Find a Good Passive Income Strategy – Watch the Experts

When I’m looking for a passive income strategy for an accredited investor I want to have a quality company. I prefer to own publicly traded companies because it’s a lot less effort to follow the news on a company than it is to run a company myself. I also like publicly traded companies because they are much easier and quicker to sell than a private company. The main challenge is that there are thousands of publicly traded companies, and sifting through all of them can be a bit like finding a needle in a haystack. So how do I find a quality, publicly traded company as a passive income strategy for an accredited investor?

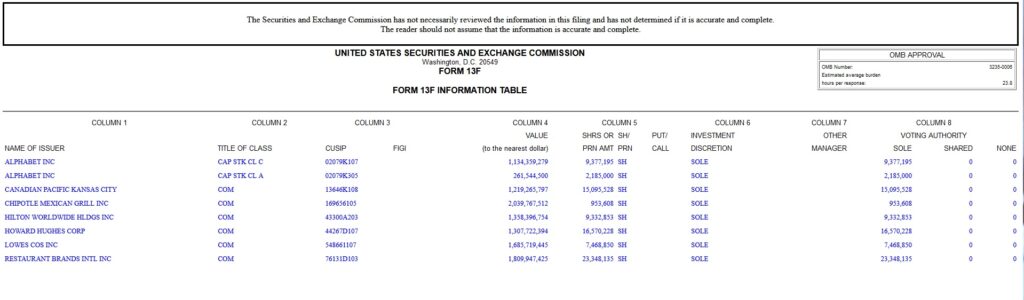

I like to look at what the experts are doing. That means the actions of the big time investment managers who are managing hundreds of millions of dollars. I can look to see what these hedge fund managers are buying and selling, and that will point me to some of the companies that smart people with lots of resources have researched and find attractive. That’s where the 13F filings come in.

What is a 13F Filing

A fund that manages over $100 million in assets must file a 13F with the Securities and Exchange Commission on a quarterly basis. These institutional fund managers must complete the 13F filing within 45 days of the end of the quarter. The 13F will show what companies the fund bought and sold during the quarter and how many shares were involved. An investment manager who manages over $100 million is likely (but not guaranteed!) to have a pretty good sense of what is happening with the stock market and the details of what is happening at the companies that fund owns. So I find that looking at the 13F filings is a good place to start my search for a company to own as a passive income strategy for an accredited investor.

When I review the 13F filings I look for an investment manager with a strong track record. I also want the investment manager to have an investment approach that matches my own. In the fund I run I like to own companies that make money, with a good leader, not much debt, and a dominant market position. After looking through enough 13F filings you will start to get a feel for the investment managers who have an investment approach that matches your own. Some of my personal favorite fund managers are Bill Ackman, Warren Buffett and Glenn Greenberg.

Each quarter I look to see what my favorite fund managers are buying and selling. I also think about the impact of the trade on the fund manager’s portfolio. Let’s say we have two funds, and each bought $20 million worth of shares in a company. One fund manages $100 million and the other fund manages $2 billion. The $20 million is 20% of the $100 million fund’s investable capital, while the same $20 million is only 1% of the $2 billion fund’s capital. I want to be sure the trade is large enough relative to the size of the fund to be significant to the fund’s investment manager.

By following the investments of the bigger investment fund managers I can see what prices they have bought into companies recently and historically. That tells me if it is likely that there is a floor in the trading price of the company that is supported by one or several institutional investors.

For example, let’s say I have a company that I like that is trading at $31 per share. The 13F filings show that over the last year several fund managers are buying into that company when it is trading at $27 per share. That tells me there may be a floor in the share price around $27, because if the share price drops from the current $31 per share down to $27 per share, those investment managers are likely to buy more shares. They have hundreds of millions, or even billions of dollars to invest, so their purchases are likely to create a price floor in the trading price. I want my passive income strategy as an accredited investor to include the purchase price the experts pay for the same company.

How to Find the 13F Filings

The SEC provides the 13F filings for free in the EDGAR database. You can see the latest 13F filings here, or search the database for your favorite fund manager here.

There are several tools available that make this 13F research process easier. I use this tool for filtering through 13F filings. I like how it tells me all of the holdings of a particular fund or fund manager, along with the recent purchases or sales of shares, the date and the share price, and the percentage of the fund manager’s portfolio the trade represents. I especially like how it tells me the number of institutional trades and how many overall shares were traded in the quarter. Seeing that trend when several large fund investment managers are all buying shares of the same of the company at the same time gives me a comfort level that owning this company, at this price, at this time is good passive income strategy for an accredited investor.