Expired Worthless Out of the Money

Our weekly trades on OXY expired worthless out of the money last week. Now we have access to that capital again, so we’re going to sell options to create cash flow. We’ll sell another cash secured put and two more covered calls. These weekly trades are a low risk way to generate passive income from a company we already own without selling our shares. And in this price range we’re happy to own more shares of OXY, so we’re comfortable selling a put to generate more passive income.

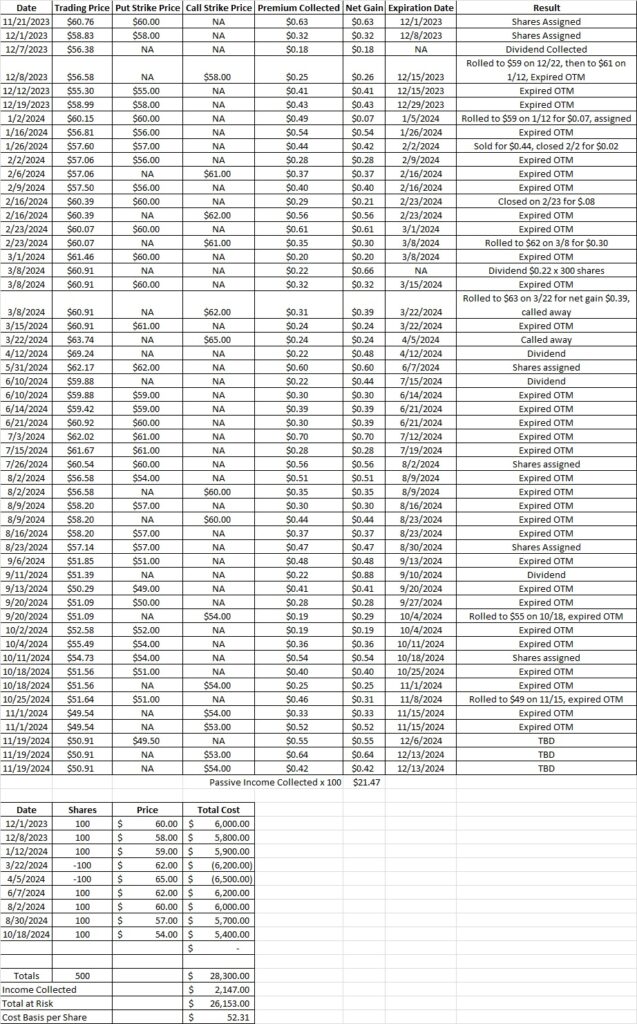

OXY was trading at $49.97 at market close on Friday. Our cash secured put at the $49.00 strike expired worthless out of the money. So we keep that premium and also free up the $4,900 we had allocated to that trade. We also had covered calls at $54 and $53. Those also both expired worthless out of the money. We currently have 500shares of OXY in this portfolio. We’ve reduced our cost basis down to $52.63 per share. So we can sell a covered call at $53 or higher, and if our call is in the money at expiration we’ll make money on both the premium and the sale of the shares. If our call is not in the money, the covered call will expire worthless and we’ll keep both the premium and our shares. Then we can sell another covered call the next week.

