Generate Passive Income from Home

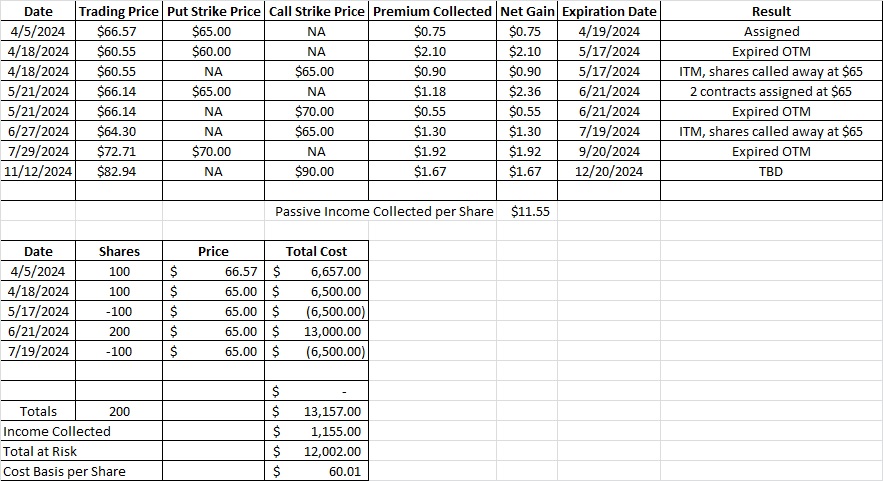

We’ve been using HHH to generate passive income from home using stock options. Here’s a link to our most recent options trade on HHH. It’s now trading at $82.19. That’s a little high for us to sell another cash secured put option on it. So now we’re going to use a covered call to create some cash flow from shares we own.

We currently own 200 shares of HHH in this portfolio with a cost basis of $60.85 per share. As long as we sell our covered call at a strike price that is higher than our cost basis we’re going to make money if our shares get called away. Ideally we’ll sell the covered call, create some cash flow from the options premium, and also keep our shares. We’ll keep the options premium we receive from entering into the contract regardless of whether or not our covered call goes in the money.

If HHH continues up and is trading higher than our strike price we’ll be obligated to sell our shares at that strike price. We could also roll the trade to a different strike price on a different expiration date. The difference between our strike price and our cost basis will reduce the cost basis on our remaining shares even more if we sell some shares on our covered call.

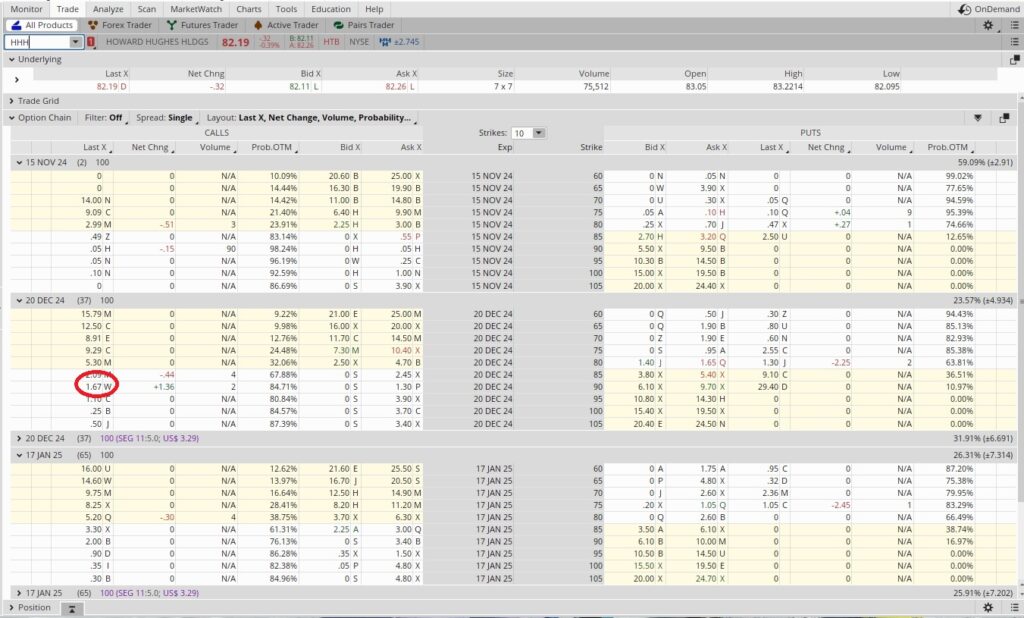

Since our cost basis is down to $60.85 per share we’ll make money if we sell shares right now. We’ll sell a covered call at a strike price that is a little above the current trading price of $82.19. We sold the $90 call option with the December 20 expiration date for $1.67. On shares we currently own we were able to generate passive income from home by selling a covered call option.

If shares of HHH are trading above our $90 strike at expiration we’ll be obligated to sell our shares at $90. If that happens we’ll make money on both the options premium and also on the sale of the shares. We may decide that we don’t want to sell the shares. Then we could buy to close the options contract and sell to open a different contract with a different strike price and an expiration date that is further out in time.

Weekly Trade Recap

We currently have 200 shares of HHH with a cost basis of $60.85 per share. We sold one contract of the 12/20 covered call for $1.67. The options premium enables us to generate passive income from home. That reduces our cost basis per share down to $60.01. We’ll keep the premium regardless of what happens with the share price. If the share price goes up through our $90 strike we can roll the contract so we can keep the shares. If we let the shares go we’ll still have 100 shares of HHH left in this portfolio. So we see this as a low risk trade.