Routine Options Trade

We like doing a routine options trade each week. Part of that means finding a great company that is trading at an on sale price. Finding a great company that is trading near a price at which we’d like to own it is the most time consuming and challenging part of what we do. Today we’re going to share a shortcut to options profits with you…. If the greatest investor of all time owns over 25% of a company and is buying more shares, is it a good idea to dig into it? We think so!

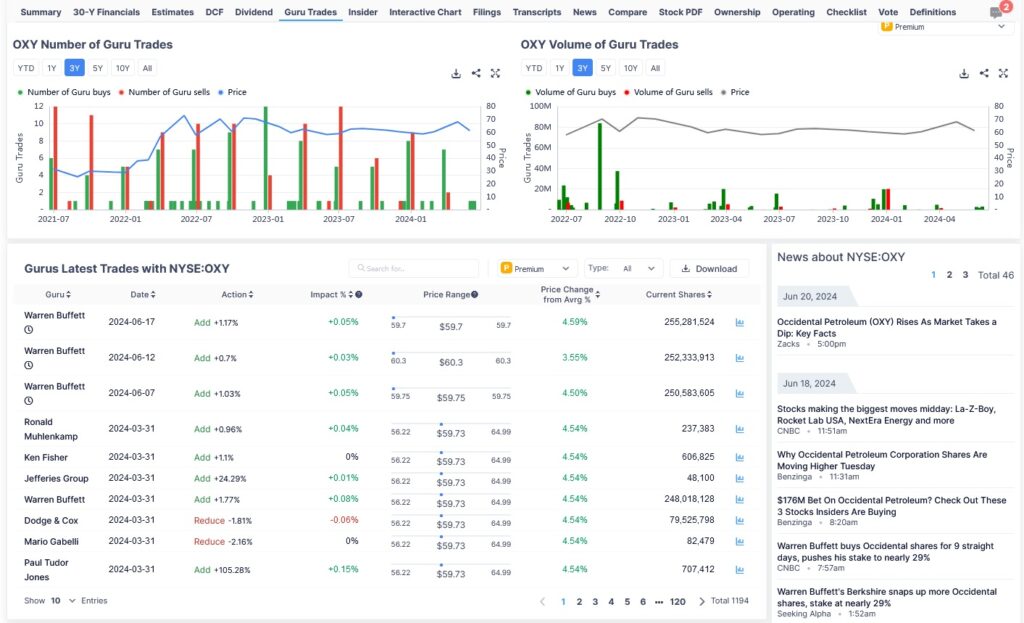

Here we can see Warren Buffett’s Berkshire Hathaway owns over 255 million shares of Occidental Petro. This week Warren bought more shares, and he now owns nearly 29% of OXY. He’s been buying shares recently from the mid $50’s per share up through the low $60’s per share. Here’s a link to the site we use to do that research.

Since Warren keeps adding shares of OXY at the current price and he’s sitting on a huge pile of over $100 billion of cash, we feel it’s pretty safe bet that he’ll continue to accumulate more shares if the trading price drops from here. That means there’s likely a price floor on OXY, which makes it a good choice for a routine options trade. Let’s look at the price chart to see where that floor is.

This is a one year chart with daily candles. We put arrows at the recent price floor of $55 and also at the points where Warren Buffett bought more shares. If we don’t want to get assigned shares we should be careful to stay below the price at one of these arrows. If we’re ok owning shares of OXY, (we are), we can be more aggressive with our cash secured put strikes.

