Easy Trade for Options Traders

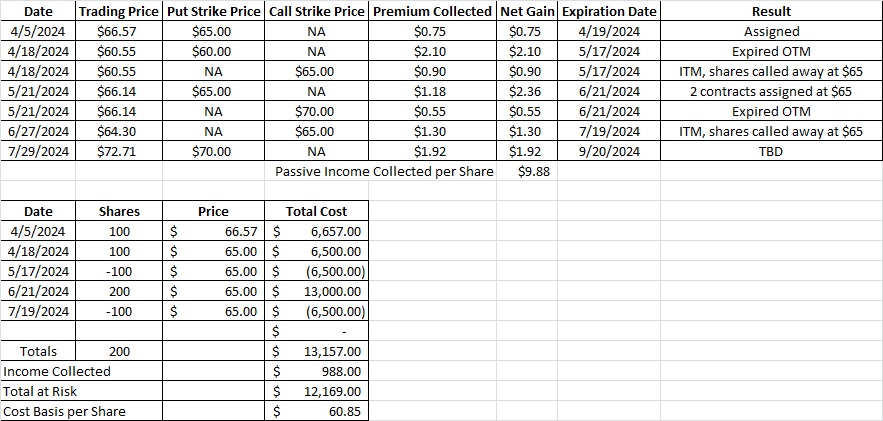

Our last easy trade for options traders on HHH was a call at the $65 strike. That covered call option contract expired in the money on 7/19, so we had 100 shares called away. That leaves us with 200 shares of HHH with a cost basis of $61.81 per share. We sold the $65 call because we had been assigned shares at the $65 strike. Even though we bought and sold shares at the same strike price, we’re ahead on the trade after collecting premium on both the cash secured put option and the covered call. Click here for details on that trade.

Now we own 200 shares of HHH and it is trading at $72.77. Since our cost basis per share is $61.81, we’re up $10.96 per share. That’s not bad considering we just started doing wheel option trades for passive income on HHH in April. That brings us to today, 7/29. We’d like to use a cash secured put to generate some options premium. HHH doesn’t have much options volume so we’re limited to $5 increments on the strike price. While that’s not great, we can generate enough premium to create an acceptable return.

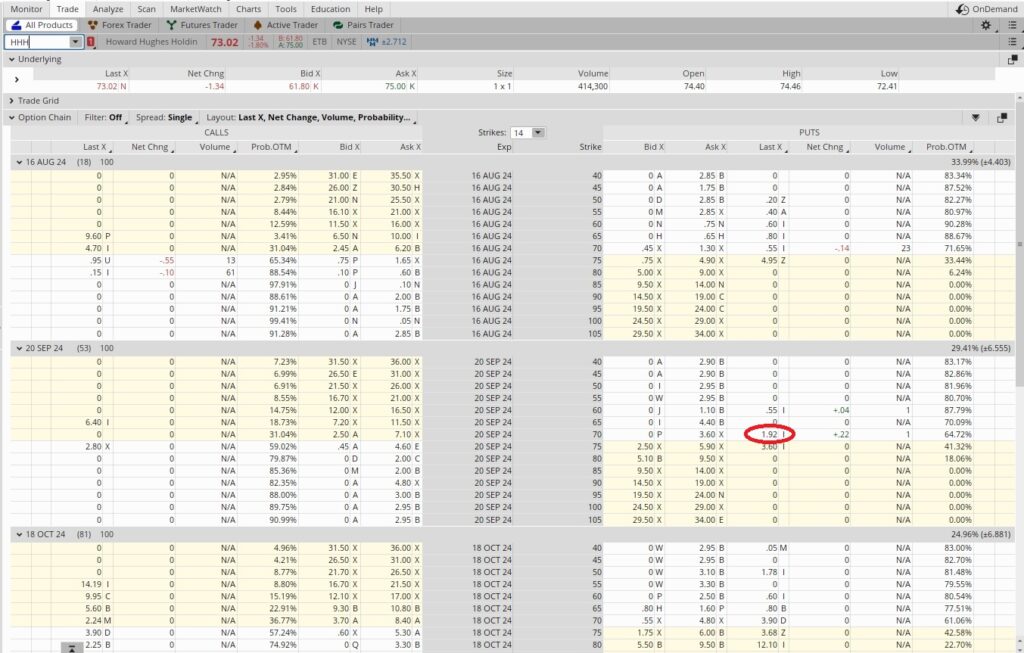

The first thing we’ll look at is the date of the earnings announcement for HHH. That was on 7/26 last week, so any volatility resulting from the quarterly earnings announcement is likely over. That’s a plus, as most options traders prefer to forgo any surprises. The next thing we’ll look at is how much premium we can generate on a put. We have 18 days until the August options expire on 8/16 and 53 days until the September options expire on 9/20.

Now we’ll check the premium for the $70 put option. We’re near market close and the $70 put for the 9/20 expiration date has only one contract of volume so far today. That contract filled for $1.92. So we take $1.92 and divide that into our $70 strike price, and we get 0.0274. This easy trade for options traders would be a 53 day trade. So we divide 365 days in a year by the 53 days in this trade and we get 6.89. Then we multiply our premium multiplier (0.0274) by our time multiplier (6.89) and we get 0.189, or an annualized return of 18.9%. That’s decent, but not great.

Let’s take a look at the $70 strike for the 8/16 expiration date. The most recent contract for that filled for $0.55. We take the $0.55 in premium and divide that into the $70 strike and we get 0.0079. This is an 18 day trade, so we divide 365 days in a year by the 18 days for this trade and we get 20.28. Then we multiply that 20.28 by the 0.0079 and we get 0.16, which is an annualized return of 16%. Usually the short term trades yield a better return in options premium than the longer term trades. That’s not the case today.

So let’s go a little deeper into the 18.9% return on the $70 put with the 9/20 expiration date. That 18.9% is the return we get in options premium by selling the cash secured put. But depending on your broker, cash in your trading account may be eligible for an additional return. We have an account at Fidelity. Fidelity currently offers a return of 4.98% on cash in a brokerage account when the cash position is in SPAXX. That means that our capital is double dipping.

We’re earning a premium with the option contract and we’re also generating income on the same cash by selecting SPAXX for our cash position. So that 18.9% isn’t really an 18.9% annualized return. It’s actually 18.9% + 4.98%, which is a 23.88% annualized return. And that’s locked in for 53 days, or seven+ weeks. So we can do this trade and be happy if we get the shares at $70. Or we can be happy that we’re getting a 23.88% annualized return for the next month and a half on this capital without being assigned shares. Either way, this easy trade for options traders generates some income, and we’re happy!

Cost Basis per Share

So we sold the $70 put for the 9/20 expiration date for $1.92 in premium. If the share price of HHH drops below $70 at expiration we’ll be assigned the shares at $70. Our cost basis on those shares will then be $68.08. We arrive at that by taking the $70 strike minus the $1.92 in premium. If the trading price for HHH stays above $70 from now through the expiration date we’ll just keep the premium. So far we’ve been able to reduce our cost basis on HHH down to $60.85 per share.