Get Shares to Collect the Dividend

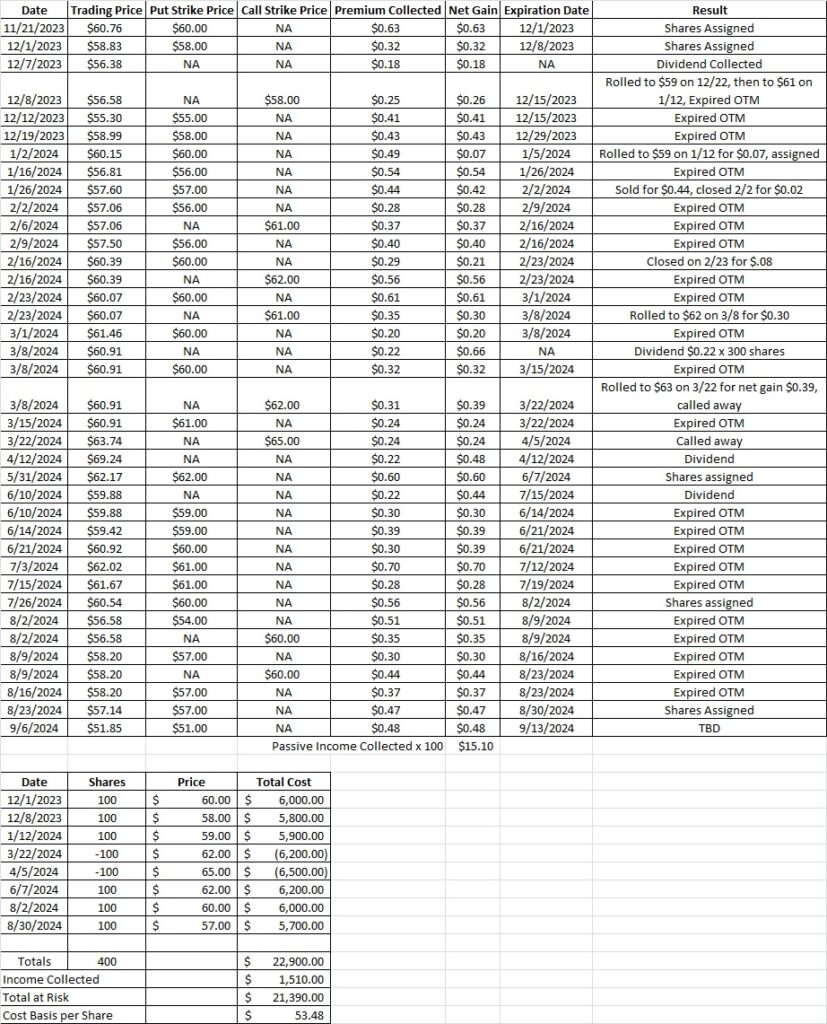

Last week we sold a put option close to the money to get shares to collect the dividend. We sold to open the $57 put option on OXY. That put option contract expired in the money on Friday, 8/30. We accepted the shares at $57 and put ourselves in a position to collect the upcoming dividend. Here’s a link to the post that walks through the how and why on that trade. After collecting those shares our cost basis per share on OXY now stands at $53.48 per share. We have 400 shares of OXY in this portfolio, and we have room for another tranche of shares. When we collect the dividend that $53.48 cost basis will drop to $53.26 per share.

