Selling Options for Weekly Income

We’ve been selling options for weekly income on OXY recently. Here’s a link to a post that walks through our last put option for passive income on OXY.

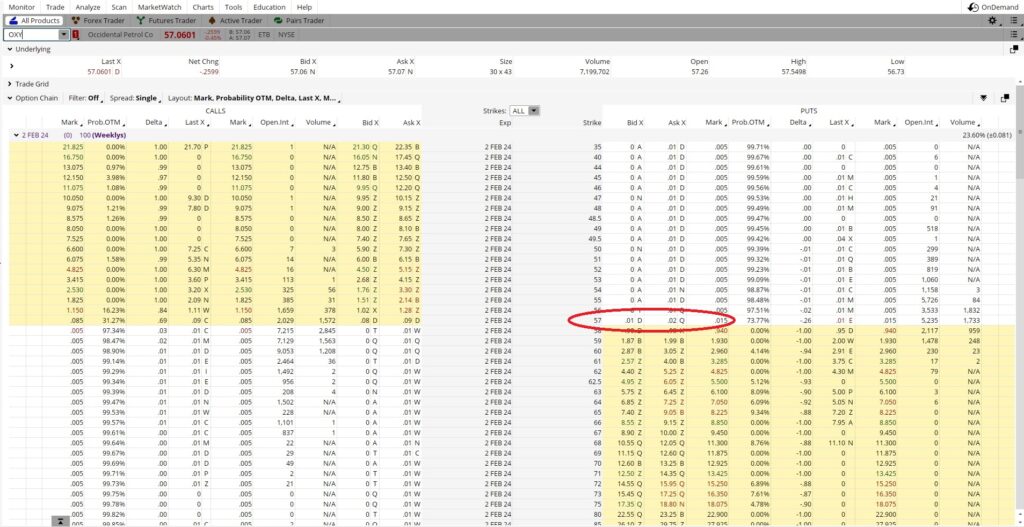

We have a put option contract at the $57 strike that expires today, 2/2. OXY is trading just above $57 per share right now and has been for the last few hours. We’re not certain if our put will expire out of the money or if we will be assigned shares. So we have a choice. We can wait until the market closes today, and if OXY is below $57 per share at the close we will get another 100 shares of OXY for each put option contract we sold at the $57 strike. Or we can close those put option contracts early at a profit, then sell them again for next week’s expiration.

Since we already have a few hundred shares of OXY, we’ll close our existing option trades early for a profit. That way we guarantee our trade from last week is a profitable trade. Then we’ll open a new trade for more passive income.

We sold the $57 put option contract last week for $0.44. That trade expires today, 2/2, and the $57 strike is currently trading at $0.02. So we sold the put for $0.44, and now we can buy back that same put for $0.02 to close the trade. That nets us $0.42 (excluding the nominal contract fee from our broker).