The Weekly Trade

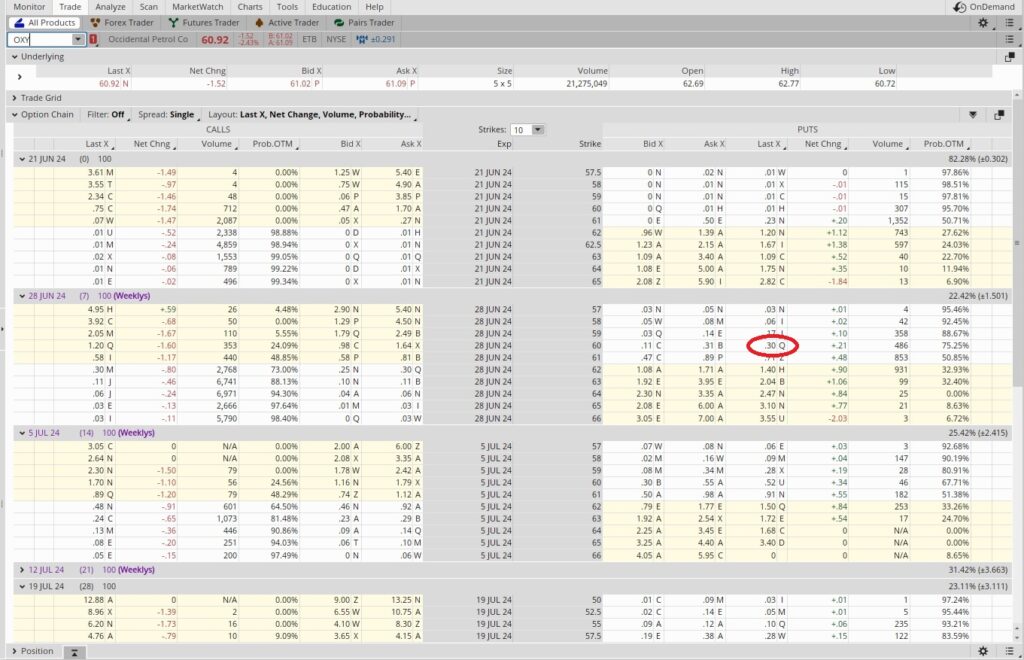

Here we can see the $60 put strike with the 6/28 expiration date and our contract filled at $0.30. For each put option contract we need to have enough money in our brokerage account to cover 100 shares times the strike price. So in this case that’s $6,000 for each contract. We’ll receive $30 in passive income for selling the cash secured put option.

It’s a one week trade. Since there are 52 weeks in a year we could do this routine options trade 52 times annually. We take the $30 in premium and divide that into the $6,000 we need to cover the trade, and that’s 0.005. Then we multiply that by 52 and we get 0.26. That works out to an annualized return of 26%. And that’s just for selling the put. The worst that can happen here is the trading price for OXY drops and we end up buying the shares at $60. Since Warren is ok buying shares at that price, we are too!

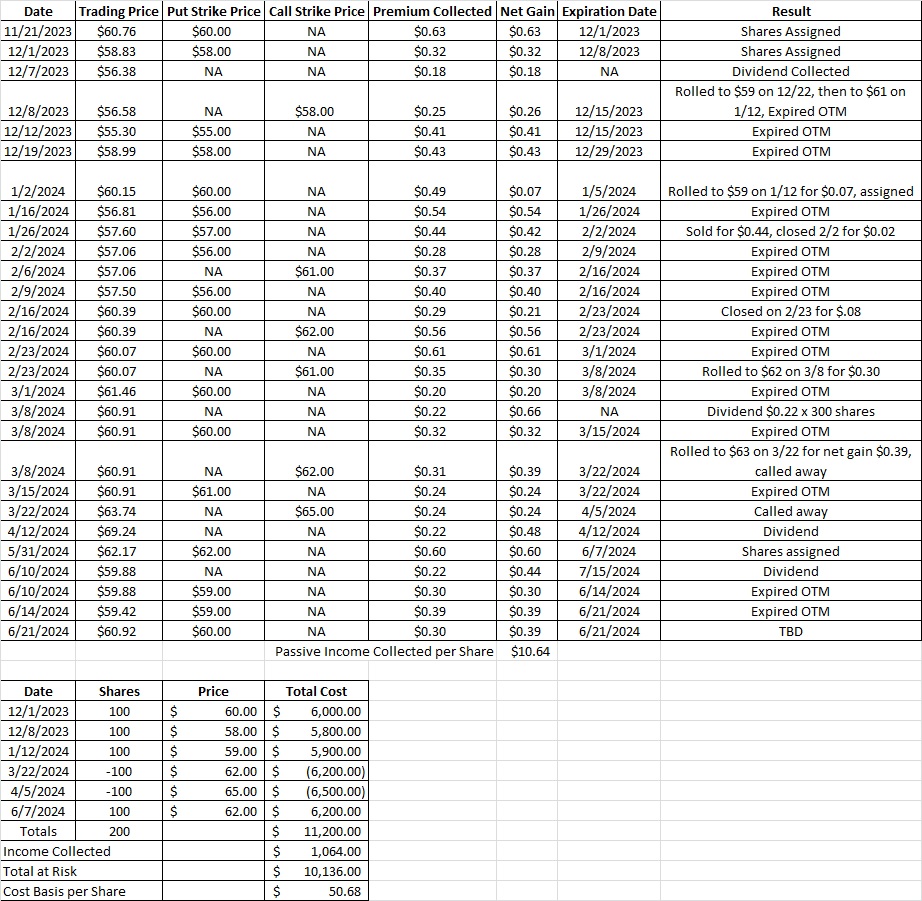

To recap, we currently have 200 shares of OXY. Our $59 put strike will expire out of the money today, 6/21. Our routine options trade this week was selling a put at the $60 strike that expires next Friday, 6/28. This brings our cost basis on OXY is now $50.68 per share.

Cost basis table