Option Wheel Trade

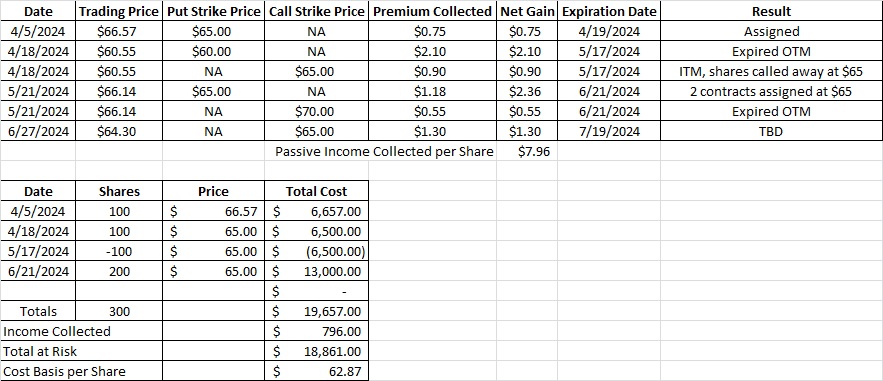

Our option wheel trade on HHH gave us another two hundred shares of HHH at the $65 strike last week. That gives us a total of 300 shares of HHH in this portfolio and our current cost basis per share is $63.30. We also had a covered call on HHH at the $70 strike, and that option contract expired out of the money.

An option wheel trade is when we sell a put on a company repeatedly. We keep the passive income we generate selling these stock options. Doing these trades long enough we’ll eventually be get assigned shares. Then we sell calls on those shares at the assignment strike price. We continue selling calls at that strike price until the covered call option goes in the money and our shares are called away. The idea is to generate passive income by selling the options premium.

Our most recent trade on HHH was selling two puts at the $65 strike price back in May. Those two put option contracts were in the money on the expiration date last Friday. So we bought those shares at $65. Now we’re going to sell a covered call on half of those shares as the second part of our option wheel trade. We’re only selling one call to reduce our cost basis because we’d like to own HHH for the long term. We feel it’s likely to trade in the $90’s, which is much higher than the current $64 per share. Here’s a link to our post that reviews why we like HHH for trades right now.

Weekly Options Trade

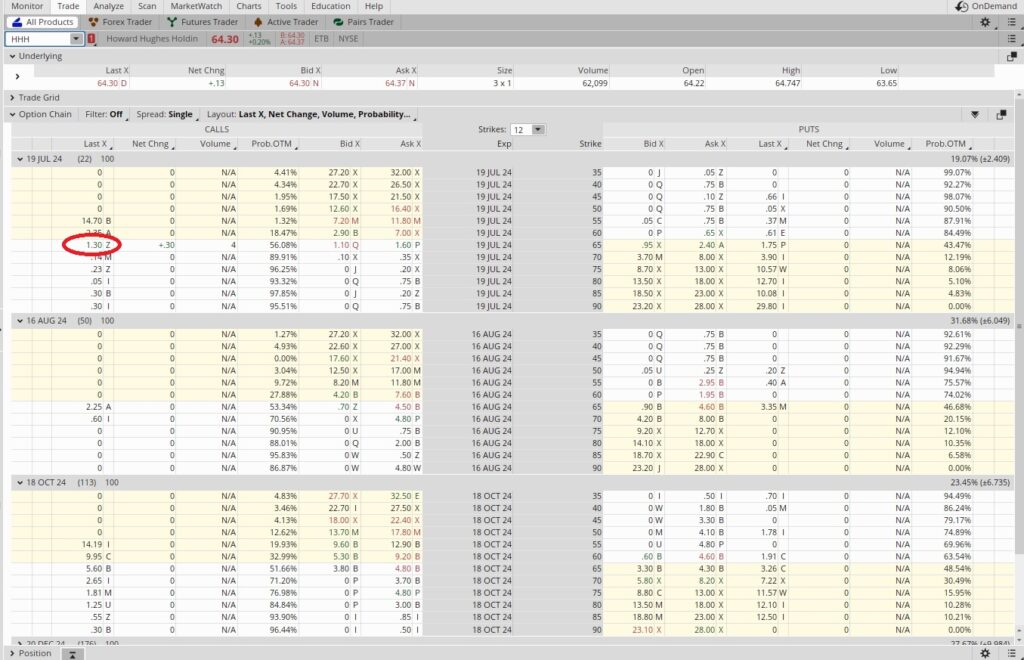

Right now HHH is trading at $64.30 per share. Since we were assigned shares at the $65 strike price we can sell our covered call at that same strike. We can see the $65 call option expiring 7/19 is trading for $1.30. If HHH is trading above $65 at expiration on 7/19 our covered call will sell 100 shares of HHH for each call option contract we sold as part of our option wheel trade. If HHH continues to trade below $65 from now through expiration our covered call will expired worthless. Either way, we’ll keep the $1.30 in premium.

We aren’t selling a put at the $60 strike because right now there isn’t enough premium to justify the capital we’d need to put to sell a cash secured put option. We aren’t selling the $65 put because we were just assigned 200 shares at that strike. We’ll wait and watch HHH. If the trading price drops close enough to $60 to generate decent premium we’ll sell the $60 put option contract.

Cost Basis per Share

To recap, we now have 300 shares of HHH in this portfolio. We sold the $65 covered call option with the 7/19 expiration date for $1.30. If we get called away we’ll still have 200 shares of HHH. If HHH continues to trade below $65 from now through the expiration date we’ll keep all 300 of our shares and sell another call at the $65 strike next month. After collecting passive income on our option wheel trade our cost basis per share now stands at $62.87.

Cost Basis Table