Sell Put Options Through Earnings

We’ve been selling options for weekly passive income, and now we’re selling a put option through earnings. Earnings announcements can introduce more volatility to the trading price of a company. That results in the options premium through the earnings date being much higher normal.

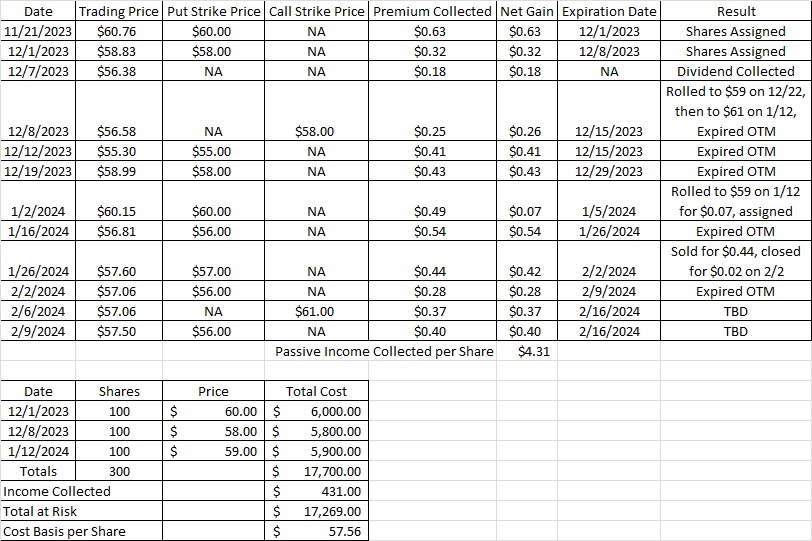

We’ve recently been selling put option on OXY as our weekly options trade for passive income. We currently own 300 shares of OXY in this portfolio, we have a put at the $56 strike that will expire out of the money today. That means we’ll pocket the premium we made in passive income by selling the put option, but we will not buy the shares for that contract. So that frees up our $5,600 for the contract and we can now sell another put.

When selecting a company to help us generate passive income with weekly options trades, remember that the company is more important than the trade. The last thing we want to do is pick a company that is likely to reduce in trade price. When we sell a put there is a chance we could buy the shares at the strike price we pick. If that happens, we want to be sure it’s a company we’re happy to own at that price. We’re happy owning shares of OXY in the mid $50’s because Warren Buffett owns so much of the company. He just bought over 4 million more shares this week at $57.15 per share. He bought more in December at $60.22 and $56.16. Here is the tool we use to do that research.

So if we sell a put at $57, we’ll pay less than Buffett for this tranche. And if we sell the put option through earnings this week we’ll get more premium than normal because of the earnings call. We’re happy to own shares of a company that Buffett owns for a price less than what he paid. There are 877 million shares of OXY outstanding, and Buffett now owns over 248 million of them, or about 28% of the total company. Because Buffett owns so much of the company it’s safe to say he has a vested interest in the company doing well.

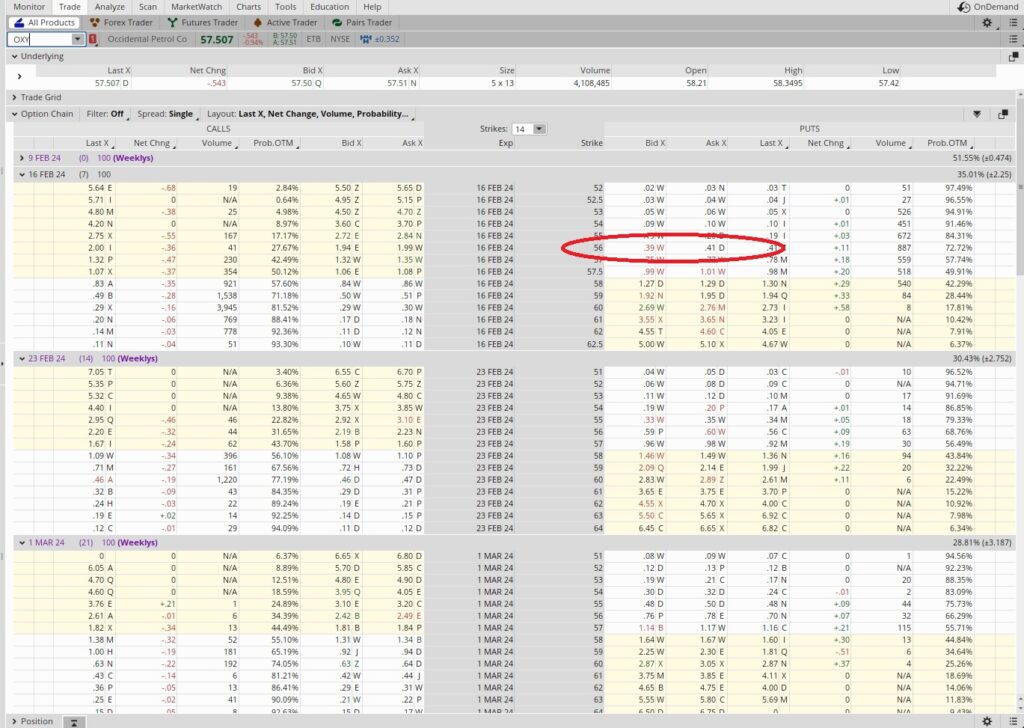

Weekly Options Trade

On the option chain for OXY below the $56 strike for the put option expiring next Friday, 2/16 is $0.40. This is a one week trade, and there are 52 weeks in a year, so our time multiplier is 52. We need $56 per share to sell this put, and one contract is for 100 shares. So we’re putting up $5,600 to sell this put option through earnings. We take the $0.40 in premium and divide that into the $56 strike, and that gives us 0.00714. We’ll multiply that by our time multiplier of 52, and we get 0.3713, or annual return of 37%. We’re happy to generate a 37% annualized return by promising to buy what Buffett bought for a price less than what he paid. Here’s a tool that helps calculate the annualized return.

Reduced Cost Basis per Share

By selling this put option through earnings we were able to reduce our cost basis per share. So far our weekly options trades for passive income have reduced our cost basis down to $57.56 per share of OXY.