Simple Options Trade

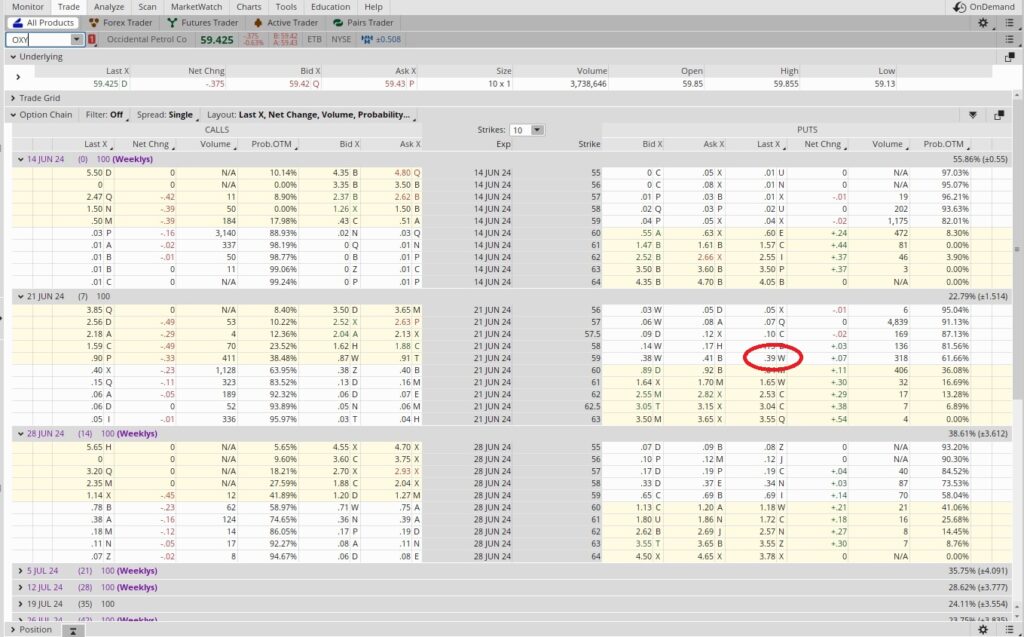

Earlier this week we did a simple options trade which was a cash secured put. Here’s a link to that post. We sold the put at the $59 strike on OXY with today’s expiration date. OXY is trading above $59 today and looks as though it will stay above $59 through the end of trading today. With OXY trading above our $59 strike the put option will expire worthless, we’ll keep the premium, and we’ll have access to that capital again.

With OXY trading at $59.42 we can do another simple options trade to generate some passive income. We still like OXY in this price range so we’re going to sell another $59 put option contract. This is another one week option contract, time we’ll use the 6/21 expiration date. This will replace the $59 put option contract that will expire out of the money today.

The Weekly Options Trade

We sold the $59 put option contract with the 6/21 expiration date for $0.39. When we do this simple options trade we need to have enough cash in our brokerage account to cover 100 shares of the strike price. In this case, that’s $5,900 for each contract. We got $0.39 in premium per share, which equates to $39 for this one week long trade. To determine the annualized return for this trade we divide the premium we get for selling to open the put option contract and divide that into the strike price. So we take the $0.39 and divide that into the $59 strike and we get 0.0066. Then we multiply that time 52, because this is a one week trade and we could do this trade 52 times in a year. That gives us 0.344, which is an annualized return of 34.4%. Here are some tools that help doing this math.

Cost Basis per Share

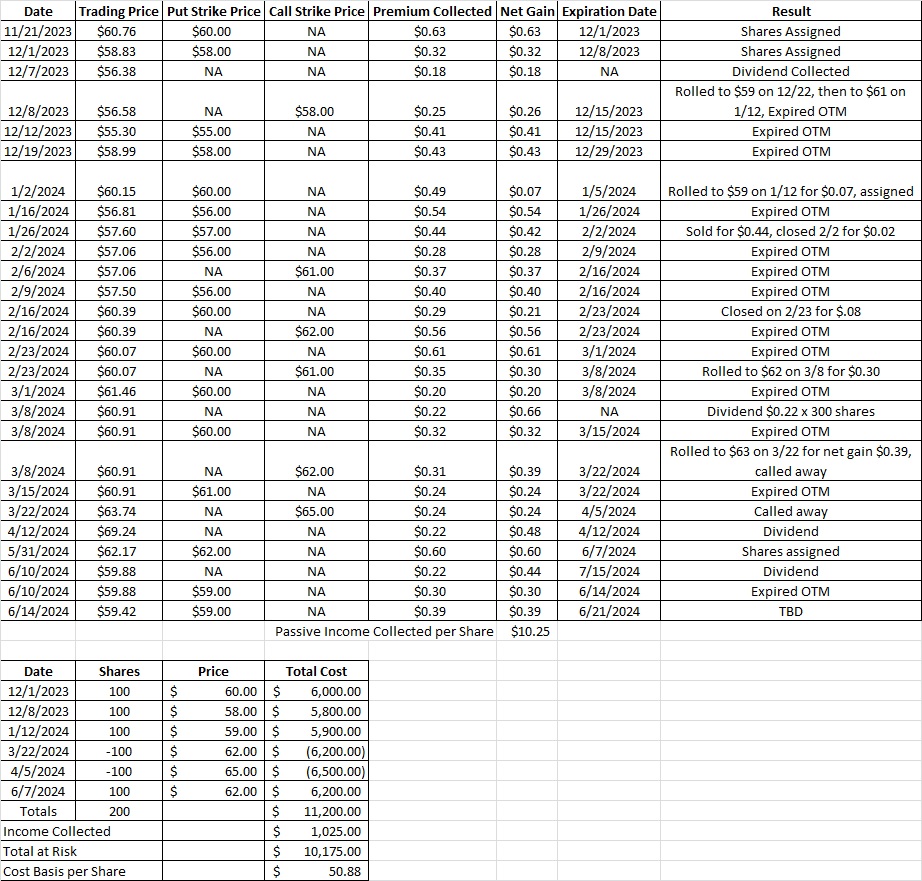

If the trading price of OXY drops below $59 at expiration we will buy the shares at $59. If it stays above $59 through the expiration date this cash secured put option contract will expire worthless. Either way we’ll keep the $0.39 in premium. If we do end up with the shares, our cost basis per share for this 100 shares will be the $59 strike price minus the $0.39 in premium, which works out to $58.61. If we don’t get the shares, our cost basis will be $50.88.