Selling Puts on a Market Down Day

Today we’re selling puts on a market down day. The S&P 500 is down about a half percent today and the Russell 2000 is down over 1.2%. When the market is dropping like this selling a put option contract will give more premium than it normally would for a strike that is just out of the money. Some people buying puts do so as an insurance policy against a market drop. When the market is dropping we can frequently get more premium selling a put than we would by selling that same put, the same distance from the money, on a day when the major market indices are even or up.

We’ve been selling puts on OXY for our weekly trades to generate passive income. Since our passive income strategy for accredited investors includes selling calls, we’ve also been selling calls on some of the shares of OXY that we have. Here is a post that discusses why we like OXY for our weekly trades right now.

We know Warren Buffett has been buying shares of OXY from the mid $50’s up through the low $60’s per share. So it’s likely that he will buy more shares if it drops much from here, which should give the shares a price floor. We can see that over the last year there’s a price floor around $55.80.

Weekly Trade

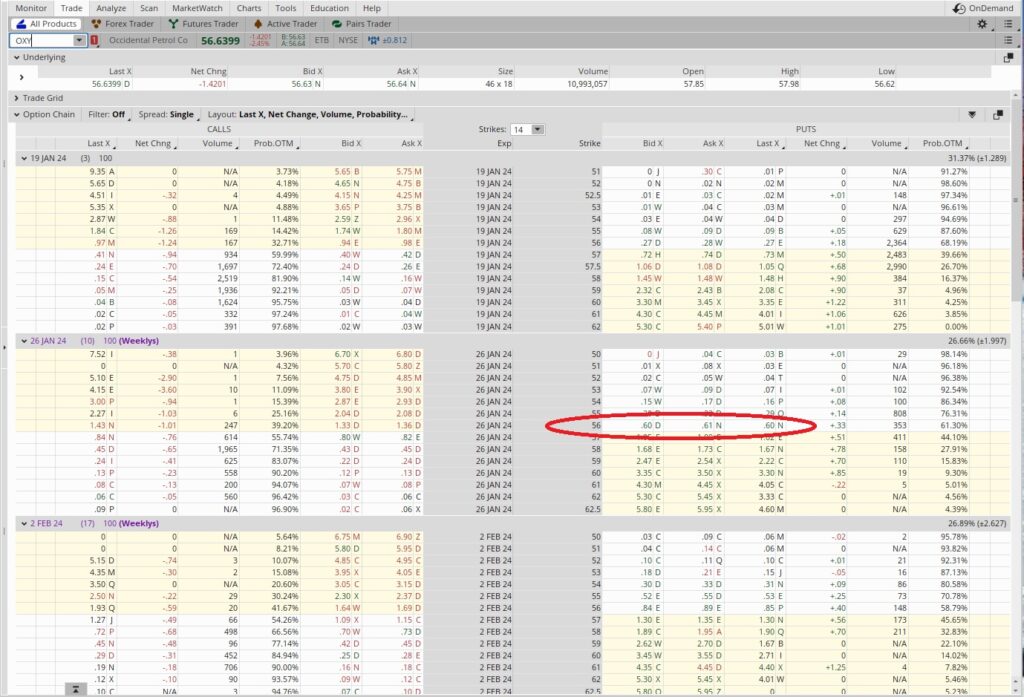

We’re looking at the $56 put expiring next Friday, 1/26. Today is Tuesday, 1/16, so that’s a ten day trade. Ten days goes into the 365 days in a year 36.5 times, so that’s our time multiplier. We can see the $56 put has a Bid of $0.54 and an Ask of $0.55. So we should be able to get $0.54 selling this put on a market down day. $0.54 divided into the $56 we need to set aside for the shares is 0.0096, and that, times our time multiplier of 36.5, is 0.352. This trade works out to a return of 35.2% when we annualize it.

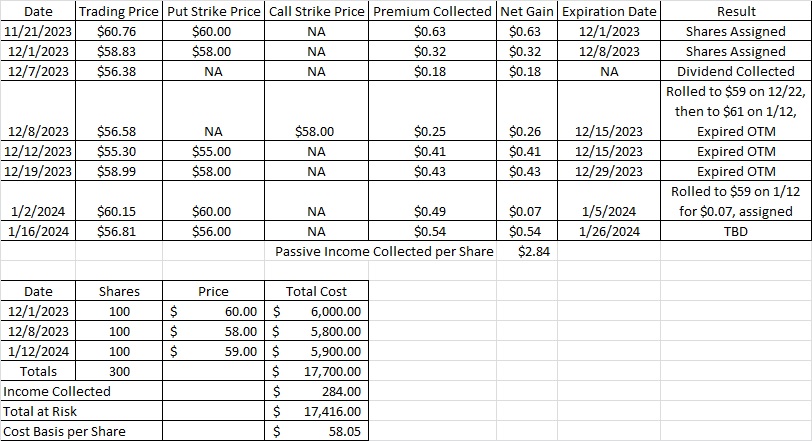

Cost Basis per Share

We add this trade to our cost basis calculator and we can see that the $0.54 from this trade means we’ve collected a total of $2.84 per share in passive income on OXY so far. That trade brings our cost basis to $58.05 per share.