Options Called Away

Today we’ll look at having the shares on our call option called away or rolling the trade. Last Friday we sold a strangle option on OXY. Here’s the post that walks through that trade. And here’s the tool we use for doing research on OXY.

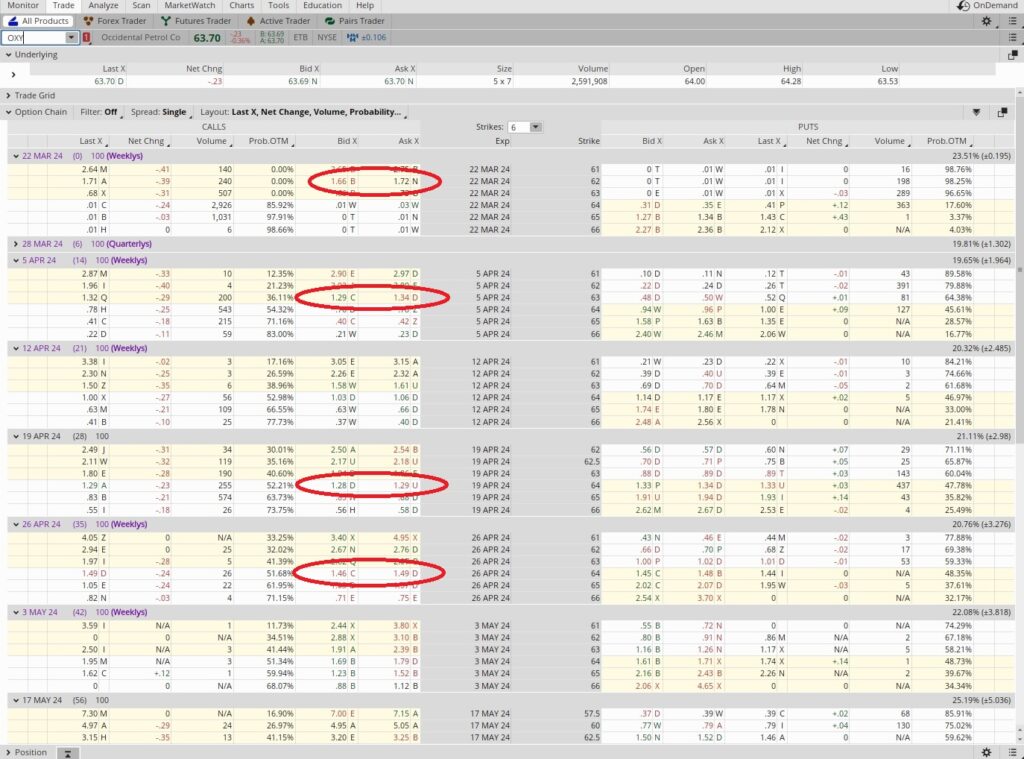

A strangle option is when we sell a put option below the money and a call option above the money at the same time on the same company. We also have the same expiration date on both contracts (today, 3/22). We sold the $61 put and the $62 call. Right now OXY is trading at $63.70. Since the trading price for OXY is above our call strike, our covered call is in the money. That means we will have our options called away after selling the covered call. If we prefer to keep the shares we can roll the call out rather than letting our option get called away. So now we’re going to look at the covered call to decide if we will roll the call out and up or let the shares go.

We sold the call $62 for $0.39. Right now the Bid on the $62 call that expires today is $1.66 and the Ask is $1.72. So we’ll assume we can buy to close the call option for $1.69. Since we sold to open that contract, we’ll take the $0.39 in premium we received and subtract the $1.69 in premium we’ll pay to close it. That gives us a negative $1.30. So if we roll the covered call out to a higher strike that is further out in time, we’ll need to get at least $1.30 when we sell to open the next covered call contract. So let’s look at the upcoming weekly expiration dates and see how far out we’ll need to roll the covered call for us to keep our shares.

Looking at the April 5 expiration date, we can get $1.31 for the $63 call option strike. That would break even on the trade part and give us an extra dollar selling the shares. The extra dollar comes from having the $63 strike on 4/5 rather than the $62 strike that expires today. So we’d hold the shares another two weeks to make a dollar. So we take $1 and divide that into $62, which gives us 0.016. This is a two week trade, and there are 26 periods of two weeks in a year. So we multiply the 0.016 times 26 and we get 0.419.

