Example of a Profitable Wheel Option Trade

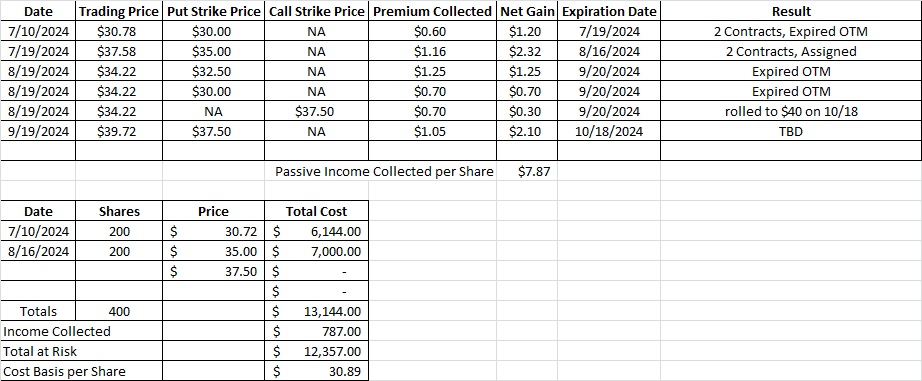

In July we started a wheel trade on MBUU for passive income. We bought two hundred shares at $30.72 and then sold two puts at the $35 strike with the 8/16 expiration date. Those contracts were assigned to give us a total of 400 shares. Then we sold another put option contract for the $32.50 strike price and another at the $30 strike price, both for the 9/20 expiration date. We also sold two call option contracts at the $37.50 strike price, also for the 9/20 expiration date. Today MBUU is trading at $39.72. Both of our put options will expire out of the money tomorrow if MBUU stays where it is. Since our calls are in the money we need to decide if we want to roll these contracts.

Our cost basis on MBUU currently stands at $31.14 per share on our 400 shares. If we let the shares go on both of our call option contracts we will sell those shares at $37.50 each. With our cost basis at $31.14, we would make $6.36 per share. That would reduce our overall cost basis on our remaining 200 shares down to $24.79 per share. With MBUU trading today at $39.72, that would be a profit of $14.93 per share in about two months. So this example of a profitable wheel option trade is not too shabby!

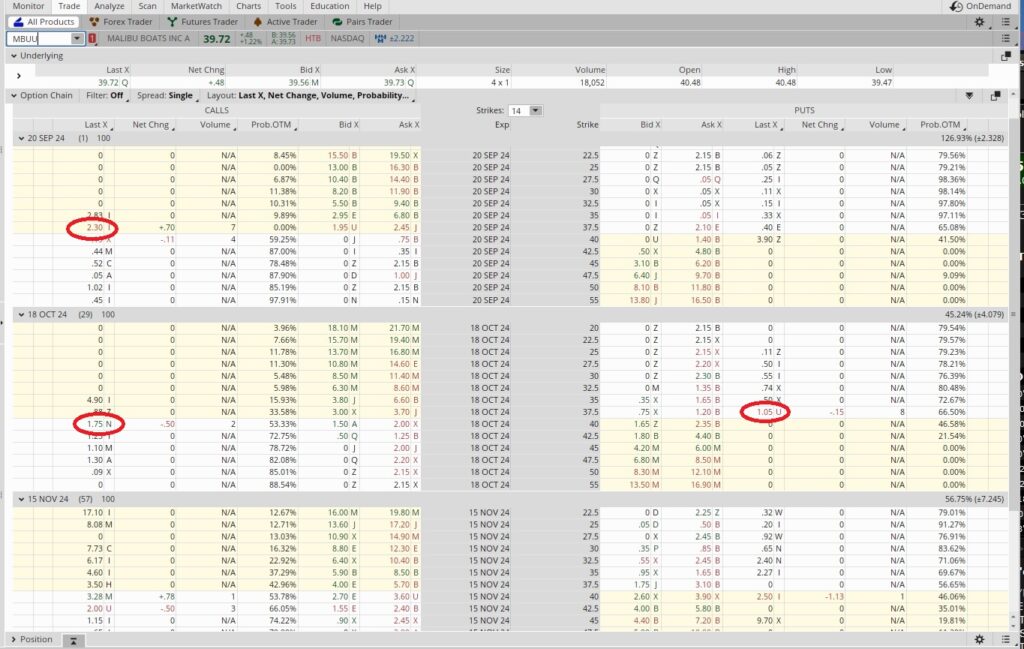

We could also buy to close one or both of these call options and sell them again at a higher strike price further out in time. The $37.50 call option contract that expires tomorrow, 9/20 last traded at $2.30. Since we brought in $0.70 in premium when we sold to open these contracts, we take that from what we pay to close the contracts. So closing the contracts would be a loss of $1.60 per share on each contract ($2.30 – $0.70). Then we can sell to open the $40 call with the 10/18 expiration date for $1.75. That would give us a net gain of $0.15 per share in premium (loss of $1.60 + $1.75). We would also gain the $2.50 in the strike price ($40 vs $37.50) if we are called away.

We can also sell to open two more put option contracts for the 10/18 expiration date. This time we’ll sell the puts at the $37.50 strike price, which gives us $1.05 per share. Since this is a one month long trade, we could do this trade (or a similar trade on another company) twelve times in a year. That means our time multiplier is twelve. We’re risking $37.50 per share, because that is how much we could have to pay for the shares if we get assigned on our puts. So we divide the options premium of $1.05 into the $37.50 strike price and we get 0.028. That, multiplied by twelve, gives us an annualized return of 33.6%. Here’s the tool we use to do that math.

So our decision point on this example of a profitable wheel option trade is whether or not we think MBUU has a longer runway up vs the likelihood that it trades sideways or down from here. We look at MBUU as a coiled spring, and lower interest rates should help MBUU’s sales. So we want to keep as many shares as we can for the ride up. Would we rather have 200 shares with a cost basis of $24.79 per share, or 400 shares with a cost basis of $30.89 and the potential to add another 200 shares at the $37.50 strike? We choose the latter.

Remember that we’re doing these trades so we can use the option premium to reduce our cost basis per share. And we’re trading MBUU because we thinkit is likely to be trading much higher in the near future. This example of a profitable wheel option trade gives us cash flow on our capital while we’re waiting for MBUU to increase in price.

Weekly Trade Recap

We rolled our two $37.50 call option contracts up to the $40 strike with the 10/18 expiration date. That gave us a gain of $0.15 per share on each of those contracts. Then we sold to open two puts at the $37.50 strike, also for the 10/18 expiration date. Those two trades bring our total cost basis to $30.89 per share.