When to Enter a Position

We consider multiple factors when we enter a position. We like a company with a dominant market position, a strong leader and without much debt. And we want a company that is trading a valuation we feel is reasonable. We also want a company that has recently had a negative event that has dropped the trading price.

Outside of their lease obligations Malibu Boats does not have any debt. That’s a huge plus, especially with interest rates having increased recently. Malibu also has $78 million in cash on its balance sheet.

Considering their Operating Expenses of $206 million in 2023, $78 million in cash is significant. As of today their market cap is $697 million. If we include the $78 million in cash it would mean that the company is trading for just $619 million. Malibu had $141 million in pre-tax income last year. If that continues, we would be paying a multiple of just 4.4 times pre-tax income for the company. They have recently grown through acquisition and have said on recent earnings calls that they will continue to look for favorable acquisitions. Trading price-wise, this looks like a favorable time to enter a position.

Event

Malibu’s long-time CEO, Jack Springer, announced in February that he would be leaving the company. The replacement President is Ritchie Anderson. He had been the Chief Operating officer for ten years and was the Vice President of Operations for two years before that. Prior to joining Malibu he had been in production management roles at Mastercraft for 28 years. Malibu is currently looking for a replacement CEO.

In April one of Malibu’s largest dealers filed a lawsuit against Malibu. The dealer, Tommy’s, alleged that Malibu had delivered nearly $100 million worth of its highest priced boat inventory to 15 of Tommy’s dealerships. In the 2023 Annual Report Malibu notes that Tommy’s made up 10.7% of Malibu’s consolidated net sale in 2023 and 9.4% in 2022. So Tommy’s is a significant portion of Malibu’s business. Tommy’s also alleged that Malibu withheld millions of dollars of incentives.

On April 11 Malibu posted a statement regarding the suit. Malibu stated hat all of the boats they sold to Tommy’s were boats that Tommy’s had ordered from Malibu. If Malibu had not delivered these boats to Tommy’s, Malibu would have been in breach of contract. In fall of 2023 Malibu learned that Tommy’s was selling boats out of trust. That means that Tommy’s had a floorplan loan for boats. Then Tommy’s sold those boats, but did not tell the bank they had sold the boats. Tommy’s also did not give the proceeds of the boat sales to the bank to repay the bank loan. That’s a huge no-no.

Malibu reached out to Tommy’s and Tommy’s bank multiple times but was unable to resolve the issue. So Malibu terminated Tommy’s dealer agreement. The bank has sued Tommy’s and has also filed a motion to appoint a receiver over the assets of Tommy’s. The statement from Malibu is available here.

So our event is three fold. We have a long time, successful president leaving the company, likely at least in part due to the situation with the Tommy’s dealerships. We have a major dealer filing suit against Malibu and we aren’t certain how that will play out. Then we have the overall economic issue with inflation and rapid increases to interest rates. This means dealers are no longer able to afford to carry as much inventory. Overall sales are down but sales price per unit is up (they are selling more of the higher end boats). For the full fiscal year Malibu is projecting a decrease in consolidated net sales in the mid to high 30% range. On their last earnings call in January CEO Jack Springer said the sales decline appears to be slowing and could be near the bottom.

Price Chart

The 5 year chart below shows that MBUU has not traded at this level since the Covid Crash. It’s hovering around the $34 support line right now.