That’s an annualized return of 42% IF we have our options called away. If not, we’ll break even on the trade. The 42% is solid, but it isn’t a guarantee. If OXY drops below $63 we won’t be selling our shares, which means we won’t be generating any passive income on our capital. We also don’t like rolling a contract for a covered call that is in the money to a new strike that is also in the money. We can usually get more premium value on an out of the money strike. So let’s look at a couple other options.

We could roll the covered call up to the $64 strike that expires on 4/19. That contract is trading at $1.28 right now. Since it will cost us $1.30 to close the existing covered call, the $1.28 is not enough to get us back to positive. We’d be losing $0.02 on the trade. It would be rolling up to a higher strike from $62 up to $64, but there’s no guarantee that OXY will continue to trade where it is. So we’ll look for higher premium a little further out in time.

The $64 strike that expires on 4/26 is trading for $1.47. That’s above the $1.30 we need to recoup, so we’d have a profitable trade. We’ll add the $1.47 to the -$1.30, and that gives us $0.17. It also gives us the $64 strike vs the $62 strike. If we our option gets called away at the $64 strike we’ll get another $2 per share. We’ll also get the $0.17 in premium. That’s a difference of $2.17 per share. It’s also a one month trade. One month can be a long time.

The math on this is $2.17 divided into the $62 strike, because that’s what we would get per share if we were to have our option called away today. So $2.17 divided into $62 is 0.035. It’s a one month trade, so we multiply that by 12. That gives us 42%. But we only get that 42% if the option is called away. That isn’t a guarantee. If OXY stays below $64 we’ll keep the shares. That means all we’re getting is $0.17 on those shares for an entire month. $0.17 divided into $62 is 0.0027. That 0.0027 times 12 is 0.033, or an annual return of 3.3%. We can do better than 3%.

So we have a choice. We can have our options called away today at $62 for a profit. We can buy to close the $62 covered call and sell to open the $63 covered call expiring 4/5 for a break even in premium. It’s likely that the covered call option would be called away because it’s in the money right now. But there’s no guarantee that OXY will continue to trade above $63 for the next two weeks. So that choice is a bit of a hedge. The other choice is rolling the covered call up to $64, which makes it more likely (but not guaranteed) that we’ll keep the shares. But if we do keep the shares, we aren’t generating much of a return on that capital for the next month.

Let’s also look at the price chart for OXY. We can see how OXY is pushing up against the $64.51 Fibonacci line. It’s been up against it the last four days. That line is providing some resistance for OXY. We can also see that line being a hurdle for OXY last September and October. There’s no guarantee it will hold, and OXY could shoot higher. But if that line does hold, we’ll likely keep our shares if we have the $64 strike, and possibly also at the $63 strike. And that would mean we won’t be generating any passive income in options premium.

We still like OXY, but we currently have 300 shares. This is one contract, which represents 100 of our shares. That means we’ll still have 200 shares of OXY in this portfolio if we have our option called away. We’ll also be selling the shares at $62, and our cost basis right now is $56.40. That difference of $5.40 per share is profit will reduce our cost basis further. We’d prefer to have our option called away at the $62 strike for a guaranteed profit right now. That will give us back that capital to use for another trade.

