Work from Anywhere Selling Option Contracts

To work from anywhere on my own schedule and retire early with passive income I have a few limitations. I don’t want a business with employees, a physical location to manage, or any kind of inventory. Avoiding a seasonal business with busier periods and quiet times is also important. I want something that is consistent year round. I prefer to have a scalable side hustle that I can do from anywhere, and one that is easy to grow without adding having to buy newer, bigger machines with larger capacity or any kind of special equipment. And I also want something that doesn’t take much capital to get started. That way I can start earning quickly and scale up as I grow my capital.

Work From Anywhere

I like using stock option contracts for passive income because I really can work from anywhere. For the basics on how this works, read this article. All I need is an internet connection and my laptop. I can easily work from anywhere my phone works because all I need is access to my broker’s website (Fidelity and Interactive Brokers) and some research sites, like the investor relations section on the website of the company I am researching and other financial research websites like this one.

Rule of 72

While I can work from anywhere selling stock options for passive income, I can also easily scale the process. I can sell some puts, then if I get assigned shares I can sell calls on those shares. It’s realistic to generate a return of 20%+ a year. Using the Rule of 72, a 19% annual return doubles an investment portfolio once every four years. A 26% annual return doubles an investment every three years. This series of articles shows how that works.

Scalable Passive Income

As the portfolio grows it’s easy to scale up this passive investment strategy by doing the same trades for more contracts. I might be doing six contracts, and a few months later doing a similar trade for eight contracts. And it usually doesn’t take any more effort to sell eight option contracts than six. It only takes more capital. Depending on the volume of trading on the company it can take a very large portfolio (eight figures plus) to have challenges filling these passive income trades.

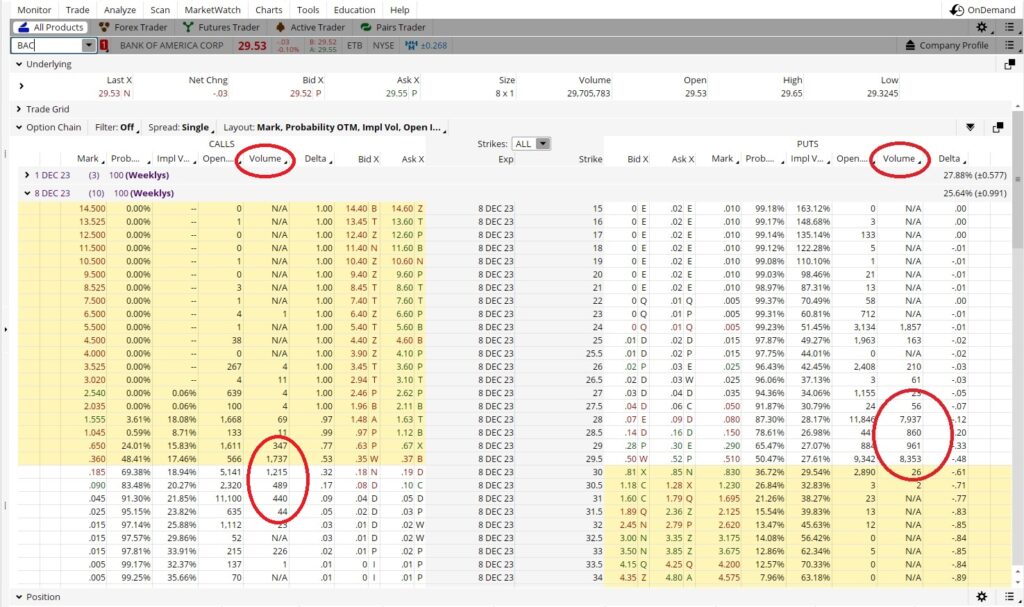

It’s pretty quick to identify the companies with low trading volume. On the option chain below for Bank of America we can see the volume of options contracts. The right side of the chain is put and the left side is call option contracts. We can see over 1,700 call option contracts traded at the $29.50 strike and over 1,200 call option contracts traded at the $30 strike. The put volume is even higher, with nearly 8,000 put option contracts traded at the $28 strike and over 8,000 put option contracts at the $29.50 strike.

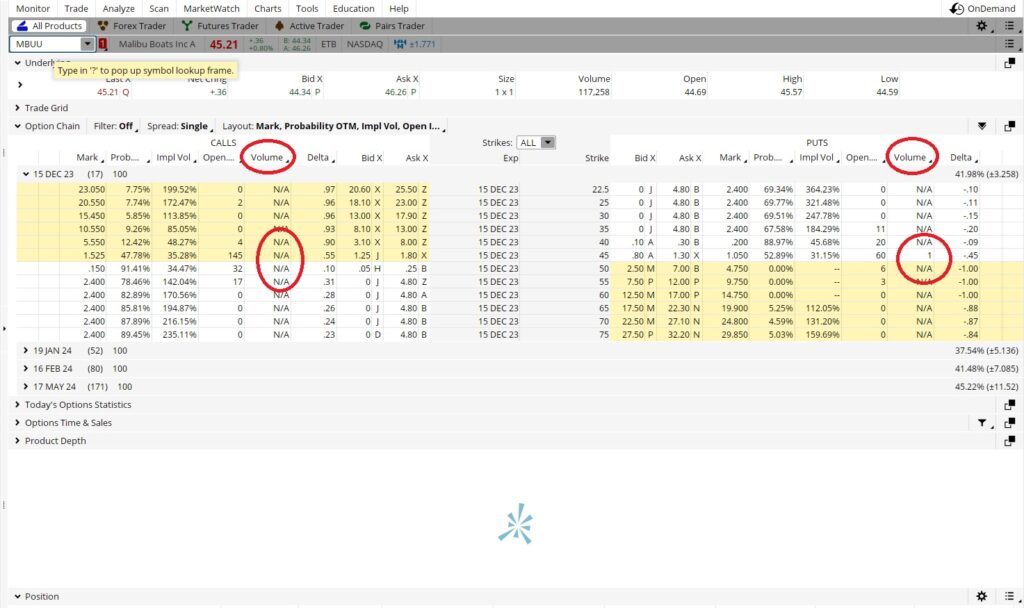

Compare that to a company like Malibu Boats, which has a total of one completed option contract trade on the same day. A person with a smaller portfolio can get a few contracts to fill on a company like Malibu Boats, but a person with a seven or eight figure portfolio may have challenges filling an order.