What to do when a Put Option Gets Assigned

When a put option gets assigned I can sell a call at the assignment price or sell another put option at a lower price to dollar cost average down. My weekly option trade for passive income last week was a put on OXY at the $60 strike. That trade expires today, 12/1. I sold the put for $0.63, and right now OXY is trading at $59.08. OXY has a dividend of $0.18 on 12/7, so I’m going to take the shares rather than roll the put option contract. Here is where I found the dividend information. So at market close today I will likely have shares of OXY in my account. Since I sold the put for $0.63 at the $60 strike, my cost basis on these shares will be $60 minus the $0.63, which is $59.37.

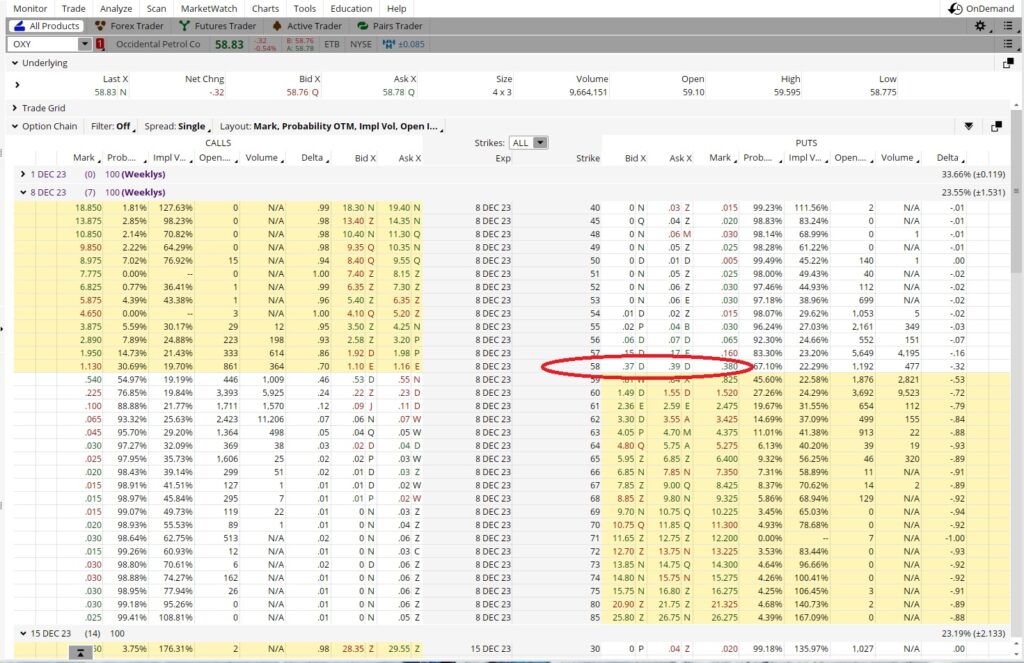

Now I have a few choices for what to do with these shares of OXY. One choice for my weekly option trade is to sell a call on the shares at the $60 assignment strike. On the chart below we can see the $60 call expiring on 12/8 is trading at $0.22. Remember that option chains typically have call option contracts on the left and put option contracts on the right.

If I sell this call I’ll need to wait for the shares to settle in my account. That will probably happen next Tuesday. The upside to selling the call option contract as soon as possible is I’m very likely to get solid premium on the call option contract because the trade price is likely to be very close to the assignment strike price. The downside is my shares could get called away prior to the dividend, which would be a bummer.

Sell Another Put Option Contract

Another choice when a put option gets assigned is to wait for the ex-dividend date so I can collect the dividend. Once my shares are eligible for the dividend, then I can sell the call at the $60 strike. Then I’ll receive the dividend of $0.18. That will bring my cost basis down from $59.37 to $59.19 per share. The upside on waiting for the dividend is I collect the dividend after owning the shares for only a week. The downside is the trade price for OXY could continue to drop. If that happens I may not be able to get decent premium when I finally sell a call option contract at the $60 strike.

I’m also going to sell another put on OXY. On the price chart below we see a support line on the Fibonnacci around $58.70 and another support line around $58.25.

The Weekly Trade

When a put option gets assigned I can sell another put option contract at a lower strike to dollar cost average down. I can sell a put at $58 for the 12/8 expiration for $0.32 as a weekly option trade. Since it’s a one week trade I could theoretically do this trade 52 times in a year. The $0.32 premium divided into the $58 strike is 0.0055, times 52 is 28.7. That works out to a return of 28.7% when we annualize it. I can work from anywhere and do weekly option trades like this. I need to be consistent with the weekly option trades if I want to retire early.

Cost Basis per Share

If the trade price of OXY drops and I get these shares, my cost basis on this tranche will be $58 minus the $0.32 premium, which is $57.68. The cost basis on the first tranche will be $59.19. That tranche averaged with the $57.68 tranche will be a total cost basis for the two tranches of $58.44.

A third choice when a put option gets assigned is to just hold on to the shares and wait while the market does its thing. If I did a good job picking the company for the put then the trade price should eventually increase. This could take some time, but can frequently be the approach that yields the highest return on investment.