Find a Company to Trade

We take several steps to find a company to trade. One way a company comes on our radar is when we monitor the 13F filings. Each quarter hedge funds with at least $100 million in assets under management must report their activity to the SEC. Those reports include the buys and sells for that hedge fund. These reports must be filed by the 45th day following the close of the calendar quarter. We find these 13F reports here. We have a list of the hedge fund managers who employ and investment approach that is similar to ours. Each quarter we review their activity, and that helps us find a company to trade.

On the most recent 13F report a fund manger we like to follow just initiated a new position in BLDR. The position is 3.5% of his portfolio, and that’s a significant amount for a new position. The fund manager is Glenn Greenberg and the fund is Brave Warrior. His fund bought 1.2 million shares in the first quarter for an average price of $145 per share.

So we listened to the last three earnings calls for BLDR and we also reviewed their competitors. The home construction industry is dominated by a few builders, and those builders need supplies. Those supplies come from either small, local lumber and building supplies dealers or the larger, national dealers. Of those national dealers, Builder’s First Source is one of the largest. Their prior CEO retired after 25 years with the company last November, and the new CEO is Peter Jackson. Peter was the CFO at BLDR prior to becoming the CEO.

With BLDR trading around $107 and moving up today, we feel the BLDR may have hit a floor. We’re happy to initiate a position in BLDR in this price range. When we find a company to trade we like to split our total allocation to the company over several tranches. We buy one tranche of shares and then sell another tranche of cash secured put options just below the money. The options premium from the put option will reduce our basis on the shares we own. It will also put us in position to buy more shares if the trading price drops through our strike price.

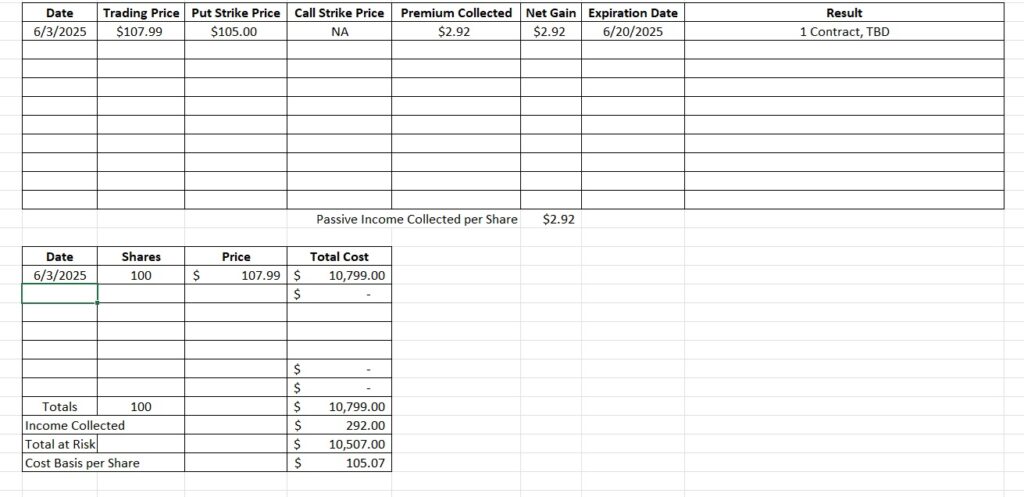

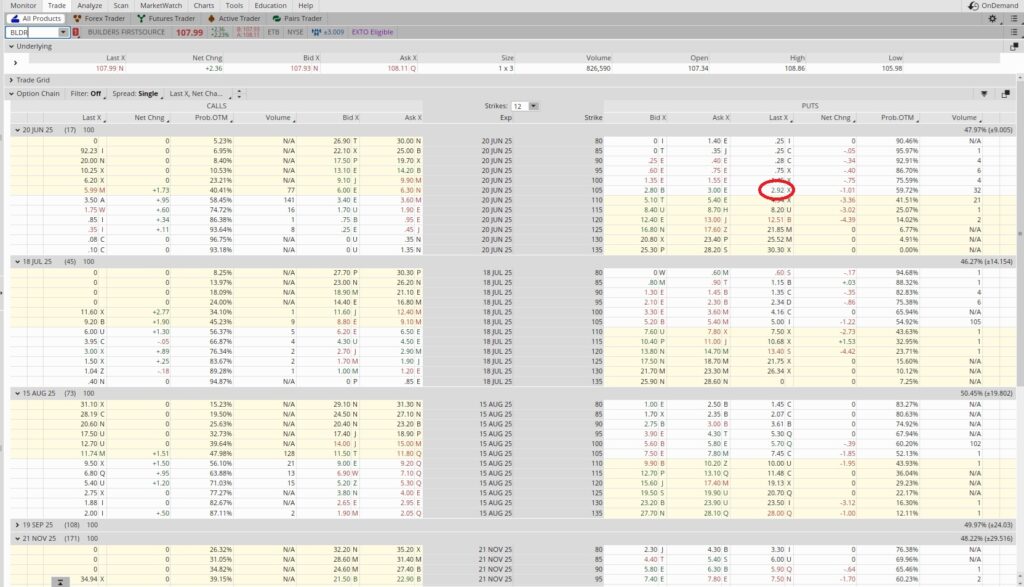

In this case we have about $60,000 we’re willing to allocate to BLDR. We bought 100 shares of BLDR at $107.99 per share. That represents one tranche for us. Then we sold to open the one contract for the cash secured put option at the $105 strike price. That put option represents our second tranche. When we sell to open a cash secured put option we’re making a promise to shares at the strike price. We need to have enough capital in our account to cover the trade, and one contract is for 100 shares. So when we sell to open a put at the $105 strike price we need to have 100 x $105, or $10,500 available in our trading account. We sold to open the $105 put strike for the 6/20 expiration date for $2.92 in option premium.

When we find a company to trade we need to put up the capital for the duration of the trade. Let’s walk through how we evaluate the put strike. Today is 6/3, and this trade expires on 6/20. That makes this trade active for 17 days. We take the 365 days that are in one year and we divide that by the 17 days this trade is active. That gives us 21.5. That becomes our time multiplier. Then we divide the option premium by the strike price. So we take $2.92 and divide that by $105, and we get 0.028. Then we multiply that by our time multiplier, and we get 0.598. That’s an annualized return on the capital we’re risking of 59.8%. Here’s the option return calculator we use to do that.

The risk with this trade is that the price of BLDR drops and we have to buy shares at $105. Since complete a valuation when we find a company to trade we’re happy to buy shares in this price range. So we’ll go ahead with the trade. If the trading price of BLDR runs up away from our $105 strike our put option will expire worthless out of the money. Either way, we’ll keep the $2.92 in premium. So right now our basis for BLDR on our 100 shares is the $107.909 we paid to buy the shares minus the $2.92 in option premium we received when we sold to open our put option. That brings out basis down to $105.07.

Weekly Trade Recap

We looked through the 13F filings to find a company to trade and we came across BLDR. We did a valuation and we’re happy to buy shares in the current price. So we bought 100 shares of BLDR at $107.99. That represents one tranche for this company in this portfolio. Then we sold to open the $105 put strike for the 6/20 expiration date. That options trade gave us $2.92 in passive income from the options premium. We track the trades for each company on our basis tracking template. That way we can see our actual basis for the company after we’ve generated cash flow trading options.