Cash Flow Options Trade

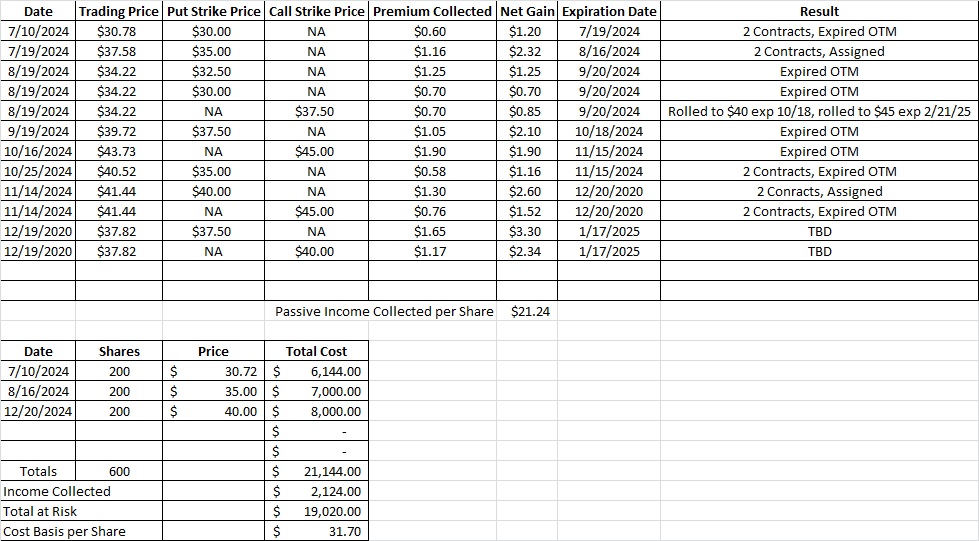

Over summer we established a position in MBUU as a cash flow options trade. There are currently 400 shares of MBUU in this portfolio with a cost basis of $28.96 per share. We have two calls at the $45 strike that will expire worthless out of the money tomorrow, 12/19. We also have two put option contracts at the $40 strike that will expire tomorrow. We’ll take the shares at $40 because we feel MBUU has a path to trade much higher than this by the end of 2025. That will give us 600 shares of MBUU in this portfolio. We’ll also use those shares for our cash flow options trade. Here’s a link to our recent post that walks through our trades on MBUU.

The FOMC meeting yesterday riled the market a bit, and now the projections are for two 0.25 rate cuts next year vs four. That will impact many things, including how many people buy expensive wake boats with financing. So it makes sense that the trading price for MBUU dropped after the press conference. We still feel MBUU is a solid company with the best product in its industry and a dominant market position. So we’re going to use this opportunity to increase our exposure to MBUU with a cash flow options trade.

We sold two puts at the $40 strike expiring tomorrow, 12/20. We received $1.30 in premium when we sold to open those contracts. We’ll be assigned those shares at market close tomorrow. That brings our cost basis per share on those two contracts from the $40 strike down to $38.70. Now we’re going to sell calls at $40 on those same two contracts. Our primary objective in selling these calls is to generate premium for cash flow, not to have the shares called away. If we do end up selling these shares at $40 we’re ok with it because we still have 400 shares of MBUU in this portfolio.

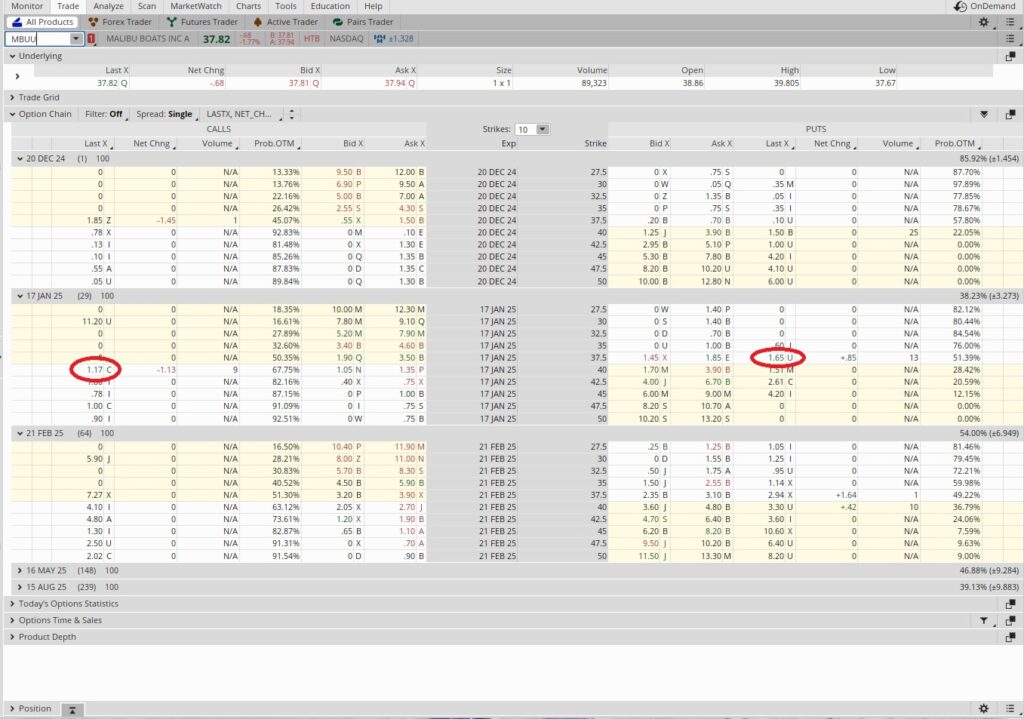

We sold to open the $40 call for the 1/17 expiration date for $1.17 each. That brings our cost basis per share from $38.70 down to $37.53 per share. If MBUU runs up through the $40 strike and is trading above $40 at expiration on 1/17 these two contracts will call 200 shares away. If MBUU stays below $40 from now through the expiration date on 1/17 we’ll keep these 200 shares. Either way we’ll keep the premium and our cost basis on these 200 shares will be $37.53. If we sell the shares at $40 we’ll make $2.47 per share. If we don’t sell the shares then we can sell another call for our cash flow options trade next month to reduce our basis further.

We’re also selling the $37.50 put for the 1/17 expiration date. We brought in $1.65 in premium for each of those contracts. That would make our effective purchase price for that tranche $35.85 per share. When we sell a put we want to be sure we’re generating an acceptable return on our capital while we wait for the contract to expire. This is a one month trade, and there are twelve months in a year, so our time multiplier is 12.

Then we divide the options premium by the strike price. So we take the $1.65 in premium and divide that by the $37.50 strike and we get 0.044. Then we multiply that by our time multiplier (12) and we get 0.528. That’s an annualized return of 52.8% on our capital, to make a promise to buy share that we want to buy at the price we want to buy them. That works for us. Here a tool that helps with that math. Our primary objective is to use a cash flow options trade to reduce the basis of shares we own. We’re happy buy more shares at a price we’re happy to own the company at or sell some shares at a price that’s profitable to sell them.

Trade Recap

We sold two contracts of the $40 covered call option for the 1/17 expiration date for MBUU. Each of those brought in $1.17 per share for each of those contracts. We also sold to open two cash secured put option contracts. We sold the puts at the $37.50 strike for the 1/07 expiration date and brought in $1.65 in premium for each of those. If MBUU continues to trade between $37.50 and $40 our cost basis per share will be $31.70 per share on 600 shares. We’ll continue to use cash flow options trades similar to this while MBUU trades in this price range.