Weekly Passive Income Trade

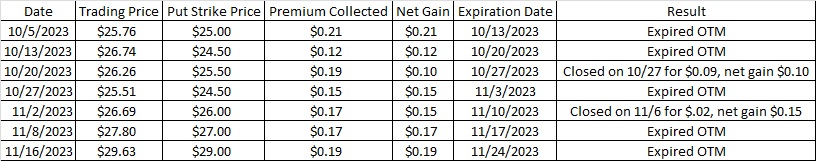

Recently my weekly passive income trade has been selling put option contracts on Bank of America (BAC). I’ve sold put option contracts every week on BAC since the beginning of October. The table below shows the results of this passive income strategy for accredited investors. Here is a link to the trade from last week.

So far my weekly passive income from this scalable side hustle has been $1.09 per share since 10/5. The average strike price of the put option contracts has been $25.93. The last of these put option contracts expired out of the money on 11/24, or 50 days since 10/5. There are 365 days in a year, and 365 divided by 50 is 7.3. So in theory I could do these weekly passive income trades repetitively throughout the year 7.3 times. I take the $1.09 of premium and divide that into $25.93, and that gives me 0.042. That 0.042 times the 7.3 times I could do this in a year is 30.7, or an annual yield of 30.7% on my capital. And I have not yet been assigned shares on these put option contracts. I’m happy when I can work from anywhere with a scalable side hustle that yields over 30%.

BAC has a dividend of $0.24 this week. If I want to collect the dividend I can buy shares today, 11/28. Or I could sell puts to collect passive income on BAC. When I sell puts I earn passive income by making a promise to buy shares of BAC at a price lower than the $29.40 price it’s trading at right now.

The Weekly Passive Income Trade

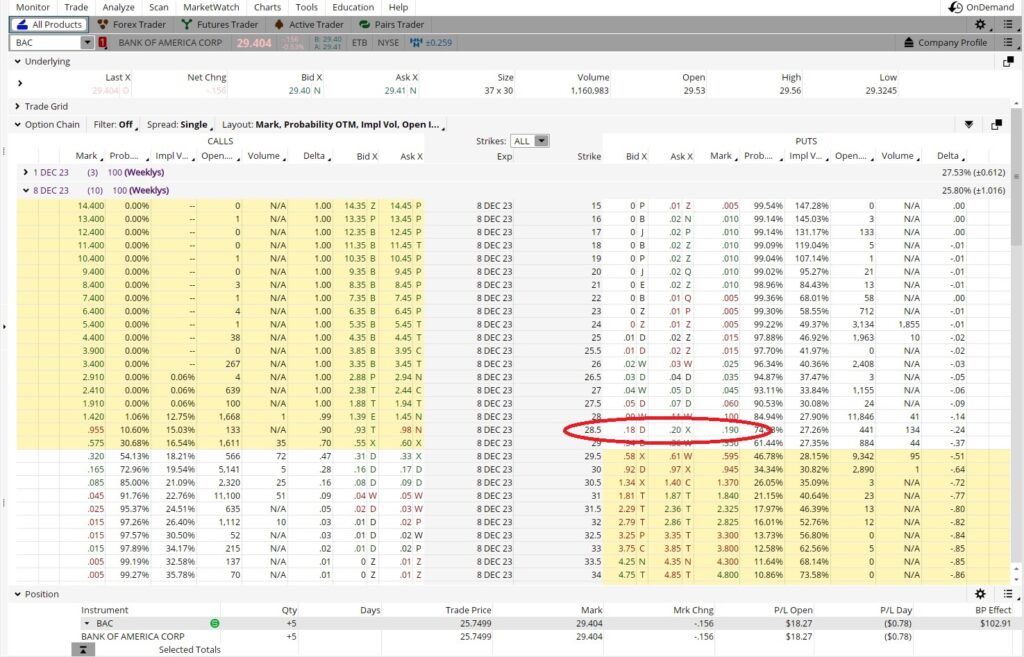

The option chain above shows the $28.50 put expiring 12/8 trading for $0.19. If I sell that put option contract and the trading price for BAC is below $28.50 when the contract expires on 12/8 I will be assigned shares. I could be assigned the shares prior to 12/8 if BAC drops below $28.50 anytime from now through Friday, 12/8. For each put option contract I sell I could get 100 shares of BAC. I need to have enough funds in my account to cover the cost of those 100 shares. 100 shares times the $28.50 strike is $2,850 to cover each put option contract I sell.

To figure out my return on this trade I take the $0.19 premium and divide that into the strike price of $28.50. That’s 0.0067. I take that and multiply it by the number of times in a year I can do this trade. It’s a 10 day trade, because today is 11/28 and the trade expires on 12/8. 365 days in a year divided by 10 is 36.5, so I could do this trade 36.5 times per year. That 36.5 times the 0.0067 is 0.243, or a passive income return of 24.3% if we annualize it.

Cost Basis Per Share

Remember that this scalable side hustle collected $1.09 per share in premium on my weekly passive income trades on BAC. That $1.09 plus the $0.19 per share on the current put option contract is $1.28. So if BAC drops below $28.50 and I get the shares, my cost basis is the $28.50 strike minus the total premium I have collected, which is $1.28. That means my cost basis per share would be $28.50 – $1.28 = $27.22 per share. If the trade price for BAC stays above $28.50 I’ll just keep the premium. And my $2,850 per put option contract will free up for another weekly passive income trade.