Introduction to Stock Option Contracts

What is a stock option contract? A stock option contract is a derivative contract that represents a future action in relation to a company or index. While that’s a mouthful, it means that by entering into a stock option contract you are making a promise that you will buy or sell 100 shares of a company or index at a specific price on (or before) a specific date. You choose the company or index, the strike price, the expiration, and the amount of premium for entering into the contract. Each contract has a buyer and a seller. The buyer has the choice of whether or not to exercise the rights of the contract. If the stock option contract is exercised, the shares will change hands. If the stock option contract is not exercised, the shares will not change hands. The seller of the contract has the obligation to either buy or sell the shares at the agreed upon price. The buyer of the stock option contract pays the seller of the contract to enter into the agreement. The seller of the stock option contract keeps the premium received for the sale of the contract regardless of whether or not the shares change hands as a result of the contract.

Some definitions to get started using options to generate passive income:

Underlying Company/Index: This is the actual company that the contract controls. It could be a company such as Ford or Coca Cola, or an index, such as the S&P 500.

Option Contract: One contract is for 100 shares of the company or index.

Premium: This is the amount of money that is paid by the buyer of the contract to the seller of the contract. The premium changes hands when the contract is purchased. The seller of the contract keeps the premium regardless of whether the contract expires In the Money (ITM) or Out of the Money (OTM).

Strike Price: The price at which shares of the company/index will change hands (if they change hands)

At the Money (ATM): This when the company is trading at the same price as the option contract

In the Money (ITM): The company is trading at a price that means the contract will be assigned

Out of the Money (OTM): This is when the company is trading at a price at which the contract will not be assigned

Expiration Date: The date the contract expires. Weekly option contracts expire on Fridays (unless the market is closed on Friday, then the contract expires on Thursday). Monthly option contracts expire on the third Friday of the month.

Days to Expiration: Number of days left on the contract

Put Option Contract: Puts are theoretically purchased by a person who wants protection in case the trading price of a company decreases. The Put Option Contract gives the buyer of the contract the right to sell 100 shares of the company or index at the strike price on (or before) the contract expiration date. The Put Option Contract obligates the seller of the contract to buy 100 shares of the company or index at the strike price on (or before) the expiration date. The seller of the Put Option Contract needs to be comfortable owning the underlying company or index at the strike price of the Put Option Contract, because if the trade price of the company drops below the strike price, the seller of the contract will be assigned the shares of the company at the strike price upon expiration of the Put Option Contract. There is also the possibility that shares could be assigned prior to the expiration date. The seller of the contract will pay the strike price even if the trade price for shares of the company is far below the strike price. If the trade price for shares of the company is higher than the strike price upon expiration of the contract, shares will not be assigned and the contract will expire worthless.