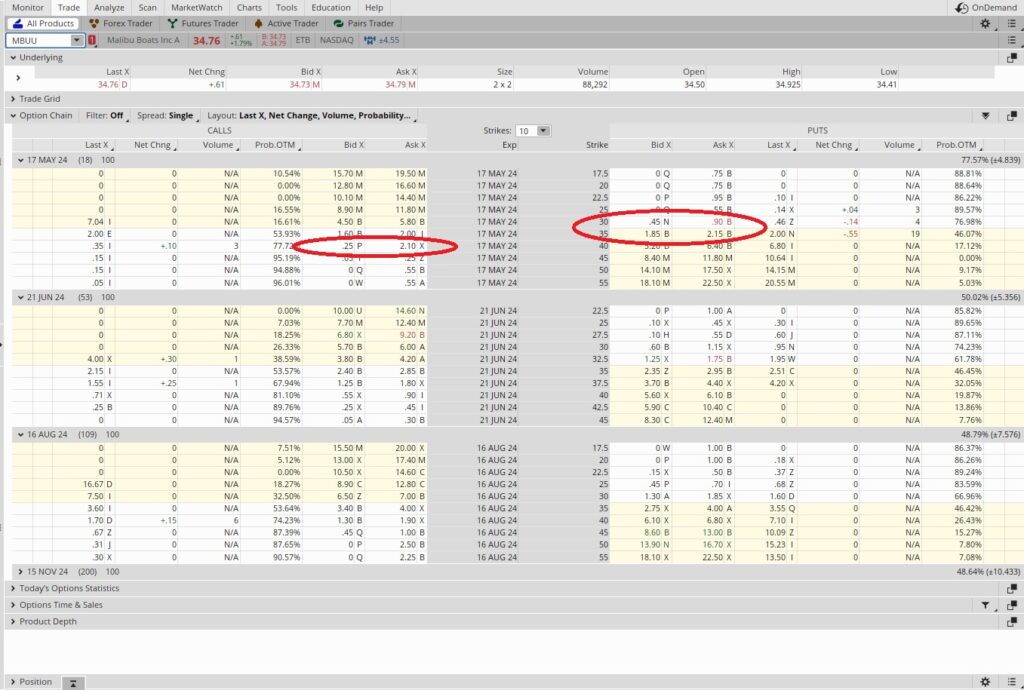

Malibu also has an earnings call this Thursday, 5/2. Generally we like to use earnings calls as an opportunity to generate some options premium as our passive income strategy for accredited investors. We frequently make a weekly options trade to generate passive income through an earnings call. In this case, we want to be sure we get some shares of MBUU prior to the earnings call in case it shoots up right after the call. So in this case, the question of when to enter the position appears to be right now. We’ll buy some shares with our first tranche in this portfolio and also sell some puts. Selling the puts for passive income will reduce our basis. If MBUU continues to drop we’ll buy the shares with our next tranche. If MBUU heads back up, at least we’ll have a few shares and capture the gain on them.

Weekly Options Trade

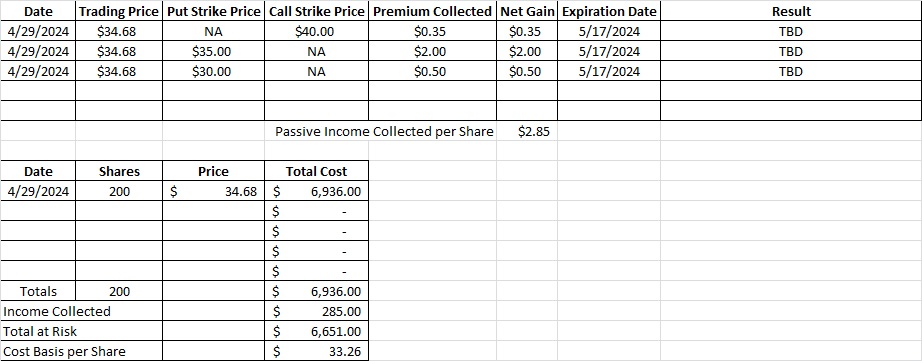

We just bought 200 shares of MBUU at $34.68. In this portfolio one tranche is about $7000, so we’re set with our first tranche. Then we sold to open one call option contract at the $40 strike expiring 5/17. That’s 18 days from now, so our time multiplier on that is 20.3. Our cost basis on the call is the $34.68 we paid for the shares, and we earned $0.35 in premium when we did that trade. The $0.35 in premium divided into the $34.68 cost basis is 0.101, and that multiplied by our time multiplier is 0.205. That’s an annualized return of 20.5% on that call. It also reduces our cost basis a bit.

We only sold to open one call option contract because there’s a chance that MBUU runs up after their earnings call and we want to be sure we own some shares outright. If MBUU does run up we can either roll the trade or let the shares go at a profit.

Then we sold to open one put at the $35 strike for $2.00 and another at the $30 strike for $0.50. The $2.00 on the $35 strike equates an annualized return of 115%, and the $0.50 on the $30 strike is an annualized return of 33.8%. Those two contracts would be our second tranche if we get the shares. If MBUU runs up above the $35 strike and stays there through 5/17 then both contracts will expire out of the money. Here’s a tool that can help with the math.

Cost Basis per Share

So to recap, we decided when to enter a position. We bought some shares, sold a call option on some of them, then sold an ‘At The Money’ put option and another put option that was just below the money. If MBUU drops a little we’ll get more shares at the $35 strike, but it would need to drop below $30 for us to get put shares on both of the contracts. As long as MBUU stays below $40 we won’t have any shares called away. Just by doing this weekly options trade to generate passive income we’ve reduced our cost basis per share down to $33.26.