How We Opened a Position

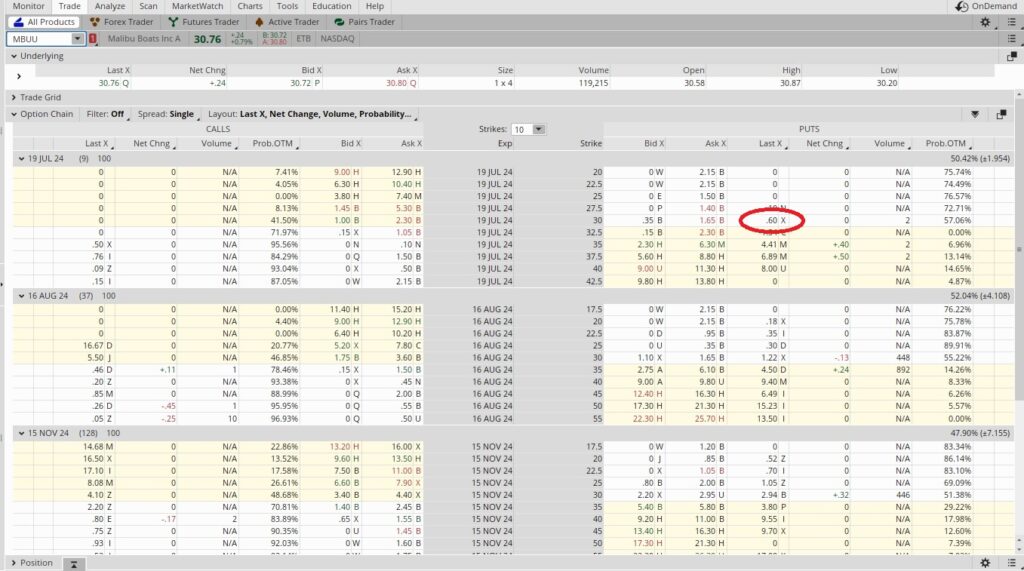

Here’s how we opened a position today in Malibu Boats. MBUU is currently trading at $30.76 share. We bought 200 shares outright at $30.72 per share. Then we sold two puts at the $30 strike price that expire next Friday, 7/19. Each of those put option contracts obligates us to buy 100 shares of MBUU at $30 per share. So we need to have $3,000 available in our brokerage account for each put option contract we sell (100 shares x the $30 strike price). If MBUU stays above $30 per share from now through the expiration date next Friday, the puts will expire worthless out of the money. We’ll just keep the premium. If MBUU drops below $30 per share at expiration we’ll be obligated to purchase the shares.

When a company we like is trading at a price we feel is a bargain, we’ll open a position by purchasing one tranche of shares outright. Then we’ll sell to open put option contracts for another tranche just below the current trading price. If the trading price stays where it is or increases, we’ll keep the premium from selling the put option contracts. If the trading price drops below our strike price, we’ll buy those shares. Either way we’ll reduce our cost basis per share for the company.

Now let’s walk through why we opened a position in MBUU today. Here’s the five year price chart on MBUU with weekly candles. We can see how MBUU has not traded at this level since the Covid Crash back in March of 2020. There was a lot more uncertainty around not just MBUU but the entire economy at that point. Now Malibu has much more production capacity, zero debt, fantastic vertical integration, and is starting stock buybacks.

MBUU is also the subject of a lawsuit from Tommy’s, a troubled boat dealership now in bankruptcy who accounted for over 10% of MBUU’s revenue last year. That lawsuit is the main reason MBUU is trading at just under $31 a share today. Another factor is the delay in the cut to interest rates (some people finance boats, a higher interest rate means higher payments). Here’s the website we use to do that research.

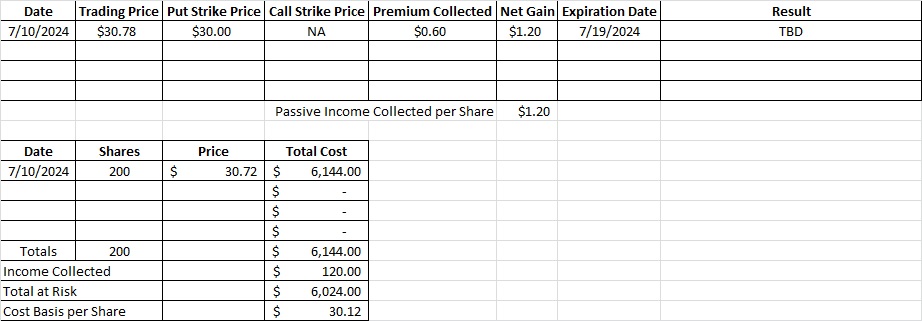

The Weekly Trade

With MBUU trading at $30.78 we sold two put option contracts at the $30 strike price with the 7/19 expiration date. Today is 7/10, so this trade is nine days long. We got $0.60 in premium per share, which equates to earning $60 in passive income for each put option contract. We’re putting up $3,000 for each contract, and making $60 for each contract. $60 divided into the $3,000 we risking is 0.02, or 2%. Since this trade is nine days long, we could theoretically do this trade 40 times over the course of a year. So we multiply the 2% by our time multiplier of 40, and that gives us an annualized return of 80%.

We’re only doing this trade because we like MBUU as a company and we’re happy to own shares at this price. If the trading price of MBUU drops below $30 at expiration and we buy these shares, our cost basis will be $29.40 per share ($30 strike price minus the $0.60 premium).

Trade Recap

We opened a position in MBUU. We bought 200 shares of MBUU at $30.72 per share. Then we sold to open two put option contracts at the $30 strike that each expire next Friday, 7/19. We received $0.60 in premium for each of those. If the trading price of MBUU stays above $30 through expiration our cost basis per share will be $30.12. If the trading price of MBUU drops below $30 we’ll buy the shares at $30. Then our cost basis per share will be $30.06. Then we’ll have twice as many shares. Provided that happens, we’ll start to sell calls on a portion of the shares to help us reduce our cost basis per share.

Cost Basis