Weekly Options Trade for Passive Income with OXY

Our current passive income strategy for accredited investors is a weekly options trade for passive income. We’re currently using OXY as the underlying company, and here is post that talks about how and why we chose OXY to generate passive income selling stock options.

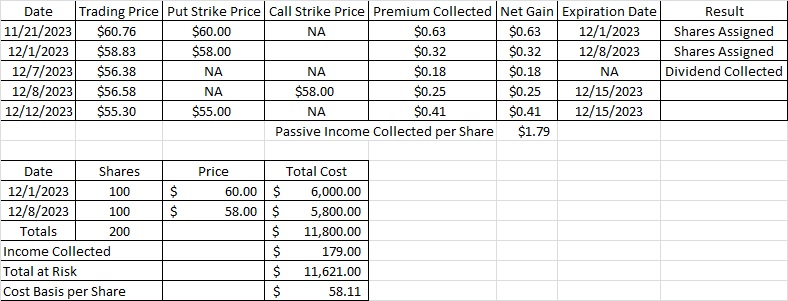

We currently own 200 shares of OXY in this account. We have a call option contract at OXY expiring this Friday, 12/15 at the $58 strike. This time we only sold one call option contract because we look at OXY as a company we’d like to own for the long term. One option contract represents 100 shares. If we sell two call option contracts it’s possible that OXY runs up and both of our call option contracts go in the money. If that happens, our shares of OXY would get called away. We’re ok if some of our shares get called away, but we want to own shares of OXY for the long term. Here is a post that walks through that weekly options trade for passive income.

A buyer of a put option contract usually thinks that the trading price for a particular company will decrease. As the trading price for that company decreases the trading price for the corresponding put option contracts increase. We can look at a put option contract as an insurance contract for an owner of shares. In the event of a significant market drop, a person who owns a put option contract could sell their shares of a company at a predetermined price. That option contract offers protection to the buyer of the contract.

As the seller of the option contract, we want to generate passive income selling stock options. We’re happy to buy shares of the company at the price we agree upon. And we’re happy to own shares of the company at that price because we’ve done our research and come up with what we feel is an appropriate price to pay for shares of that company. If we don’t want to own shares at that price, we won’t sell that put option contract.

The Weekly Trade

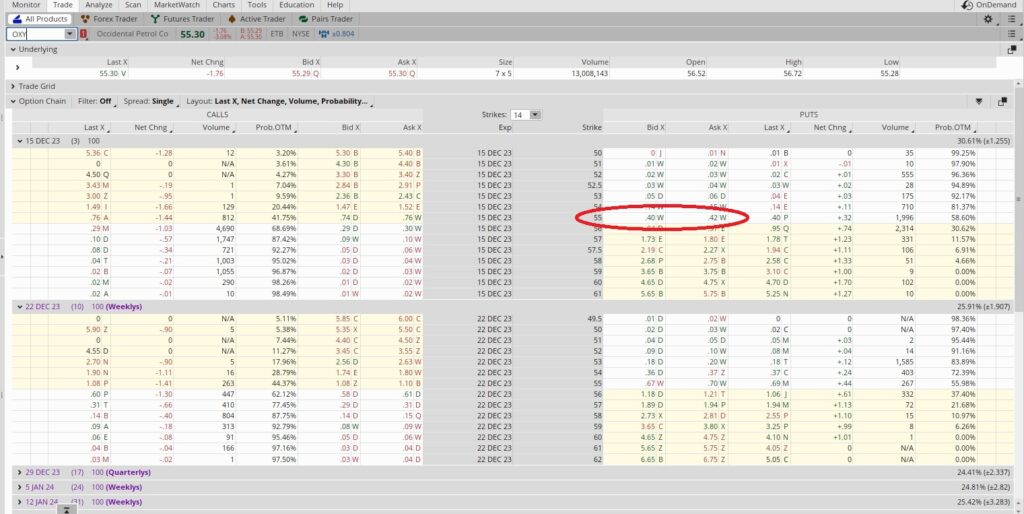

Right now OXY is trading at $55.30. It’s down about 3% today on news that it will purchase Permian Basin oil producer CrownRock. Here is the one of the tools we use to do research on companies. Since OXY is dropping today we’ll get more premium on the put option contract than we would if the trade price were rising.

We can see on the option chain below the $55 put expiring this Friday, 12/15 with a Bid of $.40 and an Ask of $0.42. We sold the $55 put for $0.41. So we take the $0.41 premium and divide that into the $55 strike. That gives us 0.0075. Today is 12/12 so there are three days from now until the expiration date. There are 365 days in a year, and 365 divided by the three days in the trade is 121. In theory we could do this trade 121 times in a year, so our multiplier is pretty high.

When we get into trades that less than a week, we like to think about the trade as a weekly trade rather than using a number like 121 as our multiplier. A weekly trade we can do 52 times in a year. So 52 times the 0.0075 is 0.388. So our weekly options trade for passive income works out to an annual return of 38.8% when we annualize it.

Cost Basis per Share

Our current cost basis on OXY is $58.31 per share. We take the $0.41 in passive income and subtract that from our cost basis on OXY. We sold one put option contract and we currently own 200 shares, so that reduces our basis of each share by $0.205 per share. That brings our basis on OXY down to $58.11.

If this put option contract goes in the money and we get assigned the shares at $55, our basis will drop to $57.07. Note that we’re only selling one put option contract at $55, not multiple contracts. We’d like to see a bigger drop on OXY before we generate passive income selling multiple stock option contracts.