Put Option Contract Expired Out of the Money

Our last weekly option trade was a put on OXY, and that put option contract is expiring out of the money today. Here is a link to the post that walks through that passive income trade. Since our put expired out of the money, we now have the capital available to us again. The put was at the $56 strike, and since each options contract is for 100 shares, we now have $5,600 per expiring options contract that we can now use again.

We still like OXY, and OXY is still in the price range where we’d like to own it. We know Warren Buffett has been buying shares of OXY from the mid $50’s per share up through the low $60’s per share. Here’s a link to our post that walks through that research.

Right now OXY is trading at $57.60 per share. When we sell a put option contract on OXY, we’ll commit to buying 100 shares of OXY for each contract. If the put strike we select is $57, we’ll need $5,700 to back-up the trade. If we do five contracts, we’ll need 5 x $5,700 = $28,500. We currently have 300 shares of OXY in this portfolio, and our cost basis is $58.05 per share. We’re OK owning more shares at $57 because it will reduce our basis below $57. If we sell a put at $57 one of two things will happen:

Option 1

OXY continues to trade above $57. If that happens, our put option contract on OXY will expire out of the money next Friday, 2/2. If our put option contract expires out of the money, we’ll keep the premium we earned in passive income by selling the put, and we’ll be able to use our $5,700 for another trade.

Option 2

The trade price for OXY drops below $57 and we get assigned the shares. If that happens, our cost basis on these shares will be less than the $57 strike price because of the premium we’ll collect to enter the trade. It will also reduce our basis per share for the portfolio below our current $58.05. We’re ok getting more shares at this price in large part because Warren Buffett has been buying OXY up into the low $60’s per share. So the ‘Worst Case’ scenario is that we own shares of a company that Warren Buffett likes. Warren Buffett also owns a large stake in OXY, in fact, he currently owns over 25% of Occidental. Here is the tool we used to find that. And our strike is at a price lower than Buffett bought it. That sounds like a win to us.

Our Weekly Options Trade

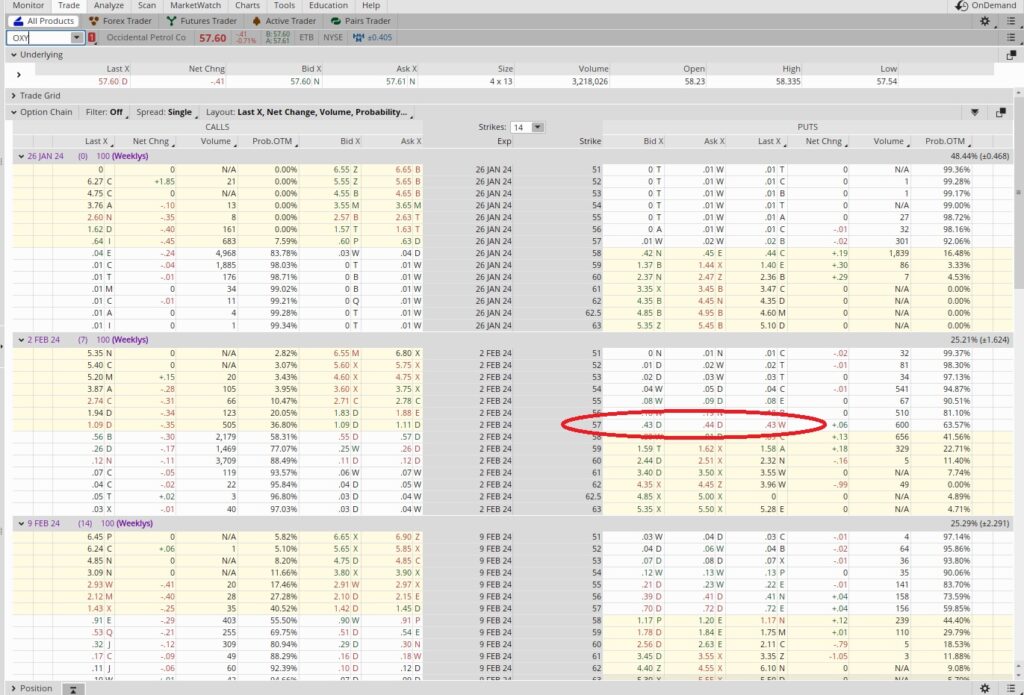

Right now OXY is trading at $57.60 per share. We’re selling the $57 put that expires next Friday, 2/2. The Bid is $0.43 and the Ask is $0.45, and we got $0.44. We divide that $0.44 into the strike price of $57, and we get 0.0077. It’s a one week trade, and there are 52 weeks in a year, so our time multiplier is 52. That works out like 0.0077 x 52 = 0.4004. That’s an annual return of 40% if we do this trade over and over again for a year. We’ll take it. Here’s a tool that helps with the math.

Our Cost Basis Per Share

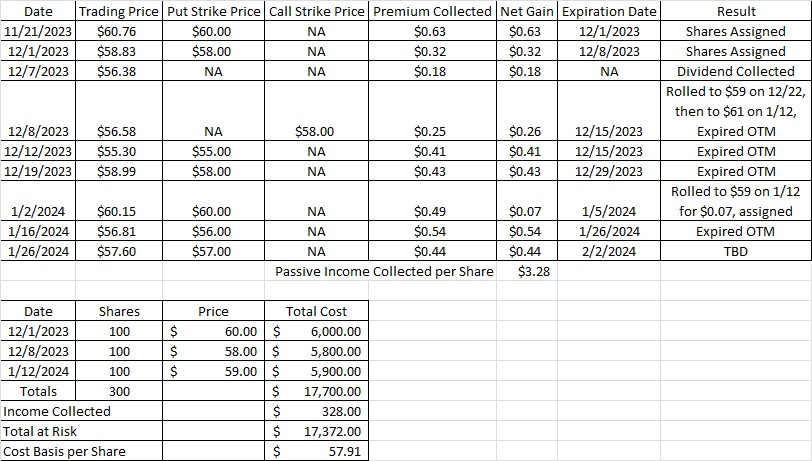

This weekly options trade gives us $0.44 in premium, so we add that to our trades on OXY. We’ve now collected $3.28 per share on OXY in options premium and dividends, which reduces our overall basis by $328. Our current basis per share is $57.91.