Put Option Contract Example

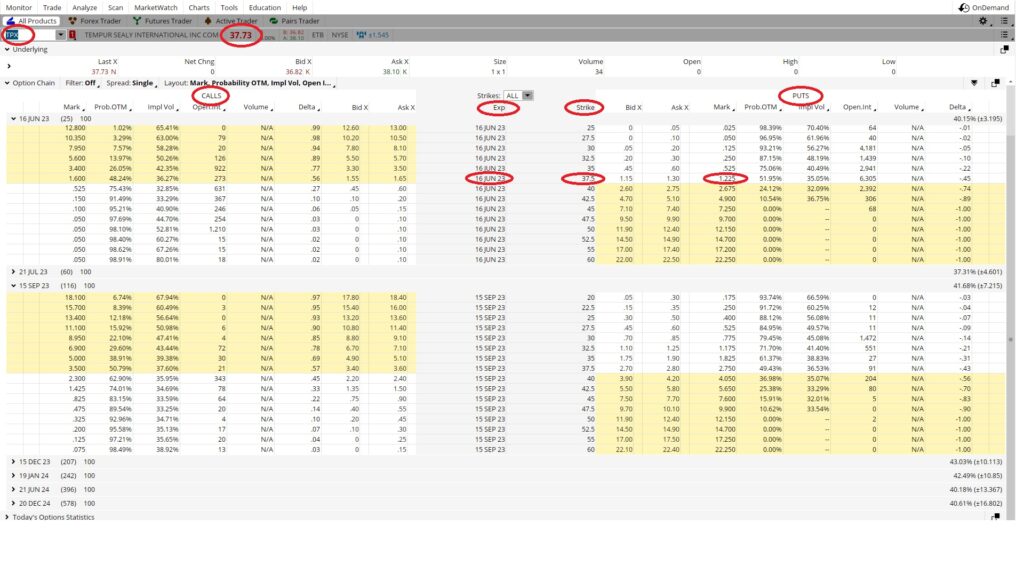

There is a company trading at $37.73. The $37.50 Put Option Contract for this company with an expiration date that is one month away is trading at $1.22. This means that the buyer of the Put Option Contract would pay $1.22 per share to enter into the contract (times the 100 shares, or $122), and the seller of the Put Option Contract would receive $1.22 per share to enter into the contract. Depending on the broker, there may also be a transaction fee and there will also likely be a nominal contract fee from the broker. The buyer of the Put contract can sell their shares of this company for $37.50 to the seller of the Put contract at any point up through the expiration date. If the company continues trading above the $37.50 strike price from now through the expiration date, the Put will not be exercised by the buyer of the Put because the buyer of the Put could sell their shares of the company on the open market for more than the $37.50 strike price on the Put contract. In the graphic below we have the company ticker circled on the top left and the current trading price for the company. Under that on the left is the information for Call Option Contracts and on the right is the information for Put Option Contracts. Under that is the Expiration Date and the Strike price for the option contract. We circled the expiration date, strike and mark price for the premium for the Put Option Contract.

The seller of the Put contract is making a promise to buy the shares of the underlying company for $37.50. That promise to buy the shares could be executed at any time from today through the expiration date, and they are getting paid $1.22 per share to make that promise. Since one contract represents the promise to buy 100 shares, the seller of the Put Option Contract should have 100 times the strike price of the Put contract in their account to buy the shares (notwithstanding margin and other factors, but for now we’ll assume this is a cash covered put). In this case, that would be $3,750 (100 shares x $37.50). The seller of the Put contract will keep that $1.22 premium they received to enter the contract regardless of whether or not the contract gets exercised by the buyer of the Put contract. If the company continues to trade above the $37.50 strike, the contract will not be exercised, which means the seller of the Put contract will not be required to buy the shares. If the trade price of the company drops below the $37.50 strike price of the contract, the seller of the contract will need to purchase 100 shares of the company from the buyer of the contract, regardless of what the current trading price is as of the date the contract is exercised. If the company is trading at $36 per share, the seller of the Put contract will still need to pay $37.50 per share, because that is the strike price of the contract. If something drastic happens and the company is trading at $21 per share at (or at any time prior to) expiration, the seller of the Put contract will still need to buy the shares at $37.50 each. That risk is reflected in the premium of $1.22 for the $37.50 Put contract that expires one month from now. Depending on the company and other market factors, the premium may be more or less than $1.22 on a $37.50 share of the company’s stock.

Call Option Contract: The Call Option Contract obligates the seller of the contract to sell 100 shares of the company or index at the strike price on or before the expiration date. A Call Option Contract gives the buyer of the contract the right to buy the company at the strike price on or before the expiration date.

The buyer of the Call Option Contract can buy shares of the underlying company at the strike price from the seller of the Call Option Contract at any time from the point the contract agreement is entered through the expiration date. If the company is trading below the strike price the buyer of the contract will be able to buy the shares of the company on the open market for less than what they would pay by exercising the contract, so as long as the trading price of the company stays below the strike price the contract will not be exercised. If the underlying company is trading at a price above the strike price of the Call Option Contract, the buyer of the contract will exercise the contract at expiration (or earlier).

The seller of the Call Option Contract is agreeing to sell shares of the underlying company or index at the strike price on (or before) the contract expiration date. If the share price of the underlying company remains below the strike price through the expiration date, the seller of the Call Option Contract will not need to sell their shares of the company to the buyer of the Call. If the trade price of the underlying company rises above the strike price of the Call Option Contract, the buyer will exercise the contract on (or before) the expiration date. The primary risk to the seller of the Call Option Contract is the trading price of the underlying company will rise above the strike price of the Call, which means the seller of the Call will need to sell their shares at the strike price rather than the higher trading price.

Call Option Contract Example

Call Option Contract Example: The same company we referred to in the Put example above is trading at $38. The $40 Call Option Contract that expires in one month is trading at $0.52.

The buyer of the Call pays $0.52 today for the right to buy shares of the company at $40 at any point from now through the expiration date one month away. If the trading price stays below $40, the buyer of the Call will not exercise the call to buy the shares at $40 because those same shares could be purchased for less than $40 on the open market.

The seller of the Call Option Contract receives $0.52 today for the promise to sell the company at $40 at any time from now through the expiration date. If the underlying company continues to trade below $40 from now through the expiration date, the Call Option Contract will expire worthless and the seller of the Call will keep their shares. If the underlying company trades above $40 the seller of the Call will have their shares called away on (or before) the expiration date. Either way, the seller of the Call keeps the $0.52 premium for entering into the contract.

More important than the basics of how option contracts work is the quality and trade price of the underlying company or index. Knowing the value of the underlying company for the option contract and being comfortable with the leader of that company, as well as the company’s place in its industry, is more important to your overall success trading options than the option trade itself.