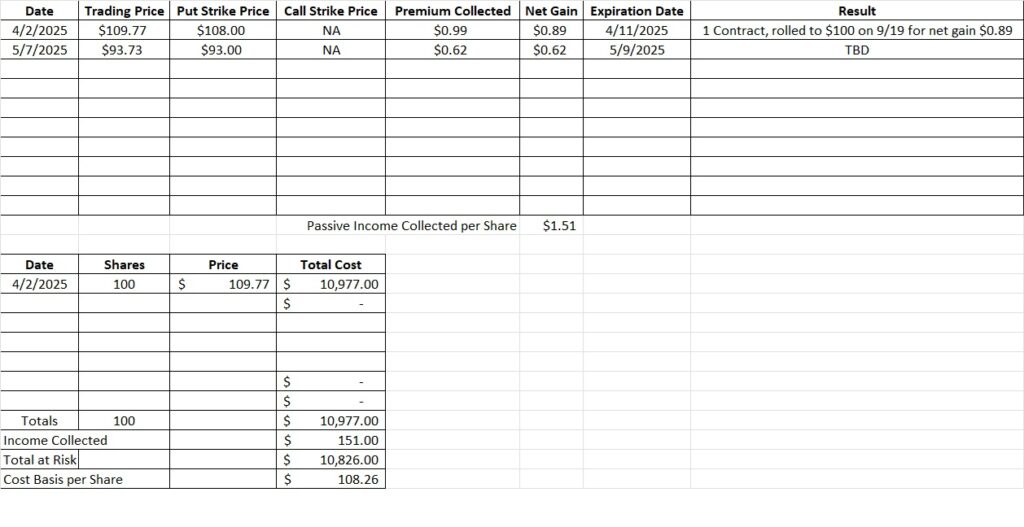

Beginner Options Trade

This beginner options trade shows how we can generate passive income before we own shares of a company.

We currently own 100 shares of UPS in this portfolio with a basis of $108.88 per share. Here is our most recent post about trading options on UPS. In this post we outlined our entry into UPS and our total allocation for tranches.

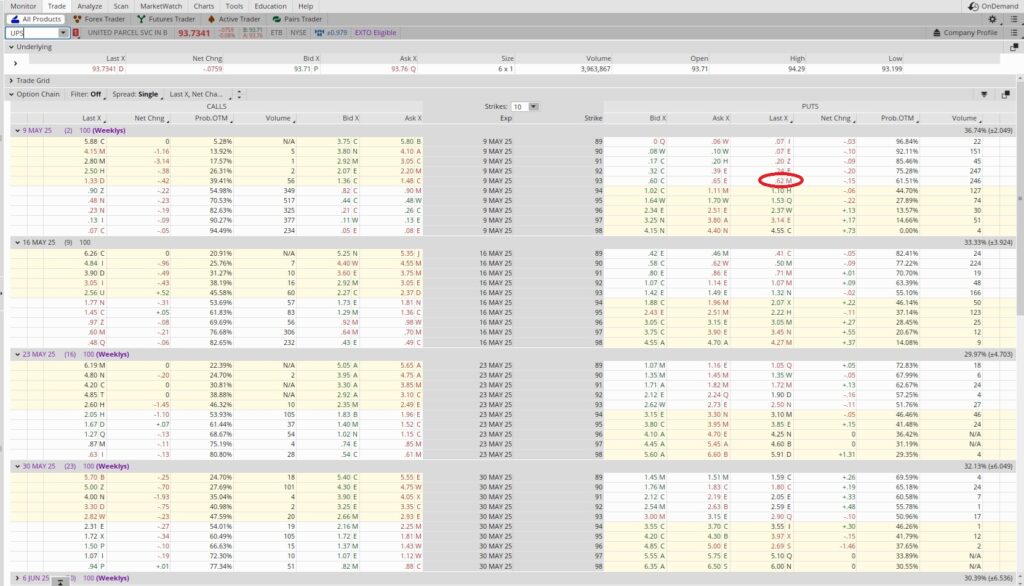

We have an active put option contract at the $100 strike for the 9/19 expiration. With UPS trading around $94 today and a dividend coming up, we’re going to sell another put option. We like UPS for the long term so we’re happy to be get more shares here. Since we want more shares we’re going to sell another cash secured put option contract close to the money. A beginner options trade like this is nice because we’ll generate passive income with the options premium. If we get assigned shares we’ll collect the dividend as well as the option premium. If we don’t get assigned, we’ll keep the premium to lower our basis. We have room in this portfolio for four more tranches, so we’re comfortable being pretty aggressive here.

