Selling a Strangle for Passive Income

Today we’re selling a strangle option to generate passive income. We opened a position in HHH earlier this month, here’s the post that walks through the why and how.

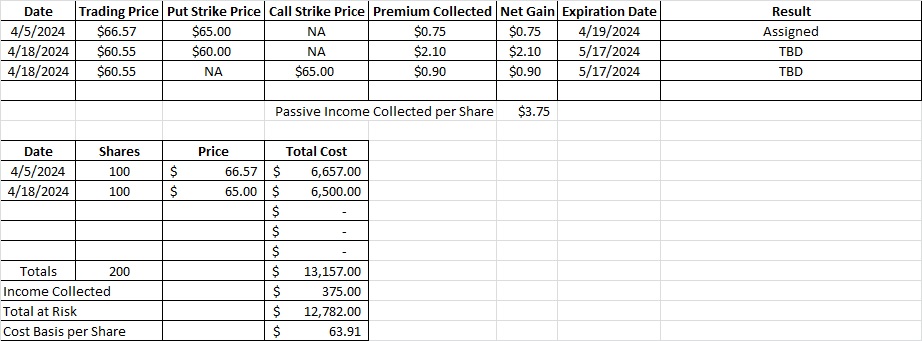

We sold the $65 put option contract back on 4/5 with tomorrow’s expiration date, 4/19. HHH has been trading in the low $60’s the last few days, and today we were assigned the shares at the $65 strike price. Now we own 200 shares of HHH.

We still like HHH as a company, and we feel that the trading price for HHH is dropping because of the talk surrounding interest rates. HHH invests in real estate and has significant exposure to interest rates. Until recently many thought that the FOMC would start cutting interest rates at their June meeting. Now that is looking less likely. The chances that there are two or fewer no interest rate cuts this year continue to increase. In general, higher interest rates do not favor real estate, so it makes sense that the share price of HHH has been dropping recently. Here is the schedule of upcoming FOMC meeting dates.

We now have 200 shares of HHH in this portfolio, so we can sell a call option contract and if the option is called away we’ll still have some shares. Our assignment price was $65. Remember that we earned $0.75 per share in option premium when we sold to open that put option contract. So even though we bought the shares at $65, we subtract the $0.75 in option premium from that. That gives us a cost basis of $64.25 on those shares. Then when we sell the $65 call, the options premium for the call option contract will reduce our basis below our current $64.25. So we’re using the options premium to generate passive income even when we’re buying and selling the shares at the same price. That’s how this passive income strategy for accredited investors creates profit.

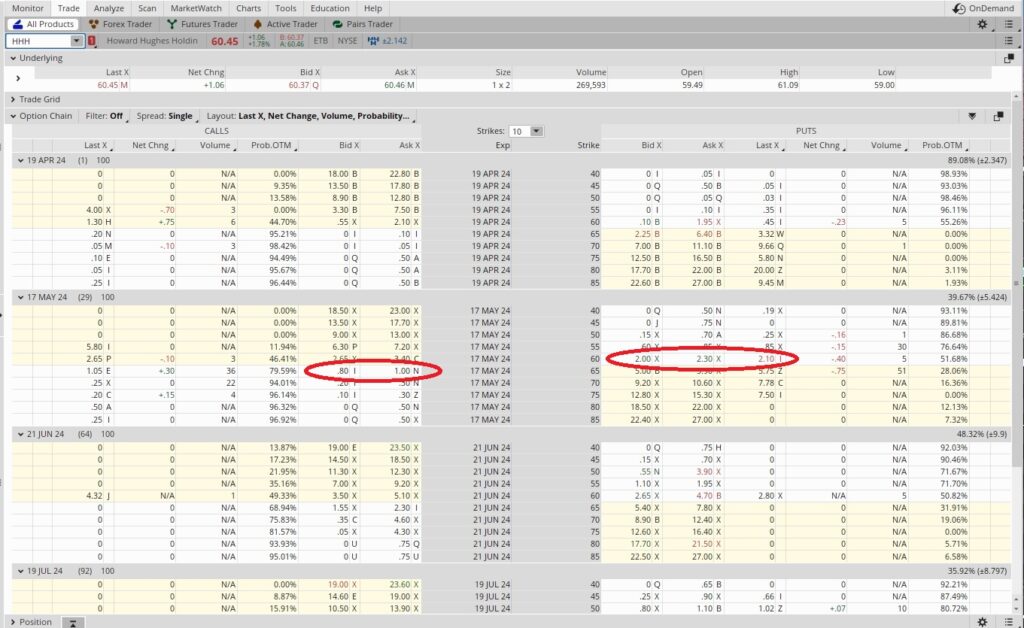

The Weekly Options Trade

The option chain below shows the 5/17 $65 call option with a Bid of $0.80 and an Ask of $1.00. We sold to open the $65 call option contract for $0.90. If the trading price of HHH is above $65 at expiration on 5/17 our shares will be called away at $65. We’d be ok with that because we made the $0.75 when we sold the put plus the $0.90 when we sold the call. That means we would have $1.65 in profit ($0.75 from selling the put plus the $0.90 from selling the call). If the trading price for HHH stays below $65 from now through the 5/17 expiration date we’ll keep the shares.

When we sell a strangle for passive income we both a put and call with the same expiration date, but at different strike prices. Our call is at $65 and we sold to open the $60 put strike for $2.10. Both strikes are for the 5/17 expiration date. The put option is a one month trade, and we’re putting up $60 (time 100 shares) when we sell to open the put option contract. We’re getting $2.10 in option premium, so we divide the $2.10 into the $60 strike. That gives us 0.035. this is a one month trade and there are twelve months in one year, so our time multiplier is twelve. So we multiply 12 x 0.035 and we get 0.42, or an annualized return of 42%. Here’s a tool that can help with the math.

Cost Basis per Share

So far we’ve purchased 100 shares of HHH outright at $66.57. We sold the $65 put, collected $0.75 in premium, and were assigned shares at $65. Then we sold the $65 call on those shares. Then we sold to open the $60 put to collect more premium. We now own 200 shares and our cost basis is $63.91 per share.