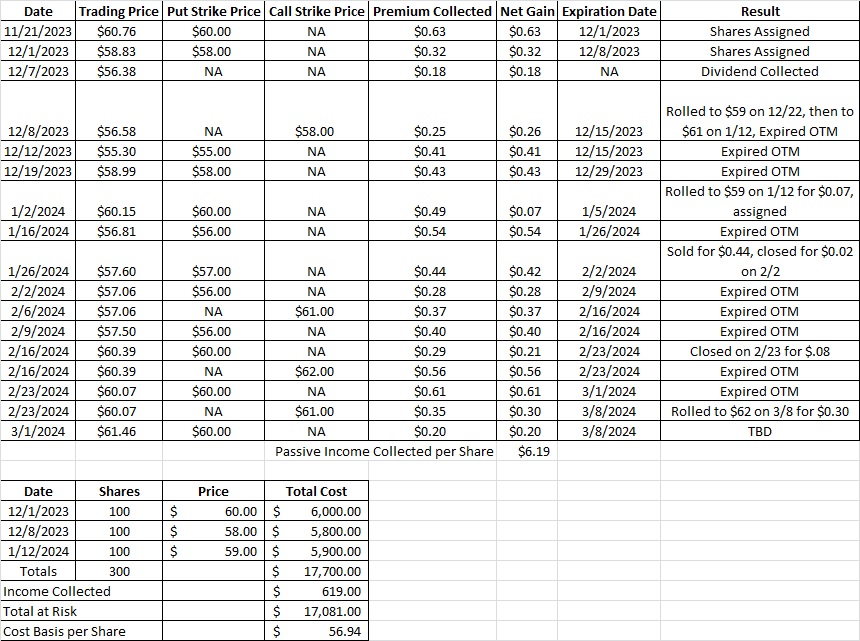

Roll One Leg of the Option Trade

We’ve been using a weekly options trade to earn passive income, and today we’ll roll one leg of the trade. Right now we have an options strangle strategy on OXY with a $60 put strike and a call at $61. Both of those trades expire today. OXY is currently trading at $61.46, so if we leave the call strike as it is we’ll sell our shares at $61. But we think we can sell our shares for more than $61, so we’re going to roll the call side of our options strangle.

We sold the put and call on this strangle option strategy trade last Friday, 2/23. We did a one week long trade on both legs of the options trade. The shorter length trades for this strategy are nice because we generally get more premium on a daily basis for shorter length trades than longer ones.

Last Friday we sold one contract of the $61 call on OXY for $0.35 in premium. Our cost basis on OXY is $56.99, so if sell the shares at $61 today we’ll make money. That’s a plus. If we buy back the $61 call we might be able to make more money, which would be an even bigger plus. So let’s walk through the trade.

Weekly Options Trade

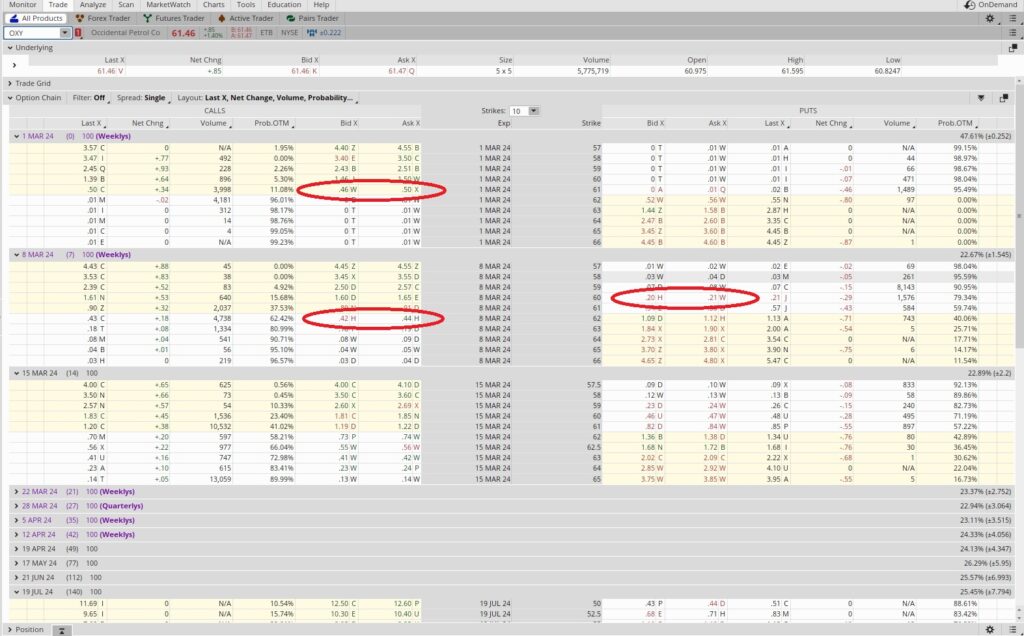

Right now OXY is trading at $61.46, so our $60 put will expire out of the money and our $61 call is in the money. We sold the $60 put for $0.61, and that leg of the trade will expire today worthless. So we keep that $0.61. We’d also like to keep our shares so we can collect the $0.22 dividend on OXY next week. If we don’t do close the call right now we’ll end up selling 100 shares for $61 at market close.

We can buy back the $61 call for $0.48. We sold the call last Friday for $0.35, so we’ll be stuck $0.13 on that leg of the trade. Then we’ll sell the $62 call that expires next Friday, 3/8 for $0.43. That would net out to a gain of $0.30. To get that, we take the $0.35 in premium we sold last Friday, subtract the $0.48 to buy back the call option contract, then add the $0.43 for selling a new call option contract. We’ll also get the $0.22 dividend on top of that. Here’s the tool we use to find that information.

We’re also going to sell another put option contract for passive income at a strike that is below the money. Since our cost basis on OXY right now is $56.99 per share, we can take more shares at $60 or $61. When we average the per share price of each tranche we’ll still have an average cost basis per share of under $60.

The $60 put expiring March 8th has a Bid of $0.20 and an Ask of $0.21. We sold the $60 put for $0.20. To figure out our annual return on that capital we divide the premium we receive of $0.20 into the strike price of $60. That comes out to 0.00333. This is a one week trade, and there are 52 periods of one week in a year, so we multiply that 0.00333 by 52. That gives us 0.173, or an annual return of 17.3%. Here’s a tool that can help with the math.

Cost Basis per Share

After rolling one leg of the trade up to $62 and opening another put option contract, we were able to reduce our cost basis per share of OXY down to $56.94. And OXY goes ex-dividend on 3/7. Any shares we own of OXY until then will get us a dividend of $0.22 per share. So next week we’ll be able to reduce our basis even further.