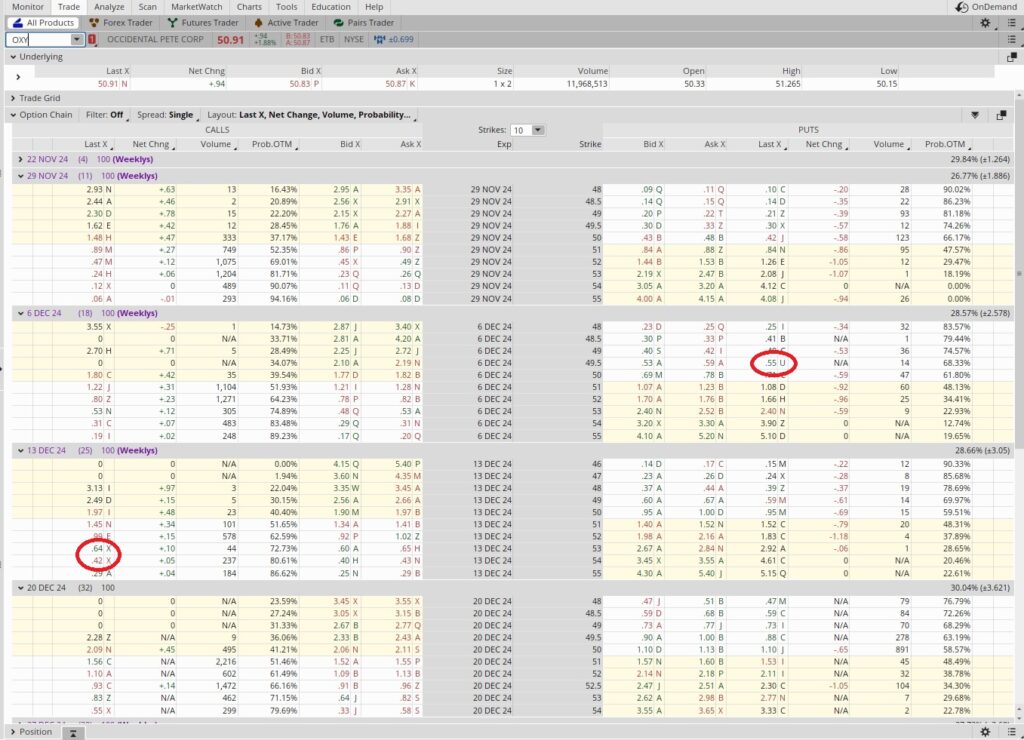

Right now OXY is trading at $50.91 per share. OXY has a dividend of $0.22 and goes ex-dividend on 12/10. Here is where we find that information. So we’d like any covered call we sell to expire after that. We’d also prefer that any put option we sell expire prior to the ex-dividend date. That way, if we are put shares, we’ll be eligible to collect the dividend as a bonus.

With our cost basis at $52.63 we want to sell our covered call at the $53 strike or higher. We were able to get $0.64 for the $53 strike and $0.42 for the $54 strike. Both covered call option contracts expire on Friday, 12/13. We’re doing two contracts because both of our covered calls expired worthless out of the money last Friday. If OXY runs up through both of those strikes we can either let the shares go for a profit or roll the covered call option contracts up to a higher strike. If one or both of the calls expire worthless out of the money then we’ll sell more covered calls to generate additional passive income.

On the cash secured put option we chose the $49.50 strike with the 12/6 expiration date. We chose that expiration date because we’d like to be eligible to collect the dividend if we are put the shares. If OXY stays above $49.50 and we are not put the shares we’ll have access to our capital again at expiration. Then we can sell another cash secured put option contract. We’ll keep the premium as passive income either way.

We brought in $0.55 on the $49.50 put. That trade lasts until 12/6, or 18 days. We divide the 365 days that are in a year by 18. That gives us 20.28. That number is our time multiplier. Then we divide the $0.55 premium by the $49.50 strike price and we get 0.011. We multiply that 0.011 by our time multiplier of 20.28 and we get 0.225. That’s an annualized return of 22.5%. We aim for an annualized return of at least 20% on our capital when we sell puts. This trade checks that box. If OXY drops below our $49.50 strike price we’ll be obligated to buy the shares or roll out of the trade. So it’s important that we only sell a cash secured put option on a company that we want to own at the strike price. This tool helps with that math.

Weekly Trade Recap

We currently have 500 shares of OXY in this portfolio. Our put option and both of our call option contracts expired worthless out of the money last Friday. We sold another put option for the $49.50 strike with the 12/6 expiration date for $0.55. Then we sold a covered call at the $53 strike for $0.64 and another at the $54 strike for $0.42. These trades bring our cost basis per share down to $52.31.