The Weekly Option Trade

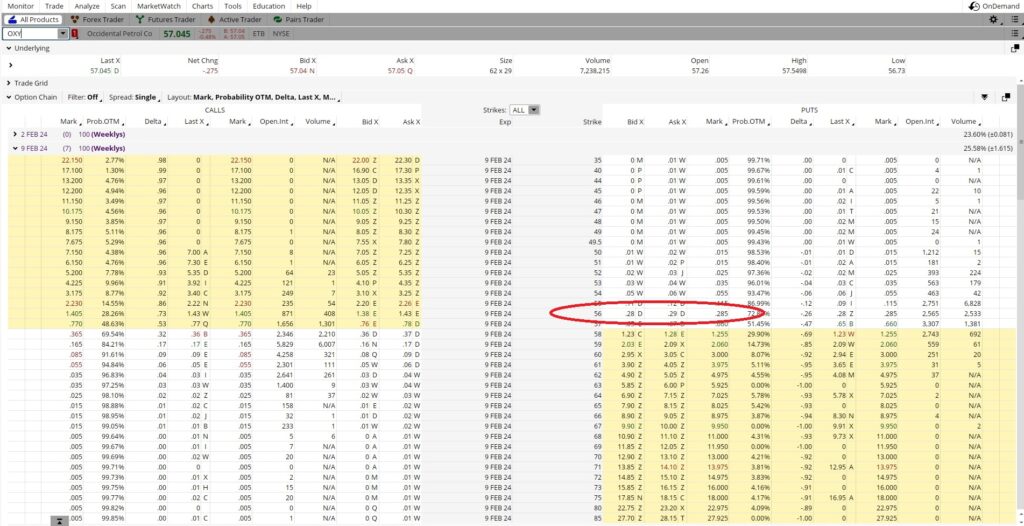

Since we closed the weekly option contract expiring today, we now have access to that capital to open a new trade. OXY is currently trading at $57.05. The $56 put option contract expiring one week from today, 2/9, is trading at $0.28. This is a one week trade, which means could theoretically do this trade 52 times in a year. So we’ll use 52 as our time multiplier.

We also need to figure in the capital that we’re risking on the trade. In this case, it’s the $56 strike price on the put. Each put option contract is for 100 shares. So when we sell the $56 put option, we need to have 100 times the $56 strike in our brokerage account to cover the trade. And we need to have that for each contract we sell. The premium is $0.28 per share, so for risking $5,600 on the weekly option contract, we’ll earn $28 in passive income.

You might be thinking $28 in passive income when risking $5,600 isn’t a very good deal. Let’s do the math and find out. $0.28 in premium divided by the $56 strike is 0.005. That, multiplied by our time multiplier of 52 is 0.26, or a return of 26% when we annualize it. Here’s a tool that can help with the math.

Using the Rule of 72, a 26% annual return will double our stake in three years. If we can consistently hit that 26% annual return (or better) for our trades throughout the year, we’ll double our portfolio in just three years. Sounds good to us!

Reduced Cost Basis per Share

And if the trade goes against us and we end up owning shares of OXY, at least we’ll own them at a price lower than what Warren Buffett has been paying for them. We’re ok with that.

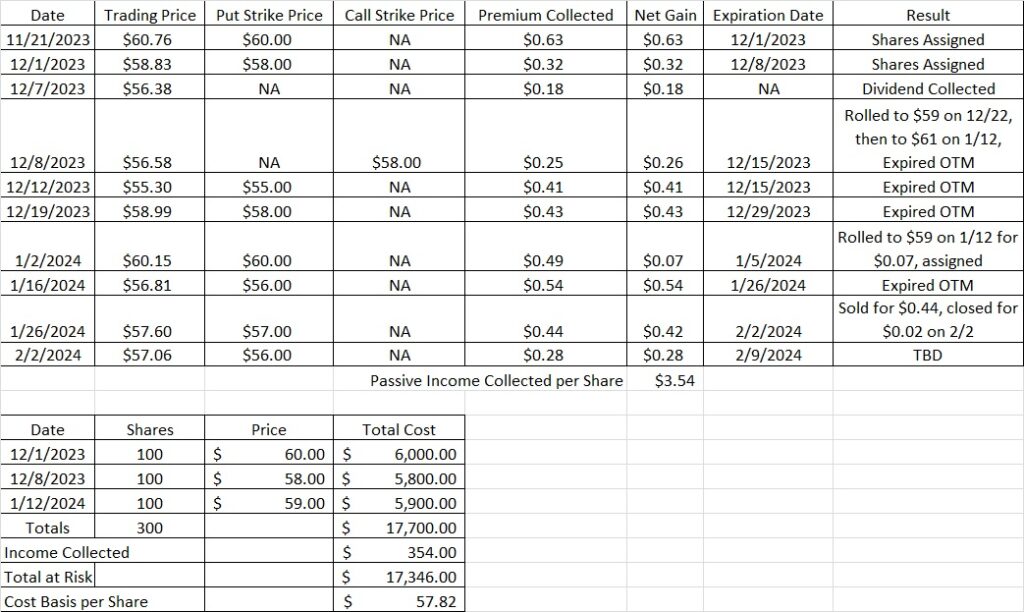

By selling options for weekly income, we’ve been able to reduce our basis per share on OXY to $57.82. Here’s our trade history.