Roll an In The Money Call Option

Our weekly options trade for passive income is in the money right now, so we’re going to roll an ‘In The Money’ call up to a higher strike. Right now we have both a put and call option contract on OXY. The call option contract is for the $59 strike price expiring 12/22. Here is a link to the post that walks through that weekly options trade.

Today OXY is trading at 60.31. Since OXY is trading at a price higher than our $59 call strike price, our shares will be called away at expiration if we do not close this trade. We were able to generate passive income of $0.36 per share selling stock option calls on OXY at $59. We’d like to keep the shares. We’d also like to continue to generate passive income selling stock options on the shares we own. Since we made $0.36 to enter this trade, we can consider that our equity in this trade.

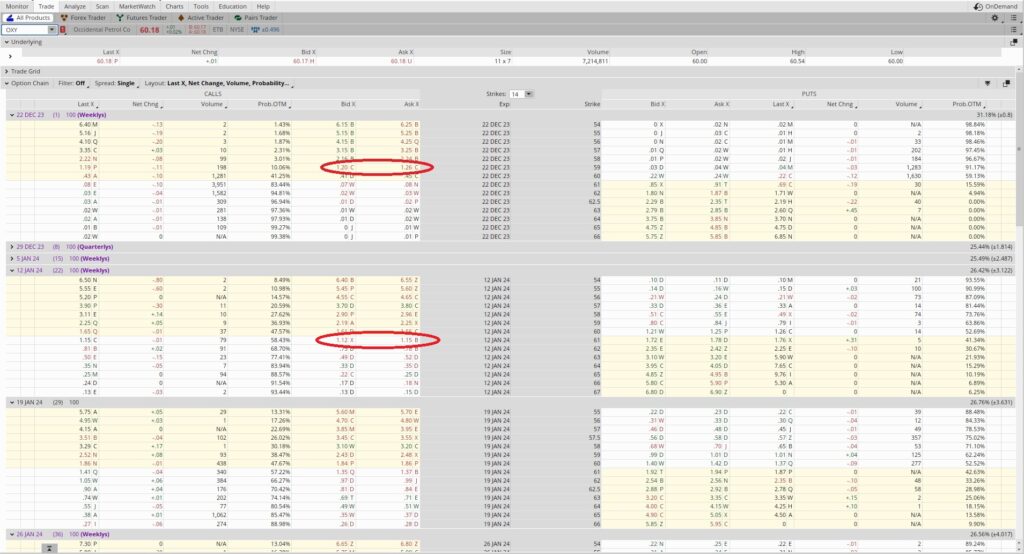

The graphic below is the option chain for OXY. We can see the $59 call option is has a Bid of $1.20 and an Ask of $1.26 for the $59 call on the 12/22 expiration date. If we buy back that call for $1.23, it won’t actually cost us $1.23 to close the trade because we made $0.36 per share entering it. So we take the $1.23 and subtract the $0.36, and that gives us $0.87 per share. So buying to close the contract gives us a loss of $0.87 per share until we open a new contract to replace the contract we closed. Since we want to use these weekly options trades to generate passive income, we find another trade that will give us at least $0.87 per share.

The Weekly Options Trade

We can see the $61 call expiring 1/12 has a Bid of $1.12 and an Ask of $1.15. We can generate $1.13 per share in passive income selling this stock option contract. If we sell this call option contract as a weekly options trade for passive income we’ll net $0.26. We take the $1.13 for entering this contract and subtract the net $0.87 we paid to close the $59 call. We’re still ahead on the trade by $0.26 overall, and we’re in a better position with the $61 call vs the $59 call. We’ll roll this ‘In The Money’ call option contract to a higher strike, and generate passive income with the premium.

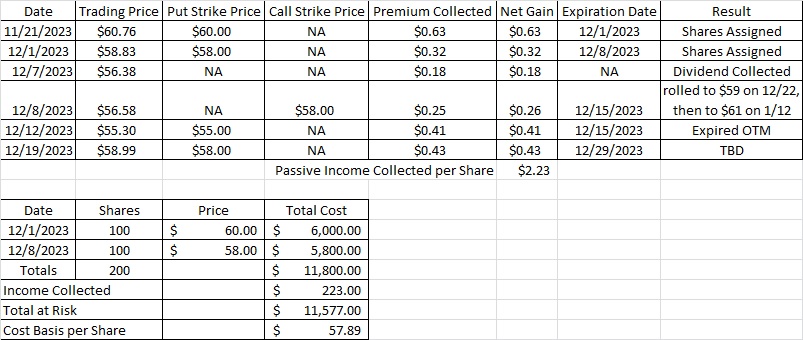

Cost Basis per Share

The table below shows our history of weekly options trades for passive income on OXY. We currently own 200 shares of OXY, and the table below shows how we’ve been able to reduce our basis to $57.89 per share by selling stock options as a passive income strategy for accredited investors. If our shares get called away at $61 we will reduce our cost basis per share to $54.77, and we will still own 100 shares. If we keep the shares our cost basis per share will be low enough that we can continue these weekly options trade for passive income at a strike just above the trading price.