Although UPS has not yet announced their dividend date for the first quarter, the last two years the dividend has been for owners of record as of the second Monday in May. UPS increased their dividend to $1.64 in February, so owning shares now will gives us a $1.64 per share. Since there are four quarters in a year that $1.64 is $6.56 annually. With UPS trading around $94 right now, that $6.56 is an annual dividend yield of 7%. That’s really strong, and it creates an incentive to some more shares here. Over the last five years UPS has grown their dividend by about 11% annually, and the CAGR for their dividend over the last 10 years is 9.3%. If that continues and our cost basis is $94, our dividend yield could increase substantially over the next few years. Here’s where we find that information.

So let’s walk through this beginner options trade. When we sell to open a cash secured put option contract we’re making a promise to buy shares. We’re picking the company, and that reduces our risk because we’re only selling a put option on a company we want to own. We’re also picking the strike price. That’s the price we’re agreeing to pay for shares. We pick the expiration date and we also pick the premium. If we don’t feel we’re getting enough option premium for entering into the option contract we won’t enter the trade.

In this case we’re selling to open the $93 put option that expires this Friday, 5/9. Each put option contract we sell to open obligates us to buy 100 shares of UPS at $93. So one put option contract means we need to have $9,300 available in our brokerage account to cover the shares. We want to be sure we’re collecting enough option to give us an acceptable return on our capital.

When we sell to open a put option one of two things can happen. If UPS continues to trade above our $93 strike price our put option will expire out of the money. At that point the put option contract will be worthless, we’ll keep the premium, and we’ll have access to our capital again. The other thing that can happen is UPS could drop below our $93 strike price. If that happens, and UPS is trading below $93 at expiation, we’ll be assigned shares at $93 and we’ll also keep the premium. If UPS drops significantly below $93 we’ll still be obligated to buy shares at $93. Either way, we keep the premium we collected when we entered into the contract. We’re only entering into this contract because we’re happy to buy shares of UPS at our put option strike price. This post shares why.

On the option chain below we can see that UPS is trading at $93.73 right now. We sold to open the $93 put option expiring this Friday, 5/9, for $0.62. That’s the per share price, and since one contract is for 100 shares, we’re collecting $62 to enter into this beginner options trade. If UPS drops below $93 we’ll buy the shares at our $93 strike price. But since we collected $0.62 per share to enter into the contract, our actual cost per share will be $93 minus the $0.62 in premium which is $92.38. Then we’ll also collect the dividend, which is $1.64. And $92.38 minus the $1.64 dividend is $90.74. So we’ll have some equity in these shares immediately if we get assigned and UPS is trading above that $90.74 number.

Now let’s look at the capital we’re risking and compare it to the passive income we’ll generate. We’re risking $93 per share and collecting $0.62 per share. So we divide the $0.62 into the $93 strike price and we get 0.0067. This trade is less than one week long, and there are 52 weeks in a year. So we multiply that 0.0067 by 52 and we get 0.347. That’s an annualized return of 34.7%. We use this tool to do that math. And it’s on the capital we’re risking when we promise to buy a company we want to buy at the price we want to buy it. So we’re getting a 34.7% annualized return to do what we want to do. Sounds good to us!

Weekly Trade Recap

Our trade this week was to sell to open a cash secured put option on UPS. We sold the $93 put for the 5/9 expiration date for $0.62 in premium. We only entered into this trade because we’re happy to buy more shares of UPS in this price range. This trade puts our basis on our overall position in UPS at $108.26 per share. That will change with the dividend and also if we are assigned shares with this beginner options trade.