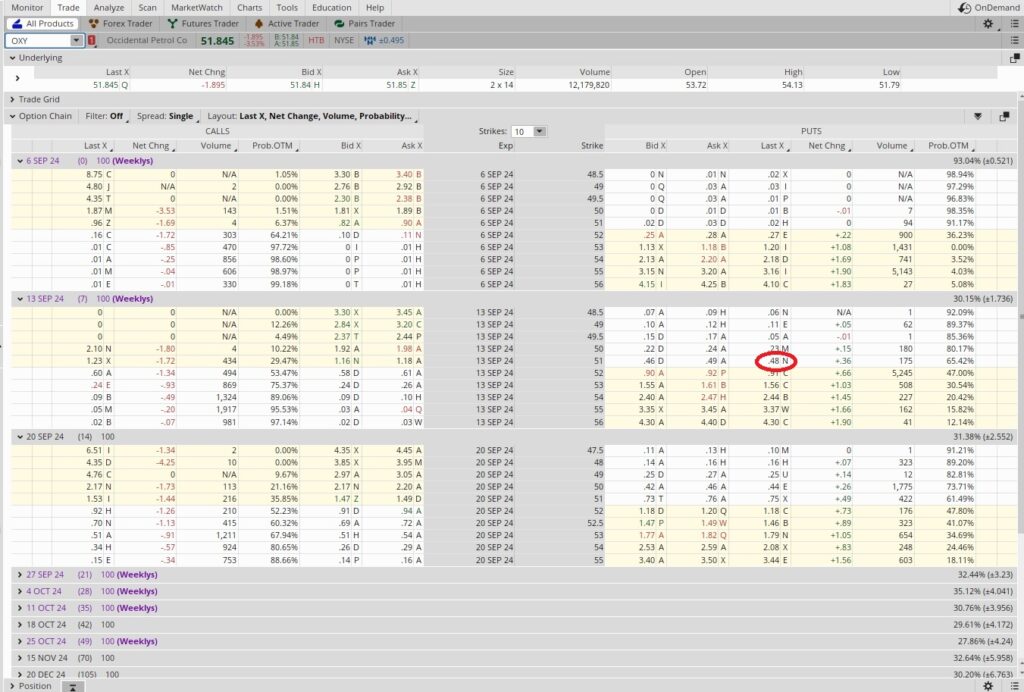

OXY is down today along with the rest of the market and right now is trading at $51.84. So we’re going to look at selling another put option. OXY goes ex-dividend next Tuesday, on 9/10. The next expiration date is 9/13, which is too late to get shares to collect the dividend. But we can still collect some premium and reduce our cost basis with that. We will also reduce our cost basis if we get assigned the shares because our put strike will be below our current cost basis.

Here is the five year price chart on OXY with weekly candles. We can see a strong floor for OXY around $56 with the green arrows. We have another floor that is a bit weaker around $51 with red arrows. Since OXY blew right through the floor at $56 we’re hesitant to sell another put super close to the money.

Another factor is that Warren Buffett currently owns over 27% of OXY and he is sitting on a large pile of cash. Over the last two years he has consistently purchased more shares each time OXY has pulled back. But not this time. Since he owns over 10% of the company he is required to report any buys or sells of the company within 48 hours of his trade. And that has not yet happened. His last purchase was in June when he bought shares at $59.75. OXY is down over 10% since then and he has not purchased more. Since we already have four tranches of OXY we only have room for two more tranches. We could sell a put at $51 and then hold out for another bigger move down for our last tranche.

By selling a cash secured put option contract we’re putting ourselves in a position to buy shares of the stock if the trading price drops below our strike price. If that happens we could be assigned the shares at our strike price.

Cash secured means that we need to have enough cash in our brokerage account to cover the cost of the shares. That could happen at any time from when we sell to open the contract through the expiration date. Since one contract is for 100 shares, we need to have 100 times our strike price available in our account for each put option contract we sell to open.

Remember that we only use this profitable options trade for beginners on stocks we want to own. And we only sell puts at a strike price we are happy to pay for a share of the company. When we sell a put option contract we might be assigned shares at our strike price. So we should only sell puts at a strike we’re comfortable paying for a share of the company’s stock.

Weekly Trade

We sold to open the $51 put expiring next Friday, 9/13 for $0.48. That means we need to have 100 x our strike price available in our account to cover the cost of the shares if we need to buy them. In this case, that would be $5,100. This trade last for one week, and there are 52 weeks in a year. Since this is a one week long trade, we could theoretically do this trade, or a similar trade on another company, 52 times over the course of a year. So our time multiplier is 52.

We earned $0.48 in premium per share for this trade. We’re putting up $51 per share to make this trade, so we divide the $0.48 into our $51 strike. That gives us 0.0094. Then we multiply that by our time multiplier, (52) and we get 0.489. That’s an annualized return of 48.9%. That works for us.

Weekly Trade Recap

Our trade last week was the $57 put, and that helped us get shares to collect the dividend. This week we sold the $51 put for the 9/13 expiration date for $0.48 in premium. We currently have 400 shares of OXY, and this trade brings our cost basis per share down to $53.48. We have room for one more tranche of OXY in this portfolio if we buy these shares.