Weekly Options Trade for Passive Income on OXY

Our weekly options trade for passive income lately has been selling puts on OXY. This post walks through why we’re trading OXY right now. Here’s the post for our weekly options trade last week. That put option contract expired out of the money on Friday, 12/15, so we keep the premium from that weekly option trade for passive income. Now that capital is free for us to allocate again with our passive income strategy for accredited investors.

Today is 12/19, and OXY is trading around $59. The market will be closed on Monday, 12/25 to observe the Christmas holiday. The stock market will also be closed on over the weekend. If we sell an option contract for passive income that expires next Friday, 12/29, the market will be closed for three of the days that contract is active. The market being closed reduces the risk of the trade going against us. That makes it more likely we do a weekly options trade for passive income during that period.

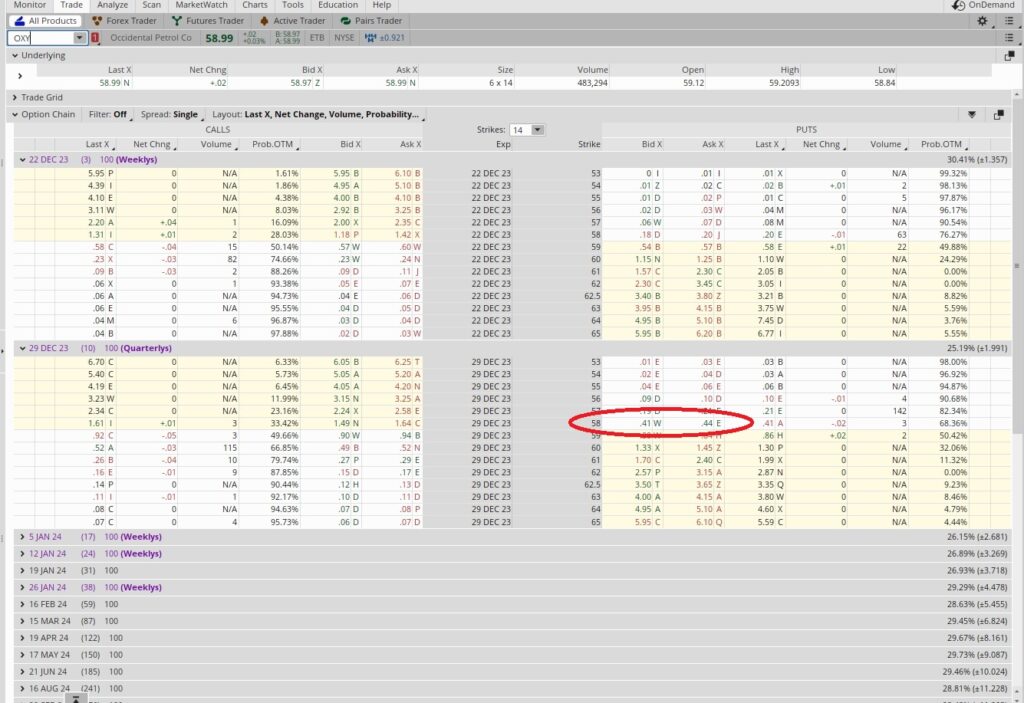

The option chain for OXY below shows the expiration dates 12/22 and 12/29. We’re going with the 12/29 expiration because we want to take advantage of the market being closed on Monday. If we sell a weekly option contract for passive income that expires out of the money on Friday, 12/22, we won’t be able to use that capital again until Tuesday, 12/26. We don’t want to waste that day of premium. So we’ll sell our put with the 12/29 expiration date to make use of that time.

Weekly Options Trade for Passive Income

Right now OXY is trading at $58.99. OXY doesn’t have $0.50 option strikes, so the closest strike below the money is the $58 strike. We filled the $58 put option contract expiring 12/29 for $0.43. There are 10 days from now until the put option contract expires on 12/29. There are 365 days in a year, so in theory we could do this trade 36.5 times in a year. That’s our time period multiplier.

When we sell the $58 strike, we need to have $58 set aside for each share in case of assignment. One contract is for 100 shares, so we need $58 x 100 = $5,800 set aside for each put option contract we sell. We get $0.43 per share to enter the contract, and that $0.43 times the 100 shares is $43 we collect. We’ll keep that $43 regardless of whether or not the contract goes in the money and we do or do not get assigned the shares. So we take the $43 and divide that into the $5,800 we need to have in our account to cover the trade, and that gives us 0.0074. That 0.0074 multiplied by our time period multiplier of 36.5 is 27.1. That works out to a return of 27.1% when we annualize it.

Most people are happy with an annual return of 8%. So the 27% annual return on this passive income strategy for accredited investors sounds pretty good to us. We’ll take it.

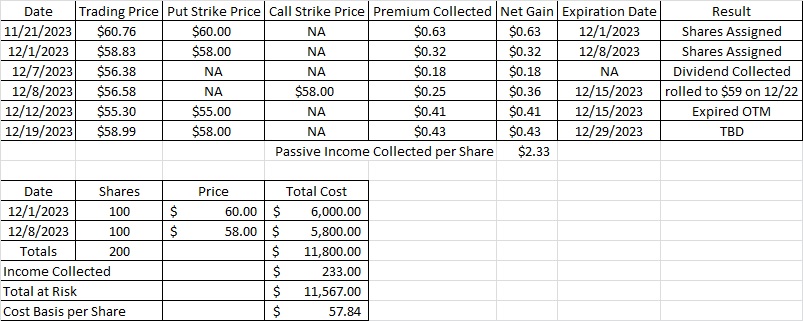

Cost Basis per Share

We’ve been trading OXY for a few weeks and so far we own 200 shares. We have a put at $58 expiring 12/29 and a call at $59 expiring 12/22. So there’s a chance we end the year with only 100 shares of OXY if the trading price runs up above our $59 call option strike.

There’s also a chance we end the year with 300 shares of OXY. That could happen if the trade price for OXY drops below our $58 put option strike and we get assigned shares.

We could also end the year with 200 shares, and that would happen if the trading price for OXY stays below the $59 call strike and above the $58 put strike. In that case we just collect (and keep!) the premium, and then when these contract expire we might do these weekly options trades for passive income again.

For now, our cost basis per share on OXY is $57.84.