Collect Dividend and then Sell Calls

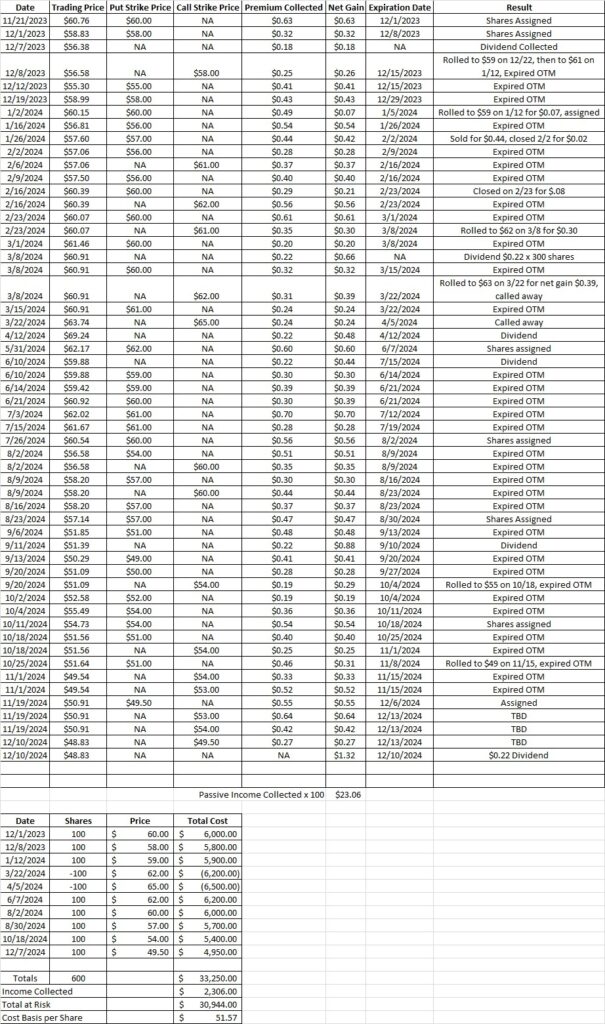

This week we’re going to collect the dividend and then sell calls on OXY. Lately we’ve been trading OXY to generate passive income selling stock options. Here’s our most recent post.

We currently have 600 shares of OXY in this portfolio, and we just bought another 100 shares at the $49.50 strike price last Friday. We took the shares rather than rolling our position because OXY goes ex-dividend tomorrow, 12/10. Now we’ll collect the dividend and then sell calls on our position. The dividend is $0.22 and we have 600 shares, so we’ll collect $132 on our position.

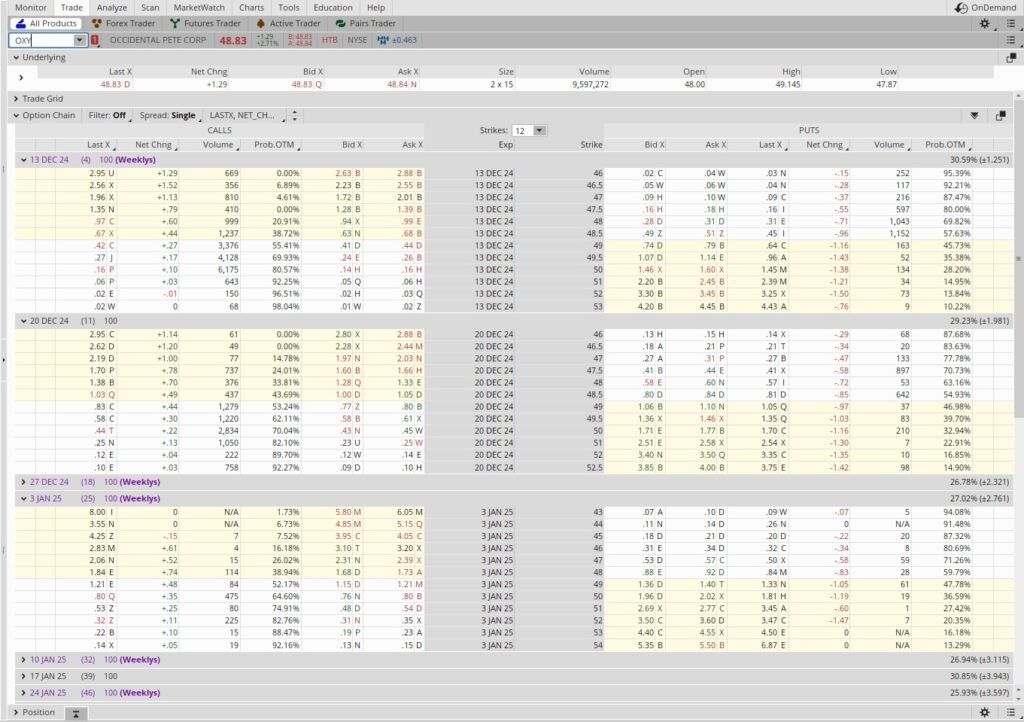

Since we were assigned shares at the $49.50 strike we can sell a covered call at that same strike and use the option premium to reduce our basis on our overall position. If OXY stays below $49.50 from now through expiration we’ll keep these shares. If OXY is above $49.50 at any point from now through expiration our shares could be called away. Either way we’ll keep the option premium.

If our shares on this contract are called away $49.50 strike price we’ll still make money on this sequence of trades. Here’s how:

When we entered the position we sold the put at the $49.50 strike. That options trade brought in $0.55 in passive income. So we take the $49.50 strike and subtract the $0.55 in premium for the cash secured put option contract. That gives us $48.95. Then we subtract the $0.22 for the dividend, and brings our basis down to $48.73. Then we subtract the premium for selling the covered call. We sold the $49.50 covered call for the December 13 expiration date for $0.27. So we subtract that from the $48.73, and that gives us $48.46. That’s how we use options premium to make money buying and selling a company for the same price.

Note that this time we sold the put closer to the money than we normally would because of the dividend. Once assigned shares we collect the dividend and then sell calls on those shares to generate more passive income. In this case we sold to open the original put option contract on 11/19. The covered call expires on 12/13, which is a total of 25 days for the trade. If our shares are called away at the $49.50 strike our cost basis on those shares will be $48.46. That would give us a net profit of $1.04 on this series of trades.

Now let’s walk through our annualized return on these trades. A profit of $1.04 on $48.46 in risked capital is 0.021. This series of trades is 25 days long. We divide the 365 days in a year by 25 and we get 14.6. Then we multiply that 0.021 by 14.6 and we get 0.31. That’s an annualized return of 31%. That works for us. Here’s the tool we use to help with that math.

We also have covered call option contracts at the $53 and $54 strikes, and those contracts also expire this Friday, 12/13. If none of these call option contracts are in the money at expiration we’ll keep all 600 of our shares. At that point our cost basis will be $51.57 per share. Then we’ll be able to sell calls on our entire position at the $52 strike and still be in a profitable position if called away. This example of how we collect a dividend and then sell calls to generate passive income helps us generate passive income on shares we own.