Earn Passive Income in a Small Town Selling Stock Options

We’ve recently been showing how to use options to earn passive income in a small town. We’ve been doing wheel trades on OXY, and our last trade was selling a put on OXY at the $61 strike. That trade expired out of the money on 7/19. Here is a link to the post that walks through that profitable trade with an annualized return of 41.8%.

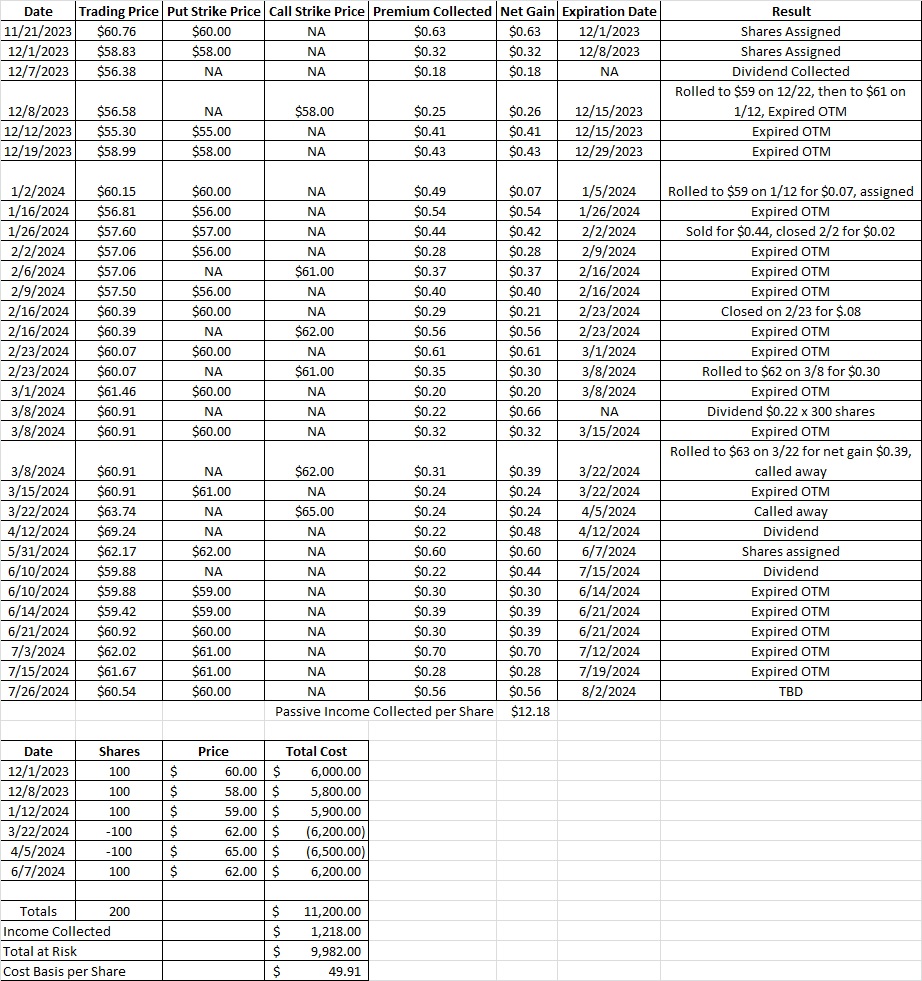

Since our cash secured put at the $61 strike price expired out of the money we now have access to that capital again. We currently own 200 shares of OXY in this portfolio and our cost basis is $50.19 per share. OXY is announcing their earnings on 8/8. We can minimize our risk level with this trade by having our put option contract to expire prior to that announcement. Here’s the tool we use to do that research.

Weekly Option Trade

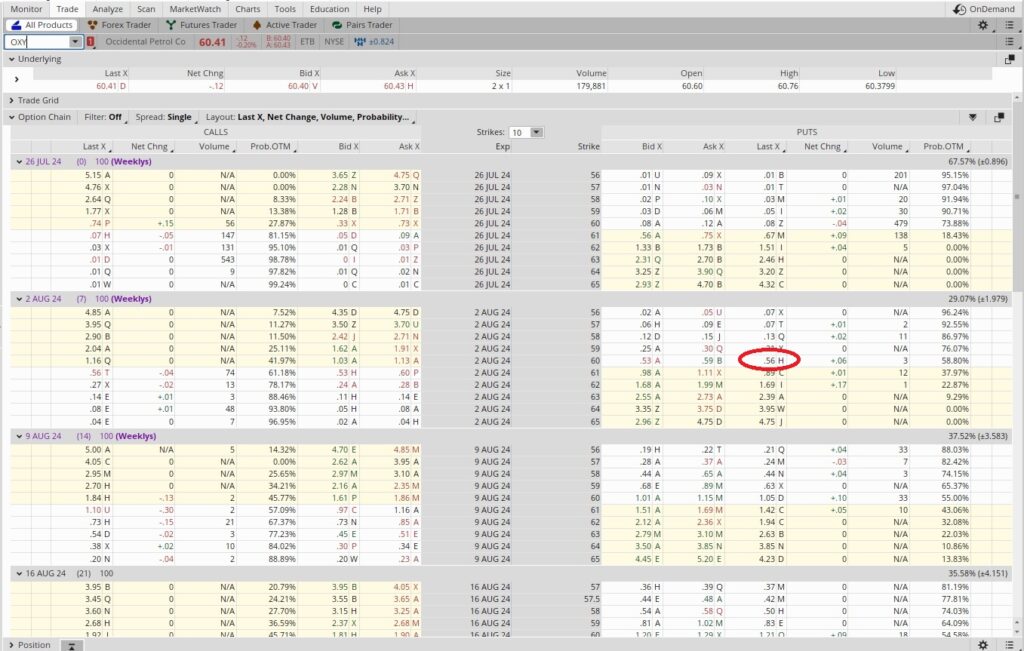

With OXY trading at $60.41 per share today, 7/26, we can sell the $60 put expiring next Friday, 8/2. We’re pretty close to the money with trade so we’ll generate some solid premium. We can earn passive income in a small town doing routine options trades like this. All we need is a laptop and an internet connection to research and execute the trade.

We sold the $60 put for $0.56 in premium. To determine the annualized return of this trade we take the $0.56 in premium we receive for selling the cash secured put and divide that into the $60 strike price. That gives us 0.0093. This trade runs for one week and expires next Friday. There are 52 weeks in a year, so we multiply that 0.0093 by 52 and we get 0.485. That works out to an annualized return of 48.5% on the capital we’re risking.

Remember that we’ll only be assigned the shares at $60 if OXY trades below $60. If that happens we’ll have the opportunity to roll the trade to another strike price and expiration date to avoid assignment if we choose. If OXY stays above $60 the put option contract will expire worthless out of the money. Either way we’ll keep the $0.56 in premium, which is a way to earn passive income in a small town.

Here is the option chain for OXY including the 8/2 expiration date. We can see the $60 put strike with the $0.56 in premium from the put option contract we filled.

Cost Basis per Share

This brings our cost basis per share down to $49.91 per share. To recap, we currently own 200 shares of OXY in this portfolio. We sold the $60 put expiring 8/2 for $0.56. That gives us an annualized return of 48.5% on the capital we’re using for this trade. If we get assigned the shares we’ll own 300 shares of OXY in this portfolio with a total cost basis of $53.27 per share. If OXY stays above $60 our put option contract will expire out of the money, we’ll still own 200 shares and our cost basis per share will be $49.91. We’ll keep the premium regardless of what happens with the trading price.