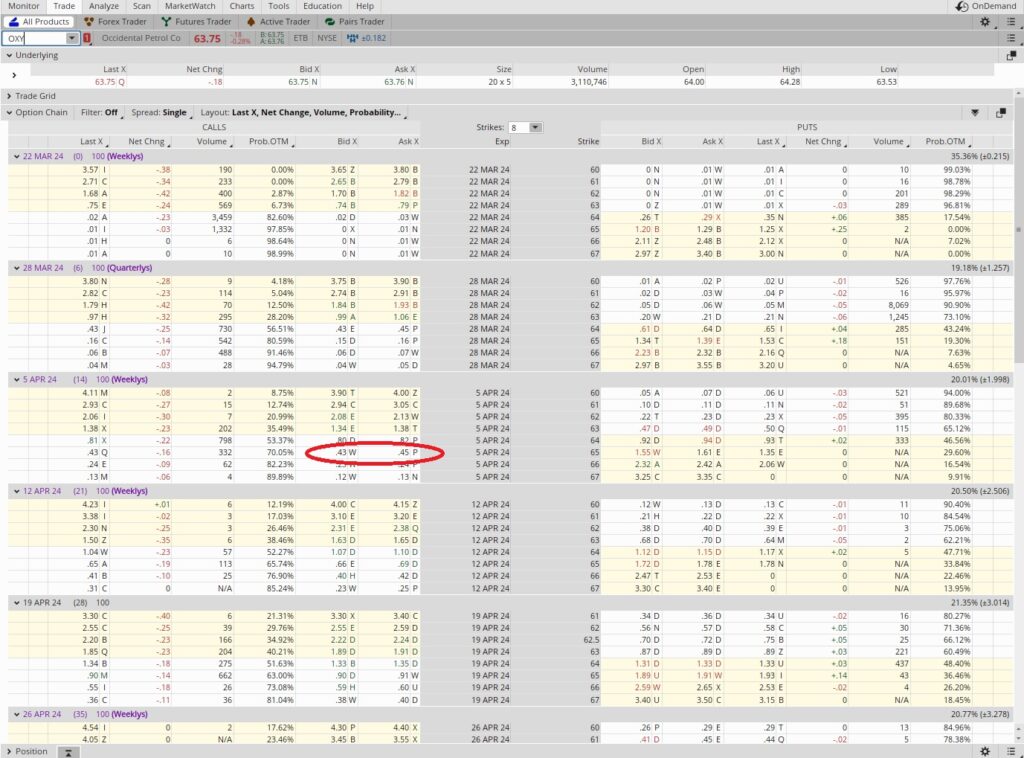

Weekly Options Trade

Since we still have 200 shares of OXY we can sell another covered call. The $65 strike is above the Fibonacci line at $64.51. It’s also above our cost basis of $56.40. So we’ll sell the covered call at $65. Next week is short week for the stock market because the market is not open on Good Friday. We want to take advantage of the extra premium over the three day weekend next week. So instead of our typical one week trade, we’re going to out two weeks this time. The $65 call strike expiring 4/5 is trading at $0.44. We’ll take that one.

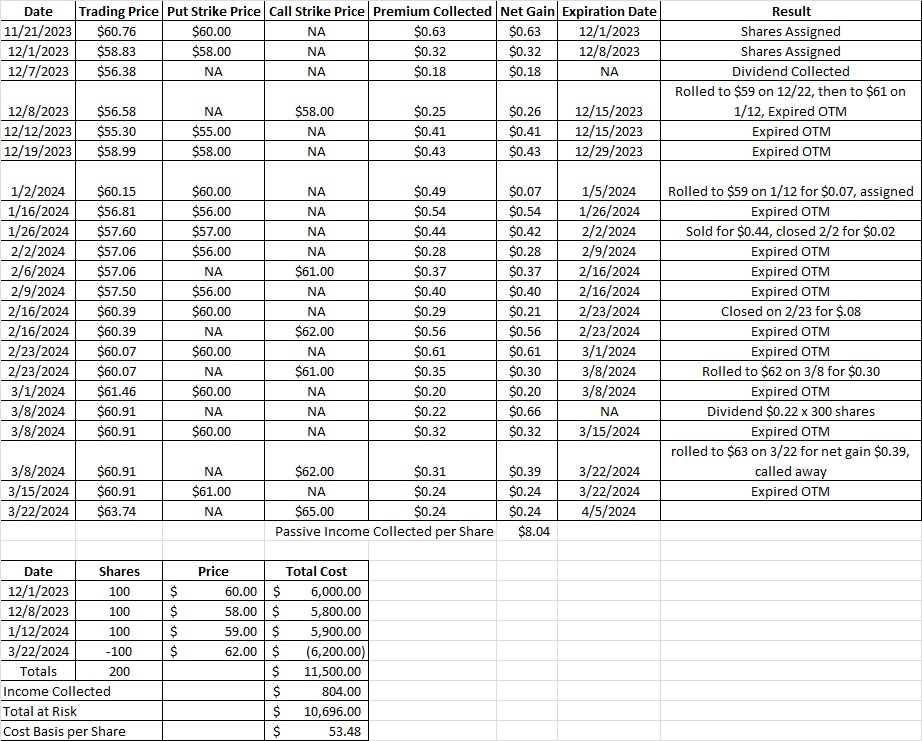

Cost Basis per Share

Since we had our option called away at $62 we reduced our cost basis per share quite a bit. We also earned another $0.44 in premium on the covered call expiring 4/5. That brings our cost basis per share down to $53.48. With OXY trading at $63.70, we’ve made $10.22 in passive income per share that we currently own. That’s a gain of 19%. We started using capital for these trades back on 11/21. Today is 3/22, so it’s been about four months. There are 3 periods of four months in a year, so we multiply that 19% by 3 and we get an annualized return of 57%. That works for us!