Adjust the Position

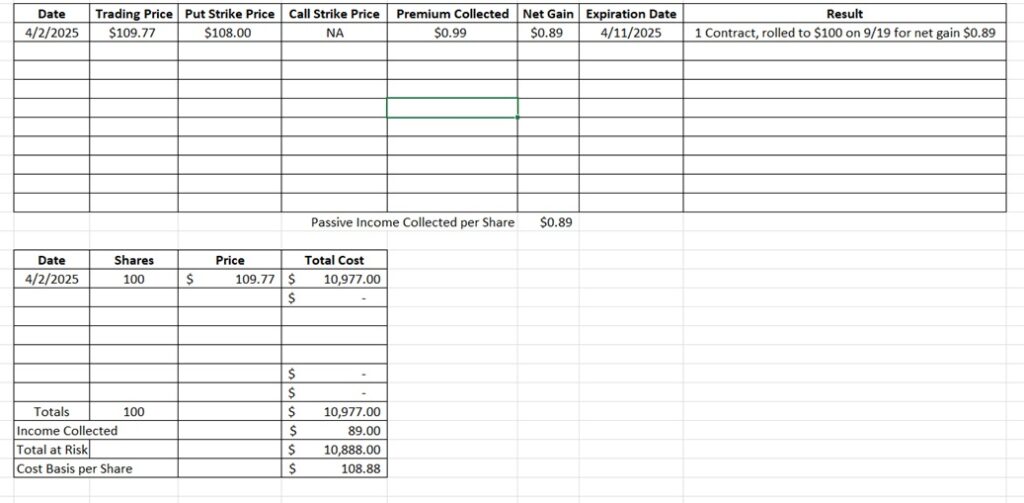

Today we’re going to talk through how we adjust the position. Back on 4/2 we entered a position in UPS. We currently own 100 shares of UPS in this portfolio with a basis of $108.39 per share. We also have a cash secured put option at the $108 strike that expires tomorrow, 4/11. Here’s the post that shows how we made those trades. The Trump Tariffs have had a negative impact on the trading price of UPS. Right now UPS is trading at $96 per share, and if we don’t adjust our position we’ll be assigned shares at the $108 strike. Since we already own 100 shares we want to optimize our entry one our next 100 shares. So we can either take shares here or we can adjust the position to take shares at a lower strike.

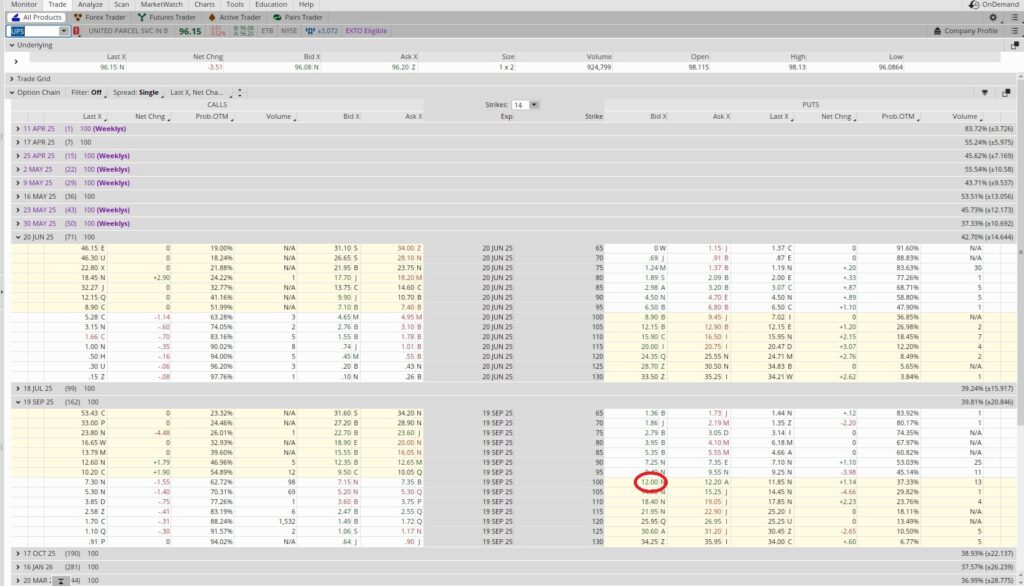

With UPS trading at $96.15 per share we can buy to close our $108 put option contract for $12.10. We brought in $0.99 in passive income when we opened the put option. If we close the put option for $12.10 we’ll subtract the $0.99 for a total loss of $11.11 per share. Now we’ll look for another put option with a lower strike price that will give us at least $11.11 in premium.

We can see the $105 put option strike for the 6/20 expiration with a bid of $12.15. We’d be improving our position by $3 per share if we rolled from the $108 strike down to the $105 strike. We’d also gain $1.04 on the option premium. Since today is 4/10 that trade would be active for 71 days. We take the 365 days in a year and divide that by the 71 days the contract would be open, and we get 5.14. That’s our time multiplier. Then we divide the per share gain of $4.04 ($3 on the strikes and $1.04 on the premium) by the $105 strike and we get 0.038. Then we multiply that 0.038 by the 5.14 and we get 0.198. So if we adjust the position to the $105 strike we get an annualized return of 19.8%. That’s not bad, but let’s look at another choice.

The $100 put option strike for the 9/19 expiration date has a bid of $12.00. That’s $0.89 more than the $11.11 we need, so this strike checks that box. This strike is also $8 down from our current $108, so we’d gain a total of $8 on the strike difference and $0.89 on the premium, which would be a total gain of $8.89 if we are assigned the shares. This trade expires 9/19, which is 162 days from now. We divide the 365 days in a year by 162 and we get 2.25. Then we divide the $8.89 by the $100 strike and we get 0.0889. Then we multiply that 0.0889 by 2.25 and we get 0.20. That’s a 20% annualized return. Here’s the stock option return calculator we use to help with that calculation.

By using the same approach to evaluate the different options when we adjust the position we we’re comparing apples to apples. We can do a shorter term trade that would give us the shares at $105 in June, or a longer term trade that would give us the shares at $100 in September. Both give us a similar annualized return of about 20% on our capital. With UPS trading at $96 right now both of these contracts are in the money. With a trade this long there’s plenty of time for UPS to run up over our strike price. So there’s no guarantee we’ll be put these shares.

We would be remiss if we did not mention the primary element of uncertainty that’s causing the price drop for UPS. The Trump Tariff Tax has captured the attention of the market. The instability of US policy with tariffs means we don’t know how the Trump Tariff Tax will play out. Some countries are escalating, others are waiting to see what other countries do. Since the tariffs were significantly more than what analysts had expected we’re going through more than just market hiccup over the last week. That uncertainty means we’d rather adjust the position than take shares right now.

We see UPS as a bet on the US economy. If consumer spending drops, or business to business package shipping drops, it will impact UPS. So we’re going to roll our position to the $100 strike in September to dollar cost average our position. We have about $60,000 in this portfolio that we’re comfortable allocating to UPS. So if UPS drops further we can sell another put for passive income with a different expiration date.

Weekly Trade Recap

We currently own 100 shares of UPS in this portfolio with a basis of $108.39 per share. We bought to close our $108 put option that expires tomorrow, 4/11 for $12.10. Then we sold to open the $100 put option for the 9/19 expiration date. These trades bring our basis to $108.88.