tranche will the $97 strike price minus the $0.95 in option premium, or $96.05 per share. The risk with this trade is that UPS could drop well below our strike price and we could end up owning shares until the trading price recovers. We feel UPS is undervalued right now, so we’re happy to take that risk.

When we trade options for weekly income we want to be sure we’re generating an acceptable return on our capital. In this case we’re putting up $97 per share for each contract, or $9,700 in total, for each contract. We need to have at least that much available in our brokerage account in case we are assigned shares.

We brought in $0.95 per share in passive income when we sold to open the contract. So our risked capital is $97 and we’re earning $0.95. So we divide the $0.95 in option premium by the $97 strike price and we get 0.0098. Then we multiply that by the number of times we could do this trade in one calendar year. This trade last for one week, so we could do this trade 52 times over the course of a year. So we multiply that 0.0098 by 52 and we get 0.509. That’s an annualized return of 50.9% on the capital we’re risking. Here is the options annualized return calculator we use to help figure that out.

As we trade options for weekly income we also like to use the other side of the trade. The put contract generates premium on the down side of the trade. Then we use a covered call to create cash flow on the up side of the trade. We sold to open the covered call at the $101 strike on for $0.65.

Weekly Options Trade

We sold to open the $97 put on UPS for $0.95 in option premium. The duration of the trade is one week, and that works out to annualized return of 50.9% on our capital. We also sold to open the $101 covered call for the 6/13 expiration date. The call option gave us $0.65 in premium. As long as UPS continues to trade between $97 and $101 from now through next Friday both sides of the trade will expire out of the money. If the trading price drops below our $97 put option strike we’ll buy another 100 shares at $97. If the trading price rises above $101 we’ll either sell 100 shares at $101 or roll the position to a higher strike price. These trades combine to reduce our basis on UPS to $99.06 per share.