Reduce Cost Basis Template

This templates helps us track our reduced cost basis of shares of companies. The goal of our weekly options trades for passive income is to reduce the cost basis of shares we own. We’re doing the trades on companies we’re happy to own over the long term, at a price we’re comfortable owning the company, for what we feel is a reasonable return on the capital we’re putting up to cover our put option contracts.

Once we’ve been assigned shares we’ll sell calls on some of those shares at the price we were assigned. Even if the shares get called away we’ll make money because of the premium we made by selling the put. We’ll also earn premium by selling the call option, and that will also reduce our cost basis per share. We may sell several weekly option trades to generate passive income before we’re assigned shares. Once we have shares, we might sell calls for weeks or even months before those shares get called away. All of those trades can make it challenging to keep track of our cost basis per share.

So we created a template to track how we reduce our cost basis per share of a company. Remember that the most important thing about using weekly option trades to generate passive income is the company we’re using, not the trades. If we pick a good company and we get it at a reasonable price, we feel comfortable that we’ll have a profitable trading strategy owning the company over the long term.

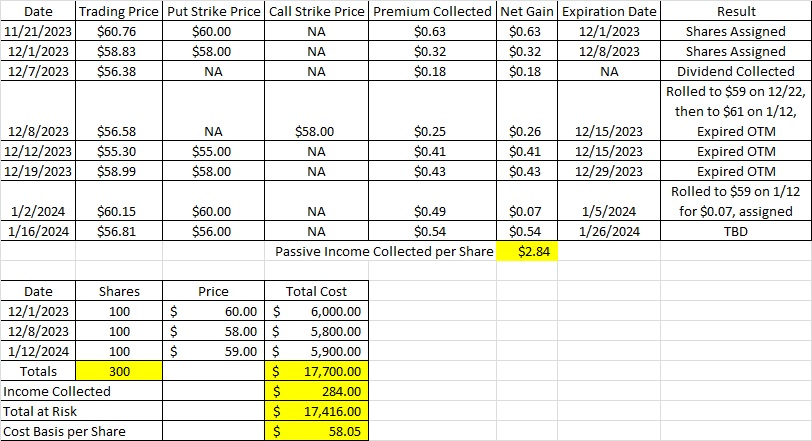

The top of our template for reducing cost basis per share breaks out each trade we’ve done on the company. We include the Date we entered the trade, Strike Price, Premium, Net Gain, Expiration Date, and a Result/ Comments field. The Net Gain is sometimes different than the Premium Collected if we close a trade early or roll it. We total our passive income under the Net Gain. That’s what we use to reduce our cost basis per share.

The bottom of our template includes the date we acquired/sold shares, the trade price, and the total cost for each trade. The last row shows the reduced cost basis per share for our shares of the company. The yellow cells have formulas and the rest of the cells we enter manually.