Trade for Today

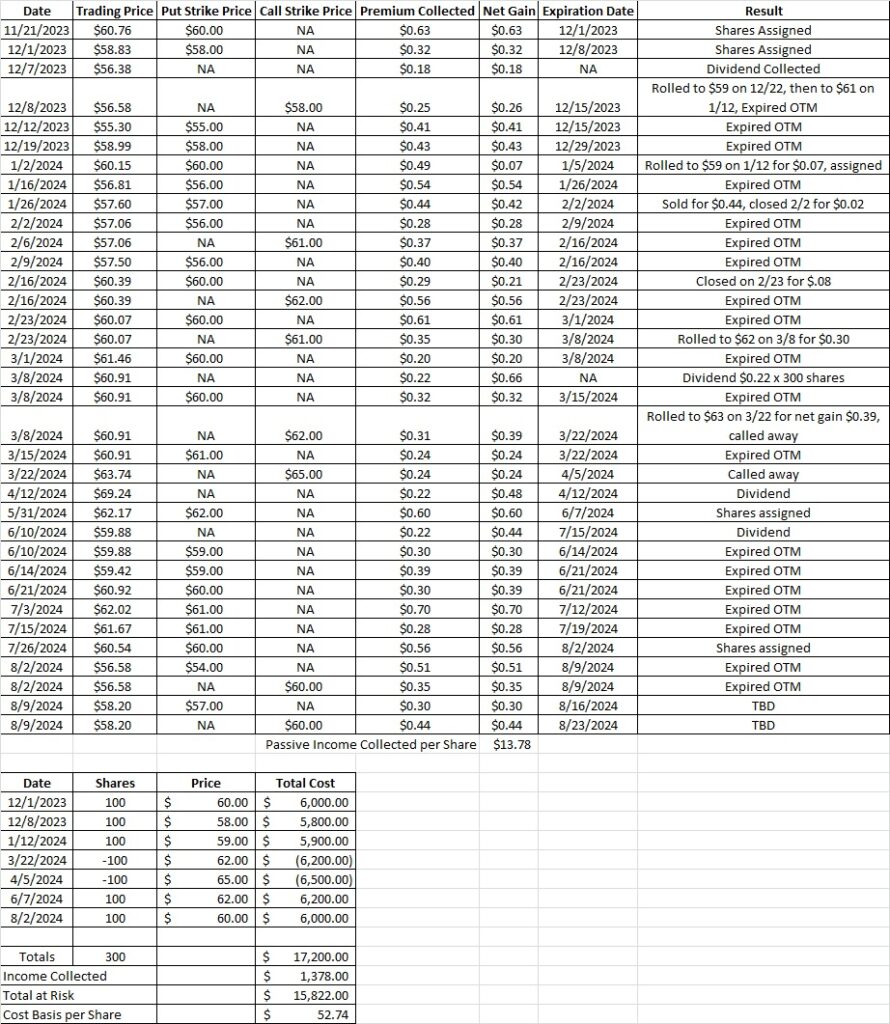

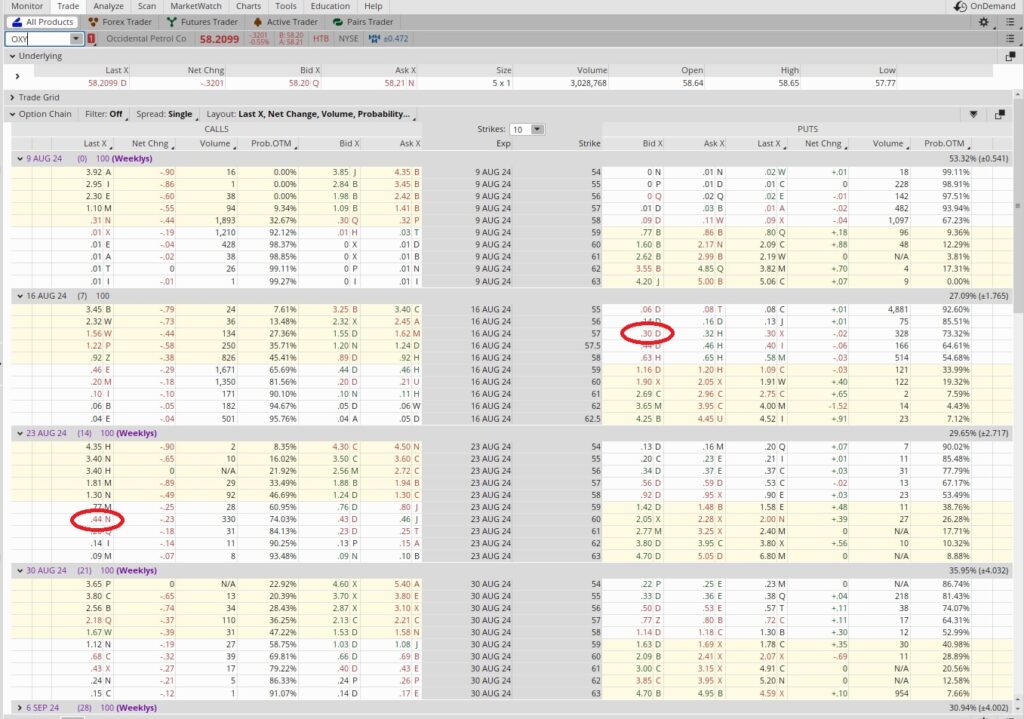

Our trade for today is similar to our last trade. Last week we sold a strangle option on OXY with a $54 put and a $60 call expiring today, 8/9. OXY is trading at $58.20 right now so both legs of this trade will expire out of the money worthless. Right now we have 300 shares of OXY in this portfolio. For this portfolio one tranche is about $6,000, and we have three tranches of OXY. We have room for a total of five tranches in this portfolio. So we’re going to sell another put and also a call to generate some passive income.

Weekly Trade

We can see on the call side that we can sell the $60 covered call expiring 8/16 for $0.20. We could also sell the $60 call with the 8/23 expiration date for $0.44. OXY just had their earnings call this week so we don’t need to worry about selling a call through earnings. By picking the 8/23 expiration date we’ll generate $0.22 in passive income per week vs $0.20 per week using the 8/16 expiration. So we’re going with the 8/23 expiration date.

On the put side we’re going with the $57 strike with the 8/16 expiration date. We’re able to get $0.30 in premium selling the $57 put. So we take $0.30 and divide that into $57 and we get 0.0053. This is a one week long trade so we could do this (or a similar trade) 52 times over the course of a year. So we multiply the 0.0053 by 52 and we get 0.274, or an annualized return of 27.4% on our capital. We’re happy with that return if we don’t get assigned the shares. If we do get assigned the shares at $57 we’re also happy because Warren Buffett recently bought a few million shares of OXY for $59.75 per share. So we’d be buying this tranche at a price that’s lower than what Buffett paid. Here’s the post where we walk through that research.

Trade for Today Recap

We currently have 300 shares of OXY with a cost basis of $52.99 per share. Our trade for today was to sell a put at the $57 strike with the 8/16 expiration date. We also sold a call at the $60 strike with the 8/23 expiration date. If the trading price for OXY stays above $57 and below $60 our cost basis per share will be $52.74.