Weekly Options Trade for Passive Income

Our weekly options trade is a passive income strategy for accredited investors. We recently sold a put on OXY at $60. We were assigned the shares last Friday so we are eligible for the dividend this week. Our weekly options trade last week was to sell another put on OXY, this time at the $58 strike. That trade expires today, 12/8. OXY is trading at $56.52 right now, so we should get the shares for that contract at market close today.

Since we want to generate passive income selling stock options we can either take the shares at $58 or roll the trade down. If we roll the put option contract we will buy back the $58 put that expires today and sell another put at a lower strike that is further out in time.

Here is the one year price chart with daily candles for OXY. We can see a support line around $55.83.

This is the three year price chart with daily candles for OXY. On this chart we can see another support level around $54.30. OXY hasn’t traded below $54 per share since May of ’22. It looks like the price may floor here, so I’m going to keep the $58 put on so I get the shares. I want to be sure I get some shares at this price level in case OXY runs up and away. If OXY continues to drop I will sell more puts below the current trade price.

We have 100 shares of OXY and we’ll get more shares at the $58 strike. We can sell the $58 call on those shares to generate passive income selling stock options. The shares we’ll be assigned on the $58 put option contract will settle in our account early next week. Since we know we’ll be getting the shares we can go ahead and sell the call option contract on them right now because we already have shares in our account. By selling the call option contract right now we’ll earn premium over a few more days than we would if we waited until next week to sell the call. And we’ll still have an extra 100 shares of OXY in our account next week.

We aren’t selling calls on all 200 shares because we think that OXY will be trading far north of $60 over the long term. So we’re using some of the shares to generate passive income selling stock options and we’re holding the other shares for the longer term gain.

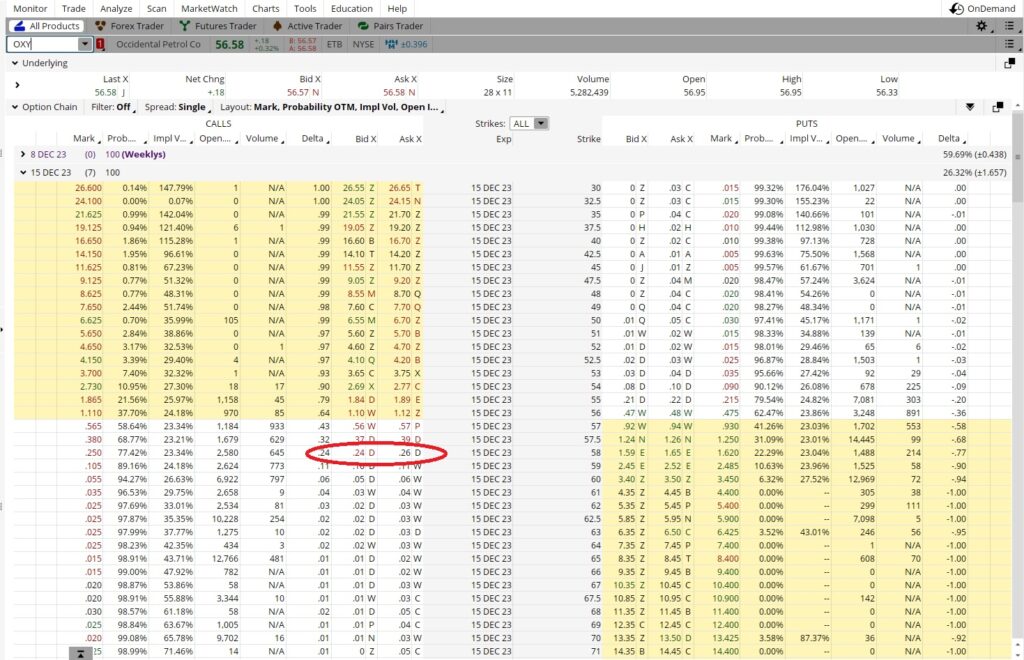

The Weekly Options Trade

The option chain below shows the $58 call option contract expiring 12/15 with a Bid of $0.24 and an Ask of $0.26. We sold that call option contract for $0.25. We divide that $0.25 into the cost basis of $58, and that gives us 0.43. This is a one week trade, so we could do this trade 52 times in a year. The 0.43 times 52 is 0.224, and that equates to an annual return of 22.4%. Not bad for a passive income strategy.

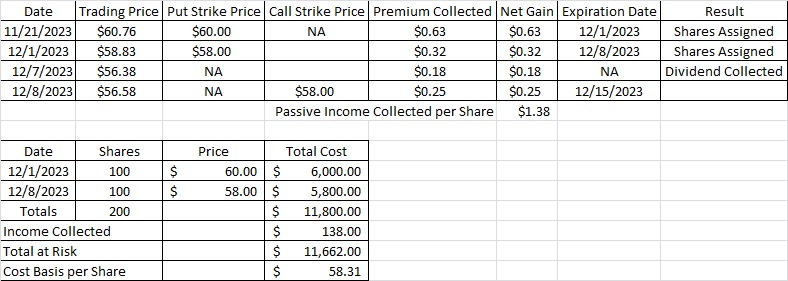

Cost Basis per Share

So far we’ve sold two puts on OXY and have been assigned the shares on both contracts. We collected OXY’s dividend on the first batch of shares this week. Then we sold a call option on one contract. The table below shows the trades, the dividend, and the option premium. After generating passive income selling stock options, our basis on OXY is currently $58.31. If the $58 call option contract goes in the money and we lose the shares our cost basis will change. If the $58 call expires out of the money on 12/15 we’ll be in a position to sell another call as our passive income strategy for accredited investors.